Frequently Asked Questions

1.) Is there such a thing as an automobile authorized user tradelines?

No, authorized user tradelines and the practice of buying them for credit score improvement are related to credit cards and credit cards alone. They don’t work for auto loans.

2.) Is there such a thing as a mortgage authorized user tradelines?

Same answer as above. Authorized user tradelines and the practice of buying them for credit score improvement are related to credit cards and credit cards alone.

3.) Do seasoned tradelines help after bankruptcy?

That all depends on what state your credit was left in. If your credit was a mess, all your accounts were discharged, and you have relatively nothing on your credit report, then it could potentially help. But if you reaffirm your accounts, and you still have derogatory items after the bankruptcy, then tradelines wouldn’t help as much.

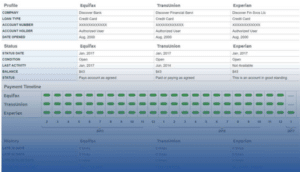

4.) How long does it take for an authorized user tradeline to post to a credit report?

Typically within 30 days. Each tradeline reports once per month. If you order a tradeline on the 1st and it reports on the 20th, that tradeline is going to be posted in 20 days. The only time it takes longer to post is in the scenario that you order a tradeline too close to the report date and you have to wait until the next reporting cycle (1 month plus a few days, give or take).

So, if you order a tradeline, it should be on your report within 30 days, tops. If the tradelines do not post within 30 days, then the company either dropped the ball or there is something wrong with your credit report (security freezes, fraud alerts, etc.).

5.) Does making someone an authorized user help their credit?

Not always, but it can if it’s done correctly. The tradeline has to be of sufficient quality with a high enough limit, low balance, and perfect payment history. Too many negative items on the report will prevent it from helping.

6.) Can piggybacking credit hurt your credit?

In some cases, it could. If the tradeline you’re added to has missed payments, high balance, and an imperfect payment history, the tradeline could actually hurt your credit.

7.) Do authorized user tradelines still work?

Yes, since 1974 the law has not changed. Despite all the propaganda about FICO 08, credit bureaus, etc., authorized user tradelines still work and we do this every single day.

8.) What are some reasons authorized user tradelines do not report?

There could be several reasons. There may have been data glitches at the bank, or the authorized user has security freezes or fraud alerts on their credit report which prevents the tradeline from showing up. It’s also possible that the authorized user was added too close to the reporting date, so the tradeline didn’t get on for that cycle.

There are many more reasons why tradelines do not post on an authorized users credit report, but we have yet to encounter a scenario in which we were unable to get the tradeline to post correctly.

9.) Are primary tradelines better than authorized user tradelines?

To cut to the chase – no. You cannot buy primary tradelines like authorized user tradelines. This is a common misconception, and we’ve written quite a bit about it here, if you’d like to learn more.

10.) Can I add too many tradelines?

More tradelines = better score? Yes, but there’s limits. It is possible to add too many tradelines. A lot of clients ask how many tradelines to add for optimal credit score results. So, we wrote this article (and published a video regarding the same thing) to answer that question.

Hello my name is Calvin and in interested in the price for a seasoned tradeline

Hey Calvin. Please give us a call at 800-431-4741, email us at info@superiortradelines.com or register for free at https://superiortradelines.com/start/

Discussing tradelines options, pricing, etc., is very easy from there. Authorized user tradelines are for sale, daily. So, for example, there are deals right now which you can ask about. View https://superiortradelines.com/specials/ for more details, but don’t forget to ask about these special pricings when you hop on the phone with us.

I need to get a loan for 12000 but my credit score is between 575 and 603. I want to know how can trade lines increase my credit score in s month to get a loan.

Possibly. But, a full answer requires more information than you provided. For example, what score do you need to get approved? Supposed we boosted your score with authorized user tradelines to (hypothetical for the same of discussion) 850… do you otherwise qualify for the loan (income, purposes, no significant collections or charge off accounts, etc)? Also, your credit scores could be 575 to 603 for many different reasons (limited credit to bad credit). We may be able to help under certain circumstances and may no be able to help under other circumstances. So, yes, authorized user tradelines will increase your score, but… the real important question is whether or not it will help achieve your goals. To answer that question, we’d need to do a (free) credit report analysis.

