Like a fingerprint or DNA, no credit report is the same. As such, the impact of tradeline on credit score is entirely dependent on what is on the credit report.

Unfortunately, the “40 to 50 points per tradeline” claims you see on competitor websites are so false and misleading. They could be considered humorous (if only these claims didn’t negatively affect real people’s lives).

Piggybacking credit tradelines affects everyone differently because everyone’s starting point is different.

Table of Contents

Can you tell me, generally, how much my score will increase by adding Seasoned Tradelines?

Generally, the fewer the number of tradelines (or accounts) you already have on your credit report, the larger impact the authorized user tradelines will have on your credit score. Likewise, the inverse is also true.

Largely, the fewer negative items you have on your credit report, the higher your score will increase after adding seasoned tradelines. Again, the opposite applies.

We will discuss three scenarios…

- What credit score increase to expect with negative items such as collections and charge-offs

- What happens if you try to pack your credit report with too many seasoned tradelines

- The benefits of adding tradelines to a thin credit file.

Tradeline’s impact on the score when added to a report with derogatory items…

Of course, all situations are different. However, it is possible to boost your score with tradelines even if you have negative items on your current credit report.

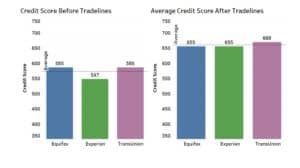

Again, the amount and severity of the negative items will determine how much of a boost you get. Furthermore, the appropriate selection of tradelines can help to counter the problems with your report. For example, below is a credit report with derogatory items and the addition of tradelines. The scores went from between 590 and 630 to over 700 on all bureaus.

When you look at the report, you will notice derogatory items and assume there’s no way this file would be in the 700s. The tradelines are to thank for this score.

adding-tradelines-to-a-file-with-negative-or-derogatory-itemsadding-tradelines-to-a-file-with-negative-or-derogatory-items

Can I just load up my credit report with Tradelines and get an 800 credit score?

We’ve run into a couple of situations where clients demand that we sell them 5 and 6 tradelines.

Unfortunately, we decline each request as it simply will not work. Additionally, we like to help our clients, not hurt them. If you exceed a certain amount of authorized user tradelines, it seems to freeze any movement in your score. Unfortunately, we are not sure why this happens.

Take the scores from the report below. Theoretically, with that many lines, this client should have been in the 700s, but the client barely got out of the 600s. By the way, this client came to us for additional lines… no that wasn’t a joke. More importantly, no underwriter worth their salt would allow such a significant amount of authorized user tradelines through closing. Even if it worked, you’d be wasting your money because a good underwriter is going to kick off excessive AUs from your file.

why-stacking-your-file-with-tradelines-will-no-workHow much can my score increase with nothing but Seasoned Tradelines?

If you are in the rare (yet lucky) position of having no credit or very limited credit, you can expect drastic increases in your credit score. For illustration, below is from an individual whose credit file was 3 years old when they purchased tradelines. They literally had no credit whatsoever and a zero credit score. Thus, to avoid the catch-22 of the inability to obtain credit because of a lack of credit, they purchased tradelines for sale from Superior Tradelines, LLC and. The tradeline impacted their credit score, which went from zero to the 770s.

how-much-will-my-score-increase-if-I-dont-have-any-credit

Seasoned Tradelines Study

Recently, we conducted a study of the benefits of tradelines for over 850 participants. The study found that the average credit score increase across all 850 participants was roughly 88 points.

Does this mean that you will experience such a large boost if you add seasoned tradelines? No.

As stated above, the benefit of the tradeline will depend heavily upon what is already on your credit report.

If you are interested in getting tradelines, we highly recommend that you read this study. It could guide you on whether tradelines will be a good fit for you!

Updated: July 30, 2021

Kate is a managing member of Superior Tradelines, LLC. She manages and coordinates the company’s operations and makes sure clients are assisted with care. You can contact Kate directly by calling: 321-328-0908 or by email: kate@superiortradelines.com

I have a question ok my dads credit score is 578 he has a couple of credit cards both capital one one 1500the other has about 700 owed both cards are less than half the negative side a joint jcpennys acount that his ex wife has him on that e didn’t eve know about which is maxed out which is dragging his score down by 16 point they said if he removes that account it would bring up his credit score my question is if he added a few trade lines would that bring hi score up Ro about a 640 to a 660 we are desperately trying to get approved to buy a home a he needs a better score than what he has is there any insight you can give us to bring the score up to buy a home my dads name is Thomas marton thank give me a call [moederated]

I can’t answer where your Dad’s score would be after adding tradelines without seeing a credit report. Also, tradelines may not be the best option. Consider disputing that account as fraud (since that’s what it sounds like you are describing) and have your lender do a rapid rescore. You should be fine, at that point (if that’s the only negative item).

TRADELINES, PLEASE LOOK AT MY REPORTS ADVISE WHAT YOU RECOMMEND–GINA

I used to have a lot of issues getting a loan based off my credit, my credit score was 530 to 560, I applied for a loan at the bank and they told me to pay my debts to the banks I was owing to first, I asked for my credit report from the bureaus and I realized I had 3 late payments and 5 inquires, I also had 2 student loans which made my credit fell terribly, I wanted to get my house back and I needed help, I was searching on the blog online that was when I met swifthackgenius who told me the necessary procedures, he helped me cleared the debts and the late payments, my credit score raised to 630 the first week, now my credit is 770 to 790, believe me I know how it feels to be out of debt. You can contact him and he will be ready to assist You. I hope this helps

Hey how are you I’m in desperate need of trying to get someone to do that what you had done to your creditfile, and how much did they charge

How is that guy,swifthackgenius able to erase your negative credit that’s illegal to do I thought??

