Distinguish between deals and shills.

I’ll just warn you up front so that you don’t feel tricked into reading this section.

This section is really about how you avoid bad tradeline companies who are trying to rip you off by claiming they have the best deals.

However, I will tell you how to actually get good deals on trade lines at the very end.

The best deal on trade lines is a deal in which the tradelines you purchased achieved your credit goal.

If you start with the price, you are ripping yourself off and there are many companies happy to assist you in doing so.

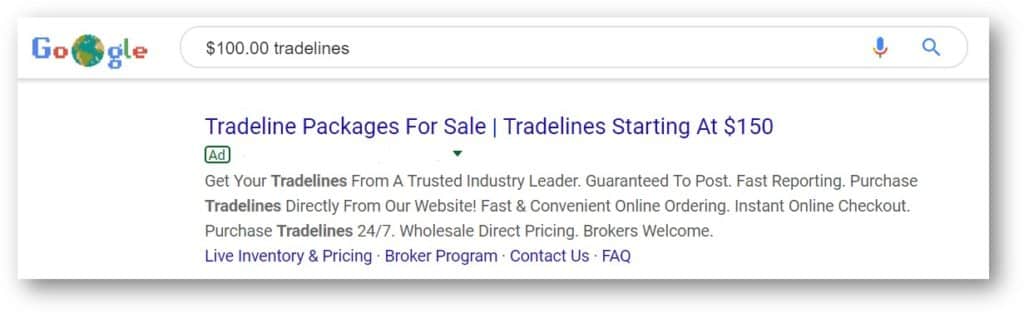

We wrote a blog post titled “This is what happens when you buy $300.00 tradelines” regarding the bait and switch ad pictured, above.

You should read it to find out why you should absolutely avoid these companies.

The basic point is that if a tradeline company would lie at the beginning of the transaction, what makes you think the tradeline company would be more honorable after they got your money?

Understanding the scammer.

But, why do they do this at all?

Imagine that you were a company that sells tradelines.

Let’s say you’re really bad at it.

