Tradelines for credit improvement.

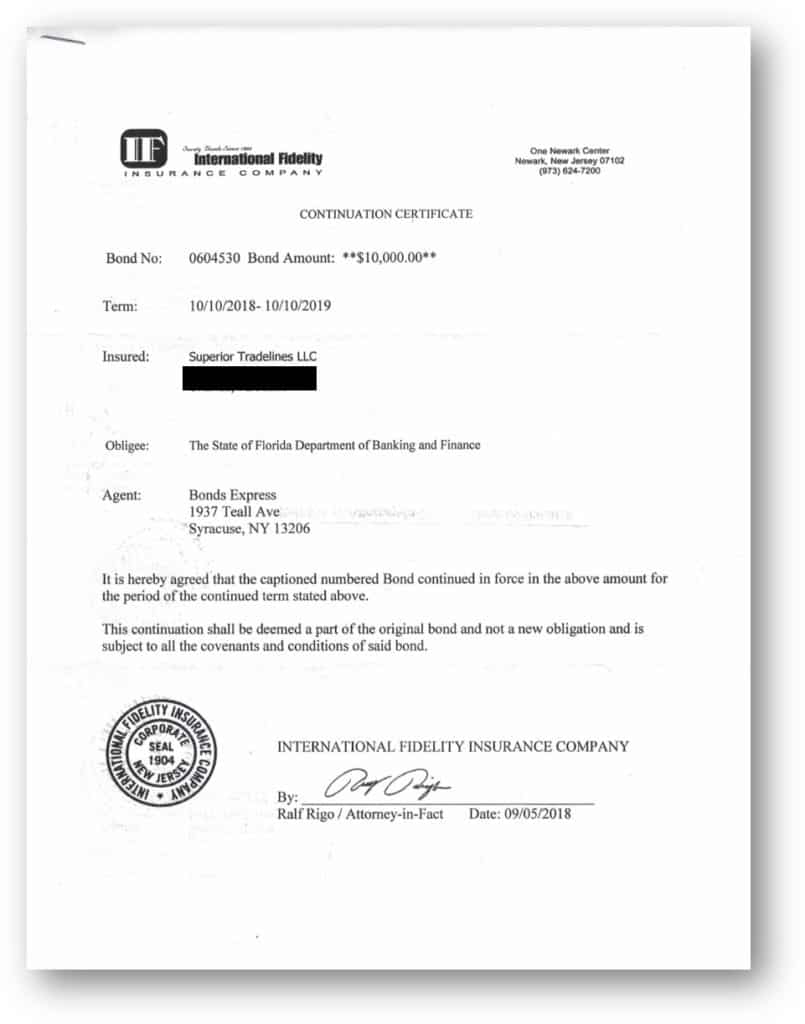

We are committed to offering the highest quality tradelines for sale while adhering to strict guidelines and safety regulations. Our services are backed by a surety bond of $10,000 and all funds are secured in a trust account at a federally insured institution until services have been rendered.

- Need tradelines that will affect your credit score the fastest?

- Want the most effective tradelines, at the best price?

- All of the above, without risk of being harmed financially?

The good news? We do just that.

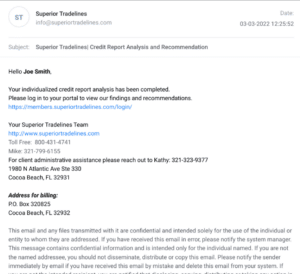

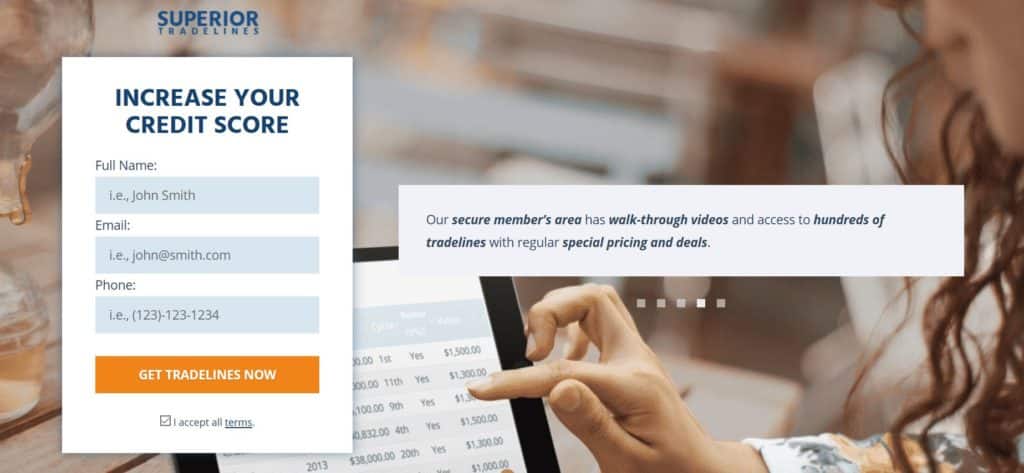

Our knowledgeable and capable staff provide a free credit report analysis, which we review and evaluate according to your current goals. We work with you to determine what would be the most efficient course of action, then we make recommendations based on our findings. If someone is trying to sell you tradelines but skips this step, you may not be receiving the best product for you.

We work with you one-on-one to develop a plan tailored specifically to your needs. We recommend tradelines based on our free credit report analysis, then we get to work. Once you have purchased the appropriate tradelines for you, your payment is placed into a secure trust account with a $10,000 surety bond. This is to ensure legal compliance as well as full transparency with our clients.

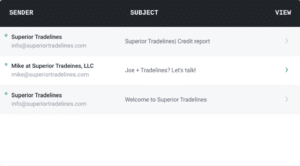

SMS and email notifications are sent out as progress is made and you will be the first to know when the tradelines post to your report. Voila, you have a new credit score! You may also be interested in our referral program, which can earn you $20 for each person you refer to us. You, and everyone you know, will be on your way to a better credit future! Learn how to earn money from referrals here.

Our Process: Visualized.

We know purchasing tradelines to increase your credit score can be daunting. We’ve taken the mystery out of the process by outlining each individual step below. Contact us if you still have questions.

Begin.

Go to Sign Up Online from the top right corner of any page.

Register.

Enter your name and phone number to begin.

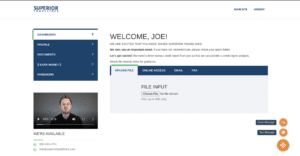

Welcome.

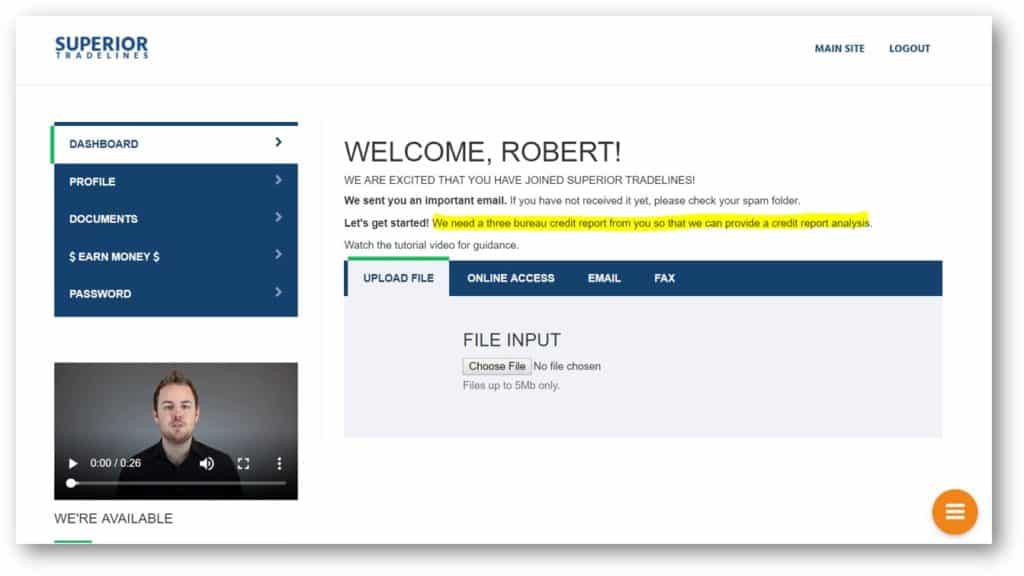

The first thing you’ll see is a request for a credit report. There are step-by-step instructions as well as video walkthroughs for each step.

Request credit report.

Once a credit report has been submitted, you can complete your profile, watch the walkthrough videos for each step, or upload or view documents.

Setup.

Profile setup is quick and easy.

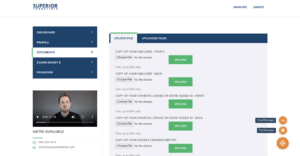

Upload.

Upload documents conveniently in one place. Watch the walkthrough video on the left if you need assistance.

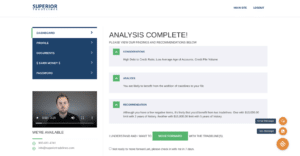

Review.