Just give us a call anytime at 800-431-4741 or email us at info@superiortradelines.com Also, you can get access to the members portal (for free) at https://superiortradelines.com/start/

Thanks!

Hi, I would like to purchase a home within the next 6 months. I need help with boosting my credit score. I am interested in learning more about adding trade lines.

Mignon,

You’ve certainly come to the right place. As you can we, we write non-stop about authorized user tradelines. “Competitors” steal our content, constantly. But, what’s easier than reading hundreds of pages about tradelines is hoping on the phone with us. We can answer your questions, directly, within minutes rather than indirectly searching hours online. You can call us at 800-431-4741 or email us at info@superiortradelines.com

To answer your question: It depends on what’s in your credit report. Tradelines may or may not help. The good news is that you’re 6 months out from your credit goal. So, whether you need credit repair or tradelines, you have plenty of time to get things going.

Hello. Im interested in possibly using tradelines to boost my score as well.

Sure, give us a call at 800-431-4741 or email us at info@superiortradelines.com

Also, you can check out our new tradelines evaluation tool, here: https://superiortradelines.com/tool/

do you get a card ( CPN ) card like a SS Card once you get the CPN Number.

Gwendolyn, please read this article we wrote about credit profile numbers.

What is the length of time a trade line is good for? Say if I purchase today is this purchase good for 3 months, 6, or 1 year?

Here’s a video which answers your questions: https://www.youtube.com/watch?v=_fi9JZxNgBQ

I want to get me a truck by December 2017 but my credit is at 440-468 coz of one charge off n 2 collections of which am paying off my collections already. I wanted a boost to 750 only thats all i can ask if its possible. I have one open account which is in good standing

What’s good about your situation is that you have a good, a reasonable timeframe and you’re seeking advice. That’s a good combination. Given those scores, authorized user tradelines may not be an option. I believe you need credit repair first. Please check out https://credzu.com/ You can match your specific credit goals with credit services providers, like credit repair, debt settlement, etc.

I am interested in using tradelines for a credit boost because I want to refi my truck next year. Right now, I have a credit school of 614 but I have a collection item on my account. Will this help?

It depends on the age of the collections, if they’re actively reporting, how large the collection debt is, the origins of the debt (medical, student loans, credit cards, car loans, etc.). So, it depends on a lot of things, which requires a credit report analysis to determine. My gut says, no, it’s not going to work. I think you’d be better off doing credit repair, especially since you have time before you need to refi. Tradelines will work after credit repair, as well.

Hey does income have to match trade line? Let’s say I have a 50000 trade line, does my income have to match it?

That’s an interesting question! The answer is, “no.” However, a $50,000.00 tradeline may look out of place and could get flagged as “authorized user abuse.” So, there’s not exact formula, but it should probably make sense. Moreover, keep in mind that you don’t need a $50,000.00 line to get the largest impact from tradelines. For example, suppose a $10,000.00 line got you 35 points, whereas a $20,000.00 got you 40 points, whereas a $40,000.00 line got you 43 points. This isn’t exact, but the concept of diminishing returns DOES, in fact, apply. So, you should get a credit report analysis and we can help you determine the best, most cost effective, tradelines for your goals.

Is this the same as a cpn? How long does it take? Cost?

No, CPNs are illegal versions of a Social Security Number. Authorized user tradelines are added to your social security number so as to increase your credit score. We do not add authorized user tradelines to CPNs (or anything other than a social security number).

As far as the duration, please see here: https://www.youtube.com/watch?v=5gX2jpHU84g

As far as the cost, please see here: https://superiortradelines.com/faqs/tradeline-costs and here https://superiortradelines.com/forum/how-much-do-tradelines-cost

Hi, I would like to purchase a home within the next 2 months. I need your help with boosting my credit score. I am interested in learning more about adding trade lines. My current credit score is 719.

