Abstract

This study analyzed the impact of authorized user tradelines for credit score increases by examining the credit scores of 860 participants before and after adding one or multiple tradelines.

The effects of the following aspects of tradelines were studied: the age of the tradeline added, the limit of the tradeline added, how many tradelines were added, the effect of other information on the credit report, and the age of the participants.

The study separated the participants who started the research with credit files from those with no credit file. The only scores used in this study were FICO scores.

Finally, the study evaluated individuals who experienced a decrease in credit score to determine the reasons behind those results.

This study indicated that tradelines generally have a beneficial impact on credit score, resulting in an average increase of 88 points. While this could be due to multiple factors, the primary reason for this improvement was the addition of the tradeline(s). Tradelines typically increase the average age of accounts, decrease the average utilization, and add positive payment history to the credit report. All of these factors positively impact the credit score.

Introduction

An authorized user tradeline is a line of credit which an individual has been granted permission to use. However, the individual is not legally responsible to maintain this line of credit.

The 1974 Equal Credit Opportunity Act (ECOA) imposes two significant requirements. First, all creditors are required to report authorized user information to the credit bureaus. Second, all creditors must consider the history of the accounts held by a spouse when determining creditworthiness.

How do tradelines for credit work.

Because the creditors report data for all authorized users without differentiating whether an authorized user is a spouse, effectively all authorized user tradelines must be considered when determining creditworthiness (2). The inclusion of authorized user tradelines in the analysis for creditworthiness enabled the authorized user to feel both the “benefit or burden” of the tradeline, depending on the tradeline’s standing to which they are added.

Scoring models assign value to both primary and authorized user tradelines. Because of this, authorized users can use both types of tradelines to build their credit history and manage their credit. “Piggybacking credit” became a commercialized product where tradelines for sale are purchased by consumers looking to improve their credit scores.

All accounts on a credit report are considered tradelines, including authorized user tradelines. Creditors, like banks, report tradeline information to the credit bureaus. Credit bureaus maintain the database of information upon which credit scores are based (3). The three main credit bureaus are Equifax, Transunion, and Experian.

Even though credit bureaus generate and sell their own credit scores, these are rarely the credit scores used by lenders. The most widely used credit scores come from remodelers like Fair Isaac Corporation (FICO).

How scores are used.

Lenders use credit scores produced by scoring models to make decisions regarding creditworthiness. These systems take the information on your credit report and run it through multiple algorithms to determine your credit score.

Credit scores are a relative indicator of how worthy of credit an individual is. Higher scores indicate that an individual is worthy of credit, while low scores indicate that an individual is unworthy. Lenders use this score to determine whether an individual is worth the risk of extending credit to and how likely it is that the individual will pay back their debt.

Because of errors in data maintained by the credit bureaus, credit scores are not always accurate. Credit scores are constantly fluctuating based upon the score model used. Different websites may use different score models or a model they created themselves. Additionally, the scores alone do not provide substantial evidence regarding an individual’s creditworthiness. There are many important factors that can influence lending decisions that aren’t included in the credit score, like salary or stability of work, for example.

A credit score is based upon five primary factors of a credit report. These five factors include payment history, credit utilization, credit age, diversity of credit types, and new credit (inquiries). A change to any of these factors often results in a shift in the credit score.

What is a good credit score?

To obtain a good credit score, there are a few goals to achieve. You should have good payment history, low credit utilization, and old lines of credit on your report. Additionally, diverse types of credit (mortgages, loans, credit cards, etc.) and few new inquiries can also improve your credit score.

Credit can be hard to obtain, especially when you have a small or nonexistent credit file. That is where authorized user tradelines become relevant to consumers looking to develop their credit files and scores.

A study by the Federal Reserve found that over one-third of the population had at least one authorized user tradeline on their reports (1). Authorized user tradelines, often called seasoned tradelines, allow the authorized user to piggyback their credit off an individual who has already established a line of credit.

The process of piggybacking credit is fairly simple. An individual with established credit adds a third party as an authorized user to one or more tradelines. Then, the information associated with the tradeline will report to the authorized user’s credit report. This information includes the payment history, limit, and age of the account. Once this new information has been reported to the bureaus, the credit scoring agencies factor in this new information.

This can have significant beneficial effects on the authorized user’s credit score if the tradeline is in good standing. However, the importance of the change in credit score will vary between individuals.

Benefit differentials.

For example, a 20-point increase for someone with a credit score of 685 will be quite beneficial. This increase would result in the transition from “fair” credit to “good” credit. However, a 20-point boost to an individual who has a starting credit score of either 750 or 460 would be less beneficial. In this situation, the individual in the same scoring brackets of “very good” or ‘very bad” credit respectively. The distribution of the participants within the scoring brackets is examined in Analysis 5.

A survey study conducted by Credit Knocks in 2019 studied the impacts of authorized user tradelines on credit scores. This study looked specifically at individuals of varying ages, ethnicities, income levels, and education levels. The study found that “being added as an authorized user had a more significant impact on credit scores than income, ethnicity, or education” (4).

A similar study conducted by the Federal Reserve examined the role of authorized user accounts on an individual’s credit score. The Federal Reserve focused specifically on the impacts on married women’s credit score (4). These studies found a correlation between the presence of authorized user accounts on credit reports and higher credit scores.

However, neither of these studies quantified the tradeline’s benefit on the score. Additionally, neither study examined the impact of each aspect of the tradeline on the credit score.

That is where this study comes in.

Method

This study analyzes the contribution that an authorized user tradeline makes to a credit score. Furthermore, this study intends to understand the impacts of the tradeline’s specific aspects.

To begin with, each participant submitted a credit report to Superior Tradelines, LLC in the normal course of business. Then, each participant’s credit report was evaluated by Superior Tradelines experts. This process helped to determine the potential ability to benefit from the tradeline. The participants who were eligible for tradelines were then assigned a tradeline that would be maximally beneficial to the participants.

To begin, each participant provided a credit report that our credit experts analyzed.

Result examples.

For example, participants who struggled with high utilization are typically assigned tradelines of higher limits to negate that negative factor. In contrast, a participant with no credit history was given an older tradeline.

Once the tradeline(s) had been assigned, the impact was analyzed. The tradeline’s features were recorded including the age and limit of the tradeline, and the number of tradelines added.

