No. You can’t use an individual tax identification number (or “ITIN”) to build credit and credit scores to get loans instead of your social security number. Don’t get me wrong, I admire creativeness. But, the line is drawn.

This concept – of tradelines and ITINS – originates from two scenarios: First, people think using ITINs is better than using CPNs (and SSNs, for that matter). Second, people who are legitimately eligible for an ITIN wish to build credit on their ITIN since they’re not eligible for an SSN.

In both situations, the ITIN is not an option.

Table of Contents

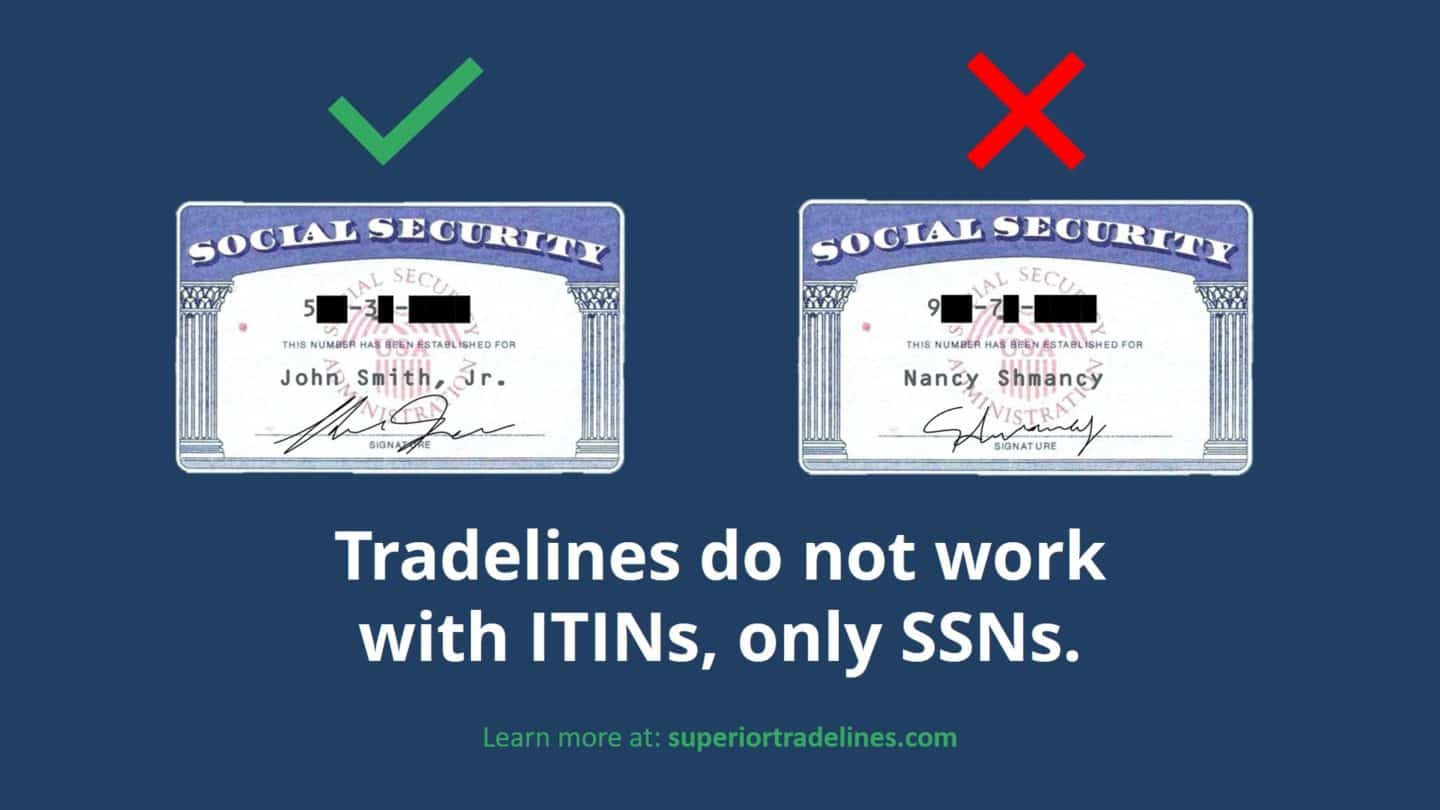

ITINs and SSNs are noticeably different.