It’s 100% illegal: https://superiortradelines.com/dictionary/what-is-a-credit-sweep/

Hi there. I’m sinking due to a collection on my credit. Can this credit guru help me please?

What’s the name of the person you used to help clear your credit

I would like to boost my credit score over 700.

My husband and I, want to get information on trade line to improve our credit score and the cost.

Maxine, we would be happy to discuss your goals and our services. Please give us a call at 800 431 4741

Hi,

My wife just received her social security number a month or so back. So I believe her credit is 0. Will the tradelines help with her credit? Can I get a general estimate of credit increase plus costs? Will the increased credit be approved for loans? Will this be permanent?

Thanks

Hey Eddie,

As a general rule, the less contained in a credit file, the higher your score will go after you add positive tradelines. This is true even if everything in your credit report is positive. Your wife is in an extreme scenario, where she has nothing on her credit file. There is a double edged sword here. First, her scores would go through the roof. She’d probably be in the high 700s (I’ve even seen 800s after adding tradelines to a blank file). However, very few lenders would approve her for credit with ALL authorized user tradelines. So, your best plan of action (depending on what your goal is) would be to add tradelines, boost your score and obtain personal (revolving) credit cards. The AUs would boost your scores and allow you to get more attractive credit card offers. Thereafter, it would be her personal credit cards that would continue to increase her credit scores.

I think that covered your first few question, but with regard to whether or not the credit score increase from authorized user tradelines would be permanent… it is not. The very essence of this process is to provide a temporary boost to your credit scores.

I hope that helps!

What about something like my situation where I have 2 collection items (student loan$1000 and gas bill $100) and a cc for $500 I’ve had for 8 months. Should I 1)open another cc account then immediately add tradelines 2)wait for the new primary account to age then add tradelines or 3) I don’t need another primary account? And could you recommended someone for credit repair?

Hey Ron, this really depends on your overall goal. For example, are you trying to get a mortgage, car loan, credit cards, etc.? Depending on your answer, our answer to your question might change. Generally speaking, however, I would pay off those student loans before making any other purchases (even if that means you don’t buy tradelines from us). Student loans and utility bills enjoy government back protection and will forever haunt you. Just bite the bullet and get rid of those things. I would call and offer 50 cents on the dollar. If they don’t budge, just pay it. Student loans will usually settle at 85% or at least they will waive collection costs (but interest and principal is very rarely waived).

Next, make sure you pay your current card on time. Call them obsessively and ask for an increase in limit.

I wouldn’t get a new primary line, because they are going to look at your credit report and give you another $500.00 limit card (this will keep you in the $500.00 limit club).

Once you pay off your debt and have a good goal in mind (and maybe received a limit increase from your current credit card), come talk to us about tradelines and we can see if they will help achieve your goal.

Hope that was helpful!

Hi. I have had a rough life as of late. 2 houses that sank in an area where the new upgraded drainage system made all the homes (built on a swamp in the 70’s) started settling when the ground started drying up 20 feet below.

I had 2 homes there and thus 2 foreclosures with all my neighbors. The whole development went under.

That, along with a divorce and bankruptcy and finally a car accident that put me out of work forever at 44 y/o.

I’ve been doing alot of confusing research on SCN and CPN’s. The offers come with a number and 1,2 or 3 tradelines on a clean slated number. This is based on the 1974 privacy act of keeping your ssn private to the owner, work and IRS, among some other items.

Any thoughts on this route? There have been excellent (or fake) sites and then others that really explain the good,bad and ugly of this route but make a good case either way.

I just need my credit back. My own score is 514 with many judgements and all the stuff you’d expect.

What is your take on these SCN’s, CPN’s

I WOULD LIKE TO FIX MY CREDIT

I WOULD LIKE TO ADD LINES TO MY BUSINESS

I WOULD LIKE TO ADD TO 2 OF MY SONS

I HAS FAIR CREDIT 22 yrs old

1 HAS NO CREDIT 23 yrs old

WE ARE READY TO PURCHASE PROPERTY

CAN U HELP

Hi. My name is charles and I was wondering how to get a better attractive cc offer and where from I have only two items on my report that are negative that I have been trying to get removed for a while Barclay and a Macy’s department store cc. My score if fico’ed around 650. I wanna get a tradeline from superior to get it at 720. Question is would I have to, to get approved for a credit card around 10000.

Hey Charles, your questions are good ones, so let me take them one at a time.

Good credit score + good income + recently approved credit = Attractive credit card offers. That’s the formula. Now, in that formula, you will see that we only help with the good credit score part. So, the income and previous approvals is up to you. So, let’s discuss that.

Income is obvious; the income you disclose on credit applications has a direct impact on the amount of credit you will receive.

The credit score on credit applications has a direct impact on whether you will be approved the terms.

Now, here’s where it gets sticky. If you have limited credit, tradelines will make your scores go through the roof. However, if you have only negative items that are actively reporting, you’re going to drastically diminish the positive impact you would otherwise receive from adding tradelines to a limited file.

In your situation, you’d be better off removing those negative accounts (disputing if inaccurate, or settling if possible).

From there, you’re in a great position to benefit from tradelines.

Assuming your income is qualifiable, I don’t see what else you could do to position yourself for credit approvals.