This study examined the credit scores of 860 individuals to determine how much impact the tradeline had on their score. All evidence, consisting of tests, analyses, research, or studies, has been conducted and evaluated objectively by qualified persons and is generally accepted in the profession to yield accurate and reliable results.

The study has shown that the addition of authorized user tradelines to a credit report can improve the credit score. Adding seasoned tradelines in good standing can help improve some factors that impact the credit score. These factors include payment history, age of accounts, and credit utilization for an individual.

Improving these factors results in an improvement in the credit score, which is heavily based upon these factors.

Range and participants.

This study analyzes the credit reports and scores of 860 individuals that purchased authorized user tradelines through Superior Tradelines LLC over one year.

All tradelines that were included in this study had to meet the following requirements:

- no late payments,

- balance below 20%,

- regular usage,

- and they were from well-known banks.

The tradelines varied in age from 1-21 years old and varied in the limit from $3,800 to $50,000.

At the start of the study, all participants provided their credit reports and credit scores before adding the tradelines. After the tradeline(s) appeared on their reports, their updated credit scores and reports were collected.

The following data was collected for each participant:

- the credit score for each bureau before tradelines,

- the credit score for each bureau after the addition of the tradelines,

- the limit of the tradelines,

- the age of the tradelines,

- and the age of the participant.

If the credit score was static or decreased, the credit reports were analyzed to determine what factors inhibited the tradeline’s contribution.

Additionally, the source of the credit score was noted: most credit scores came from Experian.com, CreditKarma.com, TransUnion.com, Equifax.com, and IdentityIQ.com.

Timelines.

The before scores were recorded within 45 days of the tradeline reporting. This short timeframe limited the impact of factors other than the tradeline. This information was then analyzed to determine each participant’s score change for each of the three bureaus.

Different bureaus.

The reason this study separates data from each bureau is that each bureau reports different data. Ideally, each bureau would report the same information, but that is not always the case. Thus, the data from all three bureaus needed to be separated during the analysis process.

Authorized user tradelines interact with what is on the credit report to determine the score. Therefore, combining sources with different data on the reports would result in inaccurate results from our analyses. Additionally, some lenders use a specific bureau when approving loans. To mimic what lenders see from a specific source, the data for all three bureaus were kept separate.

Different scoring models.

Some participants used different sources for the before and after credit scores. Since different sources often use different scoring models, the credit scores provided by two different sources could be different. This can be the case even if the credit report’s information is the same. For this reason, before and after scores from different sources were not included in the analysis.

When participants had no credit score, they were assigned the value of 0 to the bureau with no score. If the score for a specific bureau was not confirmed, then that bureau was not factored into the analysis.

Increases, decreases, and no change in scores.

The analyses indicated that authorized user tradelines generally lead to an increase the credit score. However, there were instances in which the credit score was static or decreased between the collection of the scores. For these cases, the credit reports were analyzed to determine what other factors inhibited the tradelines’ effectiveness.

