Seasoned Tradelines FAQs

Seasoned tradelines are a great tool to use, but they promote a lot of questions. The basic premise is that the tradeline (or “account”) is seasoned (or “aged”) so that when you’re added to it as an authorized user, your credit score is positively affected.

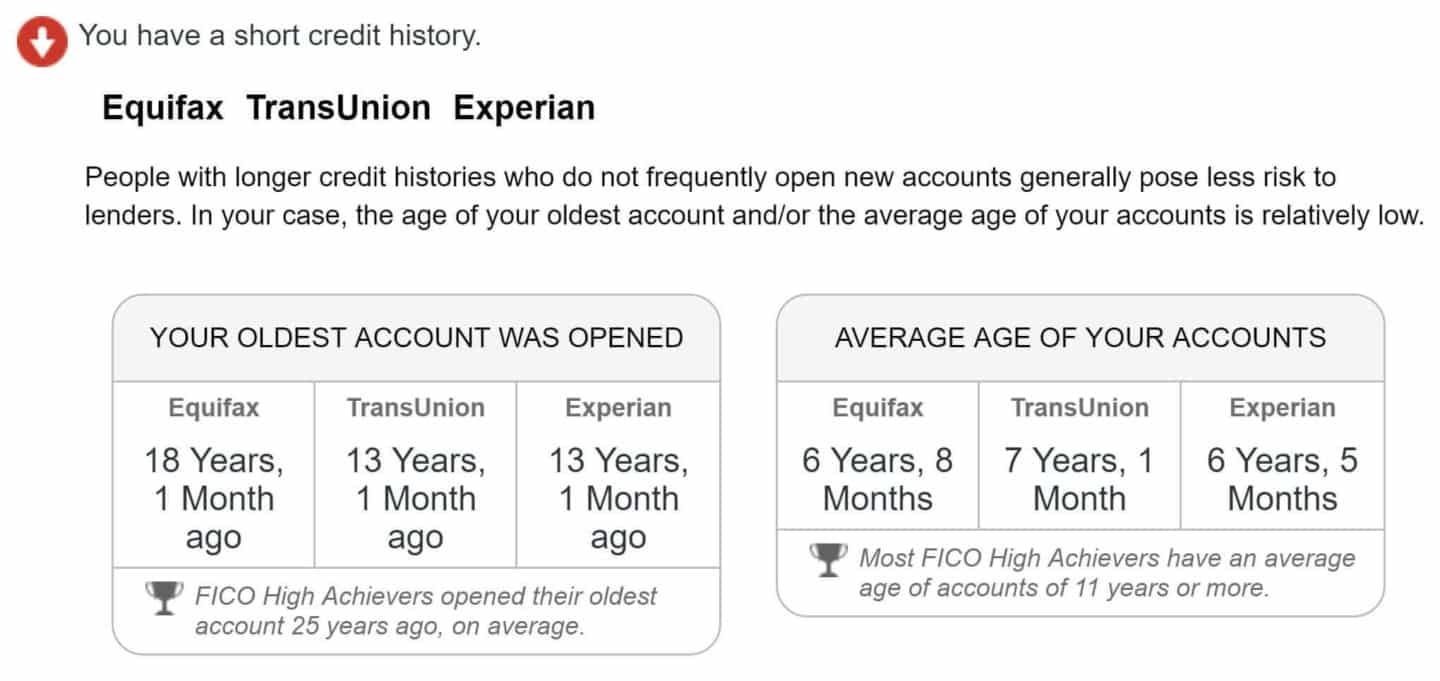

Seasoned tradelines can increase your average age of accounts, decrease your debt-to-credit ratio, etc. These benefits result in an increase in credit score.

This is a great FAQs page to visit prior to diving into some of the more complicated areas of seasoned tradelines. If you have any other questions, please see other categories of trade lines to the right of this text or contact us.

