Disclosure: We’re not lawyers. We’re not giving legal advice. If you’re looking for a legal opinion, you need to retain an attorney. This page is more of a research paper that you can use for topics to bring up to your attorney, but you cannot rely on it for legal purposes.

Table of Contents

Are tradelines illegal? Not yet!

“This is possible because creditors generally have followed a practice of furnishing to credit bureaus information about all authorized users, whether or not the authorized user is a spouse, without indicating which authorized users are spouses and which are not. This practice does not violate Reg. B.”

The answer to the question of whether the practice of buying tradelines is legal or not can appear somewhat unclear initially. This can understandably cause many people to hesitate, wondering about not only the legalities, but even the moral implications as well.

Moral, or immoral?

There are a few factors to consider, including laws, regulations, and guidance from credit reporting agencies. We’ll take a look at all of these to explore whether buying tradelines is legal or not.

The internet suggests that it is a well-settled principle that adding authorized user tradelines to your credit report to help boost your score isn’t illegal. You can search for “are tradelines legal” and find many opinions.

We are not giving legal advice, but merely pointing out the consensus on the internet. Even an FTC spokesman Frank Dorman said: “What I’ve gathered from attorneys here is that it is legal, however, the agency is not saying that it is legal technically.”

What are tradelines?

Tradelines are the accounts on your credit report. In recent years the term has also come to mean “adding authorized user accounts to credit reports.” The standing of the tradeline (i.e., whether or not the tradeline has a positive payment history) will determine whether or not it is beneficial to the authorized user.

If you have a low credit score, you can become an authorized user on a revolving account and your credit report will inherit the positive characteristics of that account. If that account is in good standing, with perfect payment history, your credit score could increase.

“Consequently, becoming an authorized user on an old account with a good payment history, may improve an individual’s credit score, potentially increasing access to credit or reducing borrowing costs. As a result, the practice of “piggybacking credit” has developed. In a piggybacking arrangement, an individual pays a fee to be added as an authorized user on an account to “rent” the account’s credit history.”

The legal origins of “piggybacking” credit.

First of all, when we refer to “piggybacking credit”, we are referring to the same thing as adding an authorized user, or purchasing seasoned tradelines. It’s all synonymous. In short, this process refers to hitching a ride on someone else’s good credit standing, which as a result can improve your credit score.

The ability to piggyback off of someone’s credit card account came about as the result of the 1974 Equal Credit Opportunity Act.

This implementation of this law gave rise to the unintended consequence of piggybacking credit. Piggybacking works to increase credit scores – that’s why people do it. Because having a good credit score is valuable, people will pay to be added as an authorized user.