Results

Analysis 1: General Findings

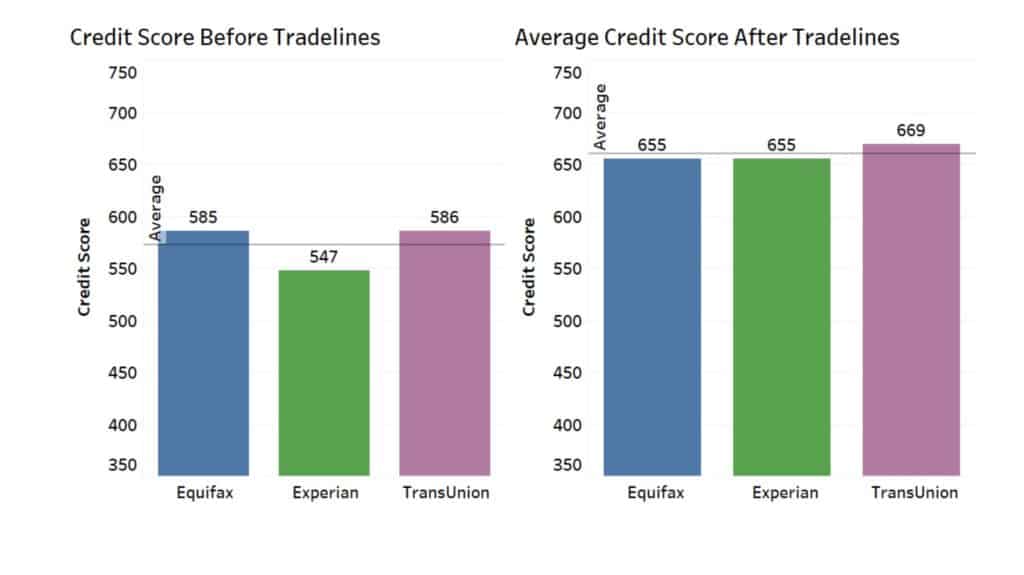

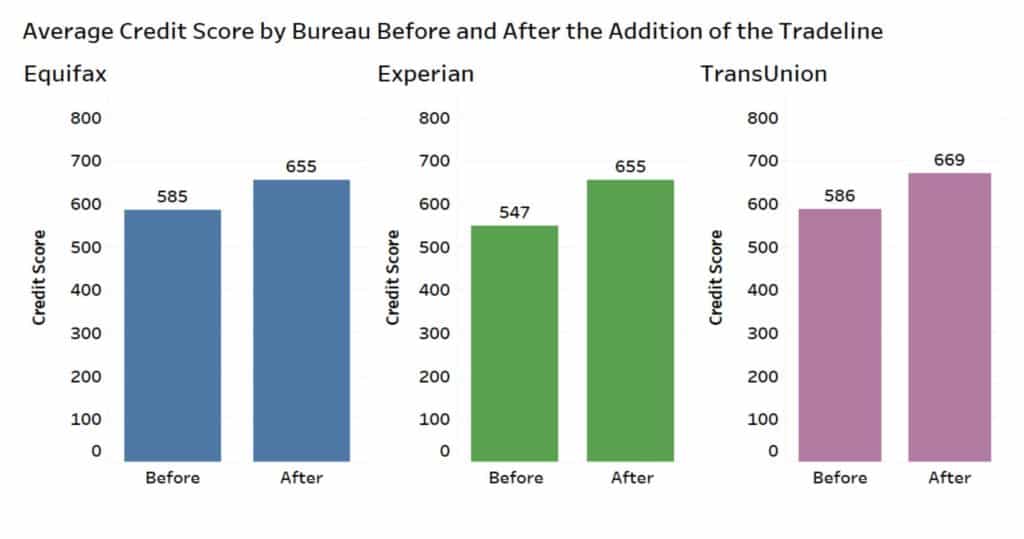

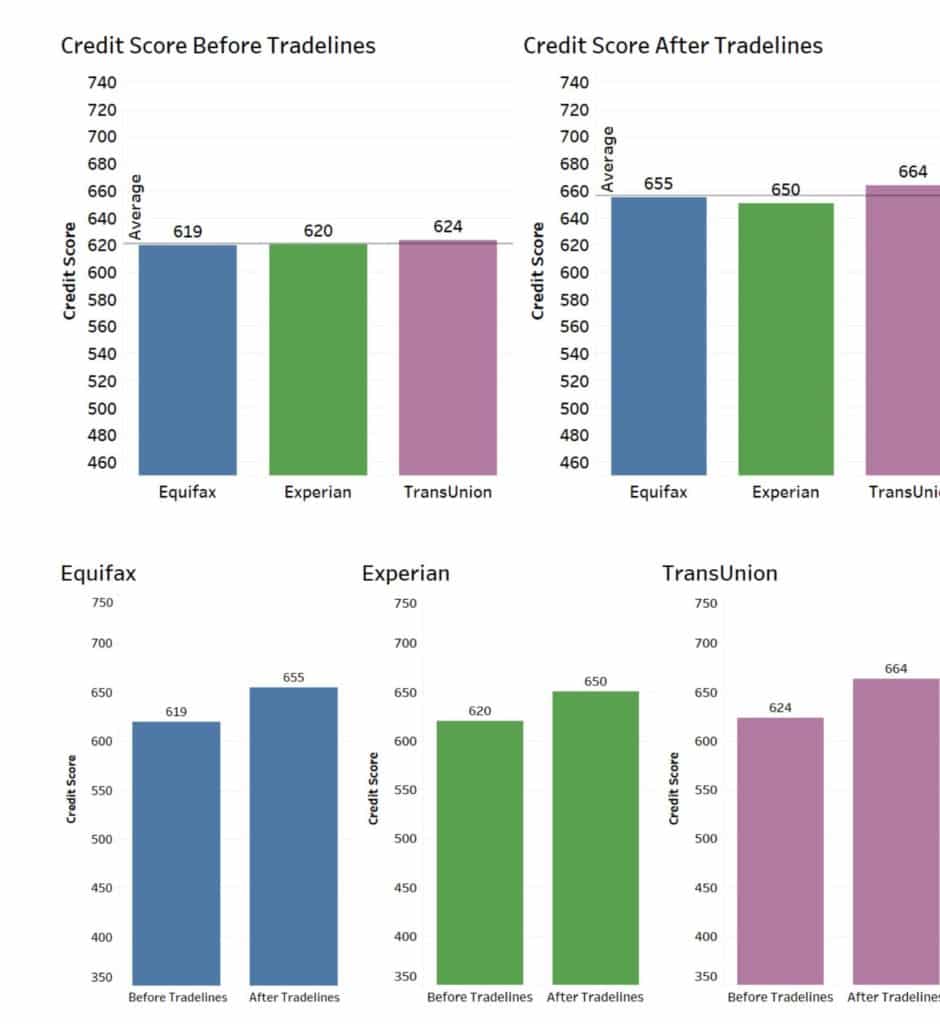

Data was collected from 860 participants using the methods stated above. Then, the average credit score for each bureau was determined both before and after the tradeline was added.

By comparing the average scores before and after the addition of the tradeline, it was found that the tradelines had a positive impact on the scores. The average change in Experian score was 108-points. Equifax experienced an average increase of 70-points. Further, TransUnion experienced an average increase in 83-points.

Finally, the before and after credit scores from each bureau were averaged. It was found that the average credit score increase for each participant was 88 points.

A significant average increase in credit score implied that authorized user tradelines could drastically improve the authorized user’s credit score. However, many factors go into this general average, which is explained further below.

