More tradelines = better score? Yes, but there’s limits. It is possible to add too many tradelines. A lot of clients ask how many tradelines to add for optimal credit score results. So, we wrote this article (and published the video regarding the same thing) to answer that question.

Can you add too many tradelines? Yes.

Here’s a quick video to introduce the concept.

The basic concept is that if you add tradelines to a credit report, your credit scores will increase. This is true. If you add more than one, you’re likely to increase your score even more. Add three? Yes, you’re probably going to increase your score even more.

But, what about four tradelines?

No.

You’re probably not going to increase your score and you run two risks:

- Wasting money.

- Being flagged for authorized user abuse.

Table of Contents

Wasting money by adding too many tradelines.

Since you’ll experience diminishing returns (i.e., the score increase per tradeline will go down as you add more of them), you will reach a max benefit. This usually happens at about three tradelines. In can happen with even less than three tradelines (depending on the circumstances of your credit report).

So, there is a significant chance that you can (and likely will) waste your hard earned money if you purchase more than 4 tradelines.

I’ve heard of companies selling a “4 tradeline package” or even a “5 tradeline package.” This infuriates us, because we know it’s not beneficial to the consumer. Also, it causes a larger problem.

Being flagged for authorized user abuse.

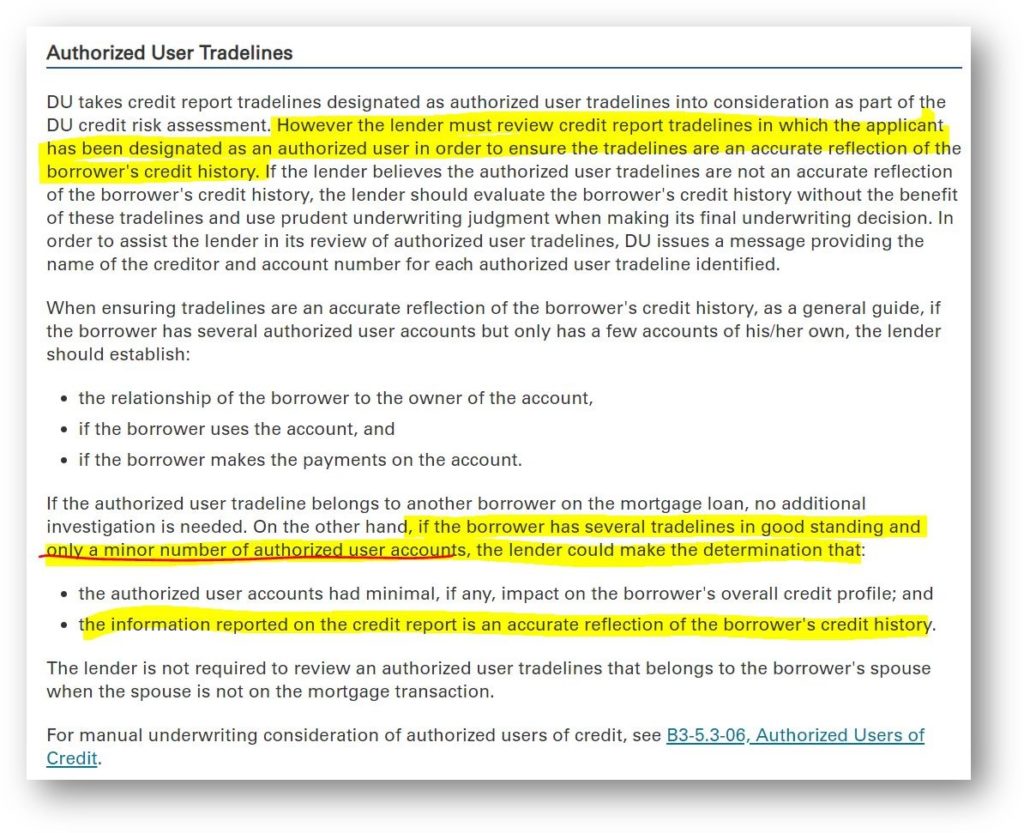

Banks generally allow authorized user tradelines through underwriting. But, did you know that they do not have to consider non-spousal authorized users? This entire industry only works because banks simply let it happen.

Banks must (or as the law says “shall”) consider spousal authorized user tradelines. But, they simply allow non-spousal lines as well.

However, there’s a limit for them, too.

There are underwriting guidelines (see below) that say they can consider AU tradelines if they appear to reflect the borrower’s creditworthiness.

Although this is anecdotal, it is based on a decade of tradeline experience: Banks will usually flag anything more than 3 tradelines as authorized user abuse. When they do this, they won’t just kick off the fourth or fifth account, they will kick them all off of your report. As an aside, and for that reason, you can’t add tradelines to CPNs or ITINs. Also, this practice doesn’t transfer to the auto industry as well as others.

What we’ve found

We did a study that looked at the credit score increases for over 800 participants that added tradelines. That adding three tradelines does usually yield a higher credit score increase than two lines, and two lines usually yields a higher increase than 1 line. However, the increase is not evenly spread over 3 lines.

Here is the breakdown: In our study, we found that the first tradeline added yielded an average credit score increase of 75 points. The second tradeline increased the score an additional 60 points, and the third tradeline increased the score an additional 37 points. In total, three tradelines lead to an average increase of 172 points.

NOTE: Please keep in mind that these numbers represent the averages in the studies. The exact impact of the tradeline depends entirely on what is on your credit report specifically.

How to do it right.

Connect with us. We will review your credit report and provide a recommendation (for free). From there, you can purchase the tradelines (or other credit services recommended). Once purchased, you’ll be updated with a tradeline status and once it hits your report, you’ll have a new credit score.

To do so, start here or email info@superiortradelines.com.

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Please contact me

I was seek a price quote to purchase at least three primary tradelines.

Please provide the cost estimate for purchasing three primary user tradelines

If so how long does it take for the lines to post?

Also, do they post to all three bureaus?