I would like to get some pricing, also want to know if you offer primary tradelines

Hey Jay, to get pricing, you can call us anytime at 800-431-4741 or email us at info@superiortradelines.com Also, you can get access to the members portal (for free) at https://superiortradelines.com/start/ Also, you might want to check out https://superiortradelines.com/specials/ as we are currently running discounted tradelines on select inventory.

As far as primaries go, please check out our article here: https://superiortradelines.com/faqs/primary-tradelines/

As the title implies, it’s “everything you need to know” about primary tradelines. Hope that was helpful!

How long does the tradeline that I purchase stays on my credit report

Hey Parris,

We had another client ask this so we added it to our Seasoned Tradelines Video Series. Here’s the video concerning how long the seasoned tradelines will remain on your credit report.

https://www.youtube.com/watch?v=_fi9JZxNgBQ

If it is unclear, please email us at info@superiortradelines.com or call us at 800-431-4741 for a more detailed answer.

You can always get your free members account by clicking here: https://superiortradelines.com/start/

Thanks!

My number is 5168133603 I need some trade line to boos my credit and in the same process I want form a partnership with you to by tradeline for clients I do credit repair as a business

This is a great question and for some odd reason they wouldn’t answer? I would like the same service as well

Hey Anthony and Bobby, I think you’re referring to our affiliate program. We welcome you to register here: http://superiortradelines.com/start/resell

We try to get to all comments, but there are thousands of them and we may miss some at some point.

At any rate, we look forward to helping you and your clients.

Hi, after watching the video you shared to the previous commenter, I have a clarification question to ask.

When I purchase a tradeline, how long (in months) will I be listed as an authorized user on that account?

The video above was not clear on this.

As a preface to my answer, please understand that being listed as an authorized user at the bank on the account is NOT the same thing as being listed as an authorized user at the credit bureaus.

The answer is that you will be listed for AT LEAST one cycle. So, more than 30 days. Sometimes, you need a cycle or two. But, 75% of the time, it is just over 30 days. Then, it reports to the credit bureaus for about 90 days after that, then it continues to report, but in an “inactive” status. Could be active longer, but that’s the minimum.

Let me know if you have any other questions!

If I’ve never had any credit at all would I gain from buying a seasoned trade line??

Yes, very likely. Check out https://superiortradelines.com/study/

How long do tradeline stay on your credit report I am looking for tradeline that will stay on for 6 to 12 months do you offer that service

Hey Jason,

The quickest answer is here: https://superiortradelines.com/videos/ (look for the “How long do tradelines last?” video).

The answer, there, is about 45 days, or so. Now, you mentioned something about extended times, which I can understand, but I’d like to add something new to the mix which I think you should understand.

First, tradelines do best as a temporary measure. Here’s one reason why: You’re on a stranger’s account. Now, we vet our vendors, etc., but maybe something crazy happens. Maybe they get divorced and have a financial mess and miss a payment (there’s solutions for this). Maybe they work with some other company that works with CPNs and the line (which you are on) gets flagged for fraud and they freeze your credit file. So, the point is, you should use tradelines for what they are… a short term fix.

Second, there’s no reason to have authorized user tradelines stay on your file that long. That’s almost admitting failure, because the purpose is to “piggyback” off of the credit boost to get into your own lines of credit (which will make your score go up and stay there, if you pay on time).

Anyway, I thought I’d share those thoughts with you.

Thanks!

I really don’t understand what you are saying about tradelines I looked at some online and they have prices from $2,600 down to $375 is that what someone’s going to pay for credit score to go up? Because if someone has to pay that for your credit score to go up you might as well just get a secured card and it stopped at your credit that way because then at least you’ll have your money at the end. Why should I have to give someone $375 or $2,600 in that fact to boost my credit score when I can do it just with a secured card?

Great question. First of all, $375 is unrealistically low and $2,600.00 is insultingly high (unless it is a package of multiple tradelines). Even our best deals (https://superiortradelines.com/specials/) right now are sitting at $498.00. You can find deals for $500.00 and they go up from there.