To discuss this in more detail, give us a call at 800-431-4741 or email us at info@superiortradelines.com or get free access at https://superiortradelines.com/start/

Hello,

I was trying to raise my mothers credit score I paid down 3 of her 5 cards to under 30% and her score went to 716 with her overall credit utilization going down to 36%. I wanted to get her over 720 so I paid down her largest balance on another card and let the balances rise on 2 of the other cards and the overall credit utilization went down to 27% but crdit score went down instead of up then I added her as an authorized user on my sister card and that helped her utilization score but her credit score didn’t go up.Do you have any ideas as to why her score dropped even though I lowered her credit utilization and added a tradeline.(sisters card was $21,000 with no balance.

Mark,

What I love about this question is that it reveals the complexity involved when you’re dealing with banks, credit bureaus, credit scores, etc. There is a reason to hire a company when dealing with an industry as unique as authorized user tradelines.

As to your question, there’s simply not enough information in front of me to answer accurately. There is an assumption that more tradelines with better history and low balance equals higher credit score. This is not always true. In fact, not only will the score stop going up, it will start going down. If you think about it from a risk standpoint, the more open and available lines of credit you have, the higher risk you become (such as a bankruptcy risk after racking up massive amounts of revolving debt and not paying it back). In addition, not many people know this, but the tradelines on a credit report are not the only thing that determines your credit score. And I’m not talking about age, address, employment, etc. There’s actually a different “score cards” into which consumers are placed by FICO algorithms. So, when you added additional tradelines to your mother’s file, you may have moved her into a different scorecard which looked at her overall debt to credit ratio differently than before.

I’m going to stop there, because as you can see, it gets immensely complicated and without the benefit of all the facts, I’m just speculating in a really complicated way.

And if I can plug a shameless pitch here, please encourage your sister (and mother for that matter) to sign up for our vendor program through which they can both earn pretty substantial monthly income.

Thanks!

Hi can I have your office adress in north Carolina please.thank you

Darelle, we do not have an office in North Carolina. Only in Florida. However, we offer services across the Country. Let us know if we can help!

I would like someone to advise me on trade lines

Hey Jack, please call 800 431 4741 or email info@superiortradelines.com (if someone hasn’t already reached out to you by now).

Im trying to buy a home credit problems in tha past my score 610 i make 90,000 no bills ,just got a 200.00 secured capital one .so how would this tradeline help me

What happens to my credit score after the Authorized User Account is removed?

Hello,

Assuming that the tradeline is completely removed and assuming that nothing else changed in your credit report, your score will return to the exact same place it was before the tradeline was added.

However, that’s not really how it works. First of all, the tradeline will go into “terminated” status or just simply stop updating. When this happens, your score will slowly start slipping back to where it was pre-tradeline.

So, you don’t really want to sit around and watch this happen. You will want to take advantage of the tradeline when it is actively reporting. This means, you should add tradelines in reaction to your goal and you do not want to react to tradelines with a goal…be prepared to take advantage of the score increase.

After you add your new account (credit cards, auto, mortgage, etc.), the authorized user becomes irrelevant because you will be establishing new credit with your payments.

Hope that helps!

Does adding someone with two open collections as an authorized user effect the main account holders credit score?

I have a decent score and im considering adding someone with two negative collections on thier report. I wouldnt want those two negatives to seep through to my decently clean credit report.

Are there any other things i should be aware of before doing this?

Also, if I were to add this individual as an authorized user, would they reap benefits of all my cards and trade lines, or just the one account I add them to?

I have about 6 active good accounts with zero to super low balances, but i only want this person tied to one specific card. Is this even possible? Or would all 6 accts be connected to them?

Lisa,

100%, there’s a 0% change an authorized user’s credit history will affect your credit history. Adding someone as an authorized user is a one-way street. That is, only the history of the primary account holder will have an impact on the authorized user’s credit history, not the other way around.

The would only benefit from the accounts onto which you add them as an authorized user.

6 accounts “could” be added, but it isn’t a good idea.

If you have 6 accounts, you should probably call us, enter into our vendor program (because there’s a lot of money to earn) and we will show you the ins and outs of this process, because it is much more complicated than can be discussed in a blog comment section.

Hope that helps and we look forward to hearing from you.

Thanks,

That was a super fast reply! Thank you so much!

Hi,

I’ve recently had a Chapter 7 discharged. Would adding a tradeline help someone in my circumstance? I have a short term goal of obtaining vehicle financing.

Alison,

It is very well possible that adding tradelines could benefit you post bankruptcy. Now, the effectiveness of tradelines may benefit your scores, but said benefit may be compromised by the presence of the bankruptcy on the reports.

Ideally we would be able to review your credit reports to assess how effective our services may be, and discuss with you how this potential effectiveness may assist in achieving the vehicle financing you seek.

I would recommend submitting a report for analysis so that one of our specialists can review you the specifics of your current credit posturing and determine whether or not the potential benefits of adding tradelines would assist in your immediate lending goal.

Thanks in advance!

I have my Fiancé tried to cosign for me to purchase a car. However the banks stated that he didn’t have any credit history. I wanted to inquire if he added a tradeline to his account will this increase his credit score enough to purchase a vehicle?

Crystal, the answer is possibly, yes. If you truly have nothing in your credit report, then, yes. However, “auto enhanced” credit scores factor things differently. So, I can give you a full answer after a credit report analysis. Give us a call at 800-431-4741 or email us at info@superiortradelines.com or you can contact us at https://superiortradelines.com/start/

How can I do this with a score of 530 to help me buy a house?

