UPDATE BELOW: Credit Bureaus fined millions of dollars for lying about credit scores.

As an educated consumer, you’ve probably checked your credit report and credit score more than a few times. You’ve probably done so prior to a large purchase, such as an auto loan or mortgage.

If you thought an online score was your “real credit score”, you may have been surprised when your lender gave you a different score. Or, you may have seen the before and after scores from adding tradelines to your credit report. Here’s what you need to know…

Table of Contents

How can I prove you don’t know your real credit score?

One way to prove you don’t know your real credit score is by checking multiple online scores. Go to credit check total, myFICO, Experian, Transunion, CreditKarma etc. If you access to all those fake scores, you’d see that they are all different. More importantly, none of these scores is your real credit score and lenders typically do not use them.

You don’t know your real credit score because there are 100s of them.

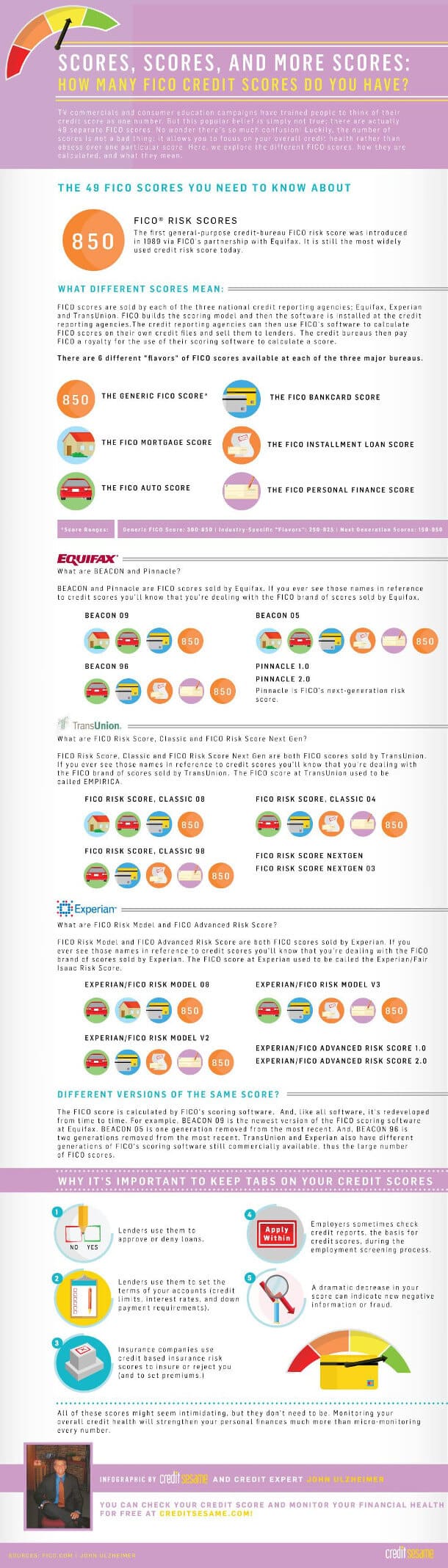

In an awesome infographic produced by Credit Sesame, you can see the almost comical ridiculousness of credit score diversity. Beacon scores, FICO scores, vantage scores, plus scores… see for yourself:

The degree to which you do not know your real credit score provoked federal inquiry.

The consumer financial protection bureau (the CFPB) conducted a study on the amazingly unnecessary amount of credit scores in existence. While their report considered many factors and other issues, we want to highlight two of them for you. In addition to not knowing your real credit score, they took it a step further to suggest you could be manipulated in this area of grey:

(1) Many scores exist in the marketplace: It is unclear the extent to which consumers understand that multiple scores exist in the marketplace. It is likely that many consumers incorrectly believe that the scores they purchase are the same scores used by lenders in evaluating their applications for credit. As described throughout this paper, literally dozens of different credit models are used by lenders. FICO alone has over 49 credit scoring models. Consumers additionally can purchase a range of educational scores or VantageScores.

…

(4) Providers of educational scores should ensure that the potential for score differences is clear to consumers: This study finds that for a substantial minority of consumers, the scores that consumers purchase from the nationwide CRAs depict consumers’ creditworthiness differently from the scores sold to creditors. It is likely that, unaided, many consumers will not understand this fact or even understand that the score they have obtained is an educational score and not the score that a lender is likely to rely upon. Consumers obtaining educational scores may be confused about the usefulness of the score being sold if sellers of scores do not make it clear to consumers before the consumer purchases the educational score that it is not the score the lender is likely to use.

Why don’t fake credit scores (or “FAKO score”) factor in authorized user tradelines?