We’ve also wrote a lot about tradeline pricing here: https://superiortradelines.com/faqs/tradeline-costs/ (read the comments, too).

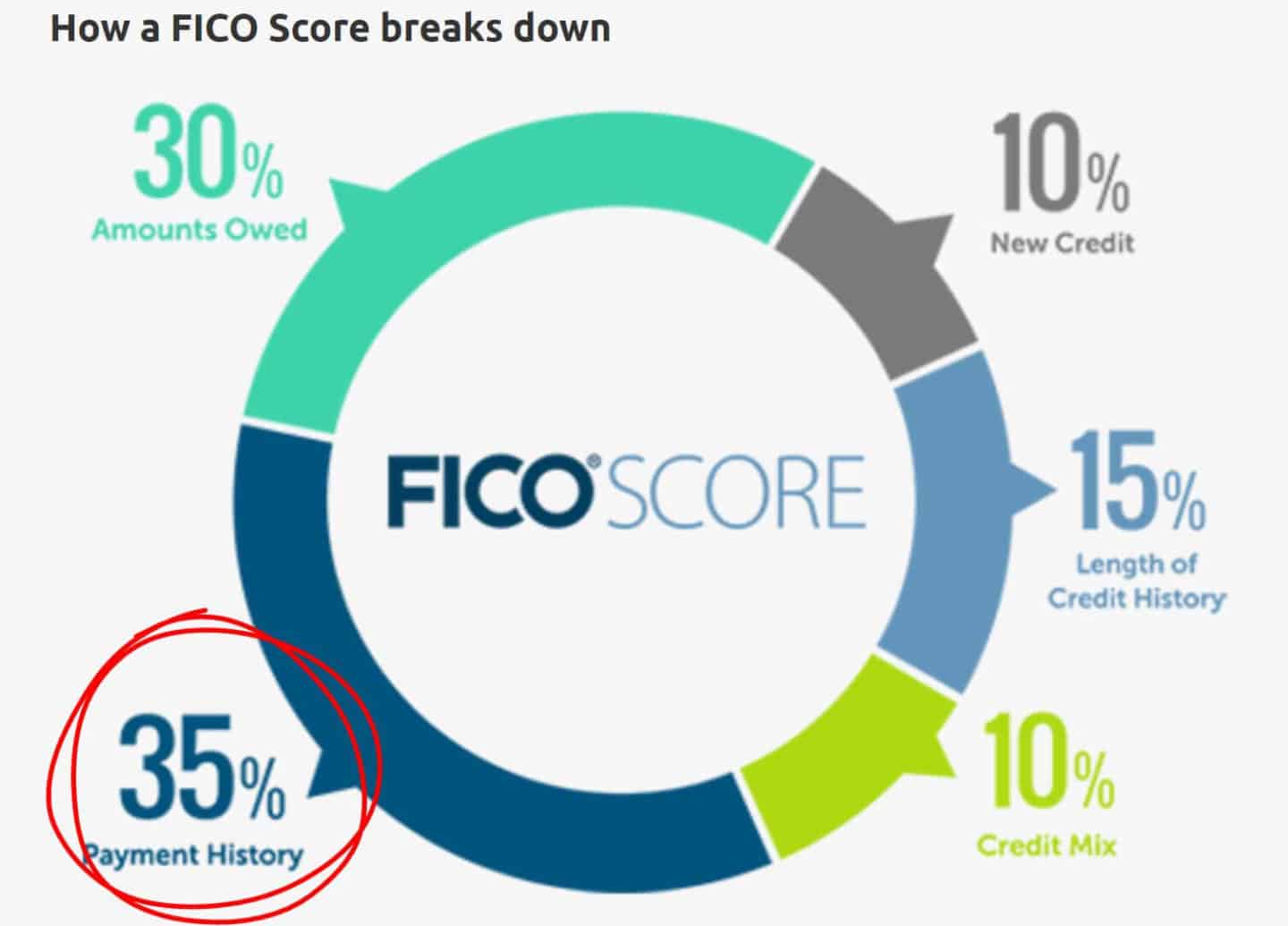

So, why would someone buy tradelines rather than secured credit card? Credit scores determine – based on what’s in your report – the likelihood you will repay a loan. So, for example, when you get a loan and pay it back, you’re getting “credit” for doing so. And, new lenders will see that and say “He did it before, maybe he’ll pay back my loan, too.” Then, over the years, your credit report gets really complicated and scoring models, like FICO, spit out a numerical represenation of your credit risk, based on the things in your report.

The thing that has the largest impact on your credit score? Revolving credit cards, the authorized user slots we sell you.

Things that have the least (if any) impact on your credit score? Secured credit cards.

Why?

You’re showing zero (literally zero… it’s secured by your own money with zero risk of default) risk. No risk, no evaulation of credit risk. No evaulation of credit risk, no “credit” toward your repayment behavior. No “credit” toward your repayment behavior, no increase in credit score.

Here’s another reason: Unless you have $10,000.00 in cash laying around, you’re likily going to get a small secured credit card; you will be told by your back to open a $300.00 account “just to have something.” This is shooting yourself in the foot… you will have placed yourself in “adolesent” score cards and likely making your credit score worse than before you had it.

In my opinion, the only circumstances you should have a secured credit card is if you’re very young and/or have no credit at all, because – in most circumstances – you will need at least one primary account to obtain funding (regardless of how high your score goes after adding authorized users).

I just threw a lot at you, so please ask further questions if I didn’t answer your question.

Thanks!

I think this sounds great and I’ve gotta say I’m super interested

I’m glad you’re excited. We would be excited have you as a client. Let us know if we can do anything else to help you and your credit goals. Trade lines are a powerful tool, but you want to use them wisely and we’re here to help you do just that.

I’m looking for more information on how much my score can increase with roughly 4 closed accounts 1 charge off and a score reported by credit karma being 604-614… And how much I’d have to pay you today, to get this ball rolling?