Kumar, if your score is a 719, you do not need tradelines. You’re 1 point away from the best rates available. You could get 1 point by paying down one of your credit cards (or something similar). In other words, take the money you’d pay us for tradelines and pay down a balance on one of your accounts. Also, this all assumes your credit score you mentioned above is real/the score a lender is going to use. If you want to elaborate on your situation, I’ll be glad to give you my opinion. However, I can’t imagine a scenario in which you would not be approved for a mortgage (unless it is an income or other issue for which tradelines wouldn’t help anyway). Let me know if I can be of any further assistance.

I have no credit cards. No length of credit history except 10yr old student loans(paid off) and one repo 5 years ago. Credit score is 527 on Experian 572 Equifax 563 TransUnion. If I add AU tradelines to my credit would it possible to get a 40k auto loan?

Hi, do you help people from the UK?, I only have a couple inquiries that’s all and wanna get an AU.

Unfortunately not. Our process only works for United States Social Security numbers. So, you can be from the UK with an US SSN. In that case, we can help. Otherwise, no. Thanks!

Hi

I would.like to get a home in the next 3-6 months. My credit score is at 621 but I need it higher to qualify for down payment assistance and better rates. I’ve recently paid off a collection account and that is what helped boosted me up. How long does these AU headlines stays on before it comes off?

Hello! This should probably answer your questions: https://superiortradelines.com/videos/

But, if you want one on one advice for your specific situation, call us at 800-431-4741 or go to https://superiortradelines.com/start/

my payment history is perfect but my credit score is low because I’ve recently started rebuilding my credit and I have 4 accounts with low limits (around $500 each) and the average age is only 6 months. will adding authorized trade lines that are years older help the “average age” of my credit lines and improve my credit score?

Bindo! Yes. Not only will it help your average ago of accounts, but it can pull you out “adolescent” score cards (people with different ages receive different calculations under scoring formulas… FICO probably thinks you’re a young kid, based on what you just said). Call us so we can discuss in detail: 800-431-4741 or go here: https://superiortradelines.com/start/

I have a timeshare that just hit my credit for 1400.00 2 months ago, and i have high balance on my credit card. will a tradeline be wise at this moment?

No idea, so far. What are you trying to do in terms of credit? Tradelines are powerful, but they don’t make sense in all situations. Give us a call to discuss your specific situation. 800-431-4741 or https://superiortradelines.com/start/

Interested in buying legitimate tradelines I have a business I help people too build their credit and restore their lives I am looking for a company I can work with that is legitimate that actually post when they say they’re going to post and can put real tradelines on an account that will not fall off and will not be delinquent and that are not expensive

Wow, Dr. Daniels, sounds like you had some pretty bad experiences with tradelines. We’d be more than happy to show you how we operate and I think you’d be ecstatic to know the company you’re looking for does exist. Please contact Raj at raj@superiortradelines.com or 407-796-1076 and ask him about our affiliate program. By the way, what’s the name of your company?

Will your score drop once the tradeline stops reporting?

Hey Leroy, go here: https://superiortradelines.com/videos/

Scroll down to the how long do tradelines last video.

Appreciating the commitment you put into your blog and detailed information you

provide. It’s great to come across a blog every once in a while that isn’t the same

outdated rehashed information. Great read! I’ve saved your site and

I’m including your RSS feeds to my Google account.

Thanks, I appreciate that.

I’m wanting to purchase a home this June. I would be a new home buyer if approved, however Credit Karma says that my Transunion is 586 and my Equifax is 594. I would feel comfortable around a 680-720 credit score. What is a good time frame to get a Tradeline(s) to boost my score and maintain that score until June when I’m wanting to purchase?

Hey Mira,

First, don’t go by online scores; they can mislead you.

Second, your score is what it is for a reason. And, depending on that reason, you may or may not need tradelines or tradelines may or may not help you (such as in the case of needing credit repair first).

Third, to find out how long tradelines take, go to our videos page, here: https://superiortradelines.com/videos and scroll down until you see “How long do tradelines take?” It’s a great video.

