Most individuals do not need to get a specific credit score when moving forward with their financial goals. Instead, they need to fit into a general score range.

FICO scores have five range categories. Credit scores lower than 580 are considered a “poor” score. 581-669 is a “fair” score. 670-739 is a “good” score. 740-799 is a “very good” score. 799+ is considered an “exceptional” score.

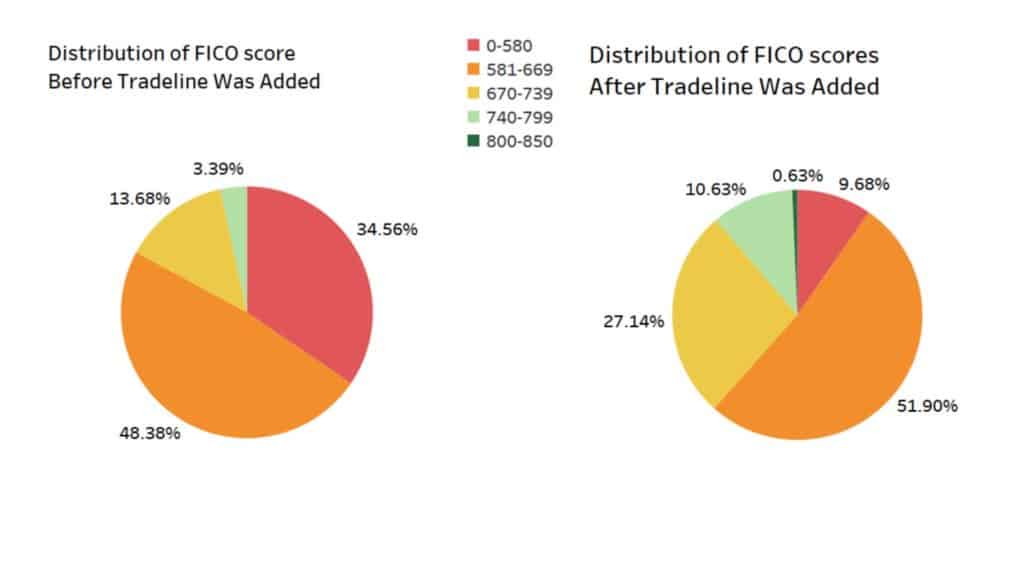

The distribution both before and after the tradelines were added to their reports were recorded and analyzed.

Many lenders use the credit scores from all three bureaus to determine an applicant’s score range. This was emulated by comparing the average of the before and after scores for all bureaus together.

Before.

It was found that most participants started the study in the lower categories:

- 34.56% in the poor score category,

- 48.38% in the fair score category,

- 13.68% in the good score category,

- 3.39% were in the “very good” category,

- and 0.00% were in the excellent category.

After.

After the addition of the tradeline, most clients were in the middle to upper credit score ranges:

- 9.68% of clients remained in the poor credit score category,

- 51.90% were in the fair credit score category,

- 27.14% were in the “good” category,

- 10.63% were in the “very good” category,

- and 0.63% were in the “excellent” category.

This analysis shows that roughly 20% of the individuals with poor credit scores improved their credit score by adding tradelines. Additionally, the proportion of clients who had great or excellent credit scores increased from 3.39% to 11.26%.

These factors indicate that the average client saw a positive shift in their credit rating due to the tradelines.

Fitting into a higher credit score category can have many benefits on achieving lending. Higher rates of approval, larger limits granted, and lower interest rates are just a few reasons people try to improve their credit score before applying for funding.

Findings.

This finding implies that the number of participants who qualified for higher credit score brackets increased after the addition of tradelines.

Great information. I am a realtor and researching tradeline companies to help my credit-challenged client.