I need some one to look at my credit report and help me out. I know I need age slot. Thanks for the help. Will be available Monday the 14 th. At around 4:00 pm mountain time West costs.

How do I purchase a tradeline ? What’s the difference between the different tradelines ? How much do they cost ?

What are all the risks & is the boost a permanent effect? This is first place I ask, though plan to search this question & am interested in comparing found results with what y’all have to say

Is it a better idea to add seasoned tradelines to my credit report, or secured lines of credit?

Will my tradeline report to all three credit bureaus?

Whether tradelines reports to all three bureaus is a question within a question. Meaning, you could be asking what we guarantee as a service provider of authorized user tradelines for sale. Or, you could be asking because your credit goals depend on the tradeline reporting to a particular Bureau. I will address both.

First, if anyone guarantees that they can report all three bureaus, they are lying. In fact, we don’t even guarantee that the report at all. No one has control over this but the banks or the bureaus. What do we guarantee? We guarantee that we will refund your money or offer replacement line if the tradelines do not report to at least two out of three bureaus. Quite often, the trade lines report all three bureaus. In fact, this is part of the testing we go through before we enter a trade line into our inventory. In other words, it is supposed to report all three bureaus. The short answer is that the tradelines should report to all three bureaus, sometimes they report two out of three bureaus. In either of those cases, our services are deemed complete. In other scenarios, the tradeline(s) may only report to one credit bureau or may not report at all. In that case, we will issue a refund or replacement line at no additional cost.

As far as goals are concerned, and whether the trade lines will report to a particular credit bureau, you should not enter into the tradeline arrangement with this contingency. Absolutely no one in the world can control whether the banks and bureaus will do the right thing. In addition, there are things that you could do yourself cause misreporting.

If I overlooked the intention of your question feel free to make comments below and we can drill down into further detail. Thank you!