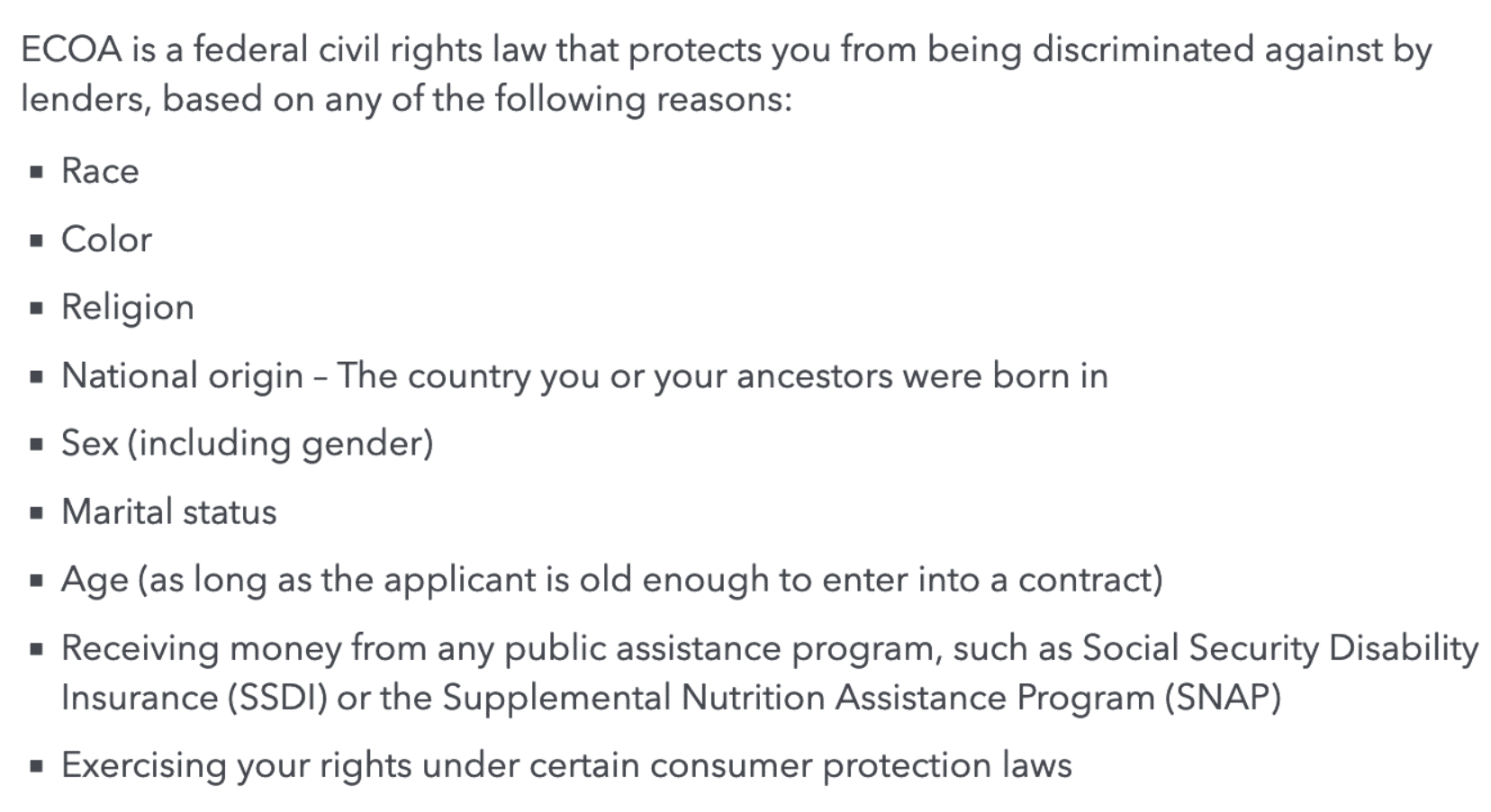

What is the Equal Credit Opportunity Act (ECOA)?

The Equal Credit Opportunity Act (ECOA) is a law that was implemented in 1974 to protect individuals from discrimination when applying for loans and other forms of credit lines from financial institutions, credit card companies, and lenders.

Why It Passed

After the feminist movement of the 1960s, women began entering the workforce with more regularity. Credit scoring was in its infancy, and at that time, it was often difficult for women to get approved for lines of credit because of discrimination. Up until then, most women had been denied access to chances to establish credit, and therefore didn’t have the same opportunities as men.

Proponents for the passage of the ECOA argued that women, single or married, were denied loans with more frequency than other applicants. It seemed that lending decisions were still “arguably susceptible to a loan officer’s personal judgments and prejudices,” according to a paper written in 2012 by Dubravka Ritter for the Federal Reserve Bank of Philadelphia.

Initially when the law passed in 1974, it was designed to prevent discrimination against sex or marital status. However, in March of 1976, the law was amended to prohibit discrimination of any kind.

How Does This Apply to Tradelines?

Because the law prevents discrimination, it means that it cannot discriminate who can and cannot become an authorized user on someone’s credit account. The law allows people to piggyback off of a family member’s credit accounts (specifically, spouses) but not everyone has access to a family member with good credit habits. Therefore, if a lender accepts anyone as an authorized user, it has to accept everyone.

Nowadays, the importance of having a healthy credit rating is paramount, for many reasons. The ability to become an authorized user and have your credit score affected in a relatively short amount of time was recognized as extremely valuable. As such, anything that is valuable becomes a commodity, and the tradelines industry was born.

Let’s take one hypothetical example:

“Joe” lost his job and fell behind on some payments.

A few months later, Joe got a new job making 6 figures. His ability to repay a loan obviously increased and his risk of default dramatically decreased.

However, the FICO model, or any model for that matter, does not consider this significant fact. Now Joe is left with poor credit and a 6 figures salary.

Not only is Joe suffering, but so is the economy. A flawed credit system prevented a consumer from purchasing a product.

- The real estate agent loses.

- The loan officer loses.

- The banks lose.

…yet, the credit bureaus and credit scoring companies got their money when Joe’s credit was pulled.

