November 21, 2023 update:

Since we published this article, the confusion over tradelines has increased. We thought we’d update this article and republish it to bring it back into sight.

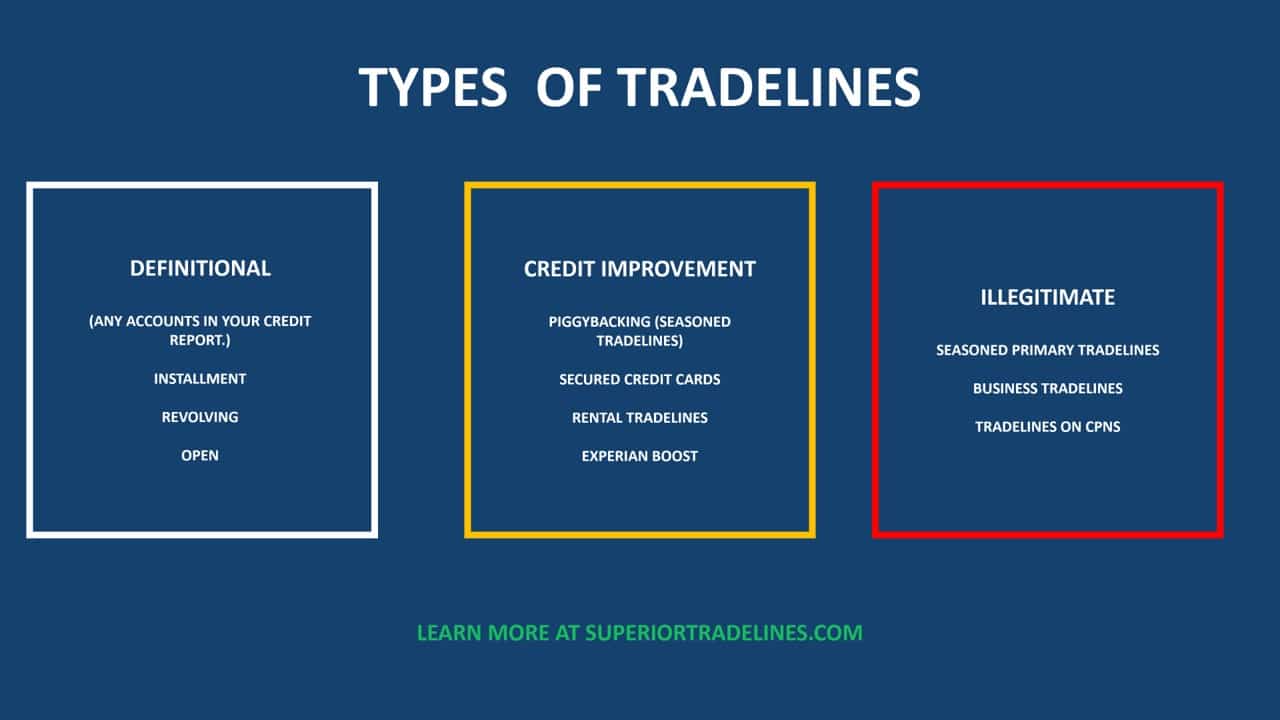

There are really two types of tradelines:

- Types of tradelines number 1: Any account in your credit report; the term “tradelines” in that context is just industry jargon for “account.”

- Types of tradelines number 2: The addition of authorized user accounts to credit reports for the purpose of increasing credit scores (sometimes referred to as “seasoned” tradelines); this is viewed as a credit hack or credit repair technique

There are sub-types within those two categories: literal tradelines and authorized user tradelines.

Table of Contents

Types of tradelines Number 1:

The term is very literal. The term “tradeline” is similar to the term “trade account”. In short, this is a line of credit that a bank issues to the company, in the form of a credit card.