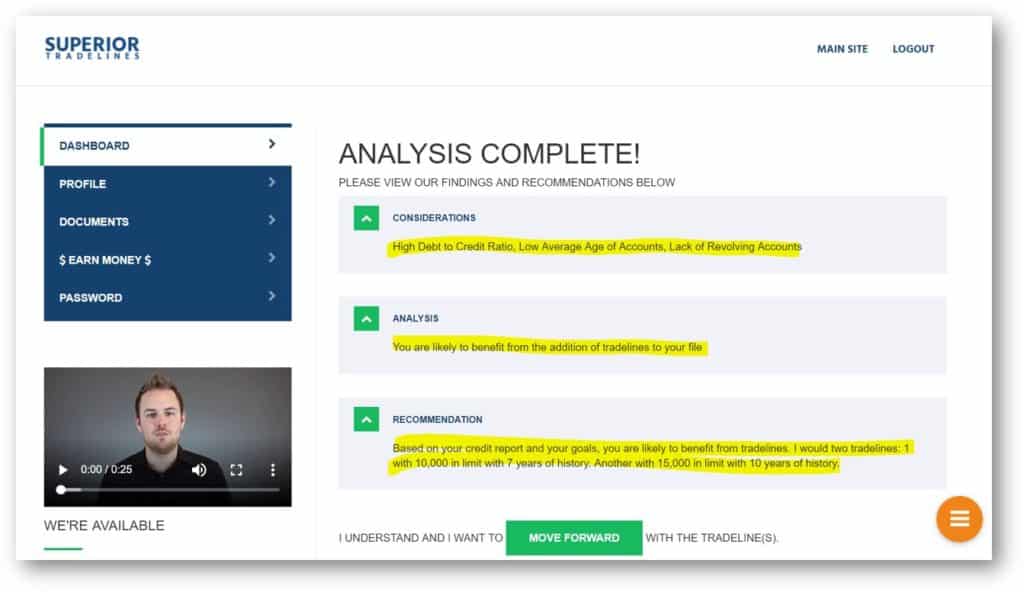

We review solutions based on your credit report analysis and recommend the best course of action to reach your goals.

Build.

We build a package specifically for you based off our recommendation and your goals.

Updates.

We provide SMS and email updates throughout the process so you are always informed and never left out of the loop.

Guidance.

Our experienced agents are here to assist you in every step of the process. Our goal is to make this as easy and headache-free for you as possible.

Protection.

All of our agreements are engineered with built-in legal compliance to protect you and give you peace of mind.

Agreement.

We provide written terms of agreement upfront for you to review. No secrets, surprises, or mysteries.

Sign.

Once you are happy with the terms of agreement, you can easily sign documents through our secure system.

Integrity.

We place your funds into a secure trust account until services are rendered. This is our way of promising to you that we refuse to accept payment until we have completed our terms of the agreement.

Earn money for referrals.

Once you see how powerful the addition of tradelines to your credit history can be, you’ll want to share the good news with everyone. We offer $20 for each person you refer who buys tradelines from us. It’s a win-win! Click here to learn how to earn money from referrals.

How much do tradelines for sale cost?

Tradelines for sale range in price.

Some companies claim to offer tradelines in the low hundreds or on a low monthly installment plan. Some companies offer them for sale for over $2,000.00 each. Tradelines under $200.00 are not really realistic as the cardholders usually get paid about this much.

So, unless they are engaging in charity, this is an unrealistic price.

Those offering tradelines for sale for over $2,000.00 are living in the old days… the “old days” being before the FICO ’08 debacle.

Today, tradelines are realistically priced between $600.00 and $1,500.00. The former will get you a $5,000.00 tradeline and the latter will get you a pretty substantial line, probably over $40,000.00.

There are deals on tradelines and these deals are usually based upon bulk orders or simplicity of use.

To see legitimate pricing and costs for tradelines, here’s an example of a tradeline list, below.

However, note that these prices may be higher or lower than listed and availability changes constantly (so a static tradeline list might not be accurate at the time you shop it).

Example Tradeline List

Tradelines listed here are publically available. A majority are unpublished and reserved for affiliates and may also be available to you, so please ask if you don't see what you need. All tradelines listed have a balance below 10% (unless otherwise notified). Prices are subject to change without notice.| Creditor | History | Limit | Cycle | Below 10%? | Value |