You’re not going to sneak through an ITIN in place of your SSN. Chiefly, they are extremely easy to identify. Here’s the structure of an ITIN.

“IRS began assigning ITINs effective July 1,1996. Subject to a 1997 Memorandum of Understanding between SSA and IRS, IRS agreed that ITINs will be nine digits beginning with the number “9” and initially will have either “7” or “8” in the 4th position.”

That’s from the Statement Of James B. Lockhart, Deputy Commissioner For Social Security.

Now we know how to identify an ITIN.

235-575-9292.

Is that an ITIN?

No.

934-70-1022.

Is that an ITIN?

Yes.

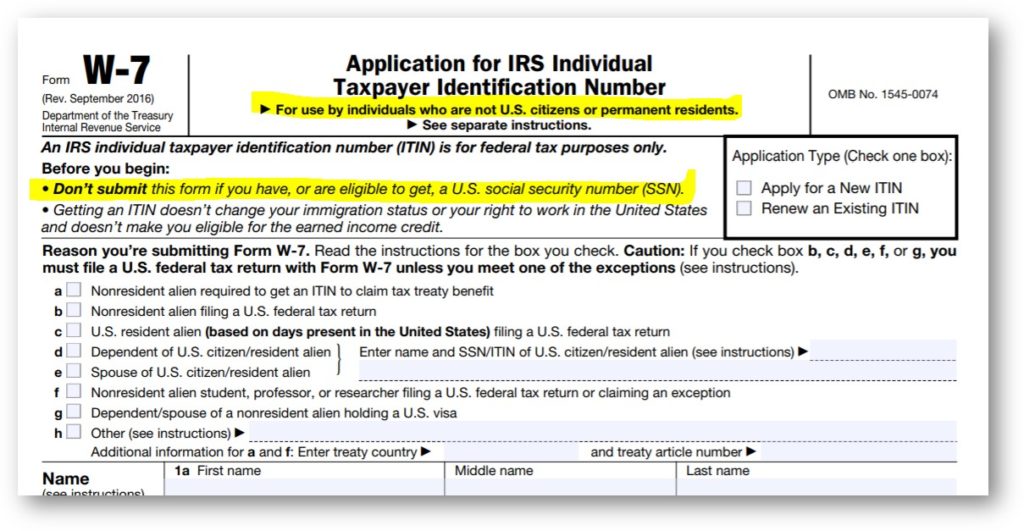

Are you qualified for a social security number?

If you are qualified for a social security number, you are not eligible for an ITIN. This is true whether you have or whether you’re merely eligible for a social security number. To emphasize, look at the top of the application for an ITIN.