Geneva,

Your goal of buying a house is a good one. There’s so many benefits to home ownership, so good job setting an awesome goal! However, I can’t answer your question as posed. It would require a full analysis of your credit situation. You’re more than welcomed to contact us and we can discuss that (free of charge).

800-431-4741

info@superiortradelines.com

https://superiortradelines.com/start/

Thanks!

How much do your credit line run

Tradeline costs vary, but here are two articles we’ve written the cover the topic thoroughly:

https://superiortradelines.com/faqs/tradeline-costs/

https://superiortradelines.com/forum/how-much-do-tradelines-cost/

Thanks!

I just filed a chapter 7, will the trade lines help my credit to start over

Hey Ben, the answer is probably, but it depends. There are two good questions and answers here: https://superiortradelines.com/forum-tag/bankruptcy/ You should definitely read those. The basic answer is yes, your scores will increase dramatically on a clean file. However, if you “just” filed, then you’ll likely have items hanging over and hurting you. If you’re discharged and clean, that’s a different story. Anyway, please be sure to read those questions and answers linked above, but better yet… you should get a (free) credit report analysis from us. Whether you buy tradelines or not, you’ll walk away with information you didn’t have before you called us at 800-431-4741. You can also email us at info@superiortradelines.com or get free access at https://superiortradelines.com/start/

Thanks!

I’m trying to buy a car and in the past I’ve had 3 trades on my report and I’m looking to add 2 more one really seasoned trade thats a Amex whic I was told looks good on the report but doesn’t post history and another seasoned trade thats 7 years old. I was told that I need to show a long history so the trades have to be about 7 years or better to buy a car how ture is this..?

Will, Thanks for reaching out to us! You bring up a lot of really specific points, which are all valid, but I want to stay focused on the goal and how we may be able to assist. There are a lot of factors that go into qualifying for an auto loan. A former employee of ours worked in the auto industry and helped to shed some light on how to go about buying/leasing a vehicle: https://superiortradelines.com/auto/buying-or-leasing-a-vehicle/. The effectiveness of an older line(s) is really dependent upon what else is on your reports. You should get a free credit report analysis from us. Call me at 407-476-1357 if you would like discuss further. You can also email me at mike@superiortradelines.com or setup a client profile at https://superiortradelines.com/start/

Hi, my experian is currently 544 when my mortgage lender pulled it. We need to get it to a 600. My husband added me to a Chase card with a 1500 limit and $250 balance. He then added me to a Citi bank card with an $800 limit and $200 balance. His score is 670. I have 5 collections in my name. I don’t have the money to pay the collections right now and we are in the mortgage process. Will these additional trade lines help me get to a 600 on Experian? My equifax is already over 600

Alison, it’s a good question and I don’t know the answer. However, what choice do you have, right? 🙂 Might as well try it. I am doubtful you will get the kind of boost you need from those accounts you described, but I don’t know what’s in your credit report.

Two issues you will face: 1) Actively reporting collections really put the brakes on credit score movement and 2) underwriting procedures may prevent you from getting the loan even if you got a 601 out of it.

Why don’t you do this. Even though you’re not in a position to buy, just give us a call in the morning and ask for a credit report analysis. We will do it for free. And, we will let you know what we think. 800-431-4741

Hello,

I have median of about 560 on all three of my credit reports. I have repaired my own credit meaning that I have cleaned it up by paying things off/down to under the 30% and disputing anything that should not have been on it. I have two credit card accounts that are under the 30% but have two late payments in the last two years. There is nothing else on the report however, it is still not high as I need it to be for a mortgage loan I would like to be at a median of 750. Would purchasing a trade line help? How much of a trade line should I purchase to do so and from where?

Correction the Mid score was actually 500 when it was first pulled for the load and has went up to 560 after repair.

Probably. If you have very little credit and even less negative information (2 year old late payments aren’t that bad), then adding tradelines should certainly help. I can’t give more of a detailed response than that without first looking at your credit report. Reach out to us and we’ll do that for free. Thanks!

My score is 570 and my husband is 540 we would like to buy a house. But we filed a ch 13 and would trade line help increase our score.. we have been cleaning our reports up.. Because we started out in the low 400.. would it help if we discontinued our 13.. and bought trad line to increase our scores..

I didn’t quite understand the full picture and there are some legal questions in there that I don’t want to touch, but I’ll try to answer. When you said “discontinue…” your bankruptcy, do you mean that your bankruptcy was not discharged and it is still pending, which means you can dismiss it? Actually, now that I just wrote that, I realized I can’t answer you at all until I know the answer to that question 🙁 You should give us a call at 800-431-4741 to discuss.

Matias I need advice. I have two capitol one credit cards in collections with a total of 715. I called to set up a payment plan which I don’t know if that was a good idea being that after I pay it off it will still be on my credit. And I have another in collection for merrick bank totaling in 800 and I have a unpaid school expense of 8000 in collections. I am willing to pay the capitol one and merrick bank for a pay to delete but they refuse that’s why I just set up the payment instead. As for the unpaid school expense I was unaware of until recently , the school never notified me before it was sent to collections so I ended calling collections and I told them I don’t know what this is and they told me to call the school and then when I called the school they told me to call the collection agency because it’s no longer in there hands. This isn’t a loan by the way. I disputed the matter with Experian and I plan on doing it with the other two bureaus. I’m only 22 and I feel like I destroyed my entire credit. And I want to move into an apartment at the end of the year and sell my Lexus and get a new car before I move. I’m not expecting a miracle. But I need some advice being that I already put my self in a rut I can’t possibly get out of.