|---|---|---|---|---|---|

| Citibank | 2015 | $50,000.00 | 1st | Yes | $1,500.00 |

| Citibank | 2001 | $50,000.00 | 11th | Yes | $1,300.00 |

| Chase | 2005 | $46,100.00 | 9th | Yes | $1,300.00 |

| Chase | 2017 | $40,832.00 | 4th | Yes | $1,500.00 |

| Chase | 2013 | $38,000.00 | 20th | Yes | $1,300.00 |

| Citibank | 2004 | $38,000.00 | 26th | Yes | $1,000.00 |

| Barclays | 2016 | $37,000.00 | 21st | Yes | $1,100.00 |

| Chase | 2013 | $36,471.00 | 18th | Yes | $1,000.00 |

| PNC | 1987 | $35,000.00 | 7th | Yes | $1,075.00 |

| Citibank | 2015 | $35,000.00 | 16th | Yes | $950.00 |

| Citibank | 2010 | $34,100.00 | 18th | Yes | $1,000.00 |

| Barclays | 2013 | $32,500.00 | 15th | Yes | $850.00 |

| Citibank | 2012 | $31,000.00 | 24th | Yes | $1,000.00 |

| Discover | 1996 | $30,500.00 | 22nd | Yes | $1,000.00 |

| Citibank | 2014 | $30,000.00 | 28th | Yes | $820.00 |

| Discover | 2013 | $29,950.00 | 15th | Yes | $975.00 |

| Discover | 2013 | $29,700.00 | 25th | Yes | $1,000.00 |

| Citibank | 2010 | $29,000.00 | 28th | Yes | $1,000.00 |

| Barclays | 2015 | $28,950.00 | 9th | Yes | $950.00 |

| Chase | 2016 | $27,000.00 | 25th | Yes | $870.00 |

| Chase | 2016 | $26,000.00 | 19th | Yes | $900.00 |

| Chase | 2002 | $25,900.00 | 12th | Yes | $1,000.00 |

| Barclays | 2014 | $25,700.00 | 20th | Yes | $950.00 |

| Bank of Amercia | 2010 | $25,000.00 | 9th | Yes | $825.00 |

| Citibank | 2013 | $25,000.00 | 9th | Yes | $1,000.00 |

| Barclays | 2015 | $25,000.00 | 11th | Yes | $960.00 |

| Citibank | 2007 | $25,000.00 | 11th | Yes | $950.00 |

| Chase | 2006 | $25,000.00 | 24th | Yes | $1,095.00 |

| Discover | 2010 | $25,000.00 | 24th | Yes | $900.00 |

| Chase | 2016 | $25,000.00 | 25th | Yes | $700.00 |

| Citibank | 2015 | $25,000.00 | 27th | Yes | $900.00 |

| Barclays | 2017 | $25,000.00 | 28th | Yes | $850.00 |

| Citibank | 1997 | $25,000.00 | 28th | Yes | $1,000.00 |

| Barclays | 2016 | $24,500.00 | 22nd | Yes | $800.00 |

| Capital One | 2007 | $24,000.00 | 2nd | Yes | $975.00 |

| Wells Fargo | 2001 | $23,900.00 | 22nd | Yes | $900.00 |

| Wells Fargo | 2017 | $22,500.00 | 1st | Yes | $800.00 |

| US Bank | 2004 | $22,500.00 | 15th | Yes | $900.00 |

| Discover | 2015 | $22,500.00 | 17th | Yes | $950.00 |

| discover | 2010 | $22,500.00 | 28th | Yes | $820.00 |

| Chase | 2015 | $22,000.00 | 15th | Yes | $925.00 |

| Citibank | 2015 | $21,200.00 | 23rd | Yes | $925.00 |

| Discover | 2011 | $21,000.00 | 3rd | Yes | $920.00 |

| Barclays | 2013 | $21,000.00 | 11th | Yes | $900.00 |

| Chase | 2016 | $21,000.00 | 16th | Yes | $800.00 |

| Citibank | 2005 | $20,500.00 | 1st | Yes | $960.00 |

| Barclays | 2015 | $20,500.00 | 15th | Yes | $950.00 |

| Barclays | 2013 | $20,400.00 | 24th | Yes | $950.00 |

| Citibank | 2008 | $20,100.00 | 23rd | Yes | $850.00 |

| Citibank | 2010 | $20,100.00 | 27th | Yes | $850.00 |

| Chase | 2010 | $20,000.00 | 3rd | Yes | $900.00 |

| Chase | 2015 | $20,000.00 | 10th | Yes | $950.00 |

| Barclays | 2012 | $20,000.00 | 12th | Yes | $955.00 |

| Capital One | 2005 | $20,000.00 | 15th | Yes | $1,000.00 |

| Citibank | 2008 | $20,000.00 | 16th | Yes | $900.00 |

| Barclays | 2014 | $20,000.00 | 19th | Yes | $830.00 |

| BMW Financial Services Card | 2017 | $20,000.00 | 22nd | Yes | $800.00 |

| Discover | 2014 | $20,000.00 | 22nd | Yes | $900.00 |

| Barclays | 2005 | $20,000.00 | 25th | Yes | $980.00 |

| Chase | 2014 | $20,000.00 | 25th | Yes | $900.00 |

| Citibank | 2005 | $19,900.00 | 9th | Yes | $900.00 |

| Discover | 2015 | $19,400.00 | 3rd | Yes | $900.00 |

| Citibank | 2005 | $19,400.00 | 23rd | Yes | $920.00 |

| Chase | 2017 | $19,100.00 | 16th | Yes | $900.00 |

| Citibank | 2012 | $19,100.00 | 28th | Yes | $950.00 |

| Citibank | 2016 | $19,000.00 | 19th | Yes | $850.00 |

| Chase | 2009 | $19,000.00 | 21st | Yes | $920.00 |

| Barclays | 2016 | $19,000.00 | 22nd | Yes | $800.00 |

| Discover | 2011 | $18,500.00 | 7th | Yes | $900.00 |

| KeyBank | 1984 | $18,300.00 | 18th | Yes | $950.00 |

| Barclays | 2012 | $18,200.00 | 10th | Yes | $850.00 |

| Discover | 2014 | $18,100.00 | 18th | Yes | $880.00 |

| Chase | 2002 | $18,000.00 | 2nd | Yes | $950.00 |

| Discover | 2013 | $18,000.00 | 2nd | Yes | $800.00 |

| Chase | 2015 | $18,000.00 | 9th | Yes | $900.00 |

| Citibank | 2014 | $18,000.00 | 26th | Yes | $800.00 |

| Chase | 2003 | $17,829.00 | 25th | Yes | $750.00 |

| PNC | 2016 | $17,500.00 | 23rd | Yes | $700.00 |

| Citibank | 2011 | $17,250.00 | 8th | Yes | $900.00 |

| Chase | 2016 | $17,000.00 | 16th | Yes | $900.00 |

| Citibank | 2006 | $16,500.00 | 20th | Yes | $860.00 |

| Capital One | 2012 | $16,500.00 | 26th | Yes | $850.00 |

| Bank of Amercia | 2001 | $16,300.00 | 22nd | Yes | $1,000.00 |

| Navy Federal | 2014 | $16,100.00 | 25th | Yes | $850.00 |

| Chase | 2014 | $16,000.00 | 25th | Yes | $850.00 |

| Discover | 2015 | $15,600.00 | 3rd | Yes | $900.00 |

| Citibank | 2014 | $15,500.00 | 12th | Yes | $850.00 |

| Barclays | 2015 | $15,500.00 | 28th | Yes | $860.00 |

| Chase | 2004 | $15,000.00 | 2nd | Yes | $925.00 |

| Chase | 2014 | $15,000.00 | 3rd | Yes | $850.00 |

| Chase | 2008 | $15,000.00 | 5th | Yes | $860.00 |

| Synchrony | 2015 | $15,000.00 | 5th | Yes | $820.00 |

| Discover | 1995 | $15,000.00 | 7th | Yes | $870.00 |

| Citibank | 2008 | $15,000.00 | 10th | Yes | $950.00 |

| Barclays | 2016 | $15,000.00 | 11th | Yes | $800.00 |

| TD Bank | 2017 | $15,000.00 | 11th | Yes | $875.00 |

| Barclays | 2016 | $15,000.00 | 14th | Yes | $800.00 |

| Chase | 2015 | $15,000.00 | 14th | Yes | $900.00 |

| Bank of Amercia | 2013 | $15,000.00 | 15th | Yes | $825.00 |

| Capital One | 2015 | $15,000.00 | 15th | Yes | $850.00 |

| US Bank | 2014 | $15,000.00 | 15th | Yes | $900.00 |

| Barclays | 2015 | $15,000.00 | 16th | Yes | $850.00 |

| Capital One | 2006 | $15,000.00 | 16th | Yes | $900.00 |

| Citibank | 2014 | $15,000.00 | 17th | Yes | $830.00 |

| Barclays | 2013 | $15,000.00 | 18th | Yes | $875.00 |

| Barclays | 2015 | $15,000.00 | 19th | Yes | $900.00 |

| Barclays | 2015 | $15,000.00 | 23rd | Yes | $850.00 |

| Citibank | 2001 | $14,700.00 | 14th | Yes | $825.00 |

| Citibank | 2007 | $14,200.00 | 16th | Yes | $850.00 |

| Elan Financial | 2014 | $14,000.00 | 15th | Yes | $800.00 |

| Discover | 2012 | $14,000.00 | 21st | Yes | $825.00 |

| Chase | 2014 | $13,800.00 | 23rd | Yes | $750.00 |

| US Bank | 2014 | $13,700.00 | 15th | Yes | $815.00 |

| Elan Financial | 2014 | $13,500.00 | 15th | Yes | $850.00 |

| Discover | 2015 | $13,500.00 | 25th | Yes | $800.00 |

| barclays | 2014 | $13,500.00 | 28th | Yes | $800.00 |

| Discover | 2013 | $13,200.00 | 25th | Yes | $840.00 |

| Citibank | 2015 | $13,000.00 | 20th | Yes | $820.00 |

| Chase | 2007 | $13,000.00 | 21st | Yes | $860.00 |

| Capital One | 2016 | $13,000.00 | 25th | Yes | $700.00 |

| Citibank | 2014 | $12,900.00 | 1st | Yes | $800.00 |

| Chase | 2009 | $12,900.00 | 5th | Yes | $850.00 |

| Discover | 2011 | $12,600.00 | 24th | Yes | $850.00 |

| Bank of Amercia | 2011 | $12,500.00 | 1st | Yes | $850.00 |

| Barclays | 2014 | $12,500.00 | 10th | Yes | $800.00 |

| Barclays | 2014 | $12,500.00 | 26th | Yes | $750.00 |

| Wells Fargo | 2016 | $12,500.00 | 27th | Yes | $700.00 |

| Citibank | 2016 | $12,100.00 | 15th | Yes | $700.00 |

| Chase | 2014 | $12,000.00 | 8th | Yes | $850.00 |

| Citibank | 2016 | $12,000.00 | 10th | Yes | $800.00 |

| US Bank | 2015 | $12,000.00 | 10th | Yes | $820.00 |

| Chase | 2014 | $12,000.00 | 13th | Yes | $750.00 |

| Barclays | 2015 | $12,000.00 | 16th | Yes | $800.00 |

| Chase | 2011 | $12,000.00 | 16th | Yes | $800.00 |

| Citibank | 2006 | $12,000.00 | 19th | Yes | $800.00 |

| Citibank | 2015 | $12,000.00 | 22nd | Yes | $800.00 |

| PNC | 2007 | $12,000.00 | 26th | Yes | $910.00 |

| Bank of Amercia | 2006 | $12,000.00 | 28th | Yes | $820.00 |

| Barclays | 2015 | $12,000.00 | 28th | Yes | $750.00 |

| Chase | 2011 | $12,000.00 | 28th | Yes | $800.00 |

| Citibank | 2001 | $11,800.00 | 9th | Yes | $850.00 |

| Discover | 2014 | $11,800.00 | 12th | Yes | $815.00 |

| Discover | 2000 | $11,700.00 | 6th | Yes | $950.00 |

| Citibank | 2014 | $11,600.00 | 21st | Yes | $700.00 |

| Chase | 2012 | $11,500.00 | 12th | Yes | $850.00 |

| Citibank | 2016 | $11,500.00 | 14th | Yes | $700.00 |

| US Bank | 2013 | $11,500.00 | 15th | Yes | $815.00 |

| Barclays | 2014 | $11,500.00 | 20th | Yes | $800.00 |

| Discover | 2015 | $11,100.00 | 8th | Yes | $800.00 |

| Citibank | 2015 | $11,000.00 | 1st | Yes | $700.00 |

| US Bank | 2014 | $11,000.00 | 15th | Yes | $700.00 |

| Citibank | 2014 | $11,000.00 | 20th | Yes | $750.00 |

| Chase | 2015 | $10,800.00 | 18th | Yes | $750.00 |

| Citibank | 2015 | $10,800.00 | 19th | Yes | $700.00 |

| Capital One | 2013 | $10,750.00 | 15th | Yes | $720.00 |

| Capital One | 2013 | $10,750.00 | 21st | Yes | $800.00 |

| Citibank | 2013 | $10,500.00 | 12th | Yes | $700.00 |

| Citibank | 2016 | $10,500.00 | 21st | Yes | $700.00 |

| Citibank | 2010 | $10,500.00 | 26th | Yes | $850.00 |

| Discover | 2013 | $10,400.00 | 28th | Yes | $750.00 |

| Citibank | 2012 | $10,300.00 | 20th | Yes | $750.00 |

| Citibank | 2001 | $10,100.00 | 18th | Yes | $900.00 |

| Capital One | 2015 | $10,000.00 | 1st | Yes | $800.00 |

| Capital One | 2016 | $10,000.00 | 1st | Yes | $700.00 |

| Capital One | 2009 | $10,000.00 | 4th | Yes | $925.00 |

| Barclays | 2012 | $10,000.00 | 9th | Yes | $750.00 |

| Capital One | 2015 | $10,000.00 | 9th | Yes | $800.00 |

| Chase | 2013 | $10,000.00 | 10th | Yes | $800.00 |

| Chase | 2012 | $10,000.00 | 12th | Yes | $800.00 |

| Bank of Amercia | 2016 | $10,000.00 | 13th | Yes | $700.00 |

| Barclays | 2014 | $10,000.00 | 15th | Yes | $750.00 |

| Citibank | 2016 | $10,000.00 | 15th | Yes | $700.00 |

| Discover | 2011 | $10,000.00 | 16th | Yes | $750.00 |

| KeyBank | 2013 | $10,000.00 | 21st | Yes | $800.00 |

| Capital One | 2014 | $10,000.00 | 22nd | Yes | $800.00 |

| Barclays | 2013 | $10,000.00 | 23rd | Yes | $700.00 |

| Synchrony | 2016 | $10,000.00 | 27th | Yes | $750.00 |

| Chase | 2012 | $9,776.00 | 19th | Yes | $800.00 |

| Discover | 2012 | $9,500.00 | 26th | Yes | $900.00 |

| Citibank | 2015 | $9,400.00 | 19th | Yes | $750.00 |

| Citibank | 2014 | $9,000.00 | 7th | Yes | $700.00 |

| Synchrony | 2014 | $9,000.00 | 9th | Yes | $750.00 |

| US Bank | 2014 | $9,000.00 | 15th | Yes | $800.00 |

| Capital One | 1998 | $8,900.00 | 28th | Yes | $850.00 |

| Citibank | 2014 | $8,600.00 | 20th | Yes | $800.00 |

| Citibank | 2016 | $8,600.00 | 20th | Yes | $750.00 |

| Citibank | 2015 | $8,400.00 | 20th | Yes | $750.00 |

| Discover | 2004 | $8,400.00 | 23rd | Yes | $800.00 |

| Citibank | 2016 | $8,100.00 | 23rd | Yes | $700.00 |

| Discover | 2014 | $8,000.00 | 4th | Yes | $800.00 |

| Citibank | 2016 | $8,000.00 | 14th | Yes | $750.00 |

| Capital One | 2013 | $8,000.00 | 19th | Yes | $700.00 |