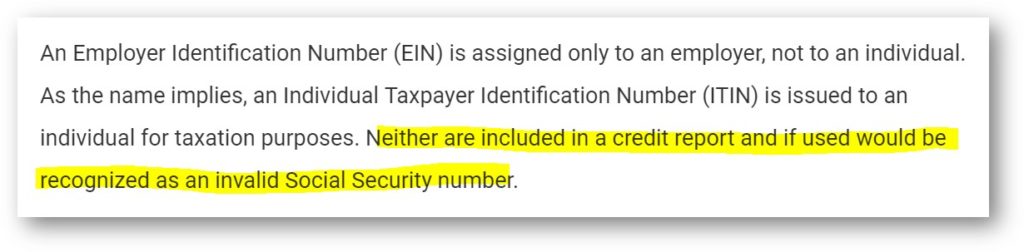

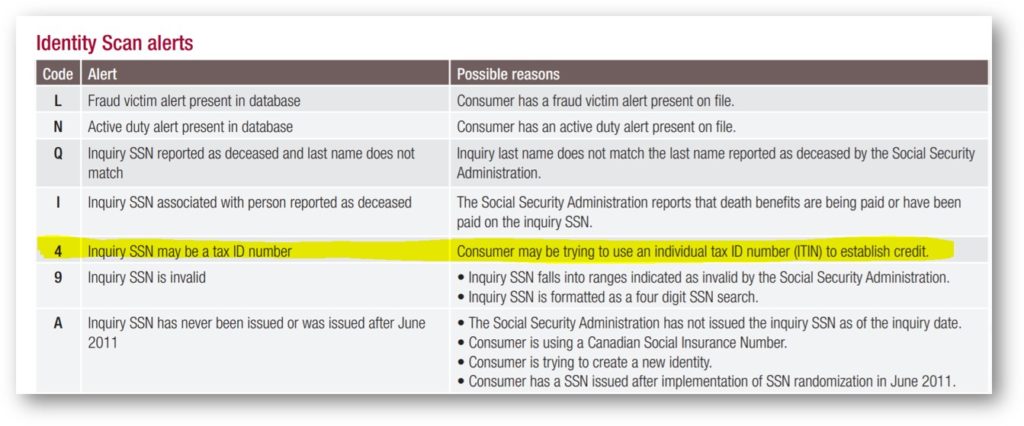

You can’t use an ITIN with Experian.

Experian explicitly distinguishes social security numbers and individual tax identification numbers and makes clear an ITIN will be viewed as an invalid SSN if used to access credit reports.

Furthermore, you can’t use an ITIN with Equifax.

Equifax literally throws a fraud error if you attempt to retrieve a credit report from them using an ITIN.

But, can I get credit?

People continue to ask:

“Fine. I can’t get credit reports and scores. But, can I get credit with an ITIN?”

There are certain banks that will allow you to apply for credit using an ITIN. Here’s the problem. You’re going to have an uphill battle. Here’s why:

- Since you can’t establish credit with an ITIN, you can’t establish a credit score.

- If you can’t establish a credit score with an ITIN, a lender cannot evaluate your creditworthiness.

- Since a lender can’t evaluate your creditworthiness, you’re likely only to get starter credit cards (I.e, $300.00 limits) from a lender who accepts ITINs.

- Since those starter cards and credit won’t be reported to credit bureaus, you’ve done nothing to better your credit future.

Credit report and scores with no numbers.

Technically, you can get a credit report and score without an SSN or ITIN.

To open a credit report, you just need a creditor (if you can get one) to report your account to the credit bureaus.

Believe it or not, they do not need a social security number. They only need certain identifiable information about you, such as your name, date of birth, address, etc. Once you get a social security number, previously unassociated information will attach to it.

After six months of credit reporting, you can generate a credit score. Credit bureaus do not need a social security number or ITIN. They just need creditor data and some identifying data to connect it to.

So, what does this mean?

It means an ITIN isn’t helpful, anyway.

ITINs are under investigation.

ITINs are the subject of a massive congressionally required investigation. No, this investigation has nothing to do with credit. It has to do with the wide-spread abuse of ITINs. There are recommendations to reduce the issuance and expedite the cancellation of fraudulently obtained and expired ITINs.

As a result of this investigation, and other things, the authorities are phasing out ITINs if they’re not renewed as required by law. In other words, ITINs are slated for the chopping block in the form of expiration dates. You can learn more here.

You’re wrong. No, you’re wrong! No, you’re wronger!

I suppose we address popular topics because we always receive our fair (well, maybe not so fair) share of criticism in the comment section of our blog posts.