Finally, what you really want to do is get a free account here, https://superiortradelines.com/start/ and then have us review your credit report (for free) so that we can tell you what we think. It’s a bit more complicated than it seems, but it is pretty simple once we see what’s in your report (as apposed to simply what your score is).

Hope that helps. Let me know if you have any other questions!

I do credit repair and would like to know if my clients have to buy a tradeline or do I buy a tradeline and have them piggyback off my credit?

Brian, please go here: https://superiortradelines.com/start/resell

Let’s see how an affiliate relationship can benefit us all, but, most importantly, your clients.

Can tradelines offset student loan debts? It is the only major issue on my report.

It depends what you mean by “offset.” If mean, alter your debt to credit ratio, yes. If you mean, counter act missed payments on your student debts, no. If you could provide more details, I can be more specific and be more helpful to you. I would make a general recommendation, though. Look at your overall goal. Then, say “What do I have to do to get to X?” Don’t get bogged down in the minutia of credit. Leverage off the time and experince of others and say “Hey, can tradelines get me approved for X?” So, let’s talk about your goal and we’ll let you know whether or not tradelines will help. If so, great. If not, we can probably point youu in the right direction.

This sounds like it is illegal – are you sure this is ok?

What do you mean?

I have never had credit. My credit report is blank- I’ve only recently applied for a credit card and was declined. I’m 42 years old.

I would be interested to know how you could help me get credit and quickly. I’ve recently been diagnosed with cancer and need funds for treatment etc.

is a matching address between authorized user and the actual account holder a requirement for tradelines to post?

It’s not necessarily a requirement, but in certain circumstances especially when the trade line doesn’t report correctly, it becomes necessary. Some clients and some cardholders don’t like this and in those situations we usually end up refunding a client. However, it does work, and so long as you trust the people you’re working with, it is a good technique to get the results you’re looking for.

Can you explain difference between authorized user tradelines and primary tradelines?