| Capital One | 2010 | $8,000.00 | 24th | Yes | $750.00 |

| Chase | 2015 | $8,000.00 | 28th | Yes | $800.00 |

| Citibank | 2016 | $7,900.00 | 20th | Yes | $800.00 |

| Citibank | 2015 | $7,800.00 | 14th | Yes | $700.00 |

| Capital One | 2014 | $7,500.00 | 16th | Yes | $750.00 |

| Barclays | 2017 | $7,500.00 | 22nd | Yes | $700.00 |

| Bank of Amercia | 2012 | $7,500.00 | 26th | Yes | $825.00 |

| Discover | 2003 | $7,200.00 | 7th | Yes | $850.00 |

| PNC | 2014 | $7,000.00 | 4th | Yes | $750.00 |

| Chase | 2013 | $7,000.00 | 11th | Yes | $700.00 |

| Citibank | 2014 | $7,000.00 | 12th | Yes | $750.00 |

| Citibank | 2014 | $7,000.00 | 12th | Yes | $800.00 |

| Capital One | 2006 | $7,000.00 | 25th | Yes | $800.00 |

| Citibank | 2014 | $6,900.00 | 11th | Yes | $750.00 |

| Citibank | 2015 | $6,800.00 | 17th | Yes | $750.00 |

| Chase | 2006 | $6,500.00 | 13th | Yes | $750.00 |

| Chase | 2001 | $6,400.00 | 14th | Yes | $850.00 |

| Capital One | 1994 | $6,390.00 | 9th | Yes | $800.00 |

| Citibank | 2014 | $6,100.00 | 19th | Yes | $800.00 |

| Citibank | 2015 | $6,000.00 | 9th | Yes | $700.00 |

| Chase | 2015 | $6,000.00 | 25th | Yes | $750.00 |

| Citibank | 2015 | $5,700.00 | 9th | Yes | $700.00 |

| Chase | 2014 | $5,500.00 | 3rd | Yes | $700.00 |

| Chase | 2008 | $5,300.00 | 12th | Yes | $750.00 |

| Citibank | 2012 | $5,100.00 | 25th | Yes | $750.00 |

| Capital One | 1998 | $5,000.00 | 28th | Yes | $750.00 |

| Chase | 2017 | $5,000.00 | 2nd | Yes | $700.00 |

| Discover | 2015 | $5,000.00 | 2nd | Yes | $700.00 |

| Chase | 2014 | $5,000.00 | 10th | Yes | $700.00 |

| Synchrony | 2011 | $5,000.00 | 17th | Yes | $800.00 |

| Chase | 2015 | $5,000.00 | 19th | Yes | $700.00 |

| Citibank | 2016 | $5,000.00 | 21st | Yes | $750.00 |

| TD Bank | 2008 | $5,000.00 | 21st | Yes | $750.00 |

| Capital One | 2012 | $5,000.00 | 23rd | Yes | $815.00 |

| Synchrony | 2015 | $5,000.00 | 23rd | Yes | $700.00 |

| Barclays | 2014 | $5,000.00 | 25th | Yes | $750.00 |

| Capital One | 2006 | $4,500.00 | 22nd | Yes | $725.00 |

| Chase | 2014 | $4,300.00 | 20th | Yes | $725.00 |

| Barclays | 2014 | $4,000.00 | 10th | Yes | $800.00 |

| Wells Fargo | 2007 | $3,800.00 | 12th | Yes | $850.00 |

| Bank of Amercia | 2011 | $1,900.00 | 17th | Yes | $850.00 |

| Citibank | 1970 | $1,300.00 | 12th | Yes | $800.00 |

Tradelines for sale, in general.

Tradelines are accounts onto which you can pay to be added as an authorized user for the purpose of increasing your credit score. Yes, you can buy seasoned tradelines for credit enhancement. Although buying tradelines can be a powerful tool, you should educate yourself and be careful.

This page consolidates every bit of information we have on the topic of credit tradelines. It is long, but if you read it, you will know everything you need to know before purchasing authorized user tradelines.

Here’s a quick video to explain buying tradelines, generally.

The 411 on buying tradelines for sale.

We wrote over 3,000 words on buying tradelines, in general, which you should read. This page, of course, is about purchasing tradelines in order to have an improved credit score.

It might be helpful to explain what tradelines are in a few sentences.

- Tradelines are accounts in your credit report. If you have good accounts (i.e, “tradelines”), you’ll have a good credit score.

- Obviously, the opposite applies. That is, if you have bad accounts in your credit report, you’ll have a bad credit score.

How to purchase tradelines for sale.

In order to get accounts, you have to apply for a credit account and be approved for credit. For example, applying for and being approved for a credit card. Once that credit card shows up on your credit report, that’s a tradeline.

If you have a perfect payment history, your credit score will increase as your credit behavior is proven. If you miss payments or max out the credit account, your credit score will go down.

This takes time, which most of us do not have.

Thankfully, there’s a shortcut.

Parents can add their children as authorized users on to their credit cards. The children benefit from this because the established history of the credit card appears on the child’s credit report. This in turn shows the full credit history of the credit accounts.

As a result, the child’s credit scores shoot through the roof (as if the child had opened and established a credit account with a positive payment history).

This is called piggybacking.

Now, here’s the trick.

-

- It makes no difference whether the parent adds his or her child or a perfect stranger. That father or mother with the credit card can add anyone they want onto their credit card account as an authorized user.

- You can pay to be added as an authorized user on someone else’s aged (or “seasoned”) account (or you can “purchase seasoned tradelines.”)

Commercialization of tradelines for sale.

Although the process is outlined above, there are some gaps in the story.

For example, how…

- Do you find people with a positive payment history on their credit file to add you as an authorized user onto their credit card?

- Does the cardholder find authorized users to add?

- Is this process commercialized so as to protect the parties involved through a broker?

In other words, how is this process put together so that anyone (not just the son or daughter of a wealthy person) can benefit from such an arrangement? Well, the practice of piggybacking credit has become as common as credit repair.

There are authorized user tradeline companies who organize and connect the cardholders and the consumers seeking to improve their credit scores through this method.

Let’s back up just a bit. Let’s put this in context with a quick note on the history of buying and selling tradelines for credit.

A quick history of tradelines for sale.

The practice of piggybacking credit has existed since 1974-ish. It is made possible by a law that was signed into law that year called the Equal Credit Opportunity Act of 1974.

“The Federal Reserve’s Regulation B, which implements the 1974 Equal Credit Opportunity Act, requires that information on spousal authorized user accounts be reported to the credit bureaus and considered when lenders evaluate credit history. Since creditors generally furnish to the credit bureaus information on all authorized user accounts, without indicating which are spouses and which are not, credit scoring modelers cannot distinguish spousal from non‐spousal authorized user accounts.

This effectively requires that all authorized user accounts receive similar treatment. Consequently, becoming an authorized user on an old account with a good payment history, may improve an individual’s credit score, potentially increasing access to credit or reducing borrowing costs. As a result, the practice of “piggybacking credit” has developed.”

Finance and Economics Discussion Series

Divisions of Research & Statistics and Monetary Affairs

Federal Reserve Board, Washington, D.C.

The 411 on buying tradelines.

We wrote over 3,000 words on buying tradelines, in general, which you should read. This page, of course, is about purchasing tradelines in order to have an improved credit score.

It might be helpful to explain what tradelines are in a few sentences.

- Tradelines are accounts in your credit report. If you have good accounts (i.e, “tradelines”), you’ll have a good credit score.

- Obviously, the opposite applies. That is, if you have bad accounts in your credit report, you’ll have a bad credit score.

How to purchase tradelines for sale.

In order to get accounts, you have to apply for a credit account and be approved for credit. For example, applying for and being approved for a credit card. Once that credit card shows up on your credit report, that’s a tradeline.

If you have a perfect payment history, your credit score will increase as your credit behavior is proven. If you miss payments or max out the credit account, your credit score will go down.

This takes time, which most of us do not have.

Thankfully, there’s a shortcut.

Parents can add their children as authorized users on to their credit cards. The children benefit from this because the established history of the credit card appears on the child’s credit report. This in turn shows the full credit history of the credit accounts.

As a result, the child’s credit scores shoot through the roof (as if the child had opened and established a credit account with a positive payment history).

This is called piggybacking.

Now, here’s the trick.

-

- It makes no difference whether the parent adds his or her child or a perfect stranger. That father or mother with the credit card can add anyone they want onto their credit card account as an authorized user.

- You can pay to be added as an authorized user on someone else’s aged (or “seasoned”) account (or you can “purchase seasoned tradelines.”)

Commercialization of tradelines for sale.

Although the process is outlined above, there are some gaps in the story.

For example, how…

- Do you find people with a positive payment history on their credit file to add you as an authorized user onto their credit card?

- Does the cardholder find authorized users to add?

- Is this process commercialized so as to protect the parties involved through a broker?

In other words, how is this process put together so that anyone (not just the son or daughter of a wealthy person) can benefit from such an arrangement? Well, the practice of piggybacking credit has become as common as credit repair.

There are authorized user tradeline companies who organize and connect the cardholders and the consumers seeking to improve their credit scores through this method.

Let’s back up just a bit. Let’s put this in context with a quick note on the history of buying and selling tradelines for credit.

A quick history.

The practice of piggybacking credit has existed since 1974-ish. It is made possible by a law that was signed into law that year called the Equal Credit Opportunity Act of 1974.

“The Federal Reserve’s Regulation B, which implements the 1974 Equal Credit Opportunity Act, requires that information on spousal authorized user accounts be reported to the credit bureaus and considered when lenders evaluate credit history. Since creditors generally furnish to the credit bureaus information on all authorized user accounts, without indicating which are spouses and which are not, credit scoring modelers cannot distinguish spousal from non‐spousal authorized user accounts.

This effectively requires that all authorized user accounts receive similar treatment. Consequently, becoming an authorized user on an old account with a good payment history, may improve an individual’s credit score, potentially increasing access to credit or reducing borrowing costs. As a result, the practice of “piggybacking credit” has developed.”