Secondly, the credit bureaus and credit scoring companies are simply one thing… companies. They are private corporations, who stand to financially benefit by judging you. Their job is to appeal to creditors and provide an alleged risk assessment of you. This is supposed to allow creditors to lend at lower risks of default.

Did you notice that I didn’t say that their job was to ensure that your credit file is accurate?

Is buying and selling tradelines to boost credit scores legal or illegal?

Because the practice of piggybacking credit is rooted in the law, few people would cast legal doubt on that process, alone. The commercialization of the practices – primarily to improve credit for profit – is where legal exposure becomes relevant.

This is where the concept starts to cause friction on the opinion-net. People often make good cases for and against the morality of the practice. Of course, the main point is that you are manipulating the credit system.

Are tradelines legal? If not, then everyone is in trouble.

That means the buyer, the tradeline company, the banks, the credit bureaus, and the government are all complicit.

This seemingly sensible contention is the focus of this article. The manipulation argument, as we call it, presupposes that the credit industry is flawless, or even functional, in the first place… in fact, it is a made-up system by a private corporation; it’s not infallible.

More importantly, it is this imperfect system that scores authorized user tradelines in their scoring model and it is the law that allows it. What is left to argue?

A lot of people search Google for piggybacking credit followed by the current year as if the concept has changed. All you have to do is keep up with the regulation that implemented this concept to end this search. When the ECOA changes, then it’s time to re-evaluate whether or not the process still works.

The practice of piggybacking credit by purchasing authorized user tradelines is supported by the law, however…

A tradeline company selling the tradelines could violate the Credit Repair Organization Act (CROA) by demanding upfront fees, for example. However, that doesn’t speak to the legality of the tradeline industry.

If you are looking for legal advice, consult with an attorney.

Ideological positions can certainly change. However, the positive impact that tradelines can have on your credit score is undeniable.

If you are looking to boost your score quickly, you should consider buying tradelines. Here at Superior Tradelines, LLC, we will help determine if you are in a position to benefit from adding seasoned tradelines.

Anything can be abused, so tradelines could be illegal if they were used fraudulently. Being added as an authorized user is perfectly legal. Whether you do crazy stuff like use credit profile numbers… Well, that’s another story. So, speaking of…

CPNs are garbage. Just stop before you begin.

There’s a malignant misconception of an obscure law that has resulted in the misguided belief that you can create a new 9 digit number, like a social security number, for credit reporting purposes. This is a form of fraud called synthetic identities, which the federal government actively and regularly prosecutes.

CPN is an abbreviation for “credit profile number.” A credit profile number is a secondary number used to commit fraud. In reality, a CPN is someone else’s social security number; thus, the use of a CPN is aggravated identity theft.

However, many consumers believe (because that’s what they are told) that CPNs are a viable option for credit enhancement. The pitch goes like this: Leave your bad credit behind; start a new credit file for financial freedom.

The problem?

CPNs are illegal.

There’s some good news. First, it’s very easy to avoid CPNs. All you have to do is stop working with anyone who suggests you should create a new social security number to avoid the problems with your current social security number.

No matter how bad your credit is, remember two things:

- All credit problems can be solved.

- CPNs solve nothing and expose you to legal consequences.

Seller/broker legal exposure:

There are two types of sellers of tradelines: individual sellers of credit card accounts with positive credit history, and professional tradeline companies. Both are considered credit repair services if the tradelines are being sold for improving credit, and are subject to the many laws and rules that apply.

The first law is the Credit Repair Organization Act (CROA). CROA has a lot of technicalities such as what the agreement between the buyer and the seller has to contain, whether the agreement should exist, rights notifications, notifications of cancellation, and other prohibitions, such as when you can take payment.

Those regulations can create procedural stumbling blocks, so if you’re not hyper-aware you could easily violate them.

The Telemarketing Sales Rule (TSR) is similar to CROA in that it regulates practices of improving a purchaser’s credit rating. But it is more stringent in the fact that it requires you to wait 6 months to get paid if you are selling credit repair services through telemarketing.

There are also state versions of both TSR and CROA, and not all states are the same, so if you’re selling to people in different states it adds a whole other layer of legal complexity.

All those laws and rules apply to vendors and credit repair companies because they see it as a common enterprise between the two. And they would see it under CROA and see it as substantial assistance under TSR.

The underpinning of all regulations for these types of services is really found in the unfairness analysis of the Federal Trade Commision Act. For example, in the “Boost my Score” case, they pled the same facts for a violation of the FTC Act and for CROA.