Analysis 2

Average Credit Score Change Given Little to No Credit

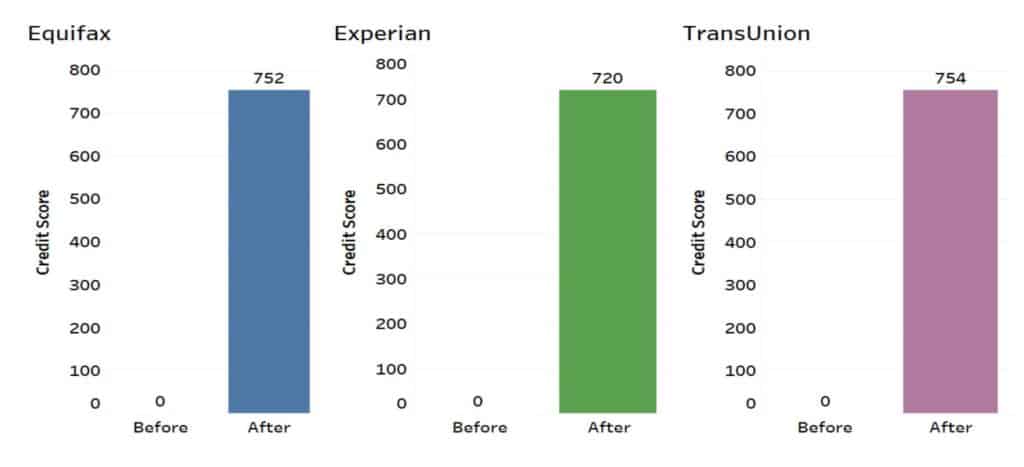

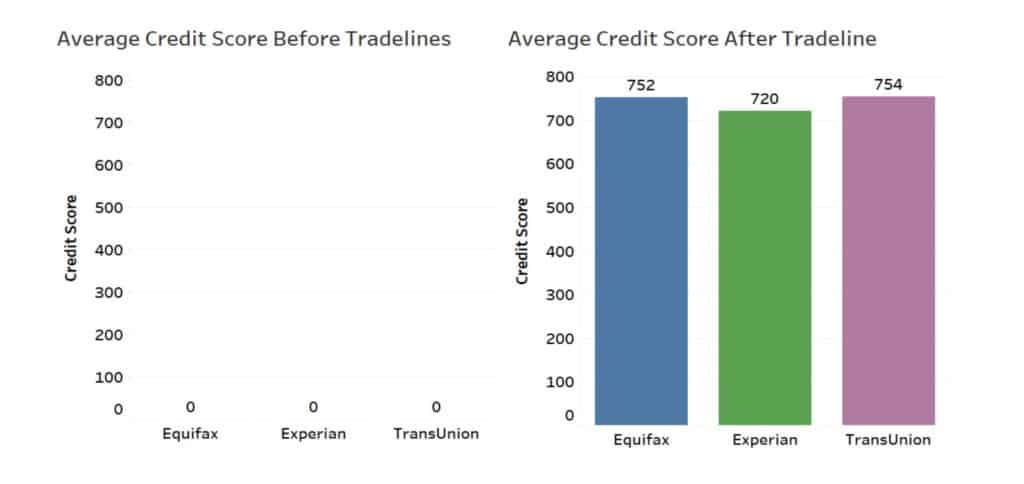

Thin or non-existent credit files typically cannot generate a credit score, so they were assigned zero value. Since the lowest FICO credit score possible is 300, any addition to the credit report would cause the score to rise hundreds of points.

Fifty-one participants had no credit score before adding the tradelines, which accounted for 6.4% of the study participants.

Since this situation occurs frequently, we separated participants who had no starting credit from those with credit scores. The data was analyzed once the participants were split into these categories.

The addition of an authorized user tradeline to the credit report for these clients resulted in an average increase in the credit scores. The average increase in score for Experian was 720-points, for Equifax was 752-points, and for TransUnion was 754-points.

Beneficial tradelines for credit.

These results suggest that it can be highly beneficial for individuals with no credit score to be added as an authorized user tradeline. Individuals who had no starting credit score were intentionally separated from those who did have a credit score. This was because authorized user tradelines tend to impact those who have a small credit file significantly.

Given that there is little information on the report for the credit score formula to include, adding a tradeline in good standing can dramatically improve multiple factors that influence the credit score.

While there are fewer of these clients, there is a higher average score which inflated the results of Analysis 1. These findings are also in accordance with the results of the study by the Federal Reserve (1).

Analysis 3

Average Increase Given Some Credit to Start with

Analysis 3 studied the impact of tradelines on credit score change for participants who had a preexisting credit file. 809 participants were included who had a credit score before the addition of authorized user tradelines.

It was found that the average credit score change was 30 points for Experian, 36 points for Equifax, and 40 points for Transunion. The average change in credit score across all three bureaus increased 35 points to the credit score.

This average increase is minor compared to the average score increases for those with no credit file.

93.6% of the participants in the study started with some credit score. Thus, this is a more appropriate figure to apply to most situations.

Average increases explained.

There are many explanations why these clients saw significantly smaller increases in their scores.

- First and foremost, the lowest FICO score is 350. If clients received any increase in score, they would see at least 350 points. This is an unrealistic expectation for anyone whose credit score is above 500, since the perfect FICO score is 850.

- Additionally, the tradelines added to their reports were no longer the only factor determining the credit score. Instead, they were among many. Since each tradeline contributes to the credit score, having multiple accounts would lessen the impact of new tradelines.

- Finally, it was impossible to guarantee that each account on the participant’s reports was in good standing. Only the authorized user tradelines added were guaranteed to be in good standing. Recent negative factors, like late payments or collections, can negate the benefit of adding a tradeline to a report.

- The clients who had credit files prior to the tradeline were more likely to have negative factors on their reports. This could be why the average improvement in the credit score is limited here.

Analysis 4

Average Increase Per Line (1, 2, 3)

The number of tradelines added to an individual’s credit reports can significantly impact the credit score change. More tradelines often result in a larger credit file, lower utilization, and an increase in the average age of accounts.

Analysis 4 analyzed the score change individuals who purchased one, two, and three tradelines to isolate this factor.

The addition of more than three tradelines is complex. Further, it is rarely beneficial to an individual to add more than three lines to their credit file. Because of this, participants were never added to more than three authorized user tradelines at one time.

Analysis findings.

- One tradeline had an average increase in 86 points to Experian, 66 points to Equifax, and 73 points to TransUnion.

- Two tradelines had an average increase of 170 points to Experian, 110 points to Equifax, and 126 points to TransUnion.

- Three tradelines had an increase of 170 points for Experian, 160 points for Equifax, and 186 points for TransUnion.

As you can see from the first graph, the addition of multiple tradelines can have beneficial effects. The average score increase for the addition of one tradeline was 75 points. Two tradelines resulted in an increase of 135 points, and three tradelines resulted in an increase of 172 points.

However, it is not a linear progression. There are diminishing returns on the credit score due to the addition of multiple tradelines. Many people believe that more tradelines will always result in a higher score. However, it is essential to note that the quality, not the number of tradelines, is critical.

When adding tradelines for credit improvement, context matters.

The impact of the tradeline will depend substantially on the information that is already on the credit reports.

The second analysis we ran shows that individuals assigned one tradeline has the highest average starting credit score. Those who were given two tradelines have the second-highest starting score, followed by those who were assigned three tradelines. The higher the starting credit score, the more difficult it is to improve the credit score drastically.

The participants who ordered three tradelines started with a lower average credit score. Thus, they would have more room for improvement to hit the same score as those given one tradeline. This is one reason that the clients who ordered three tradelines saw a larger increase than those who ordered two.

Interestingly, the ending credit score for all individuals was within 10 points for Equifax, within 32 points for Experian, and within 23 points for TransUnion, despite how many tradelines were ordered. This implies a theoretical cap on the benefit that the tradelines can provide to a credit score.

Because of this, an individual’s specific situation should be considered when determining how many tradelines to add to their credit report.

Analysis 5

Average distribution of FICO Scores

Most individuals do not need to get a specific credit score when moving forward with their financial goals. Instead, they need to fit into a general score range.

