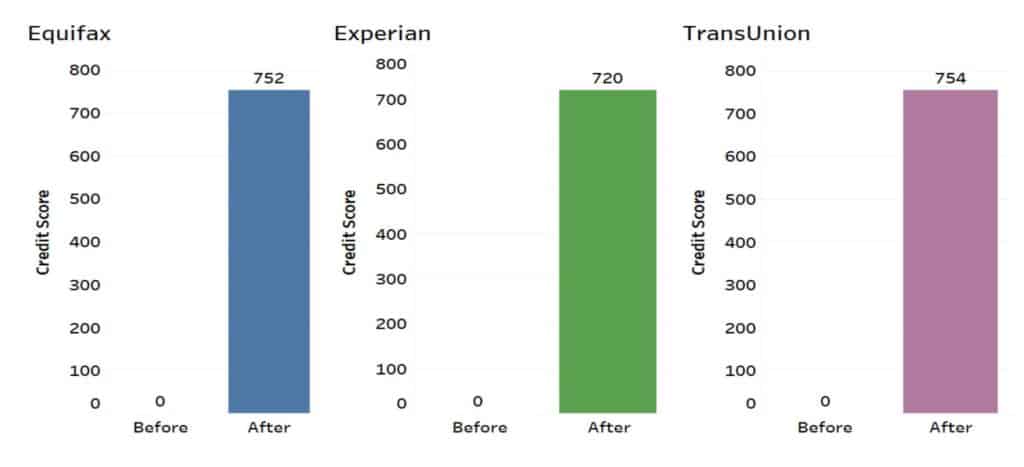

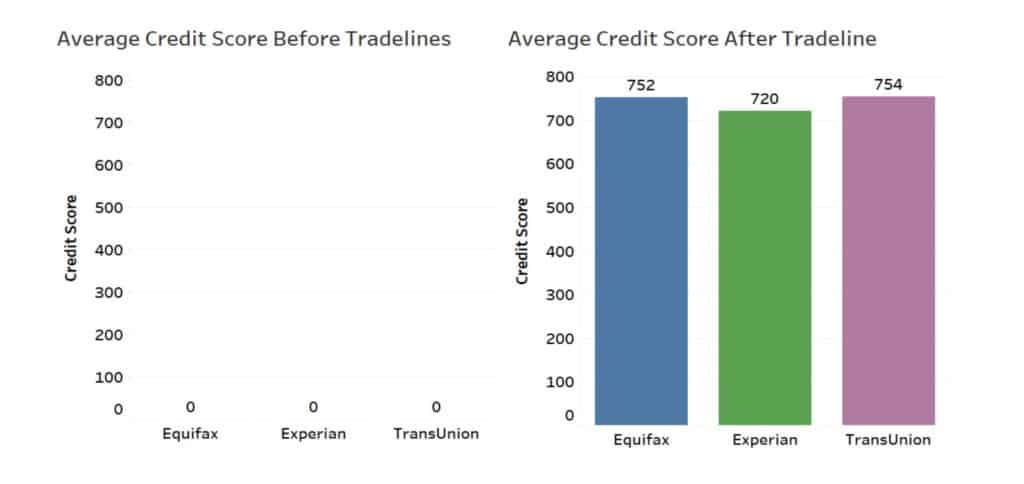

Thin or non-existent credit files typically cannot generate a credit score, so they were assigned zero value. Since the lowest FICO credit score possible is 300, any addition to the credit report would cause the score to rise hundreds of points.

Fifty-one participants had no credit score before adding the tradelines, which accounted for 6.4% of the study participants.

Since this situation occurs frequently, we separated participants who had no starting credit from those with credit scores. The data was analyzed once the participants were split into these categories.

The addition of an authorized user tradeline to the credit report for these clients resulted in an average increase in the credit scores. The average increase in score for Experian was 720-points, for Equifax was 752-points, and for TransUnion was 754-points.

Beneficial tradelines for credit.

These results suggest that it can be highly beneficial for individuals with no credit score to be added as an authorized user tradeline. Individuals who had no starting credit score were intentionally separated from those who did have a credit score. This was because authorized user tradelines tend to impact those who have a small credit file significantly.

Given that there is little information on the report for the credit score formula to include, adding a tradeline in good standing can dramatically improve multiple factors that influence the credit score.

While there are fewer of these clients, there is a higher average score which inflated the results of Analysis 1. These findings are also in accordance with the results of the study by the Federal Reserve (1).