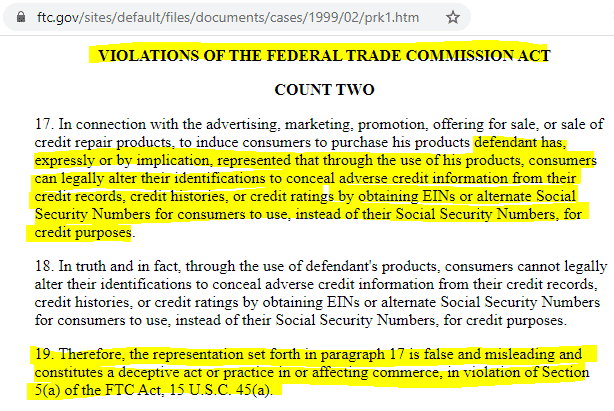

In this case, in the comment section below, we’ve shifted from ITINs to EINs. EINs, for the purpose of evading your SSN, are not different than ITINs, CPNs, etc.

This is consistent with the Federal Trade Commission’s view.

Aside from the risk of civil fines from the FTC, the FTC suggests improper EIN use could end with jail time.

Why we don’t add tradelines to ITINs.

This post stands as our policy paper on adding tradelines to ITINs. We won’t do it for the reasons listed above.

Nevertheless, there are options.

You can connect with us by emailing info@superiortradelines.com or click here to get started.

We look forward to working for you and helping with your credit goals.

Updated: August 10, 2021

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Mmmm… Wrong information… I been using my ITIN for 10+ years, built credit, 800+… Nothing free of course, I been managing properly… And Also have received my annual report and score

Hey Guillermo, first, and I’m not giving legal advice, but I’d recommend you don’t put that kind of information on public sites where prosecutors can easily see it.

See my response to Judy above, as it applies to your situation, too.

no ones going to chase this man down for doing that, this site has incorrect information that can mislead people without a social security. i my self have a credit and bank account with only my tax id so im not sure what this article is trying to tell people but only bringing down morale.

You’re crazy! The information on this website is WRONG! The IRS is handing ITIN number for a reason!!!! Why would they give you an ITIN number and lenders would allow you to open credit cards, get car loans, etc.

No one is going to do anything to guillermo… i think people should educate themselves before posting erroneous information!

Hello, thank you for the comment. You’re right: ITINs are for a reason. Specifically, “An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN).” – IRS

If you are using an ITIN as a replacement to your social, that is illegal. Sentence number on in my article: “You can’t use an individual tax identification number (or “ITIN”) to build credit and credit scores to get loans instead of your social security number.”

Hello Guillermo, Any chance you can share how did you check the Credit score. Cant really find a way out. Your Assistance will be highly appreciable.

Credit.com

You can easily get lots of info on ITIN credit score in Credit Karma which is free and they update it daily. Their business model is to give you offers on credit cards or loans intended to help build credit but most of their offers are high interest and secured (deposit required)

This is 100% inaccurate.

You 100% can use an ITIN to build credit. In fact, it’s necessary if you don’t have an SSN.

American Express, Chase, Capital One, BoA, Citi Bank and a couple of others let you get credit products with an ITIN. During the application process, you CANNOT skip the SSN field and by placing your ITIN they are able to verify your credit.

If I’m wrong then you should probably tell that to the 800+ credit score I’ve obtained by having an ITIN and living somewhere else in the world.

1/5 rating for this article.

Thank you for the comment. In response to your comment, I’d refer you to the article above (which already addresses everything you said).

I respectfully suggest that you’re mistaking “able to” with “allowed to.” You’re “able to” rob a bank, but you’re not “allowed to” rob a bank.

Perhaps it’s true that you (illegally) put an ITIN in an SSN field (which may constitute bank fraud). Perhaps it’s true that it may have worked for you (assuming the facts you wrote are correct). However, I don’t fully believe it. After all, if you have an 800+ credit score using an ITIN, why are you on a site dedicated to credit improvement on an article discussing ITINs and illegality?