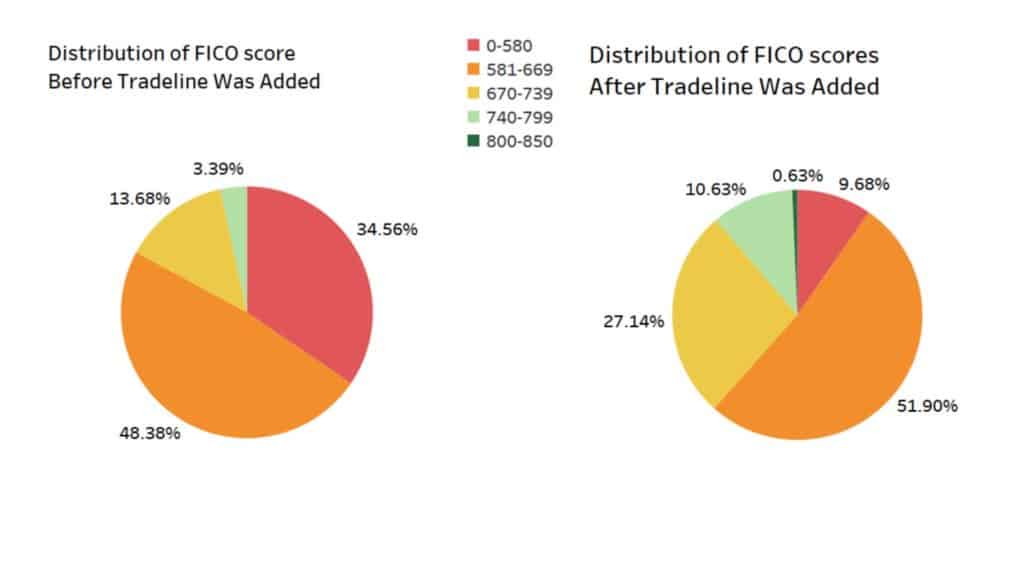

FICO scores have five range categories. Credit scores lower than 580 are considered a “poor” score. 581-669 is a “fair” score. 670-739 is a “good” score. 740-799 is a “very good” score. 799+ is considered an “exceptional” score.

The distribution both before and after the tradelines were added to their reports were recorded and analyzed.

Many lenders use the credit scores from all three bureaus to determine an applicant’s score range. This was emulated by comparing the average of the before and after scores for all bureaus together.

Before.

It was found that most participants started the study in the lower categories:

- 34.56% in the poor score category,

- 48.38% in the fair score category,

- 13.68% in the good score category,

- 3.39% were in the “very good” category,

- and 0.00% were in the excellent category.

After.

After the addition of the tradeline, most clients were in the middle to upper credit score ranges:

- 9.68% of clients remained in the poor credit score category,

- 51.90% were in the fair credit score category,

- 27.14% were in the “good” category,

- 10.63% were in the “very good” category,

- and 0.63% were in the “excellent” category.

This analysis shows that roughly 20% of the individuals with poor credit scores improved their credit score by adding tradelines. Additionally, the proportion of clients who had great or excellent credit scores increased from 3.39% to 11.26%.

These factors indicate that the average client saw a positive shift in their credit rating due to the tradelines.

Fitting into a higher credit score category can have many benefits on achieving lending. Higher rates of approval, larger limits granted, and lower interest rates are just a few reasons people try to improve their credit score before applying for funding.

Findings.

This finding implies that the number of participants who qualified for higher credit score brackets increased after the addition of tradelines.

Analysis 6

Average increase based on limit

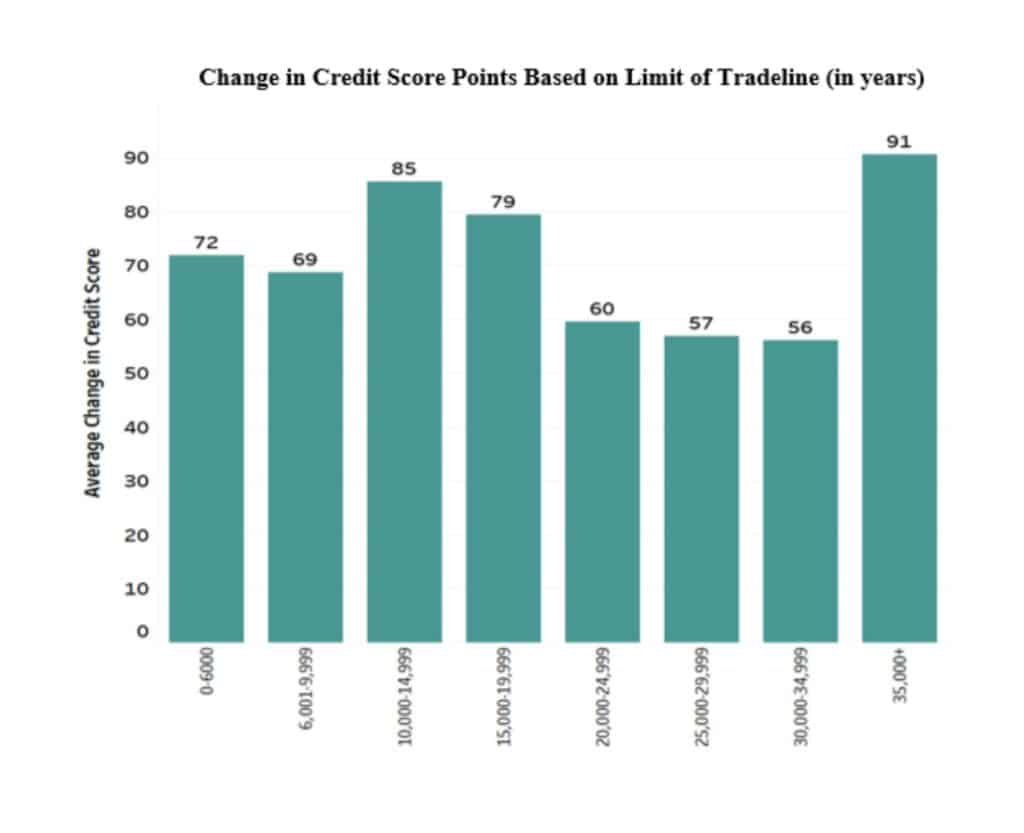

Many individuals who research authorized user tradelines want to buy the biggest tradeline possible. This comes from the belief that large tradelines will result in the maximum increase of their credit score.

Analysis 6 looked at the average change in credit score based on the tradeline’s limit to analyze this mentality’s truth.

There were 8 categories of the size of the tradelines:

- $0 to $6,000;

- $6,001-$9,999;

- $10,000-$14,999;

- $15,000-$19,999;

- $20,000-$24,999;

- $25,000-$29,999;

- $30,000-$34,999;

- $35,000+.

Because many factors influence the change in credit score, it can be tricky to isolate one feature. Only clients who ordered one tradeline were included in this portion of the study to account for this. This ensured that there was no need to account for the limits of multiple tradelines. 512 of the participants were included in this analysis.