Finance and Economics Discussion Series

Divisions of Research & Statistics and Monetary Affairs

Federal Reserve Board, Washington, D.C.

Tradelines for sale… these days.

Today, the authorized user tradeline industry is growing at a rapid rate. This is a good and bad thing.

It’s good because the benefit of adding tradelines can reach more consumers as they become more aware of the options available to them.

It’s bad because shoddy “businesses” are popping up left and right trying to clone that which has been established by legitimate tradeline companies.

As a result, the quality of service has been compromised.

If you google authorized user tradelines, you’ll see many pages of results of people offering tradelines for sale.

Go to YouTube, you’ll see everything from professional tradeline videos to people walking around an apartment complex in their pajamas “teaching” others how to increase their credit scores.

If you go on Craigslist (which you should never do), you’ll see packages from a no-name, no-company, no-phone-number “seller” asking you to irrevocably wire money in exchange for tradeline services.

In a market this ripe for abuse, you must be careful!

Buying authorized user tradelines for sale.

Here’s what it’s like to buy tradelines. You need to be very careful when you decide on a company. This is what a tradeline buying experience should be like:

1) You should research and find a professional tradelines company.

You should look for their brand. Be sure that their website has a lot of content. Look for their faces on the site. Look for direct contact information.

Once you have a level of comfort, you should call them (don’t let them hide behind emails… get on the phone so you can use your judgment and evaluate their worthiness for your business).

2) The tradelines company should offer to review your credit goals and your credit report.

Why? Because without reviewing your credit history, how else would they know which tradelines you need? If a company is offering you a list, that’s like a doctor saying “just pick some medicine and pay the clerk on the way out.” Or, it’s like a mechanic shoving a parts catalog in your face rather than asking you what’s wrong with your car.

3) The tradelines company should make an informed recommendation designed to help you, not their pocketbook.

This recommendation should include which tradelines, how many, credit limit, ages, etc. Or, if you’re not qualified for tradelines, they should make a recommendation for some other credit-related service (rather than sell you tradelines that won’t work).

4) The tradelines company should put their promises in a written agreement.

Not only should they do this, but it’s required by law. You will get an agreement that outlines the service, price, refund policy, etc. In addition, you’ll receive a rights statement under federal and state law. Also, you’ll get a notice of cancellation (showing you how to cancel, should you decide to cancel).

5) The company should hold your funds in trust (like “escrow”).

This service is to protect you in the event things don’t go as planned. In fact, if a company establishes a trust account and surety bond, that’s almost enough to trust them, because then they can get in serious trouble if they try to rip you off.

6) Tradelines for sale don’t always go as planned.

If for some reason the tradelines don’t report, a good company will either offer a refund or try the services again at no additional cost.

Tradeline Deals vs. Tradeline Scams.

Just as you should be cautious with the company with which you do business, you should be cautious for so-called tradeline “deals” and unrealistically low prices.

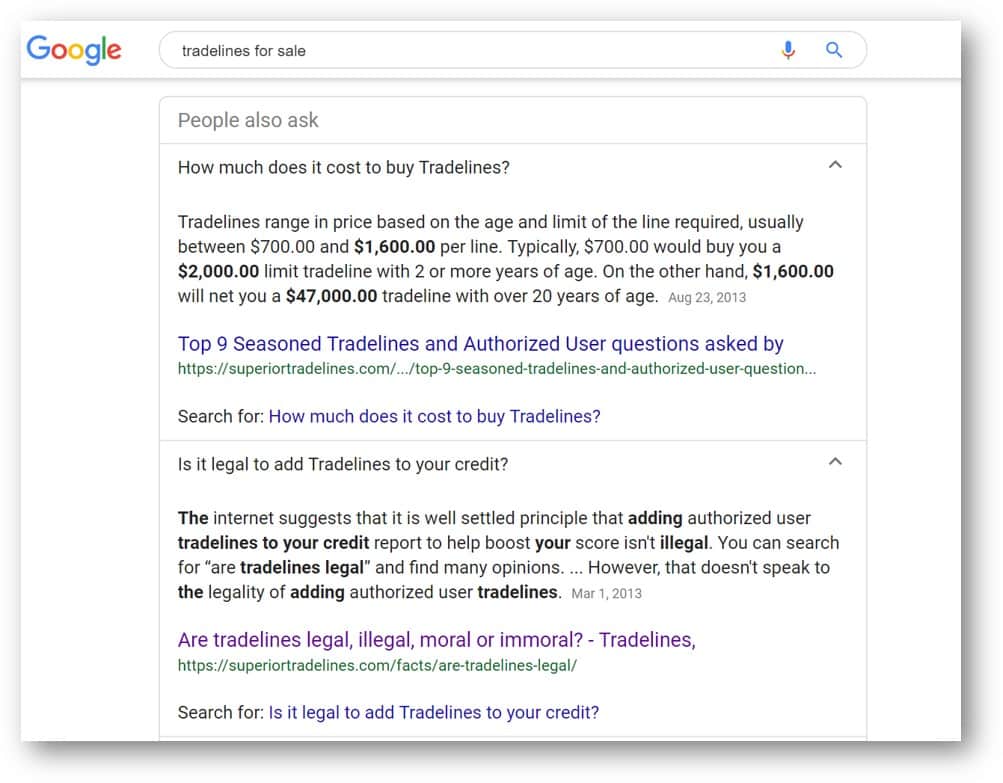

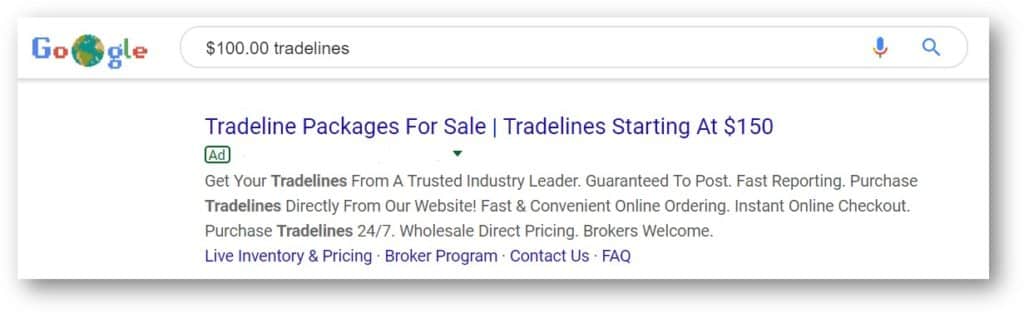

We recently wrote an article showing what happens when you buy $300.00 tradelines. We started with fake and misleading ads on Google, like this:

The article goes on to show the bait and switch as well as the resulting complaint against the company.

We say:

“Cheap doesn’t mean scam, but too cheap does.”

If that’s the case, how do you find legitimate deals?

Well, you should first understand a bit of the economics that goes into buying tradelines. When you do, you’ll be able to spot nonsense from a mile away.

First of all, to run a legitimate business, you’ll need:

- Legal expenses (establishing, maintaining, etc.)

- Accounting (filing taxes, etc.)

- An office (rent)

- Knowledge (which takes time to acquire)

- Marketing (to attract customers and vendors)

- A website (which is expensive, if it’s dynamic)

- Labor (you’ll need to pay everyone involved)

One of those people being paid is a cardholder (the person adding the clients).

They typically get paid no less than $100.00 per authorized user. $150.00 is very common. $200.00 to $300.00 is common for higher end cards.

So, right off the bat, it’s literally impossible to sell tradelines for $100.00 (or $200.00 or $300.00).

Now, you can cut out a lot of that stuff above, but you will be cutting out value. The more you cut, the more you demand less legitimacy from the tradeline company.

When people offer very low prices, they’re literally saying “I don’t do everything I should in exchange for charging you less.”

Most of the time, it’s because they have no intention of doing anything at all and you’ll likely part with $150.00 on the mere promise of service, despite no recourse, whatsoever.

Legitimate tradeline deals.

There are only a few situations in which tradeline deals are legitimate.

- The tradeline company has an oversupply of inventory and decides to take a cut from their fee which they will make up with the volume of sales resulting from the deal.

- Vendors whose lines remain unsold may agree to reduce their fee, savings which can be passed on to the consumer.

- A salesperson agrees to reduce their fee to receive a bonus based on total sales or some other kind of promotional benefit (such as a tradeline giveaway for promotional purposes).

So, to do things correctly, it’s going to cost a certain amount of money (which is way more than $300.00).

In order to offer a deal, someone at some point must be willing to forgo a portion of the fee they’re otherwise entitled to. Possibly, in exchange for some other value (i.e., more overall sales, promotion, bonus, etc.).

Where to buy tradelines for sale?

Tradelines for sale are offered all over the internet. From “that guy” on Craigslist in the middle of nowhere, to your “one-stop shops” that just seem to have every solution for every problem.

Here, are Superior Tradelines, LLC, we have a reputation of delivering on our promised services.

We do not spread ourselves thin with all the new “buzz words” and shady techniques (like CPNs).

In fact, we are bonded with a $10,000.00 surety bond, which compared to the foregoing, should answer the question with confidence… you can get from Superior Tradelines, LLC.

TRADELINES YOU CAN’T BUY:

Primary tradelines. No, you cannot buy primary tradelines. The only reason you can buy authorized user tradelines is that there is a law which says lenders shall consider them. As discussed above, this is how the practice of piggybacking credit was commercialized. There is no similar law for primary tradelines; you cannot pay to be added to a primary account and backdate history like you can with seasoned authorized user tradelines.

Mortgage. A mortgage tradeline is only a primary tradeline. There’s no such thing as an authorized user on a mortgage tradeline. Also, even if there was (which there isn’t), you would kill your purchasing power and hurt your chances of securing credit in the future.

Auto. As far as buying primary tradelines is concerned, the same thing written about mortgages (above) applies (here). You can’t buy them; it’s just not legal. Also, you’d shackle your credit report with debt hurting you credit (not helping it).