Hey Sasha, sorry for the delay in response. So, this might sound funny, but I’m serious: you’re problem is that you’re smart. In the credit world, very few people do the right thing (misreporting, failure to correct issues, etc.). So, you’d be better off (economically, mentally, etc.) to pay someone to deal with these issue for you. You’ll want to resist this advice by reason that “I am capable of doing this, therefore, I should do it.” But, for the sake of time, energy, stress levels, frustration, etc., you’d be way better off hiring a credit repair company (or debt settlement company) to do this on your behalf.

Here’s a recommendation: https://credzu.com/ You can find companies for specific things like credit repair, debt settlement, lawyers to sue on your behalf, etc.

Finally, there’s no such thing a rut you can’t get out of. While you’re not a candidate (right now) for tradelines, we’d still be willing to discuss your situation with you and give you our opinion. Call us at 800-431-4741 or email us at info@superiortradelines.com

I have one credit card that I pay off every month and never charge more than 20 percent of its limit. My house, vehicle, etc. are all paid for. I spend very little as I need little. I have been frugal all my life and now I find a credit score of 500. I don’t owe a soul and am very careful with my money. I just don’t understand why I am penalized for that..I contacted a credit scoring firm to figure this whole thing out for me but got turned down several times not until I read about a well recommended private investigator..He is all over the internet and nobody has ever spoke negative of him…I took a leap of faith and gave him a try..He boosted my scores 780 and I can’t thank him enough..He’s blunt and honest..And he respects whatever agreement you make with him..You all should give him a try for your credit score boost..His contact details are [removed]

I was excited to read your issue and provide a detailed, one-on-one response, using 7 years of experience in this specific tradeline industry. Then, I realized this was a lame attempt to advertise on our site. I’ll leave it posted for the keyword and google. Thanks!

I am currently at a 615 and added a trade line to my account. $12000 limit with $9 balance opened in 2014. How much would my transunion score move? Is it possible to have it move 5 points? Or most likely need to add more trade lines to achieve that goal?

Jess, I can’t imagine a scenario where a $12,000.00 line with 3 years of history does NOT boost your credit score more than 5 points. I will be shocked if it doesn’t. However, it isn’t magic, so there are some things to look out for. Do you have active collections or unpaid charge-offs? If so, FICO will say “Oh, nice tradeline, but you’re not a good credit risk, therefore, I’m not moving your score.” So, so long as your credit isn’t in really bad shape, you should get well above 5 points. You can always try our credit simulator. Also, if the company you bought from didn’t go over these things with you, just cross your fingers and if it doesn’t work, you can always give us a call so we can help you do it correctly.

For someone who doesn’t understand trade line. Please tell me what they are and how are they legal.

And is a time line the same as being an authorized user on a family’s card.

Andre, did you mean tradelines? If so, yes… it’s the same thing. An authorized user tradeline from a family member will do the same thing as authorized user tradeline you purchase from someone else. The benefit of buying one is that you get to be matched with an appropriate tradeline and get expert credit advice.

Andre, check out these videos: http://superiortradelines.com/videos

Hey ! what to I need to do for you to review my credit report and advise if trade lines are a good option for me

That’s what we do all day long 🙂 Give us a call at 800-431-4741 or get started at https://superiortradelines.com/start/

HELLO,

I would like to know if a trade line would help my credit so I can purchase a home. I have 2 derogatory marks, the first one the account is a closed charge off back from 2014 and the second is a collection for 1500. Other than that I have 26 accounts all in good standing and most of those are student loans all in good standing. I have 4 credit cards all equaling up to 7,500 all good standing, uti is at 65%. However, I do have late payments on my car payment twice Jan and Feb in 2016. Can this possible help my score current trans 622 Equifax 566 and Experian 621. Thanks

Renée,

First of all, your goal of getting a mortgage is a good one. Also, you did a really good job of giving me important details about the nature of your credit. I will tell you right off the bat, no mortgage lender will close a loan with a $1500 collection account opened. The first thing I would recommend is to try and settle that collection. Start at $.10 on the dollar and be prepared to pay 30%.

I would next recommend paying down your credit card balances below 30% but it’s more important that you pay off that collection first. Also, adding authorized user trade lines with high limits and low balances can help offset that debt to credit ratio.

Your late payments on the car are certainly not helpful, but I don’t think they ruin your chances… especially since they are nearly 2 years old.

So, I’m at 50% with you… I think the lines may help but I would have to really look at your report in detail.

You can all us at 800-431-4741 or get started at https://superiortradelines.com/start/

Hello recently just filed bankruptcy and have a 466 (before was a 586) and will be receiving my discharge in about 30-60 days. Everything is wiped clean, with a 95% payment. Do you recommend a trade line? how many? and how much of an increase.

It depends on what you’re trying to do in terms of credit. Mortgages are problematic after bankruptcy (regardless of score, so tradelines wouldn’t be helpful in most of those circumstances). Other loans are different. As a practical matter, when it comes to government (bankruptcy) and credit, never count your chickens. Wait for the bankruptcy paperwork. Then, check to make sure your creditors are reporting the discharge correctly. Only THEN should you start looking into options. The reason I say this is that rarely do things in government and credit go as planned. So, once you have a solid starting point (post-discharge, post-credit-repair), we will be more able to give you a recommendation.