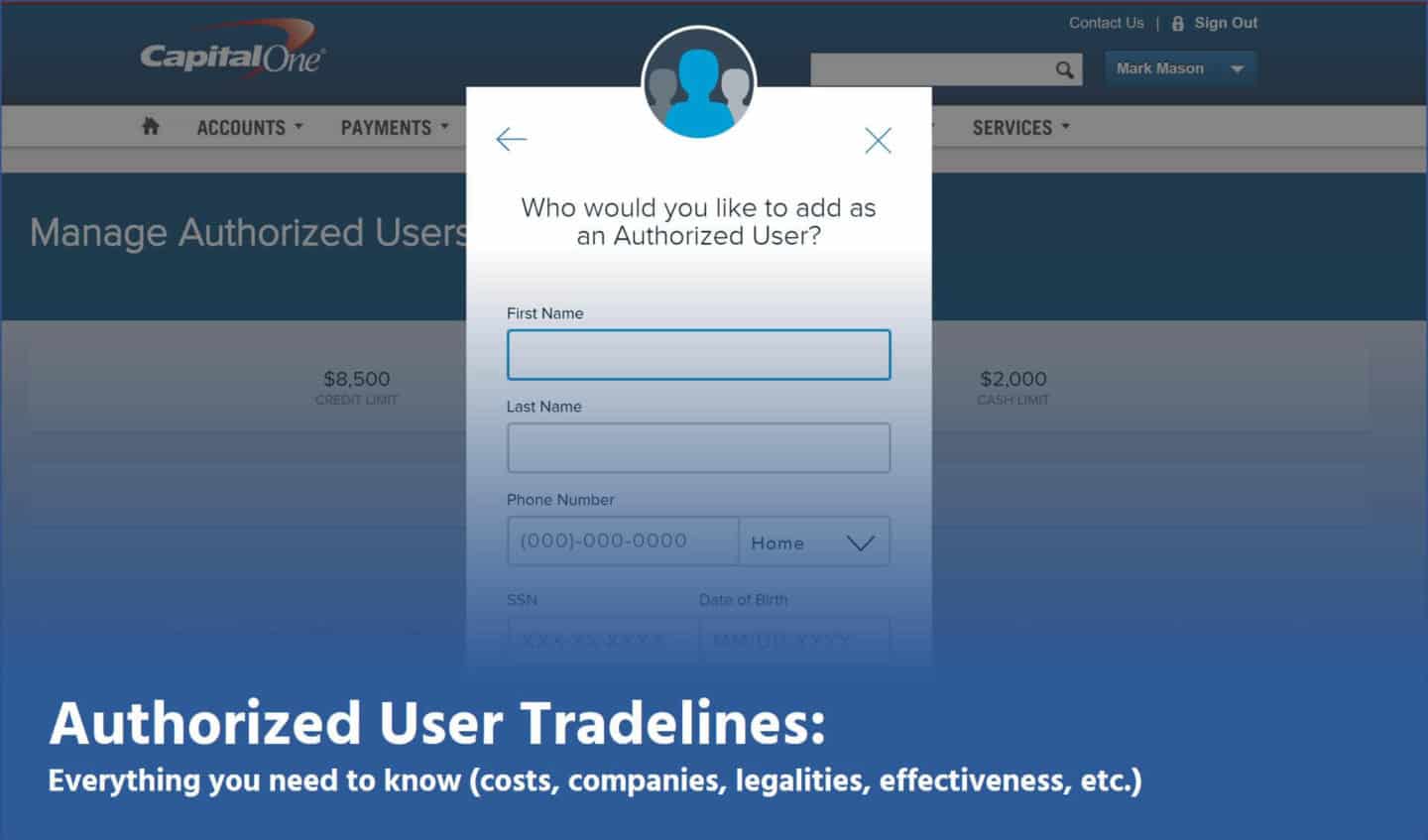

First, tradelines = accounts on a credit report (usually referring to revolving accounts, like credit cards).

Second, a “primary” tradeline (or account, usually a revolving account, like a credit card) is issued to the primary account holder who applied for it. For example, Joe applies for a capital one credit card and gets approved for a $10,000.00 credit card (or “tradeline”). Years later, after maintaining a perfect payment history, he has a “seasoned” account, otherwise known as a “seasoned tradeline.” This remains Joe’s “primary” tradeline, because he is the “primary” account holder.

Now, Joe adds you, George, as an authorized user to Joe’s primary account. You become an “authorized user” of Joe’s “primary” account. As a result, the information associated with this account appears on your credit report, which makes your credit score increase. You did not apply or get approved for this account, so it is not your primary tradeline. You were added as an authorized user to someone else’s primary tradeline… as an authorized user.

Make sense? Hope that was helpful!

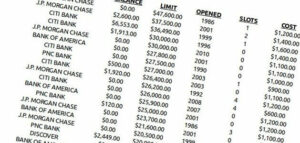

What is the best age of a trade line to get the most points? I’m considering between 16, 19, and a 26 year old trade lines. With limits between 16k and 35k. Thanks

This probably isn’t the answer you want, but I always put people’s interest above all. When it comes to tradelines, bigger and older is not always better. In fact, you could hurt your score or you could flag the tradelines as authorized user “abuse” and receive no benefit at all if the tradeline selected is not appropriate. Also, consider this: What if you don’t need those tradelines and that you could achieve your credit goals with something less (and less expensive)? For example, is your average age of accounts really low? Okay, then old tradelines might make sense. On the other hand, how old are you? Because, if you’re 24 and add a 26-year-old line, you’re going to get flagged. As far as limit goes, do you have a high debt to credit ratio? If so, those limits look good and maybe you need more. On the other hand, if you don’t have a high debt to credit ratio, those might be overkill.

If the company you’re working with is NOT telling you these things, they should. Here’s what I’d recommend.

You should call us at 800-431-4741, email us at info@superiortradelines.com or get started here: https://superiortradelines.com/start/ so that one of our trained and qualified experts can help you.