Tradelines for business credit. Business credit accounts function on a completely different credit report (Dun & Bradstreet) and credit score (Paydex). Of the very few business lines of credit accept authorized users, they only report to the primary account holder’s credit report.

Tradelines for Sale Conclusion:

Authorized user tradelines provide the opportunity to increase your credit score by being added to positive account (or “tradelines”) as an authorized user.

Tradelines for sale is the only product/service we offer and we have perfected this specialty.

If you’re looking to increase your credit score to secure a mortgage, auto loan, etc., you’ve probably sought tradelines for sale.

In doing so, you’ve probably come across a lot of questions and concerns. That’s what this page is designed to address… your questions, comments, and concerns.

Read our frequently asked questions, see examples and post comments, below.

comments, below.

looking for a tradeline of something of 5,000 limit.

Corderia, thanks for contacting us. Please call us at 800-431-4741, email us at info@superiortradelines.com or get started here: https://superiortradelines.com/start/

After you do one of those three things, we will be able to better assist you. Thanks!

Prior to adding tradelines, though, we will want to discuss your goals and see if tradelines are appropriate for your situation. In other words, we want to make sure they are going to work for you more than we want to sell them to you.

How many trad lines will you receive for 792?

Hey Joe! Do you mean “how many tradelines can I purchase for $792.00” or do you mean “how many tradelines do I need to have a 792 credit score?”

I wish to raise my credit score by adding seasoned trade lines, I have some negative items that are old that need

to be removed from my report. My present score is 525 I am looking to raise my score to 720-750 or better.

You should remove those negative items before you purchase tradelines for sale. Even if you credit score does NOT increase after removing those negative accounts, with them gone… your score will increase more drastically after you add tradelines. In other words, the less negative items, the higher your score will go after adding tradelines.

However, you should give us a call at 800-431-4741 to get a free credit report analysis, because depending on how old they are and their condition (paid, unpaid, settled, etc.), they may not play a part in this decision, at all. It requires a quick (free) review of your credit report.

Kenneth, Thanks for reaching out to us! I always recommend addressing negative content before engaging in tradeline services. That being said, the specifics of the negative content on the reports can make things murky (i.e. collections that are reporting as paid, charge off accounts reporting as settled, etc.). Check out the post on our forum for some insight: https://superiortradelines.com/forum/credit-repair-before-tradelines/ (especially before purchasing tradelines for sale). Give me a call at 407-476-1357 to discuss further, or email me at Mike@superiortradelines.com so that we can figure out what would be the best approach for you and your credit goals.

Hello, Kenneth my name it Lautusia I’m a Credit Consultant I can help you with removing the negative items off of your credit report

Hi, I have a score of 766 but a poor history age. Would like to buy a Tradeline that can boost my history age and up my score.

How many tradelines do I get for the $792? Are they primaries?

Scott, thanks for the question. As far as how much a tradeline you get for price, we do it the other way around. We do not do Price, Tradeline and Goal. We do Goal, Tradeline and Price. So, we’d have to talk to you first, review your reports and goal and then make a tradeline recommendation. Then you can talk to us about promotional, etc.

As far as primaries, you really should read https://superiortradelines.com/faqs/primary-tradelines/

We explain the difference between authorized user tradelines and primary tradelines and answer you question.

I need a tradeline at least 750 credit score

Perfect! Let’s do it! Did you get your account yet? It’s free. You can sign up here: https://superiortradelines.com/start/

hi I read over the mock agreement and it seems to detailed as if you guys will be privy to all my personal information I am not allowed to have alerts or security features on my credit or the services will be deemed complete so this leaves me wondering why do you need all my personal info in such detail if I’m only purchasing tradelines? excuse me but this sounds very suspect…..

I don’t understand specifically what you’re asking, but I’ll try to answer. We don’t need your information, the banks do. In order to have you added as an authorized user, the banks will require the name, date of birth and social of the to-be authorized user (that is, you). In addition, we request legitimate copies of this information because consumers (not us) try to pull shenanigans, for example, giving us fake social security numbers. When that happens, it puts us at risk, our card holders at risk and other clients (like you, potentially) at risk by being associated with fraud. So, we vet our clients so as to protect them. Excuse me to suggest that you have it backwards, because if a company is not doing those things, they are suspect.

As far as the security freezes, I think you misunderstand the purpose. There is a questionable credit repair technique whereby consumers (not us) falsely claim “identify theft” in order to have accurate negative information removed from their credit report. In order to do this, they fill out a police report and then blast the credit bureaus with fraud alerts and security freezes. When you do this, it prevents authorized user tradelines from reporting. So, if they don’t report, what are you going to do? You’re going to blame us for a failure to deliver. So, instead of reacting and frustrating clients, we tell them, honestly, up-front, that they must remove security freezes and fraud alerts, otherwise we will either not work with them or they are voiding their refund policy. Again, if someone isn’t being up-front with you, they are suspect.

can you please send me a tradeline list? i have a clean credit file on all three a look to boost my score to apply for new higher credit limits. please email me back

We don’t provide lists, because that is putting our sales goals above your credit goals. If anyone is giving you a list, that’s what they’re doing: putting their sales goals above your credit goals. We’ve written about tradelines lists previously. Speaking of goals, you should try our new tradeline and credit analysis tool, which will help you determine if tradelines are right for you. Also, if you have a CPN, we can’t and won’t work with you 🙁 So, hope that was helpful information.

do you have 3day turn over

Hey Sheila! What do you mean by 3day turn over?

How many trade lines do I need to have a credit score of 800

Hey Rell, that’s not really how it works. We could have 1000 tradelines and you may not get an 800 credit score. It’s much more complicated than that. You can call us at 800-431-4741 for a full discussion, but my quick advice here is this: Start with your goal, find out if tradelines will help achieve that goal and move from there. “800 credit score” isn’t really a goal, unless your lender said “You need an 800 credit score.” So, start with your end state (which isn’t necessarily a credit score) and figure out if tradelines will help you get there.

Have a 617 credit score. No negative marks. Need about 740 to 760. Can this work for me to give me a boost?

I need to be at 680 as a minimum for the home loan I want. I need it there as of now, but literally just heard about buying tradelines. I’m not far from 680… 640, 663 and 665. My scores are every increasing. I’m utilized at 3%… Just need close quicker rather than later.

Hey Elisha, you sound like a good candidate for tradelines. Please call us at 800-431-4741 or email us at info@superiortradelines.com (or just go to https://superiortradelines.com/start/ to get started) so that we can review your report and determine whether or not tradelines will help. Based on your scores (assuming they’re from a legitimate source), I’d say you’re in good shape.

Help…….Had a Bk7 that’s 4 years old (kidney transplant) and 9 items that have reported late (2016) in the past. All have been current for the last several months though I’m needing to boost my scores (currently 600 across the board ) in the up coming months for mortgage processing. My oldest trade line on my credit is showing 16 years, how is this process completed moving forward?

Thanks for the information. I won’t be able to give you advice worthwhile because I would need to know more about how those items are reporting. If you have accurate negative items, that’s one course of action. If you have inaccurate negative items, that’s a different course of action. So, the best thing you could do is go to https://superiortradelines.com/start/ and reach out to us. We will perform a free credit report analysis and you will know where you stand.

Hello, although I am 30+ I am fairly new to credit with scores of 731 695 and 703. since I waited so long to start utilizing credit I am now faced with denials due to lack of credit history. out of the 3 credit cards I have one being secured I have no negative reporting and have a utilization of 15%. I am asking what tradeline price is needed not to increase my score but to establish a seasoned record of some sort. 4 inquiries max if i can recall and a few store cards that were recieved through preapproved offers.

Wow, that’s such an awesome question. Okay, first of all… why do you need credit? Are you doing something business related? Are you trying to buy a car? …trying to buy a house? Once we know the answer to that, then we look at your credit situation to determine how to get from where you are to where you want to go (and if tradelines can help). In your situation, you have what some call “juvenile” credit (meaning, it’s young relative to your age). In those situations, tradelines can drastically effect your overall credit score, because you can “back date” cards, such as putting on cards opened around your 18th birthday. Also, we can add lines consistent with your income so scoring models (like FICI) take you out of lower “score cards.” Undoubtedly, your scores will increase by adding tradelines. However, depending on your goal, the increase may or may not be worth it (we are goal oriented, at Superior Tradelines). So, for a more detailed answer that applies to your specific situation, you have to give us a call at 800-431-4171 or get started here: https://superiortradelines.com/start/

Hi I’m interested in raising my credit score which has recently gone from 496 August 23 to 574 September 28th with the purchase of a secured visa with a $200 limit, my credit age is only 2 months with a 100% payment history. Still, only 2 months young. I had 2 negative things on my report of which I’ve gotten removed and now I have 1 dismissed chpt 13, not to be confused with a discharged chpt 13. This means I filed and then didn’t go through with it so I’m trying to get it off my credit. Other than that I have nothing else on my credit except 2 hard inquiries. Without having seen my credit report, what is your best guestimate that a tradelines will work for me?

Hey Shirley, so, while you sound very informed and convincing, I’d still like to see your report before we could make a recommendation. However, given your question as posed, I will answer:

First, what do you mean by “work?” What is your credit goal. In addition to scores (which I will address next), there are certain underwriting thresholds – such as dismissed bankruptcies – that could result in denial of credit, regardless of score. If by “work,” you mean make your credit score increase, there’s zero doubt in my mind that your scores would go through the roof. You fit one of the scenarios we’ve written about when we credit scores before and after tradelines.

So, I think I can’t do any better than that one public blog post comment area and with the limited information provided. We’d be happy to review your report, for free, and make a more specific recommendation. Call us at 800-431-4741 or get stated at https//superiortradelines.com/start/

I owe close to $100k in student loans (good standings / never late), less than 20% of credit used and no charge-off’s. Would AU’s help my score even with student loans?