The FTC definitely is in play and they use it to go after credit repair companies.

Violations of laws:

Misrepresentation is the biggest violation of all of these regulations. Vendors have to make good on their agreements, and if they don’t hold up their end of the bargain, or mislead consumers about what results to expect, they could be in violation.

Under CROA, vendors are in violation if they fail to give a rights statement disclosure, provide a contract, or ensure that the contract meets the requirements of CROA. They could also be fined or prosecuted for charging upfront for the service, or by having the consumer waive any of their rights.

A violation of the TSR would be charging for the service before six months were over if the services were rendered via telemarketing.

The FTC Act protects consumers against unfair or deceptive practices, and monitors and regulates the activities of entities engaged in commerce. Engaging in such practices could likely result in a violation of the FTC Act.

All of these regulations may apply to the credit cardholder, as well.

Buyer legal exposure:

If a company is willing to violate all of those laws they are probably willing to engage in fraud. That means you are also engaged in fraud if you choose to do business with them. If the organization conceals or avoids disclosure about the true nature of what they’re selling, they are taking advantage of the law and possibly crossing into illegal territory.

An example of this would be selling an authorized user tradeline and calling it a primary tradeline. Companies who do this are knowingly capitalizing on people’s ignorance. To understand more, we’ve written quite a bit about why you can’t buy primary tradelines like authorized user tradelines.

If an organization does anything to violate the above-mentioned regulations, they are not a safe option to work with. Even with your best intentions, you could get taken down with them. It is important to protect yourself, as well as not engage in any questionable practices yourself.

Credit agreements are legally binding documents. Any time that you provide personal information to a lender, you are required to be 100% truthful about all the information provided. By furnishing false information to creditors you would be legally liable for the consequences.

Potentially getting involved with crazy things like CPNs could get you in a whole heap of trouble that is simply not worth it. Any time you hear the word CPN mentioned you should stay far, far away. If you’re not convinced, you should read why CPNs are dangerous and illegal.

Legal cases surrounding piggybacking.

In the case of Federal Trade Commission v. RCA Credit Services, LLC, none of the parties nor court found anything wrong with piggybacking. If there was ever an opportunity for a regulator to make a definitive case against the practice of piggybacking credit, it was this one. It included FTC investigators calling RCA and thoroughly vetting the tradeline practice.

The RCA case was the most prominent, tradeline-focused case to date. It was a heavily litigated case. The court docket has 237 entries (over a thousand of pages of pleadings).

Notably, in the FTC complaint against RCA, there was no allegation that the practice of piggybacking credit violated any law or rule. That includes no allegation that the practice violates any provision of the FTC Act, CROA, nor the TSR.

In the “Boost My Score” case, they were found to have been encouraging their clients to misrepresent the nature of the tradeline to the bank. They were also found to have misled consumers about realistic expectations of their services, and charged inordinate amounts for the service.

However, while they were found to be guilty of false advertising, there were no judgments made on the merits of piggybacking in this case.

In the Top Tradelines case, they were convicted of making false claims about what they could actually provide for consumers. The people running this company were outright fraudsters who were practically doing everything illegal under the sun, including lying to consumers, charging upfront fees, and advising consumers to lie to credit bureaus.

Again, the rulings on this case pertained to the actual fraudulent nature of the activity of the corporation. No such charge was made against the practice of piggybacking, or selling authorized user tradelines.

Regulatory opinions.

In a 2008 article, USA Today quoted FTC spokesman Frank Donnan as saying, “What I’ve gathered from attorneys here is that it appears to be legal, technically… However, the agency is not saying that it is legal.”

This might sound wishy-washy, and it is, but the FTC cannot declare a practice legal. Otherwise people may engage in illegal practices (such as tradelines on CPNs) and rely on FTC statements for their defense. In fact, the FTC has recently distanced itself from this statement, in the TopTradelines case, stating that “a press statement is not a “final agency action” that could bind the FTC.

The Consumer Finance Protection Bureau (CFPB) conducted a piggybacking study in 2013. One of their hypothetical responses to “concerns about the potential harm from piggybacking” was “to outlaw the practice of piggybacking itself.” This implies the CFPB currently believes the practice of piggybacking is legal.

Industry opinions.