Essentially, we will match your credits with credit solutions and pick the best tradelines for you.

What if you have no credit history at all, can I still buy tradelines and should I pick an older account with a higher credit limit?

Hey James,

First of all, having “no credit” is extremely rare and in almost all cases (except for very young people or immigrants) it’s almost always the case that someone gets a CPN. So, just right of the bat, can you tell me about your lack of credit?

To answer your question, you will see substantial gains in the score if you have no credit. The study we often cite for authorized user information was done by the Federal Reserve Board and in it they reported:

However, bigger and older isn’t always best. Your age is a factor in determining which tradelines to add. And, that’s just one example. The best way to determine if which tradelines are best is to have a discussion with us. You can get started here.

I’m 42 yrs old, paid cash most my life, last time I could get my actual score (Credit Karma) over 2 years ago and it was about 570. 1 credit bureau had a single derogatory mark (pretty old) and another bureau had two remarks, both old and combined for under $400. Every other section was blank. I’m now a N/A on Credit Karma and a 0 on a similar service. Friend at dealership did inquiry on me and I was also a 0 and he said he never seen that. I just became a authorized user for a friends new AMX Plat card and I’m about to have 24 months backdated to credit report for my rent ($2400) per month. When my credit file reactivates I can easily deal with the two minor blemishes if they even still exist. Would I be a good candidate for a seasoned tradeline, about what age in length and range in size would best suit me??

Although you did a good summary, we can’t answer your question without reviewing your credit report. We do this for free here: https://superiortradelines.com/start/

Hi. I really like the comments and detailed answers I’ve read here. I am 40 years old and my credit score is about 650. My income is good, however I have not always been very wise with my credit and trying to get it cleaned up. My wife and I are currently in a chapter 13 because we did not qualify for a chapter 7 and trying to get our credit cleaned up. We have a lot of medical bills among other things. This has been a very expensive process and will take us a while to get on the other side of it. 12 months after discharge I would be able to apply for a VA home loan. I figured after the discharge using your services would be a great way to boost my score to get a vehicle or help me get a home loan. IDK if this works during bankruptcy and I know it doesn’t clean my credit. Is there any options better than bankruptcy?

I recently added authorized users on my account and my card was closed. They said one person was unverifiable and wont let me dispute it. How can you prevent that this doesn’t happen to me when I’m on one of your tradelines.

Great question. We actually brief our cardholders on how to avoid this situation, upon enrollment into our program.

So, why did this happen? It happened because you added an authorized user who very likely has false information associated with their credit “profile.” This could include fraud, such as credit profile numbers (or CPNs).

This issue was likely flagged at the bank and they requested documents to attempt to verify the problematic information. At the moment you were unable to do that, the bank rightfully assumes the information is “unverifiable” (as you said), meaning, it’s likely fraud.

The bank likely has a zero-tolerance policy, so you’re likely not going to talk them out of it.

How do you prevent this? You work with a company like us that screens clients for fraud and other issues. We have sophisticated systems we use to verify information, but some scammers even get passed that So, we have a staff person dedicated to manually reviewing files, including looking at copies of SSNs, IDs, etc., to make sure they are not fakes.

I hope that was helpful.

Hello,

I want to purchase a home soon. I have a 643, 665,678 credit score. I paid off all my credit card debt, but I have $34,000 in student loans with late payments a few years ago. My score has remained consistent. It went down a few points from mortgage inquiries otherwise, it won’t increase. After purchasing a home, my goal is to start paying down my student loan. I want to get a car. Will a tradeline help me raise my score?

Will an authorized user tradeline help if I am no credit score (0 credit score)?

It’s complicated, actually. The first thing we will consider when we review your credit report is whether or not your credit files are actually open and active. You cannot actually “open” a credit file by adding authorized user tradelines. For example, when you get a loan or a credit card, that loan or credit card can actually open your credit files and make them active. However, adding authorized user tradelines will NOT open your file, and nothing will happen. If, on the other hand, you files are open and active and simply have nothing on them, then adding tradelines will work and you will see dramatic increases in score.