Analysis 6 findings.

It was found that the addition of tradelines with limits up to $35000+ had the highest average credit score. The credit score boost for this category was 91 points. This limit group was followed closely by tradelines with limits from $10,000-$14,999 with an average increase of 85-point increase. The next highest was $15,000-$19,000 with an increase of 79 points. All other categories had roughly the same impact, resulting in a median increase of 60 points.

The addition of tradelines with the largest limit resulted in the most significant average change in credit score. This implies that the bigger tradelines can be better. However, the tradelines with limits of $20,000-$34,999 saw the lowest average change, which contradicts this sentiment.

These results are significant because they contradict the hypothesized outcome that a larger limit tradeline always has a more substantial contribution to the credit score than a smaller limit tradeline. This indicates that while larger limit tradelines added to someone’s credit report can have material impacts on the credit score, this is not always the case. Since many factors contribute to a credit score, it is important to fully consider all aspects of a tradeline when adding a tradeline to your reports, not just the tradeline limit.

The change to the credit score is not solely due to the limit of the line that is added. While it is an essential factor, it cannot be thoroughly analyzed independent of the tradeline’s age that is added.

Analysis 7

Average increase based on the age of tradeline

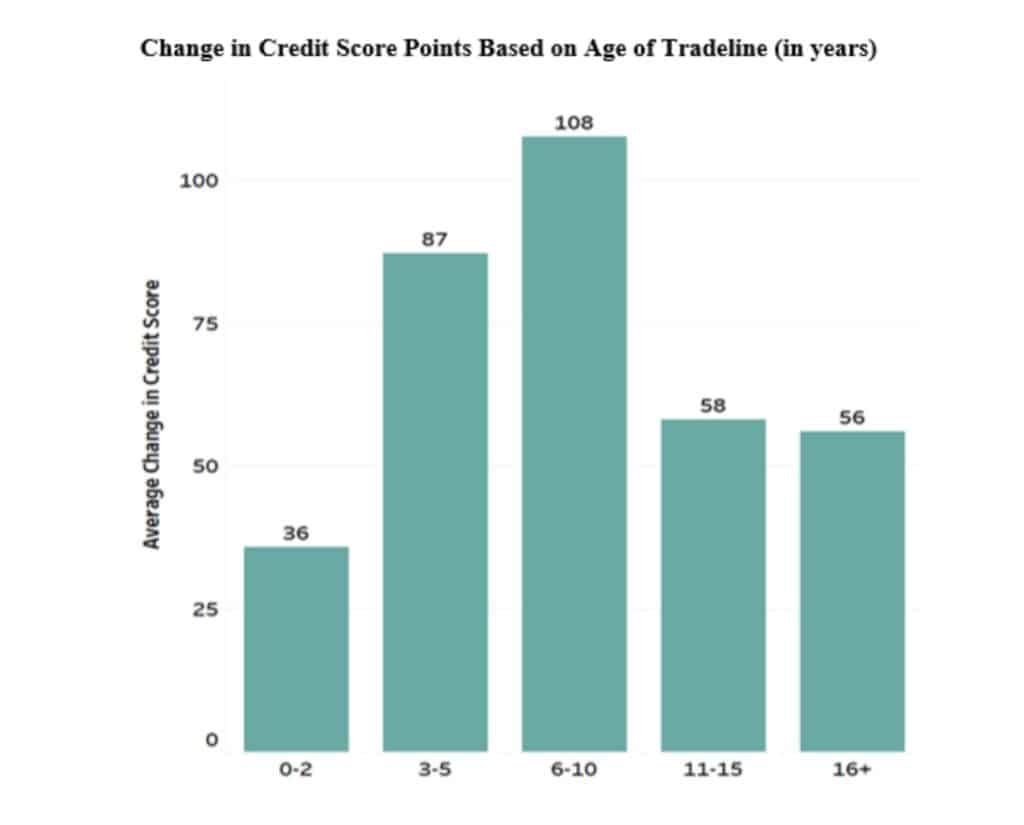

Another common belief is that the older the tradeline’s age, the more significant the impact on the credit score. This is primarily because FICO score models strongly consider the average age of accounts when determining a credit score.

The tradeline’s impact on the credit was analyzed based upon the tradeline’s age to assess this belief.

Because many factors influence the change in credit score, it can be tricky to isolate one feature. Only clients who ordered one tradeline were included in this portion of the study to account for this. This limited the need to account for the limits of multiple tradelines. 512 participants were included in this analysis.

The average change in score (tradeline age).

The average change in credit score was analyzed based on the tradeline age added to examine the impact of tradeline age on credit score. There were five age ranges specified in this study:

- 0-2 years,

- 3-5 years,

- 6-10 years,

- 11-15 years,

- and 16-21 years.

It was found that the age range that resulted in the highest credit score increase was the 6-10 age range. This age range saw an average increase of 108 points. In general, the data resembled a bell curve around this age range.

The tradeline’s average age with the minimum contribution to the credit was the 0–2-year-old tradelines. This is to be expected since these tradelines would not significantly increase the average age of accounts on the credit report.

Interestingly, the age group that made the second smallest contribution was the group of the oldest tradelines that were 16+ years old. This disagrees with the notion that higher age tradelines always have the most significant impact on the credit score. These results disagree with the hypothesis that the higher age tradelines would have the most significant impact on the credit score.

Finding indications.

The study indicates that higher age tradelines do not always have a more significant effect on the credit score than a younger tradeline. This finding is important because it implies that more factors than just the tradeline’s age should be considered when determining which tradeline should be added to a credit report.

Once again, it is essential to note that the tradeline’s age is not the only factor that impacts the score, so the change to the credit score is not solely due to the age of the tradeline that is added. While it is an essential factor, it cannot be thoroughly analyzed independently of the tradeline limit that is added.