I’m interested in purchasing a home. My scores are around 570. I have 3 credit cards reporting. 1 closed and never late. The other 2 open with very low balance of about $130 with total credit line of $900. I have 3 auto loans (1 only a few months old with 0 late payments, the second is a little over a year old with 1 late payment and the third is 5 years old with several late payments over the last 2 years). I plan to pay off the third auto loan with the multiple late payments. I have an installment loan of $5,000 for 2 years with no late payments and an old student loan for $2,000 that was in default, but paid in full 3 years ago. I do not have any collections or public records. Will tradelines help me to raise my scores for a mortgage and if so approximately how much?

Thank you

That was an awesome summary and as I was reading I was thinking “Oh, perfect, oh shoot, oh that’s good, oh that’s not gonna work” and so on. So, reading your entire post I am sure that I am not sure if tradelines will work 🙂

But, I’d be glad to take a look at your report and give you a more accurate answer. Also, if tradelines are not an option, I will be able to recommend a course of action to get you toward your goal as fast as possible.

https://superiortradelines.com/start/

800-431-4741

Let’s get connected!

hi i have disputed some fraudulant charges with all 3 credit bureaus and right now i dont have a score at all no inquaries no collections no history norhing everything is blank so what tradelines woyld u recommend and what score coyld u expect me to have after tradeline i need to buy a house so I was told that underwriters only accept 2 minimum i will establish my own credit of my own once tradelines hit i just need a boost and I would also need to know what kind of cards i sshould apply for im currently signed up with a company i pay money to every month and they report to all 3 but i have already made 2 payments and still no score they told me im pay ing to early i paid 100 bucks November and the same in December and they told me that it would not show untill February they are call self lending the money is being put into a CD idk does not seem like it is reporting was fast ass I would like.

Okay, not sure about what product you’re referring to, but…

You can add tradelines and your scores would go through the roof. But, as you pointed out, you’re not getting a mortgage with authorized user tradelines, only. But, as you pointed out, once you have the scores (and I assume the income), you could get your own primary tradelines. Also, to “check the box” of primary accounts, you could get two secured credit cards at your bank. I usually don’t recommend them, especially not for credit purposes, but they would indeed “check the box” for the “primary tradeline” requirement for mortgages.

My scenario is I have 5 new secured cards my credit profile is only two months old no negatives, late payments and I have 0 balance on all 5 and three inquiries. My question is would 2 new tradelines be Beneficial to my credit history and would I be able to get more cards with higher limits. Again I have only had credit for 2 months as a matter of fact my credit is so new I don’t even have a score. Would secured cards look out of place with 2 $25000 tradelines?

Thank y’all so much for offering so much information! My wife is a veteran. We have really done a few doozies on both our credit reports. We have been trying to raised our scores to 750 and above plus excellent her score is 550, while mine is still in the high 500’s. (I think 529 currently.) I also have a judgment against me for a credit card. The judgement doesn’t show up on my credit report anymore; I assume because it’s 7 years old. I know it didn’t just “go away”. All effort to increased and eliminate all negative item on my report was proven abortive until a saw many remarks of how this credit coach had helped them at credzu.com He did a tremendous job by helping me increase my score and remove all negative item on my credit report just a few days after we fixed agreement. Thanks am highly indebted

i find your article very informative,i will like to share my experience.i don’t know if its against your rules here.Recently I have choose to check my credit report often after attaining a score of greater attraction to lenders,kept my credit card balance low after being cleared of $8000 debt and cut my spending also i have good financial track record ust like the privilege and famous ones in getting approval for loan after fixing my credit score to 810 and all debts deleted .i have no idea before now that credit scores can also be hacked and raised.

I removed all the spammy links from your post.

Personal experience and how i got to solve it with his help …..Bad credit?was it possible to buy a house with bad credit?This was the Question i keep asking myself for years before i finally came across someone who enlightened me.I didn’t really get the trick of attaining minimum credit score to buy a house and getting away from bankruptcy,clearing credit card debts and buying a house which is precisely the situation I am in. I had to declare bankruptcy 3 years ago and am working to build back my credit, but it’s a very slow process. I need to move for a job and therefore need to buy a new home.Y’all shouldn’t pray for such of mess i’m into.The enlightenment by a friend who worked with a repair company taught me how to seek assistance from credit repair expert who knows exactly what your credit score needs and how to get collections removed,get credit card free of debts and and getting off bankruptcy.

I removed all the spammy links from your post.

Back in oct2017 I lost my job and bc I lived paycheck to paycheck I took a huge hit. My car was repo’d and I was evicted from my townhouse… by January i obtained new employment making more money than I ever had before and got to work on catching up on things… all have my back rent will be repaid by April 6 (not on my credit report) my repo is showing as a closed loan and I have 3 items in collection 2 totalling approx $600 1 (student loan) closed approx 14k… on my own I’ve consolidated my default student loans so as of Feb they’re showing as closed with $0 balance I brought my score from 425 to 506… I have 2 cap cards in good standing no lates ….my goal is purchase a home through a grant program but mini score is 620 will tradelines help? My plan is to open a secured CC and purchase a tradeline package in 2-3wks… I’ve been told AU tradelines only boost your vantage score so that one can open primary accts will the tradeline is reporting and not your FICO score which is what’s viewed for a home loan… is this true?

First of all… you’re awesome for getting knocked down and getting right back up. In fact, you’re probably better off now with the new job and appreciation for credit, etc. So, good job!

I think a secured credit card is probably a good idea in your situation, because you have limited credit. So, having a primary, secured, credit card can “check the box” on certain FICO algorithms.