So, we will need to see your credit report prior to answering your question with accuracy.

The next question after that will be; what are you trying to accomplish in terms of credit? In your situation, with a limited file, lenders are not going to have much to evaluate. Sometimes this is good, sometimes they want to see primary tradelines that you’ve had for a certain period of time.

At the end of the day, in your situation, I cannot see adding tradelines as a bad thing (unless your files aren’t open). Because, you will boost your scores and be able to establish credit on your own much faster than if you got the traditional and typical “starter” credit cards, which kind of lump you into a “starter” file.

One of my lenders said authorized user’s don’t work. Has something changed?

Holly, it’s Matias.

I re-read your email and Kate’s answer. I saw that you said he has a “0” credit score.

Here’s the problem. We right and the mortgage lender is right. That is, authorized user tradelines MUST be accepted by lenders and the lender SHALL except the new scores once added (by law). There is no question here about that.

However, there are underwriting procedures that exceed mere qualifying credit scores. So, for example, if he has nothing on his credit file and we add authorized user tradelines and his scores jump into the 800s, they could still deny his loan application if he doesn’t have, for example, 12 months of reporting on a primary tradeline (or whatever underwriting standard they set for which he does not meet).

The trick here, is finding a lender with underwriting standards most favorable to your client’s circumstances. If you are using FHA, VA, etc., you may be SOL, because those standards are mandated and the lenders have no discretion over them. That is to say, if the lender says you need a 12 month old primary line and he doesn’t have it… well, you’d need to open a primary line and wait 12 months.

So, it really depends on the circumstances, but the mortgage professional’s opinion about authorized user tradelines not working still remains incorrect.

Thanks!

Hey Holly,

The mortgage broker is flat wrong. They may be “wise” to it, but it would be a violation of the EOCA and Fed Reg. B for a lender to NOT consider authorized user tradelines.

Please see the following to learn more [here][1] and [here][2].

I hope that helps,

Kate

[1]: https://superiortradelines.com/news/fico-08-fico-score/

[2]: https://superiortradelines.com/piggybacking/piggybacking-tradelines-origins-history-process-and-legality/

HI Kate,

I was suggesting a tradeline addition for a mortgage broker’s client who currently has no score and, as you can see below, he responded that AU’s don’t work for Mortgage loans. Have you seen that in the past?

Thanks,

Holly Jewell

…

Sent: Friday, December 06, 2013 1:20 PM

Subject: RE: updated credit score now showing 0 credit score!

Auth users doesn’t work for mortgage loan’s they are wise to that now.

[MODERATED]

Sent: Friday, December 06, 2013 1:06 PM

Subject: RE: updated credit score now showing 0 credit score!

Thanks. I do know some trradeline companies I could suggest he be added as an Authorized User… but I doubt if he is willing to pay for that. I could coach him to re-establish his credit but I’m sure he just wants that for free too! Sorry to be so cynical but this guy has really gotten on my last nerve – if you know what I mean…

Cheers,

Holly

[MODERATED]

Sent: Friday, December 06, 2013 12:38 PM

Subject: RE: updated credit score now showing 0 credit score!

He doesn’t have repair needed, he needs to get some tradelines and establish his credit, he told me to send that report to you and him so I did that’s all. That guy is a mess I agree he just doesn’t get it.

[MODERATED]

Sent: Friday, December 06, 2013 11:56 AM

Subject: RE: updated credit score now showing 0 credit score!

Hi,

I’m sure you will agree – [MODERATED] is a Mess! After I repaired his credit he refused to buy a home in his price range… and kept trying all these strange approaches… like a joint loan with his mother in law (or something like that).

He has called me on at least three occasions since I straightened out his credit to get free information and tips regarding his credit. I don’t mind giving free advice but each time after I review his credit and give him free advice about what to do then he never calls me back about following through with my suggestions which often involve debt settlement or other things to get his scores up…

Is he wanting to go through credit repair again?

I’d like to sell my tradelines

Please contact info@superiortradelines.com

Have a nice day.