Nevertheless, when you said “tell that to my 800+ credit score,” that’s like saying: “You think I can’t rob a bank? Tell that to this pile of cash!”

Also, curious when you did this because it’s only very recently that the banks have caught on to this issue. As noted above, in 2018, the Federal Government took an interest in ITIN abuse and recommended canceling ITINs which were/are abused. That potentially could happen to you.

Anyone viewing these comments, my recommendation stands: Don’t mess with ITINs for credit purposes.

You’re a complete moron.

I hope no one in your family ever gets in a relationship with someone who has an itin number. I wish you well!!

I don’t want to assume this is a spam comment, but I certainly need clarification in order to help out.

This is inaccurate information. And in response to your replies above stating that it is fraud to use a tax ID # in place os a SS#, it is NOT fraud. You can certainly use your tax ID number in place of a SS#. You can let the bank or credit card company know that you are using a tax ID number instead of a SS# and they accept it as well. Their system will even inform them that it is in fact a tax ID # and not a SS#, so fraud would not be possible. I know many people who do this to avoid using SS#s whenever possible and many who don’t have SS#s and have been able to purchase homes, cars, and build a life responsibly by using their tax ID #. Whoever is reading this, go to an accountant, go to a bank, speak to someone qualified to answer your questions, and inform yourself. Do yourself a favour and stop asking random people on the internet.

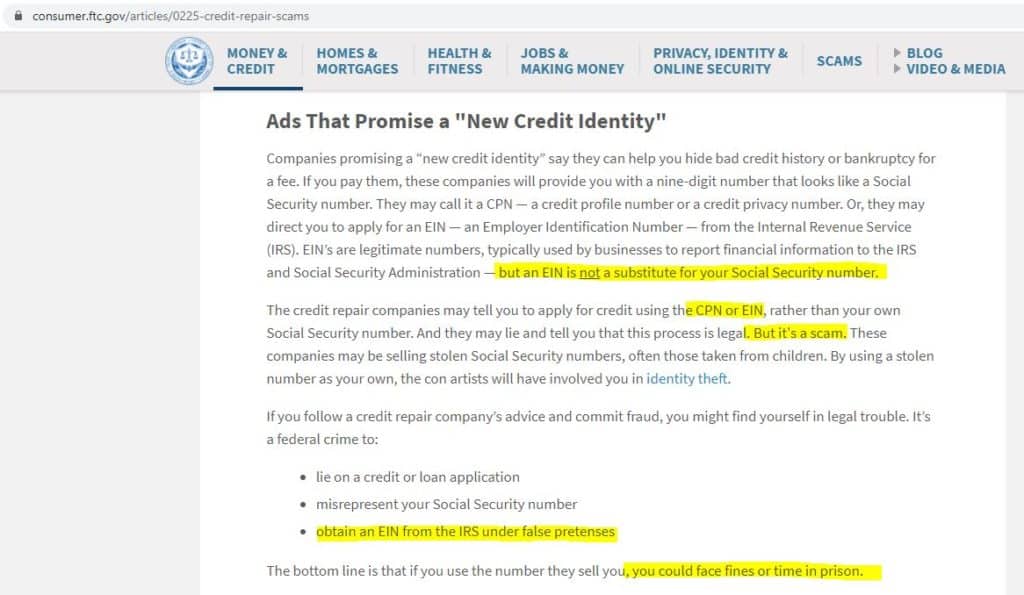

Is the Federal Trade Commission a sufficient source? If so:

“…Or, they may direct you to apply for an EIN — an Employer Identification Number — from the Internal Revenue Service (IRS). EIN’s are legitimate numbers, typically used by businesses to report financial information to the IRS and Social Security Administration — but an EIN is not a substitute for your Social Security number…”

“…The credit repair companies may tell you to apply for credit using the CPN or EIN, rather than your own Social Security number. And they may lie and tell you that this process is legal. But it’s a scam…”

https://www.consumer.ftc.gov/articles/0225-credit-repair-scams

Is the address in the ITIN the same that address in the bank?, can you obtain a credit report with your itin or only fico score? thanks

What happens to the credit you have built with your ITIN number, once you obtain a social security number? Does it get erased? Do you have to start all over to build credit again? Or does your ITIN # merge with your new social security # ?