Analysis 8

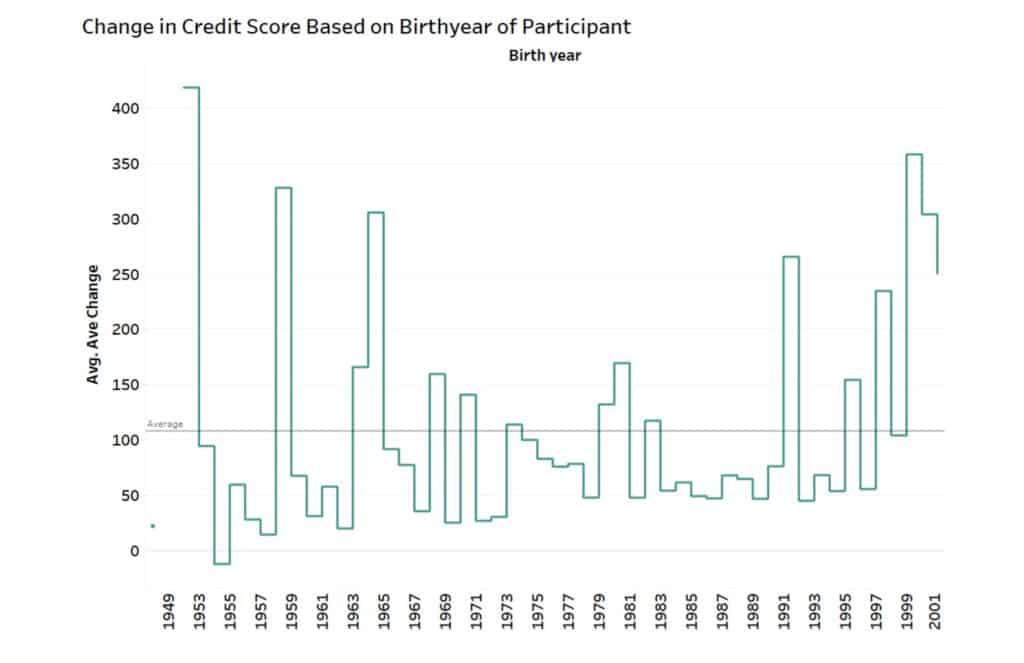

Change based upon the age of the individual

The study included participants that ranged in age from 19-72 years old.

The average change in credit score was analyzed based upon the participant’s age to determine if age had any impact on the change experienced from the addition of the tradeline. It was found that the average increase in the credit score was roughly 108, but there were no trends in which ages saw the most change from the addition of the tradeline.

This finding indicates that authorized user tradelines can be beneficial to individuals of all ages. There is not a single age range that benefits more than the other groups. It should also be noted that while there is no single group that benefited the most from the tradeline, the average increase across all groups was 108 points.

Analysis 9

Tradelines for credit don’t always work.

Credit scores are based upon five primary factors from the credit report. While adding authorized user tradelines can be beneficial for most people, they do not always result in notable changes to the credit score.

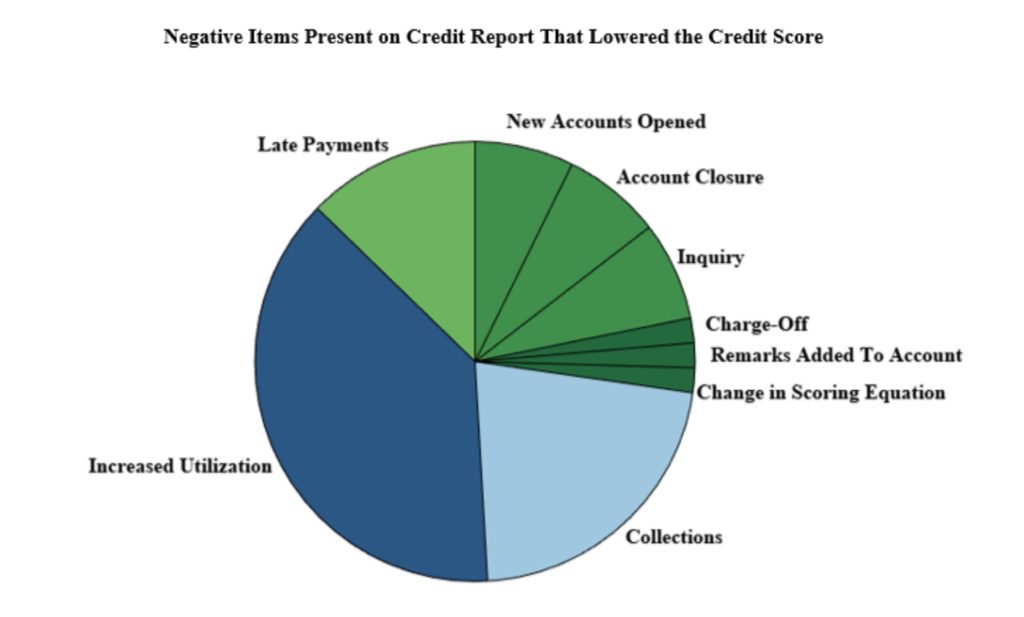

For clients with little to no change in the credit score or clients with a decrease in the credit score, the credit reports were reviewed to determine why the score did not change/decrease.

Roughly 5.8% of the individuals in this study experienced a decrease in credit score.

The primary reasons that clients had no improvement in the credit score or had a decrease score were as follows:

- increased utilization of accounts,

- new collections were placed on the report,

- the addition of new inquiries,

- old delinquent accounts were updated,

- and there were recent late payments.

The following chart shows the distribution of which factors were most prevalent when clients did not experience an increase in the credit score.

An increase in utilization decreases scores.

Given that the credit scores heavily factor in the accounts’ utilization, an increase in utilization can dramatically impact the credit score. Since the study participants were able to use their accounts throughout the study, this was the most prevalent factor that we saw inhibit the participants from improving their credit score.

Following that, new collections were another factor that was quite common among individuals whose credit scores did not improve.

The third most prevalent negative factor that was observed was the presence of new late payments.

Payment history is another factor that is heavily involved in determining the credit score, so a decrease in the payment history can significantly hurt the credit score.

Some other factors are the opening of new accounts, the closing of accounts, the addition of new inquiries, or new charge-offs and remarks. These factors contributed to combined account for roughly 25% of the cases, while the three prominent factors accounted for approximately 73% of the participants that experienced a decrease in score.

Interesting decrease in score.

It should also be noted that in 1 case, there were no negative accounts on the report, but the score still decreased. In this case, it is hypothesized that the credit scoring equation for the credit monitoring site was changed. Sites will routinely update their credit scoring equation, which will result in a change in the credit score even if no information on the credit report has changed. This is not a common occurrence, as it only accounted for 2% of the 5.8% of participants whose scores decreased.

Conclusion

The addition of authorized user tradelines can be an effective way to improve a credit score. This effort tends to be particularly effective for individuals who have little to no credit history. For individuals with a starting credit score, authorized user tradelines can still be used to improve the credit score.