It is TOTALLY FALSE that AU tradelines only boost vantage scores. That is to say, it is TOTALLY FALSE to suggest that AU tradelines do not boost FICO scores. That is to say, it is TOTALLY TRUE that AU tradelines do boost FICO scores.

You will get a MUCH higher increase from adding authorized user tradelines than you would from adding a secured account. The reason is simple: FICO (and all scoring modelers) are evaluating risk. With a secured (i.e., no risk, it’s secured by funds in advance) there is NO risk and therefore, little impact to your credit worthiness representation called your credit score. In the case of unsecured authorzed user tradelines, your credit score will be positively affected.

Hello, I have just recently in the past year worked hard on repairing my credit. I have done pretty well in having all of my collections removed, Judgments, disputed all of the eras corrected and brought my school loans all current by consolidating them. I went from the low 500s to now the high to 669 (give or take because it teeters month to month depending on my credit card utilization for the month) The negatives that plague me include late payments in the past on my school loans. I have been successful in obtaining 3 ccs, one with a very high limit. However, My score is at a complete stand still now. Time is the only thing that can improve my score. My credit cards are all pretty new with the oldest being only a year old. I would like to boost my score to the mid 700s to get a great rate on a mortgage. I know there is no question that tradelines would help my situation. My question is would it boost my score enough to reach my goal? Also, how soon before applying for home financing should i look to add tradelines?

Hello and good morning. I have been working on my credit for about 3 Years. Coming from a 408 I’m up to 650-680 across all three bureaus without using any AU tradelines. I have very limited credit about $2,000 revolving with one CC and 3 store cards altogether. I have one one negative item which is a paid in full charge off I’m working on getting off and a student loan of about 6,000 I’m good standing. Do you think I could benefit from a seasoned trade line and does the limit on the trade line matter or is it more about the age? Or should I just wait for my score to go up more? I am so dying to hit the 700 club but I can’t think of anything else to do to boost my credit because it’s hard getting approved for anything. I don’t have many inquiries either by the away. Any reply is greatly appreciated!! I

Hey Christopher, I think – assuming everything you said is accurate and up-to-date – you could benefit from tradelines. However, I have one concern about your goal; the 700 credit club is cool, but not worth it unless it leads to something. Securing a home, business loan, car, etc., or something else that will add value you to your life is what we hope our clients pursue. I don’t mean to sound negative, but I just want to make sure you get your money’s worth if you buy tradelines with us. Let’s talk… 800-431-4741 info@superiortradelines.com or https://superiortradelines.com/start/

My Efax score is 536. I have Midnight Card <$500 2014 collection Credit One $538 2014, Fingerhut <$500, 2015 collection, Comcast $284 collection 2014, Nationdwide Recovery $250 Ambulance Collection 2012, and Capital One Closes $4226 balance where i allowed a car to me repoed that i had never missed a payment on for like 42 months +~ [i really got took on that deal] it should be falling off March 2019. 2012~1014 was a very bad time my health failed and i lost my mother who i was caring for. So i basically fell off the Credit Ladder in or about 2014. Ive taken out a loan from a co called SelfLender. I calculated it should raise me quiet a few points. I also took out a card with First Premier just last week. Havent even paid the $95 fee yet. I changed my mind but he caught me off guard when they called. I had just walked in the door and i thought it was Capital One so i agreed to it without thinking. I called again to cancel it but they talked me out of it. The inquiry hadnt shown up so i just agreed ti keep it. Although Capital One doesn't show up in the deragotory section im sure its still having a huge impact. From what ive read paying off these others wont really help my score unless they are removed. Ive disputed everything with Equifax but have no way of seeing the results because they have me living at 5 different addresses in the past 3 days. Do t know how that happened but its been a complete nightmare trying to get it fixed. I finally just gave up.

With all that will adding a trade line to my file help. I forget to mention that i have 3 really good ones on my file ranging from 15000~29000 that are paid as agreed but they are closed and probably ready to drop off. Dates range from 2007~2009

Thanks for any advice. I REALLY need a new car my other died and im having a terrible time making doctors apts.

Mark, assuming everything you said is accurate and up to date, no; Tradelines WILL NOT HELP. If anyone says anything differently, they are lying. Do me a favor. Contact cory@credzu.com

100%, you need credit repair and an expert that can guide you.

Although you did a good job finding some cool solutions (superior tradelines, selflender, etc.), I would say do not buy or engage any other services, aside from credit repair.

Contact cory@credzu.com and he will absolutely help you find what you actually need.

There are a few recommended steps you can take to improve your credit score that put you on the path to a good credit score. Improving your credit score is all about doing the right things over a long period of time. My colleague mentioned about notablespy assisting him over his credit score and how they clean up DUI report and Chexsystem. I wondered if they could fix my credit profile too. I already thought i’ll need to work all my life to pay up all this dept. But at my very state now I have my very low score of 465 brought me up to 750 within every 48 hours to get completed. After then My whole story changed, he did not just remove the negatives on my report only but also increased my score a bit higher up to 800 just in 14 working days. I owe a lot to Notable spy and that’s why i’m here sharing the good news right here.

I have successfully removed late payment, collections, charge offs, bankruptcies, Inquries.

That’s good stuff!

I have 530 transunionand 560 equifax a BK in 2013. Since then i had 4 charge offs, i have a current card with 200 limit and jewlery loan both 4 months old. Can adding a trade line raise my score to 600 so i can buy a house?