Hello Jay, I suppose if I had to answer the question the way you wrote it (limited details), I would say yes. However, it depends on what you’re trying to do in terms of credit and it also depends on your income relative to your debts. It is unquestionable that if you add trade lines to a credit report credit scores will increase. However, whether the score increases enough for your goal is one question and whether your income or assets gives you through underwriting is another. Would be more than happy to discuss your situation with you so please give us a call at 800-431-4741 or get started at https://superiortradelines.com/start/

Hi

I was referred to this company by someone and they ensured me that you all are a great and a legit company! Im contacting because I want to speak with someone so that I can figure out the cost and exactly how the process works.! I want to know what is the upfront cost as well as the garuntee

Tiffany, those are all really good questions. They are easy to answer, too. However, almost all credit related question depend on what’s in your credit report. So, that’s why we recommend you call us and get a free credit report analysis. We can do it right there on the phone with you and answer any question you have (including time, guarantees, costs, etc.).

Call us at 800-431-4741 or get started here: https://superiortradelines.com/start/

I have 0 credit. I need a loan totaling 7500. How many tradelines would you recommend? The amount and how much history on the line(s) would help me accomplish my goal. Being that the score also is 0 what do you believe will it reflect the score in reference to your prior experience?

Ty, just to clear up something so someone doesn’t take advantage of you: Tradelines DO NOT dictate how much of a loan you will receive, but may affect whether you receive the loan at all and on what terms.

Scores shoot up dramatically if you have blank file and you add tradelines. However, the amount you get is determined by – among other things – your income or ability to pay.

Does this make sense?

Since I have 43 inquiries and 1 derogatory mark, and age of credit history is what is determining my credit score to be 585 with Transunion/Equifax. Would it be wise to purchase Tradelines at this time?

Not sure without looking at your report. You should reach out to us (https://superiortradelines.com/start/) so we can do a (free) credit report analysis and help you make that determination.

Are you currently seeking tradelines to sell? How do i become an affiliate?

Sure. Please email kate@superiortradelines.com to discuss options. Thanks!

Do u have tradelines for sell?

Yes.

I’m trying to build my fico score up to build a home from the ground up I’m appling for a construction loan and I just paid all my bills owed on my credit now I wanna add some primary trade lines to my account and my wife I wanna add some lines to her account also how can you help me because I have spend so much money and no results and getting tired of ripped off

How much are your trade lines and how long does it take to post

Can you apply a Tradelines to my new business?

No one can. Business credit reports work different than individual credit reports. https://superiortradelines.com/faqs/business-tradelines/

Based on comments I can tell its a case by case basis of what a trade line can do for your credit im thinking a tradeline may work for me but i would like an experts opinion before i invest my money. I if i only had 10’000 dollars worth of debt and 7500 was student loans but not any solid good credit history would a trade line help then? Like what kind of scenarios are there and what testimonials are there. Is the $792.00 the minimum or the set price what do i get how does it help i have a lot of questions

Ghaea, you’re spot on. You absolutely do want to know – before you buy – what the reasonable expectations are for tradeline results. That’s why we do a credit repair analysis and tradelines recommendation (for free) prior to you buying tradelines. You can get started here: https://superiortradelines.com/start/ We look forward to speaking with you.

Is there an trade line amount that would not go thru due to looking suspicious because of the high limit?

Example: I have a total credit limit of 11,000, and i add a trade line with a limit of 25,000. How does this work or doses this work to increase my credit score?

It’s a good question. It isn’t a matter of “looking suspicious.” Anyone in the Country has a right to add anyone they want as an authorized user on one or more of their credit cards. However, there are underwriting guidelines that can question whether the tradeline “is an accurate representation of” a borrowers credit worthiness. The example you raise, is a good one. I think 11,000 to 25,000 is okay. I think 11,000 to 50,000 might not be an accurate representation. Lenders will scrutinize someone with 4 collections, no primaries and everything else authorized user tradelines. They will say “Yeah, great score, but this isn’t you…”. In cases that make more sense, underwriters will actually accept the AU and the benefit the client enjoyed from it.

I see that you guys dont specialize in help getting funding. But do you have any recommendations for funding i m in the process of getting my credit fixed and buy some tradelines from you guys.

Please contact Raj at raj@superiortradelines.com He has the connections.

What method of payment do you use for purchases and at what point do I pay?

Hey Lennor! It looks like you’re already registered as an affiliate, with those questions answered. If not, let me know. Thanks!

Researching tradelines, yet I dont see anything regarding the credit utilization on these lines. IS there a max percentage on each line? is there a time frame your allowed to function as an authorized user?

Hey Matias. First, cool name. Second, I’ve taken your questions and answered them above. They are the second and third questions, respectively.

Thanks,

Hi, can I discuss what my options are with someone?

Hi!

https://superiortradelines.com/start/ <-- click there to get started! Have a good one!

What is the best company to get tradelines form?

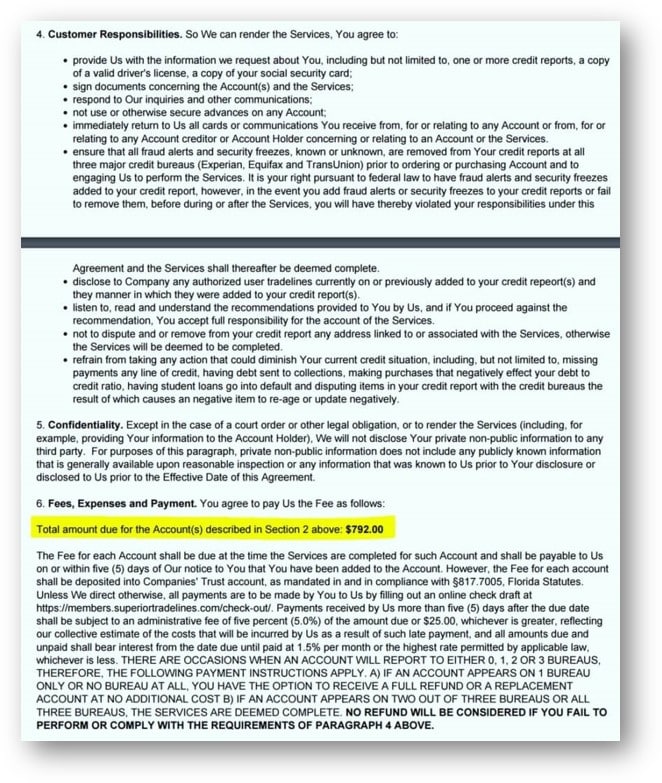

Superior Tradelines, LLC is the best company offering tradelines for sale. There are three main areas to judge tradeline companies. 1) Complaints 2) Reliability and 3) Financials. Regarding complaints, I would not recommend believing everything you read, but you should consider complaints you read online so long as they are believable based on common sense and you use your judgment (companies have used complaint boards to attack their competition). You should note, Superior Tradelines, LLC has never had a legitimate complaint. Superior Tradelines, LLC works with nearly 90 different companies, and wouldn’t have these affiliations if we were unreliable. Lastly, Superior Tradelines, LLC is bonded with a $10,000.00 surety bond, so your money is safer with us than any tradeline company on the internet.What you do NOT want is companies that pre-empt your ability to get a refund. Look at the terms we found on a competitor’s website:

You do not want to work with a company like that.

Also, how long do I remain as an authorized user after I buy tradelines from you?

Before answering, I want to commend this question. The reason it’s a great question is that it means the person who posted it recognized that tradelines should be closely timed with a credit goal.

One more thing you should know. There is a difference between how long you’re an authorized user (actively at the bank) and how long the tradeline will be listed as an authorized user in your credit report. Both questions are answered below.

Tradelines for sale at the bank: Contractually, we guarantee 1 reporting cycle. This means you will be added as an authorized user, we will verify that it has reported to your credit report. Once it has reported, we will instruct the primary cardholder to remove you. This usually happens within 30 days. Sometimes it takes two cycles. So, the answer is that you will be actively listed as the authorized user for 30 to 60 days.

Tradelines for sale on credit reports: Once you’re added to the tradeline and that we’ve confirmed the reporting, you will be removed. Now, the tradeline listing in your credit report will remain for a very long time. We have no control over this duration. Neither does the cardholder. Neither does the bank. It can last for many, many years. However, we wrote an entire blog post on this specific topic, which you can read here.

Can it be set up for 60-90 days

My current scores are currently at a 526, 519, 497. I want to increase my scores so that I can purchase a nice vehicle. I am currently in a chapter 13 until next year. If I bought maybe 3 tradelines, would that help my scores?

In terms of your goal: I’m not sure you should be buying anything during a bankruptcy (there’s potentially negative issues that could occur).

In terms of credit scores: Usually, high 400s, low 500s means there are currently negative items recently reporting. Usually, that prevents the tradelines from impacting credit scores as much as they should. I would recommend you contact cory@superiortradelines.com or call him at 321-799-6159 to discuss a full range of credit solutions (in addition to tradelines).

where’s the listing for business tradelines? also, do business tradelines help in unsecured loan decisions, or are they overlooked?

https://superiortradelines.com/faqs/business-tradelines/

Tradelines are lines of credit reporting on your credit report, your credit card, home loan, auto loan, student loans etc. etc. are all considered credittradelines..

This is how it works, we add authorized user tradeline(s) to your credit report to help increase the credit score, add credit stability, decrease your overall owed debt ratio and most importantly to make you credit worthy.

The way we accomplish this is by adding you to a credit card with determined amount of age and limit as an authorized user (AU).

How long do we get access to the tradelines upon purchase?

The tradelines report between 30 and 60 days, actively, but they might say on the report for much longer than that.

Here’s a good video about that: https://www.youtube.com/watch?v=_fi9JZxNgBQ

I need 4 points!!

