Credit scores are based upon five primary factors from the credit report. While adding authorized user tradelines can be beneficial for most people, they do not always result in notable changes to the credit score.

For clients with little to no change in the credit score or clients with a decrease in the credit score, the credit reports were reviewed to determine why the score did not change/decrease.

Roughly 5.8% of the individuals in this study experienced a decrease in credit score.

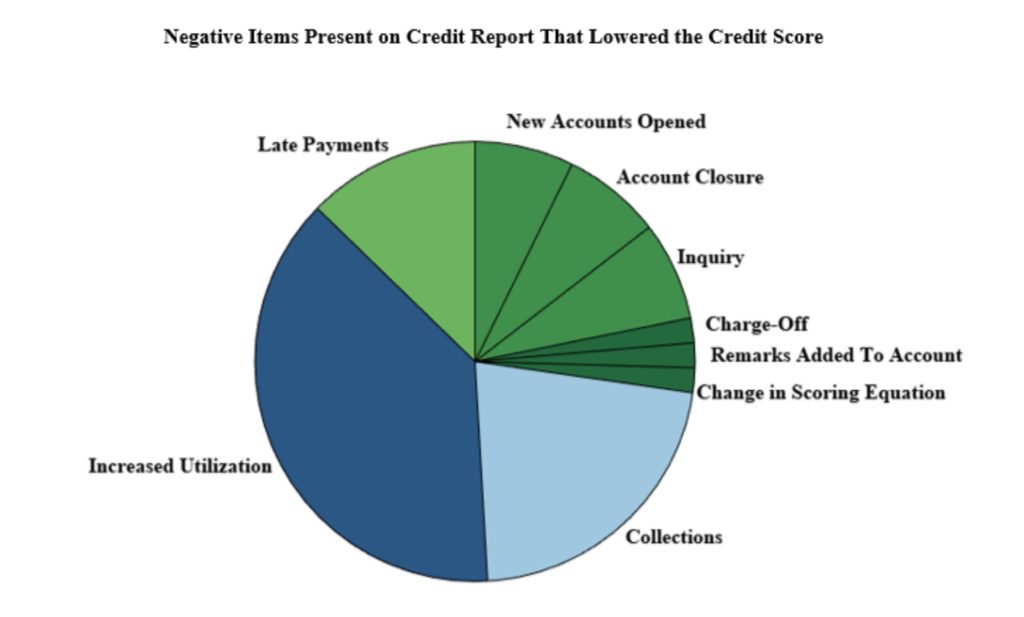

The primary reasons that clients had no improvement in the credit score or had a decrease score were as follows:

- increased utilization of accounts,

- new collections were placed on the report,

- the addition of new inquiries,

- old delinquent accounts were updated,

- and there were recent late payments.

The following chart shows the distribution of which factors were most prevalent when clients did not experience an increase in the credit score.

An increase in utilization decreases scores.

Given that the credit scores heavily factor in the accounts’ utilization, an increase in utilization can dramatically impact the credit score. Since the study participants were able to use their accounts throughout the study, this was the most prevalent factor that we saw inhibit the participants from improving their credit score.

Following that, new collections were another factor that was quite common among individuals whose credit scores did not improve.

The third most prevalent negative factor that was observed was the presence of new late payments.

Payment history is another factor that is heavily involved in determining the credit score, so a decrease in the payment history can significantly hurt the credit score.

Some other factors are the opening of new accounts, the closing of accounts, the addition of new inquiries, or new charge-offs and remarks. These factors contributed to combined account for roughly 25% of the cases, while the three prominent factors accounted for approximately 73% of the participants that experienced a decrease in score.

Interesting decrease in score.

It should also be noted that in 1 case, there were no negative accounts on the report, but the score still decreased. In this case, it is hypothesized that the credit scoring equation for the credit monitoring site was changed. Sites will routinely update their credit scoring equation, which will result in a change in the credit score even if no information on the credit report has changed. This is not a common occurrence, as it only accounted for 2% of the 5.8% of participants whose scores decreased.