Probably not. In addition, the underwriters (even if we get your score up) may decline the loan because of the charge offs, alone.

I owe about $12k in credit card debt and have a $3k collections account on my credit report. No missed payments. The collections account is willing to settle for $1500. I don’t have the money to pay off all of my credit card debt but paying over $600 a month in minimal payments. My question is will adding a trade line help my situation? I would like to apply for a personal loan or credit card with a limit large enough to transfer the balances and pay the $600 monthly that I have been paying towards the balance. I know this will save a lot in interest and cut the time in paying my debt off drastically.

I don’t think it’s a good idea 🙁 Given your situation, I think you need to focus on paying off the debt. Do not go into debt to pay off debt. Just pay off the debt. Plus, I don’t think it would work, now that I think about it… the collections would probably prevent you from getting approved for a credit card, especially one with favorable terms (as you idea would require). Also, if you don’t have the $600 for the debt, you don’t have the funds for the tradelines. Also, since the collections are already collection (that is, they can’t get worse), let them sit there and rot. You can cut a payment deal with them, later. It sounds to me like your financially under water, but you’re fighting it. I would try to negotiate directly with the credit card company. If they get the feeling you might default, they might work something out with you.

Over three years now i have been working, managing and behaving myself because i know i already have negatives on my credit report so i intend to work hand in hand to clear this up. I have bigger plan so i tried to get loans but my credit was so bad from my years of financial struggle so its was not approved. The banks will do ABSOLUTELY NOTHING to help you, give you a break, work with you to help you pay them off. Instead, you get condescending lectures on how irresponsible you are. Next, they raise your interest rates through the roof and systematically destroy your credit rating. Through this experience, I learned a whole lot about the monetary and banking system, There is something about this credit repair programming they don’t seems to help, it was more then a mind torture i couldn’t cope. The bitter truth is there is no quick fix for your credit unless you have a great hacker who could do that through the backdoor. I had been scammed once but i thank God i met Notable spy i read about notablespy from a discovery book called brain point I actually saw a testimony like this about him and i decided to try him out. His approach alone showed seriousness and professionalism.This hacker is a genius and comes highly recommended by a lot of people. He’s affordable and genuine unlike a lot of fakes I see on the internet. Now I am free and highly happy because Notable spy already fixed my credit and raised my score from 525 to 782 and also paid off the many dept on my credit report. Can you imagine that? What a blessing he is to my life . Mail directly at

Lexington Law is a huge rip-off scam. They tell you that they will fix your credit, they make very big promises to get you to sign their contract. You pay the monthly payments and getting nothing in return. I used them for over a year and 8 months and my credit scores actually went down. We had a very sick child and had a lot of medical collections and because they inquired about those to try and dispute them it basically quote refreshed the debt thus making our scores lower. We were young and dumb back then. I recommend 90creditspecialist @ g m a i l . c o m. He is a genius, get through with him today and you will be glad you did. He saved us from Financial ruins and bankruptcy…He deleted all the hard inquiries, late payment, collections, derogatories on our credit report and then proceeded to improving our credit score to the early 800’s

This is clearly spam but I wanted to let it through so that people can see what kind of nonsense there is out there. Also, Jenny, which probably isn’t your name and you’re probably not from this country, you can get sued for defamation by suggesting someone is a rip off by implying that they’re committing a crime when they are not. Lexington Law is a pretty damn big company with the resources to go after you. So, I would be careful with that.

3 credit cards maxed out and 1 collection which paying off before doing program thinking on doing a piggybacking account double the amount on my personal credit cards how much would my score increase

Hey Matias, Thank you for answering everyone’s question regarding our credit situation. I was trying to get some advice for my next options, I have one credit card open on my credit report balance is 1706 out of 3500 limit. The credit utilization is below 50% and I only have 4 inquiries on my credit report. I recently applied for a credit card on credit karma who said I had a very good chance, I would be approved for it, but yet I was still denied. I paid off all my collections and lowered my credit usage significantly and even got a higher paying job yet I keep getting denied for a credit card or credit limit increase. I’m currently in school and owe 20,000 in student loans but the payments are deferred, because I’m still in school. I thought that was a reason I got denied and I also recently started a new job, so I thought that could be another reason why as well. My credit score TU is 695 and experian 680.

Question so if my credit age is 2 years old and i buy a seasonal tradeline that is 10 years in age, will it increase my credit age?? Even once they take me off will the age stay increased??

i just paid off 5 of six charged off accounts settled with third party within months of being in collections my score is a 519 and im trying to buy a home will trade lines help me at all ?

Recently a few days ago I paid for a American Express $50,000K card Tradeline. I read this online and said “Because there is no limit reported on the American Express cards, the Fico score doesn’t consider this balance into the credit utilization and therefore has no effect on the score. I need to know how much points I got for this kind of credit limit? thanks Nestor Perez

You didn’t get that from us 🙂 We don’t use American Express for that reason. The age is a major factor for improving credit scores, so with American Express not reporting history, that potential impact is gone. However, that large limit may positively impact your credit score. How much, I have no idea without first seeing everything in your credit report. If you want a general answer, check out our credit score study here: https://superiortradelines.com/study/

Interested in this concept, wife and I are tired of renting and just welcomed our daughter into this crazy world. Solid income 93,000. Median score is about 560, 2 secured cards paid on time. One we managed to mess up, in collections. New car loan, 6 months old , 30,000. One also just paid off. About 7 accounts in collections, all but one are medical. Maybe 1 late payment in last 6 months. Advice?