The quick answer is that they don’t have to. Under current law, lenders must consider authorized user tradelines. Therefore, if the score used by lenders (or “real FICO score”) does not consider authorized user tradelines, the lenders would not use those scores. Therefore, FICO would lose a LOT of money from lenders if they did not factor in authorized user tradelines in their real scores

However, as we already mentioned, lenders do not use most online scores. Therefore, online credit scores do not need to factor authorized user tradelines. So, once you purchase tradelines from us, please understand that it is possible that only your “real credit score” will be affected. Meaning, only the scores lenders will use will see the real impact of the tradelines. You might see a little gain on the consumer or “online” scores, but the real impact is only seen on the real credit score side of things; lender credit scores.

UPDATE:

From TheAtlantic:

From Time:

It’s true. All three bureaus have generated their own type of credit score and charged people for it. Once again, lenders do not use these credit scores. The purpose of these scores was to provide consumers with an estimate of their credit rating, and to satisfy the consumer’s need for an easy, all-access number.

As you can see, the truth did come out eventually, and the bureaus had to pay major fines for deceiving consumers.

What does this mean for you?

This may sound like doom and gloom. You may be thinking “If I can’t get more score online, how can I know if I’m in a good place to apply for new credit?”

Here’s our answer: Credit Scores are not perfect, but they can point you in the right direction.

Experian and CreditKarma both provide analyses on your credit report – they tell you the major areas that require your attention. I’m sure other services offer this as well. Some of these areas include your payment history, your average age of accounts, your utilization, etc. While the exact number might not be perfect, it certainly gives you a place to start.

If you are in the low 500’s, there are likely problems with your credit report. You can focus on improving those areas prior to pursuing your credit goals? Not sure where to begin? We can provide a free credit report analysis and recommendation. Get started with us today!

Updated: November 16, 2021

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

I still don’t understand this. If I go to Equifax.com or MyFico.com, am I not getting my score from Equifax or FICO? If not, what is this score and why would it not be considered “real” if it comes directly from Equifax or FICO?

Fantastic questions. The world “real” can mean many things. In terms of credit, we should consider “real” anything that a lender is going to use. Otherwise, why would you care about a score if a lender isn’t going to use it. For example, if I created a Superior Tradelines’s Credit Score, would you buy it for $15.00? I wouldn’t, and I own Superior Tradelines 🙂 The point is, when you go to Equifax.com, Transunion.com, Experian.com, or even MyFico.com, these are not “real” credit scores. MyFico.com is the closest, but unless the scores are being used for lending purposes, the companies are not required follow certain rules and regulations. They can call it an “educational” score and sell you snake oil (yes, even MyFico.com). You can prove this to yourself. The next time you apply for credit (credit card, mortgage, car loan, etc.) ask them for your scores. Then, go pull your reports and scores online (anywhere you want). 100% of the time, the scores are going to be different.

One very relevant example. Under the Federal Reserve Board Reg. B (and the Equal Opportunity Act of 1974), lenders are “required” and “shall” consider authorized user tradelines when evaluating credit. If you are buying scores online, scores that are NOT being used for lending purposes, the score providers do not have to consider authorized user tradelines. So, we could add tradelines to your file and your scores could shoot up 100 points from a real tri-merge hard pull report pulled by a lender, yet your online scores could stay the same.

I know this is confusing, but it seems to me that banks, bureaus and government agencies seem to want it to remain this way. Keep asking question, Brett!

Thanks,

Matias

This is fascinating! Thanks for all the great information on your site. So, for instance, if you add a tradeline that boosts my hard pull/tri-merge but not an online score, how will I be able to determine the effect of that tradeline (to see if it is adequate to support whatever my anticipated increase or goal was)? How do we determine that the “real” one went up adequately before approaching the big car purchase or mortgage application? Do you have access to those reports…do I? Thanks!

Wow, great question. It is clear you read and completely understand what was written. Since only lenders are authorized (with a permissible purpose) to pull your credit (and credit scores), that is the only way to do it. There are round about ways of “verifying” your new scores, but this would add a hard pull to your credit report and, in some cases, could bring down your score by a few points. So, to answer your question 1) you can’t easily verify it prior to an application and 2) you don’t really want to…

How do we know your “real” scores go up? We see the result of client goals over and over again (thousands of times). The process is all algorithmic and engraved in law… it’s not a “chance”, it is just how it works; if you add positive credit history with an appropriate age, limit, balance, etc., your scores will go up.

Our experience comes into play when we apply the facts above with an individual’s unique situation. We make a tradeline recommendation based on your current credit situation and goals.

You asked a very complicated (yet noteworthy) question, so I hope this answer was what you were seeking. If not, ask me further questions.

Thanks,

Matias