This study found that the average change in credit score for all 860 participants was a 108-point increase to Experian, a 70-point increase to Equifax, and an 83-point increase to TransUnion. Such a significant increase in score was expected since many participants started with no credit score. These participants skewed the results to higher-than-normal means.

The average change in credit score across all three bureaus was a 742-point increase for clients who had no credit score. This supports our hypothesis and makes sense because a jump from having no credit score (given a 0 score in this study) to even a bad score results in a 350-point increase since the lowest FICO score is 350. This finding is also in agreement with the study by the Federal Reserve (1).

The average change in credit score across all three bureaus was a 35-point increase for individuals who started the research with a credit score. This also makes sense because adding a tradeline to an existing score will dilute the impact of the added tradeline since there are factors beyond just the tradeline taken into consideration when determining the score.

More tradelines for credit score improvement has limits.

There was a positive correlation between the average increase in the credit score and the number of tradelines added. This increase was not linear, which agreed with our hypothesis, but contradicted the common opinion that more tradelines will always improve.

Because the credit scores consider multiple factors, adding more tradelines will dilute each tradeline’s impact. While this is still beneficial overall, there are diminishing returns on each line. Thus, any tradeline beyond the third added to the credit report tends to be only marginally effective at improving the credit score, particularly for individuals who started the study with a credit score.

During this study, there was a noticeable shift in the distribution of average FICO scores for each client from the lower score categories to the middle and higher score categories. This agrees with our hypothesis that tradelines help improve credit scores in a practical way.

This finding is also important because the score category that an individual is placed in impacts their interest rates and approval rates. Placement in a higher score category often results in lower interest rates and an increased likelihood of approval. Hence, the shift towards the higher groups implies that the tradelines can help the participants get approved for their financial goals or obtain better loan rates.

A higher limit does not always result in higher scores.

While it is commonly thought that the higher the credit limit of the tradeline, the more significant the credit score increase, this was not what was observed in the study. While the tradelines with over $35,000 had the most considerable average impact on the credit score, the tradelines from $20,000-$24,999 had the lowest impact on the credit score. The second and third most significant increases were seen by the tradelines that ranged from $10,000-$14,999 and $15,000-$19,999, respectively.

These findings indicate that while the higher limit tradelines can be beneficial for some individuals, the limit is not the only factor that should be considered when selecting a tradeline.

Additionally, there is no strong correlation between the size of the limit and the increase in the credit score. These findings also indicate that choosing tradelines appropriate for your credit file could be more beneficial than choosing tradelines based on their limit. While there are situations where high limit lines are necessary, this is not the case for most individuals.

In a similar vein, it was hypothesized that the older the tradeline is, the more impact it would have on the credit score. This was also contrary to the results in the study. It was found that tradelines with 6-10 years of history had the highest average impact on the credit score. Interestingly, the highest age group had the second-lowest effect on the credit score, indicating that age is not the dominant factor in determining the tradeline’s impact on the credit score.

The age of participants did not matter.

The impact of the tradeline for participants of varying ages was also analyzed. The study found no association between the participant’s age and the benefit they received from the tradeline. This implies that it is not the individual’s age that matters, but rather the information on the individual’s credit report that determines how much impact the tradelines have on the credit score.

Finally, every situation in which the tradeline did not result in an increased credit score was analyzed. The tradeline is just one portion of the credit report, and there are many other factors on the report that can limit or negate the impact of the tradeline.

The most common factors encountered when completing this study were increased utilization of the accounts, new collections, and new late payments. 35% of the FICO score is determined by the payment history and 30% by the utilization. Thus, it logically follows that poor payment history and high utilization can inhibit the tradeline’s effects.

Our findings support this conclusion.

Collection accounts matter.

Collections are also negative accounts that can hurt the credit score, which agrees that this was our third most common negative factor that inhibited the tradeline from providing benefits to the participant. Having recent negative information on the credit report can seriously impede the tradeline from impacting the credit score.

These are the most common factors that inhibit the tradeline from providing benefits. However, only 5.8% of the participants in this study experienced no increase or a decrease in their credit score.

While this study found a correlation between the addition of authorized tradelines and an increase in the credit score, some caveats go along with this analysis.

Credit scoring models change often.

First, credit scores are constantly changing due to all the credit reports’ factors and the ever-changing score models released by scoring companies like FICO. Because of this, isolating any one feature (age, limit, number of tradelines added, etc.) is next to impossible.

There were correlations between the tradelines’ features and the impact on credit score. However, the relationship between the features analyzed and the change in the credit score is not causative.

Additionally, all of the seasoned tradelines used in this study are in good standing, meaning they have no late payments, consistent utilization of the account, and utilization below 30%. Since late payments and high utilization can have adverse effects on your credit report and credit score, it is crucial to only utilize tradelines in good standing to improve your credit score.

This study did not analyze the impacts of tradelines that were not in good standing and cannot represent how poor standing lines affect a credit score.

Credit use can change scores.

Finally, all clients were using their credit outside of our study. During the study, consumers continued to use their credit. This added uncontrollable changes in the reports that could factor into the credit score. The primary examples of these are the client applying for new credit, making payments, or changing their credit utilization. These examples can alter the tradeline’s impact on the credit score, either positively or negatively, depending on the situation.

Sources:

- Avery, Matias B, et al. Credit Where None Is Due? Authorized User Account Status and “Piggybacking Credit”. www.federalreserve.gov/pubs/feds/2010/201023/201023pap.pdf.

- Fraser. “Fair Credit Billing Act and Equal Credit Opportunity Act.” FRASER, 28 Oct. 1974, fraser.stlouisfed.org/title/fair-credit-billing-act-equal-credit-opportunity-act-1033.

- Sigman, Matias, et al. “Tradelines: An Ultimate Guide to Understanding Tradelines.” Tradelines at “Superior Tradelines, LLC”, 26 Apr. 2019, superiortradelines.com/tradelines/.

- “The Unknown Variable That May Boost Your Credit Score More Than Race, Income, or Education [New Study Results].” Credit Knocks™ – Build and Repair Credit, Save Money on Loans, 10 Oct. 2019, www.creditknocks.com/authorized-user-credit-score-statistics/.

Looking to buy a new car ASAP but don’t want to spend a lot on trades please help to boost score from 679 to 700+

Check out options here: https://superiortradelines.com/start/