The simple answer is, yes.

As with everything in life, the complicated nature of this question deserves a better answer. In fact, we need to ask more questions, too.

- How does denial of credit affect your credit score?

- How does approval of credit affect your credit score?

- Will the impact be different depending on the amount of the credit obtained?

Let’s explore these issues.

Table of Contents

If I am denied credit, will my credit score suffer?

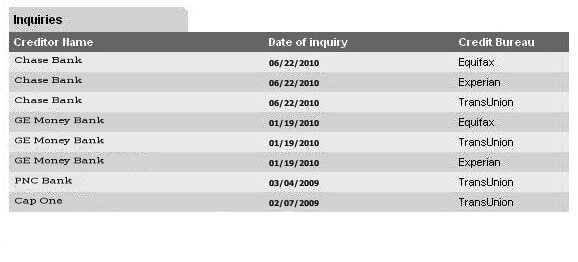

Technically, yes. However, perhaps not for the reasons you think. For the most part, the credit bureaus (and subsequently credit score modelers) will not know that you were denied credit. So, your score will not be negatively influenced just because you were denied credit. It’s the inquiry that could bring your credit score down after you apply for credit. You usually start to see a decrease in your credit score from excessive inquires after 6 inquiries within the previous 24 months. There is no hard line rule as to the number of score points you will lose, but the internet seems to be settled on the idea of between 3 and 6 points per inquiry.

There is one thing to watch out for… Under the FCRA, if you are turned down for a line of credit, you can request a free copy of your credit report citing the denial. DO NOT DO THIS. You are essentially saying “Hey Credit Bureau, I was turned down by a lender because my credit is bad”. This will decrease your odds of getting approved when you next apply for credit.

The impact credit approval has on your credit.

Too much credit = bad

Being approved for credit does have an impact on your credit score. Traditional wisdom suggests that this is “always” a good thing. However, there is such a thing as “too much credit”. So, for example, if you have a lot of credit and you apply and get approved for more credit, you actually become a risk in the eyes of score modelers (like FICO). Why? Because you could rack up a large credit line and default on it. This is currently an issue being addressed by Bankruptcy Courts today.

Small limits = bad

In addition, if you applied and got approved for, say, a $300.00 line of credit, this tells the score modelers that you are “only” worth $300.00 in terms of risk. If you are starting from nothing, this is fine… you have to start somewhere. However, if you have had credit for a while and were approved for only $300.00, this would probably bring down your credit score a bit.

Young Age = bad/neutral

Your score could actually go down because of the new account. The decrease is also caused, in part, by the inquiry that appears on your report prior to the addition of the new tradeline. However, the largest impact on your score is the result of the addition of a line with no previous payment history, which decreases the average age of your accounts.

The inquiry will remain on your reports for 2 years, but will cease to impact your credit score after 6 months. However, it will take time for the new account to positively affect your credit score (so, please, make your payments on time).

Credit Score Increase – good

Lastly, and despite the rare conditions above, being approved for credit usually has a positive impact on your credit score. Let’s say you applied for 4 different credit cards and were denied. The credit bureaus would count all of these inquiries and your score would likely decrease. On the other hand, if you applied four times and you were approved for a line of credit, FICO and other score modelers would consider the inquiries as one and chalk it up to “rate shopping”.

“I was approved for a credit card and my score went up 10 points, how is this possible?”

First, it’s unlikely that your score actually went up 10 points with a new account. I assume you are viewing online credit scores, which are fake scores. In addition, these online scores and merely trying to mimic what FICO would do. So, as I said, you probably didn’t get a 10 point boost. In the rare case that you actually did get a 10 point boost, it is likely due to factors other than just a new account. For example, the credit card could have diversified your credit portfolio. Alternatively, you may have decreased your debt to credit ratio once the new line was added to your credit report (if the line of credit were substantial enough to in fact do this).

In summation, applying for new credit cards/mortgages can impact your credit score – for better or worse. If you want to improve your chances of getting approved, consider authorized user tradelines which can help you improve your credit score. For more information, please email us at info@superiortradelines.com.

Kate is a managing member of Superior Tradelines, LLC. She manages and coordinates the company’s operations and makes sure clients are assisted with care. You can contact Kate directly by calling: 321-328-0908 or by email: kate@superiortradelines.com

One thought on “If you apply for credit, is your credit score affected?”