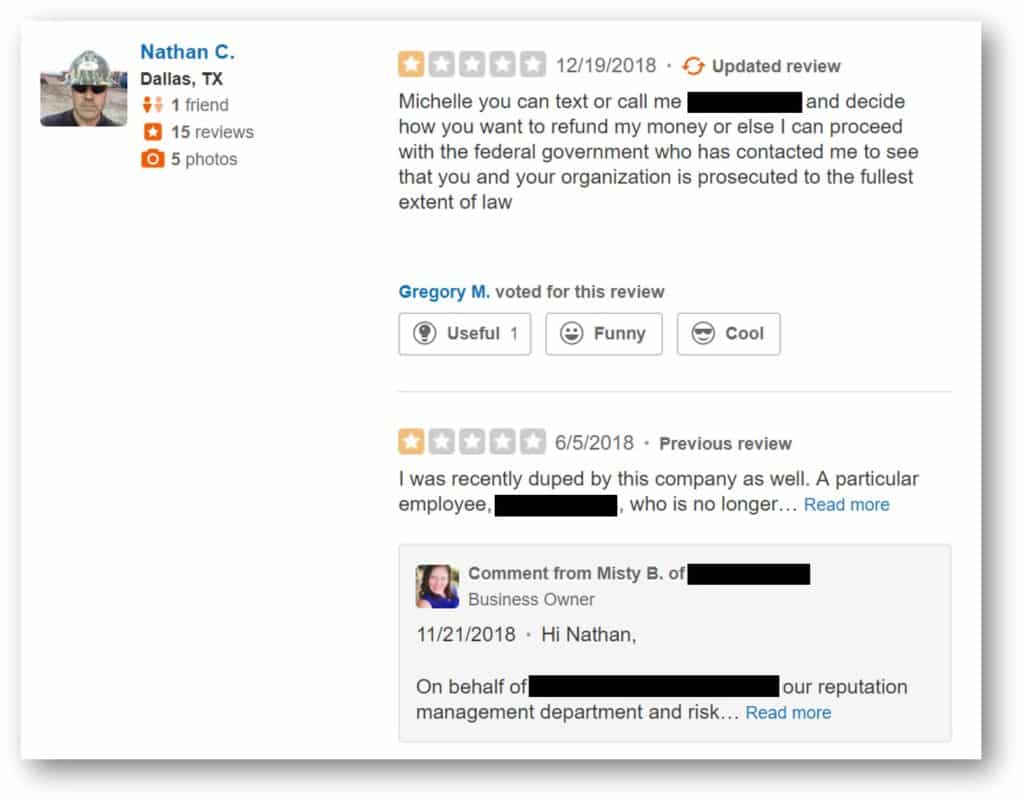

And, suppose you have very few clients because you rank poorly in Google or have a ton of bad reviews.

And, finally, pretend that the clients you do get can sniff out your lack of preparedness and qualifications to help clients with their credit.

What would you do?

You (the bad tradeline company, not actually you) would have no choice but to take advantage of people’s desire to pay less and offer lower prices to get them in the door.

It’s the only thing you can do to “compete.”

And, since you (the bad tradeline company, not actually you) know that you’re not really going to do the job in the first place, it just doesn’t matter because any money you get is more than zero.

The client’s recourse is a review online, which doesn’t matter to a scammer.

We’ll explain in our “best tradeline companies” article.

This is what’s happening in the trade line industry today.

This is the biggest hazard you face.

So, what do you do?

Here’s who you should avoid and how to avoid them:

- Avoid anyone that lacks a website, business or any brand recognition (because they can just get a new google voice number and craigslist ad after they take your money).

- Avoid working with anyone who hasn’t been in the industry for at least five years. You can look up their business records or their whois records for their domain.

- Avoid anyone who tries to get your business based on price alone and does not discuss your credit goals and your credit issues first.

- Get on the phone with everyone you intend to work with; do not work with them if they feel evasive, salesy, or lack credit expertise (or engage in illegal or questionable behavior).

So, now that you’ve narrowed down who not to work with and found someone you do want to work with, how do you get the best deal?

The answer is simple.

Ask for a good deal.

No, I’m not joking.

If a tradeline company has a legitimate consumers on the line, they will work with you on price.

In addition, if you’re easy to work with and prepared to handle all the documents and agreements, expect reduced prices.

Again, though, the most important thing is working with a company and purchasing tradelines that will achieve your goal.

Everything else is a waste of time and money even if it is a “good deal.”

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Hi Rob & thanks for your service.

I’m working diligently to repair my credit due to some errors while serving on active duty, I wasn’t always on top of things. Having gone through a few credit repair agents associated with UCES and IdentityIQ, I was suggested by one of them to consider a tradeline. Honestly, I hadn’t heard of it and I read a few other blogs before getting to this one so I better information than before.

To be transparent my credit reports are cleaned up but not consistent – it’s a full time job to stay on top of this when you’re single, in school, working and trying to stay safe. Regardless, I understand that my livelihood is dependent on access and opportunity and having a simple life is harder to achieve when I am struggling to reach the 700s. Of note, it’s a big improvement from where I was in the 500s but my goal is to be high 780-825. The most recent agent I worked with was less interested in helping me clear issues in my credit so I cut my ties and contacting the bureau and creditors directly to dispute and settle some things – even though some aren’t mine, fighting it will take forever in court. I will deal with the legal things later.

I wrote all that to ask some questions, when should someone in my situation consider working with a reputable person/group/tradeline to get a tradeline? Are there any you suggest that can help upgrade the auto enhancement score (charge off in 2015, last payment 2019 according to bank)? I saw in your other blogs and comments that tradelines are met with suspicion to some/most lenders and creditors, so with my intent to purchase acres of land and build a home before organizing my life around entrepreneurship, is having tradelines on my credit beneficial? Lastly, are there various forms of tradelines (i.e. home, business, auto, credit building/worthiness) that report or have a better relationship with the credit bureaus? In closing, any thoughts or advice about cryptocurrency?