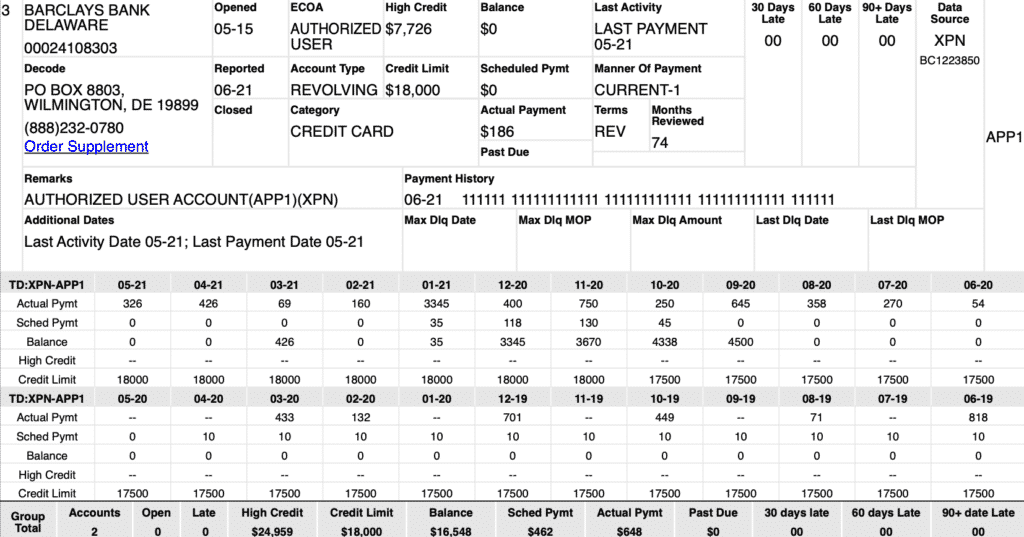

As seen below, consumer credit reports list these different accounts. The industry professionals call these accounts “tradelines”.

Here’s an example:

You can see the date opened, date of last activity, payment history, balance, limit, status, type, source, etc. Hence, a specific account’s information is collectively referred to as a tradeline.

Here are the different types of tradelines in that context:

- Installment accounts: These are usually “fixed” payment arrangements. Some examples of these accounts are car loans or appliance floans.

- Mortgage accounts. A mortgage account is technically an installment account. However, banks, credit reports, and scoring models treat these accounts differently than installment loans. Therefore, we distinguish them.

- Revolving accounts. Revolving accounts have open-ended charging abilities, like a credit card or a home equity line of credit. You have a total spending ability that you can charge up or pay down. Unlike installment accounts or mortgages, you can purchase more than one thing over time. And, your spending limit can increase or decrease over time.

- Open accounts. Consumers rarely have open accounts. Open accounts are very transactional. You “buy” something on credit and pay back the amount once it is delivered.

All types of tradelines look the same on a credit report. More specifically, while some reports may change format or layout, the information in a tradeline is usually the same.

If you read this far, you’re probably like:

“Yeah yeah yeah, that’s not what I mean. What are the types of tradelines that improve credit scores?”

Type of tradelines Number 2:

The types of tradelines designed for credit improvement are called seasoned tradelines or authorized user tradelines and the process is often called piggybacking credit.

In this credit improvement vein, you can add many versions of tradelines to your credit report for the purpose of increasing credit scores.

Here are the different types in that context:

- Piggybacking credit. This is where a cardholder adds you as an authorized user to an existing account in good standing, with a high limit and low balance. A 24-page study shows piggybacking effectiveness.

- Secured credit cards. This is where a bank offers an individual a credit card after the individual places money upfront, securing the line of credit.

- Rental tradelines. This is where a company converts your rental history into a “tradeline” that reports to the credit bureaus.

- Experian Boost. Experian started a program to allow people to convert certain bills into credit.

Bonus: buyer beware!

Unfortuantely, there are many types of tradelines that are totally illegitimate. This isn’t subjective. It’s important to realize that people have gone to jail for misuse of tradelines in certain ways.

Here are some tradelines you’d probably want to stay away from:

- Seasoned primary tradelines. These simply do not exist (without fraud). Piggybacking authorized users works because of laws (ECOA). Having a seasoned primary tradeline would exist only if a law was broken (FCRA).

- Business tradelines. Business tradelines exist, if you establish a business, establish banking relationships, establish a Dun and Bradstreet credit report and establish a line of credit under the business’s name and EIN which reports to the Dun and Bradstreet credit report. They do NOT exist as an account you can buy, like tradelines for sale on the consumer side.

- Any tradeline on a CPN. So-called credit profile numbers are fraudulent secondary social security numbers. Because CPNs are a form of “synthetic identity fraud, any tradeline on it is associated with the fraud.

Conclusion.

In conclusion, tradelines are accounts in your credit report, with many different types. Further, piggybacking credit is the addition of authorized user tradelines. In the right circumstances, the greatly improves credit scores. Finally, fictitious and fraudulent tradelines are easy to spot and you should stay away from them.

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.