I’ve been wondering the same thing ever since I learned that a credit can be built with the itin. Did you receive an answer on this Brad?

You have to notify the credit bureaus so they can transfer your credit card information to your ssn

Great Judy, this help me a lot !!!

one month ago i did my ITIN, how do i get my credit report? and another question, can I do financing using my ITIN? Thanks a lot

Wow……

Go and speak to someone qualified to answer your questions in person at a bank.

Is the Federal Trade Commission a sufficient source? If so:

“…Or, they may direct you to apply for an EIN — an Employer Identification Number — from the Internal Revenue Service (IRS). EIN’s are legitimate numbers, typically used by businesses to report financial information to the IRS and Social Security Administration — but an EIN is not a substitute for your Social Security number…”

“…The credit repair companies may tell you to apply for credit using the CPN or EIN, rather than your own Social Security number. And they may lie and tell you that this process is legal. But it’s a scam…”

https://www.consumer.ftc.gov/articles/0225-credit-repair-scams

As far as I know, if you can get a credit card with an itin number, you would inevitably build a credit record. Every time that you pay your bills on time your are building your credit record. You don’t need to try to cheat on applications since a lot of institutions give you the option to apply for their services with your itin number. Is good business for them after all, if they know how to manage it.

hello any body can help me out how I can get my credit score pulled out

This is 100% inaccurate and WRONG, I reported to be removed from google.

You 100% can use an ITIN to build credit.

Reported it to Google? I would ask you to consider your instinct to “report” information you think is “wrong” to have it “removed.”

You might want to consider what kind of society you will end up with if that is how communication devolves.

If you would like to help others, why don’t you explain how it is “wrong?”

Be specific.

I look forward to it.

Yes this information is partially correct. You can build a credit with your ITIN number that is why IRS gives it to you, so you can report your taxes. It will give you credit to purchase and get loans.You will not be able to have SS benefits because its only to report taxes. This ITIN is mainly for people who do not have SS #.

You can check your scores with credit karma app or with your bank app. Just put in your ITIN and answer some questions to verify.

Once you get your SS card you can wrote a letter to IRS and send a copy of your CP565 which is the letter that IRS send you with your ITIN# and a copy of your SS card and let them know you will like to transfer your credits to your SS#. The only thing you are right is that if you have your Social Security you shouldn’t use your ITIN.

Wow, you get a lot of hate on this article. I get what your saying. The fact that some people do use them as an identifier violates their legally defined purpose. It also it states on the ITIN they are not to be used as a form of ID. So you’re not wrong, you’re 100% correct. Do some people still use them as an identification, maybe we should plead the 5th on that and not say anything. Now for my plug, weren’t SSN only supposed to be used for income tracking? Basically Uncle Sam can bend the use of SSN, but if you do it, beware. Kind of like Cops can speed because honestly who is going to pull them over, that doesn’t mean that you can, or that you have an argument that will win in court if you get caught speeding. You will still be responsible for your actions. Really though, you should be careful saying anything about your actions online…maybe just maybe, I could be a prosecutor looking for my next big case. Hehehe. I am not, but what if? Leave the writer alone, he or she is not wrong. If the author said you were right, or even I said so, it is not an argument in court. Talk to an attorney at your own expense if you are looking for a legal argument that could make it right, maybe they know something no one else does. Yes, my spouse has an ITIN. No I did not get my darn stimulus because of it. Uggg. The whole ITIN and SSN thing sucks.

How did you get to know what is your annual report and score?