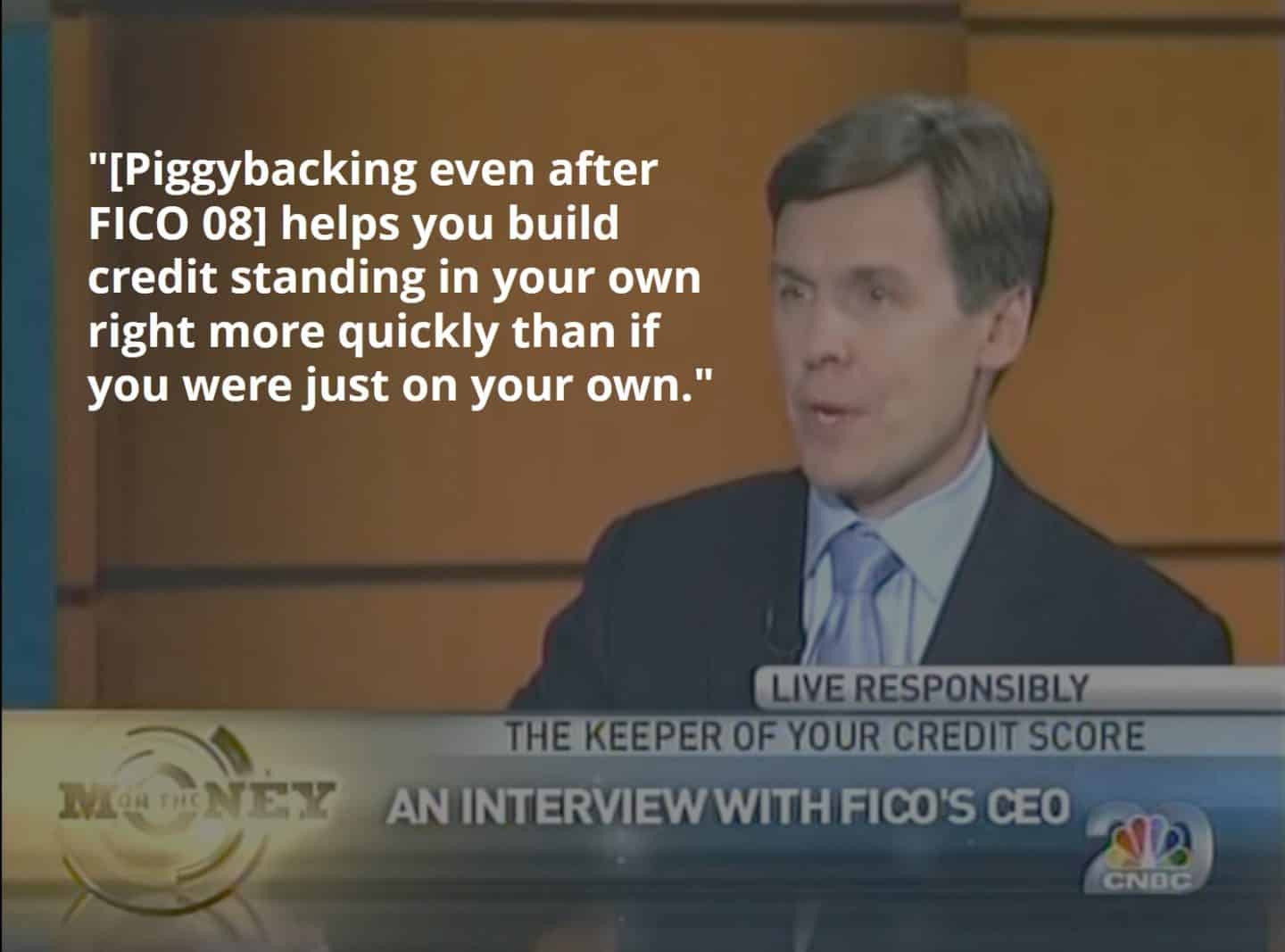

“Fair Isaac Corp., creator of the well-known FICO credit score, had announced last year it would end the practice…” of piggybacking “…but during Congressional testimony Tuesday, acknowledged it had changed its mind.”

– Jeremy M. Simon, Staff Reporter

www.credit.com

“After consulting with the Federal Reserve Board and the Federal Trade Commission earlier this year, Fair Isaac has decided to include consideration of authorized user trade lines present on the credit report.”

– Thomas J. Quinn

Vice President of Scoring Solutions, Fair Isaac Corp.