I’ve never seen anyone buy tradelines and get less than 5 points, but… you probably don’t need tradelines to get 4 points. Just go pay down a balance, etc. If you really want to evaluate tradelines, we can review your report and make a recommendation here: https://superiortradelines.com/start

I’ve taken the long way rebuilding my credit over the last few years. Even used Lexington law to try and remove some credit card debts that made it to collections but that was a waste of money as they are still there. Credit karma gives me confusing info so I rely On FICO which is at about 661 now. My goal is to have an 800+ score with at least a couple credit cards from the major companies with limits off 50k or better. What do I need to do achieve these goals ASAP?? I would also like to add that I’ve been paying in a 35k loan on my tow truck for close to two years almost a thousand a month with no late oaymrants and nine if it is being reported to credit bureaus which would help my credit what should I do ????

To whom it may concern: I’m overwhelmingly doing extensive search on your company about the service you offer and the qualifications a individual need to reach his or her goal.. I have numerous of questions so may you please reach me at my email inshallah!!!

Shlonek ya achie, sabah el khair! I’ll have Cory reach out to you.

Ma mushkala!

Shukran ja zeelan,

Matias

I would like to talk interested in a tradline 989-472-6449 or jjallenjanes78@gmail.com

Im looking for a 20 year old line with at lease a 10,000 limit for 750 or less i don’t care about the reporting date

Wow. After looking over all of the information on your site I’m glad I didn’t do business with a highly questionable “company”. I’m so glad I found your site. I will be reaching out very soon. I feel confident that you’re legitimate competent company.

i do credit repair, and im very new about the tradelines.

i would like to know more about this tradelines.

how does it work if i have a client that needs a trade line.. the client has to contact you?! or just by having his personal information, you can just add a tradeline for them…?

also. when a person get an tradeline, how long the person has to have the tradeline for?!

I would like to get help getting my credit score in the 700s.I don’t have bad credit just no credit for years.I would like to be able to get a 25% down mortgage on a multi unit

To Whom It May Concern,

I was referred to your site from a friend. Said your company was reliable and accurate with reporting. I am in need of several tradelines. Your availability is leas than I was expecting. I am looking for a line that report to all 3 bureaus $20,000 limit or better, 3 years or older, price range between $350-$425. Let me know what is available as I would like to make a purchase asap.

Thank you,

Kelly

Is there a telephone number?

I currently have a 668 credit score…. what do i need i order to at least obtain a 750 or above?

i have some tradelines to sell. can u send me a list of how much you pay depending age and limit. thanks

Me and my husband are interested in purchasing tradelines to improve our credit. Is someone able to contact me?

I will be teady to purchase tradelines in 2 weeks.Why you guys dont have a phone number to call into the business? I need a list to what tradelines that will be available when i am ready to purchase them.

How can I own my own Tradelines to sale

I want to get a 650 credit score. Is this possible with tradelines?

Whether its possible to get a 650 credit score with tradelines is a dynamic question. As posed, it’s impossible to answer the question. So, I’ll provide some scenarios in order suggest a possible answer. Obviously, to determine where you can go you need to determine where you are. More importantly than where you are, in terms of credit, you need to know why you are there to begin with. For example, you could have a 500 credit score for many, many reasons. You could have a 500 credit score if you have very little credit and one tiny blemish. Or, you have the 500 credit score because you bunch of credit and the balance of negative to positive accounts results of 500 credit score.

In the first hypothetical, it’s possible to see drastic increases in score because the positive impact of the added trade lines will not be inhibited by other items in your credit report. In the second hypothetical, the impact an increase in score after adding trade lines to your credit report will be subdued by the other accounts in your report.

So, I guess it’s impossible for me to answer your question. However, we provide free credit report analysis on all client credit reports and after this 10 minute procedure we can answer your question, in fact. While it is possible to reach 650 with trade lines, is not possible to answer that question unless a full credit report analysis conducted.

What is the impact of pulling my own personal credit?

We require before and after reports from our clients to confirm that the tradelines purchased reported as promised. Because of this, some of our clients express concern with pulling their credit reports because of a malignant misconception that (any) credit report inquires negatively affect credit scores. Let’s clear this up…

From credit repair experts, to executives at FICO, inc., to any rung on the latter at any of the credit bureaus, everyone would agree that a consumer who pulls his or her own credit report online will have absolutely no credit score impact whatsoever. This is one of those rare questions which can be answered unequivocally. From the horse’s mouth:

The only time your credit score is negatively affected by pulling the credit report (otherwise known as a hard inquiry) is when a lender or insurance provider with a permissible purpose to access your legitimate credit report does so. Again, from the horse’s mouth:

In fact, it’s not just one or two inquiries, but how many inquiries you have overall in context. Typically, your scores are not affected if you have an inquiry that is subsequently accompanied by a new line of credit. It’s usually when you have excessive inquiries and no line of credit, because this tells the credit bureaus lending institutions evaluated your credit and did not give you any type of account. This means two things. First, that you’re excessively looking for credit which is a risk indicator. Second, you were denied by multiple lending institutions, which is another risk indicator.

None of this applies at all to a consumer who pulls his or her own credit report. You absolutely will not be penalized for curiosity and online consumer education reports and scores are not at all considered for lending purposes.

In conclusion, there is no situation in which a consumer’s credit report would be negatively affected by that consumers review of their own credit report online.

I would like a credit report analysis. How much does a credit analysis cost?

Credit repair analysis is free, for a reason. There’s a cliché in Florida that if an attorney charges an initial consultation fee, it means no clients are retaining him. I think that cliché should absolutely apply to trade line companies. All that is to say, we don’t charge a single penny for credit report analysis. In fact, some of our competitors call in pretending to be clients just to get our advice. We used to get frustrated by this, but we realized spreading good information will be good for everyone in the economy.

So, not only is our credit report analysis free, but we do this as a mandatory step in our process… No client can order trade lines through our system without a full credit report analysis, recommendation, and a decision on the client’s side as to whether or not they wish to move forward.

Here’s an example of a tradeline recommendation for tradelines:

In some cases, we recommend credit repair, debt settlement, or other corrective actions prior to adding trade lines. Here’s a recommendation for credit repair:

“Free” things do exist, despite the old adage that “there’s no such thing as a free lunch.” But, there’s a bigger perspective, if you care for the reasoning: We only get paid if you buy tradelines. Since we only provide tradelines, what good is your time spend with us if we’re not able to sell you tradelines? So, you and Superior Tradelines, LLC have a vested financial interest in cutting to the chase and finding out if you’re a qualified candidate for tradelines. If we charged for that, it would actually slow things down (and cost more than we charge). It makes more financial sense to do a credit report analysis right away, for free, just to figure out if you’re a potential client or not. If not, then we can guide you on what you need to do before purchasing tradelines. If so, then we’re already a set ahead of the game and we’ve hit the ground running. So, sometimes it pays to do things for free.

Nevertheless, our credit report analysis is 100% free of charge and we’re happy to discuss any credit situation with you. Although we specialize in trade lines, we’ve seen every tradeline issue in existence. So, we should be able to lend some advice. In the off chance that you present a unique situation for which we never experienced, our network of affiliates will include someone who can sufficiently handle the issue.

You should not hesitate to contact us for credit report analysis.

How much do authorized user tradelines cost per point of credit score increase?

That’s such a good question, after all these years I’ve never thought about it in those terms. Well, I mean I’ve never thought to break it down on average on a per point basis. Prior to writing this answer, I started to consider pulling up some data and before I did so, I realized that the question is probably not a good one to pose or answer. I say this not because it’s actually a bad question, but that it’s merely academic and serves no purpose for clients who have purpose.

The reason for point analysis wouldn’t make sense is that two people could receive different credit score increases with the exact same lines. So, an average answer would be meaningless given the uniqueness of individuals and their credit reports.

Actually, here’s a better way to explain what I’m trying to say. Suppose two different people purchase the exact same tradeline package for $1,000.00. One person has a clean file, with little to no information in it aside from the new tradelines purchased. The other person has collections, charge offs, late payments, etc. One person went up 200 points, the other person went up 20 points. One person, then, paid $5.00 per point ($1,000.00 / 200 points). The other person paid $50.00 per point ($1,000.00 / 20 points). Well, the “average” there is $27.50 per point.

But, that’s not accurate, at all, because, we’d never sell to the person with collections, charge offs, etc. We’d recommend credit repair prior to adding tradelines.

So, the real question isn’t how much tradelines cost per point, but how much tradelines cost for you, given your particular credit goals and credit situation.

A better way to look at the situation is to ask yourself what is the goal you’re trying to achieve and how much do the tradelines cost which you need in order to achieve that goal. At the end of the day, that’s the only number that matters. And since everything in the world is negotiable, ask us for the best price on the tradelines you need and we should be able to help you. As long as were all negotiating in good faith and no legitimate costs associated with trade lines, there’s no reason we can’t make a deal that will help you with your critical.

With 3 more credit cards dated 1986-2001, and having available credit 10k-16k, how can I sell my good history? How do I find out how much money I could make with you given the current cards I have available for use of piggybacking credit? Is there someone I could speak to about this?

Patricia,

We’ve already discussed this by phone, but I wanted to answer the question you posted here in the event someone else was curious about our program, etc.

Thanks for reach out to us, by the way. Hopefully you’ve found our ethic and operation to be above board and that the other company you worked with that made you “uncomfortable” is a thing of the past.

Our vendor program, also know as a card holder program, allows people who’ve maintained positive credit history on their revolving credit cards to make money selling authorized user slots to individuals who wish to piggyback off of that history.

We pay a flat fee per authorized user added to each revolving credit card each month. The fee is due and payable to you after the account reports to the cliet’s credit report, which is verified shortly after you add them. While we wait for the account to report, the money is maintained in a trust account. This protects all involved… you, the client and Superior Tradelines.

If you have any other specific questions, please do not hesitate to ask.

We look forward to working with you.

Thanks!

Once I have purchase a tradeline, how long does the tradeline show on your credit report? Is there a time limit?

Thank you for your help.