“This is possible because creditors generally have followed a practice of furnishing to credit reporting agencies information about all authorized users, whether or not the authorized user is a spouse, without indicating which authorized users are spouses and which are not. This practice does not violate Reg. B.”

– Matias B. Avery, Kenneth P. Brevoort, and Glenn B. Canner

Divisions of Research & Statistics and Monetary Affairs

Federal Reserve Board, Washington, D.C.

Which way is the wind blowing?

Since 1974 until the present, it has been common knowledge that the practice of buying and selling tradelines is a legal one. However, for the first time in 45 years, the FTC has indicated that it may change its position on the practice. No law has changed, nor have any judges ruled. However, the FTC has – in two cases – slipped in arguments that appear to question the legality of the practice.

Their argument is: If the authorized user does not have access to the card (which is a piggybacking arrangement, it does not), then it’s not really an authorized user. That means untrue information is being reported to the credit bureaus. Reporting untrue information or causing untrue information to be reported to the credit bureaus is a violation of the CROA.

In 2019, the FTC first asserted this argument in the TopTradelines case.

In 2020, the FTC made the exact same argument in the BoostMyScore case.

We’re unsure where the FTC is going with this argument. Becoming an authorized user is, in fact, an authorized user whether the authorized user has access to the card or not (not to mention equal opportunity considerations). Nevertheless, we wanted to add the “which way is the wind blowing” just in case this FTC position materializes into something more definitive.

5/6/2022 UPDATE:

The FTC just filed another lawsuit against a company with a laundry list of questionable behavior having nothing to do with tradelines. However, the FTC asserted this argument again, for the third time.

This needs litigated and decided.

Avoiding legal issues:

The best way to avoid any legal issues is to work with an experienced, reputable tradeline company. Remember that the onus is also on you to do the right thing, and that you could be complicit for the fraudulent activity of an organization you are associated with.

We review extensive tips on how to avoid getting scammed, and how to find the right tradeline company for you.

One of the best ways to protect yourself is to use an escrow platform, such as Credzu. Using an escrow platform is a great way to make sure your money is secure until the transaction is complete.

We’ve been in business for over ten years. We know the ins and outs industry, and we’re here to help you make the right decision that will benefit you the most. Just comment below or call us with any questions.

Frequently Asked Questions

1.) Have any companies been sued directly for piggybacking credit?

The answer is no, but tradeline companies have been sued for doing things that violate the CROA, TSR, and FTC Act.

2.) Have any consumers been sued for piggybacking credit?

Again, no. Consumers have been sued for synthetic identity fraud that used piggybacking to enhance their false identities. But they weren’t sued directly for piggybacking.

3.) Will an authorized user’s credit behavior (good or bad) affect the primary account holder’s credit report and score?

No. It is a mischaracterization to believe that you’re taking information, putting it in a bag and shaking it to mix it all together. Accurately, what is happening is this: The primary account holder adds the authorized user at the bank. The bank reports information about that account to the credit bureaus. Nothing from the authorized user is being reported. Only information from the primary account holder (for only that specific account) is being reported. It’s a one-way street.

4.) If an authorized user’s credit has some collections or judgments on their report, would tradelines still boost their score?

Yes, your score will go up, but… from what to what? Right? If you had a 700 and a collection or judgment brought it down to 500 and the tradeline brought it up to 575, that’s amazing, right? 75 point boost? Well, even so, you can’t get approved at 575 (for anything that I know of). So, it’s best to do a measured approach between credit repair (or debt settlement) and tradelines.

5.) Is bankruptcy a good option?

It’s such a good question and the answer depends on a lot of things. For example, you probably wouldn’t want to invoke the power of bankruptcy for a $5,000.00 charged off a credit card. You’d want to reserve that extraordinary right massive debt for which you are unlikely to recover (like failed businesses, significantly upside-down mortgage, etc.).

6.) What would happen if the primary user ended up defaulting, say through some major change in life circumstances? Would the authorized user then become equally liable for the credit card debts?

An authorized user is never responsible for the debt on the primary account. A primary account holder could mess up his or her account and negatively affect the authorized user’s credit score and if that happened, the authorized user can dispute the account off his or her credit report.

Now, in a non-business relationship (friends, family, etc.), there is more of a risk of that happening, but with us, the primary account holder is paid handsomely to keep their account in good standing.

5.) Is it safe to buy tradelines?

If you are buying from a knowledgeable, reputable source, such as Superior Tradelines, then yes.