Last updated: July 23, 2021

“Business Tradelines” – They’re not what you think!

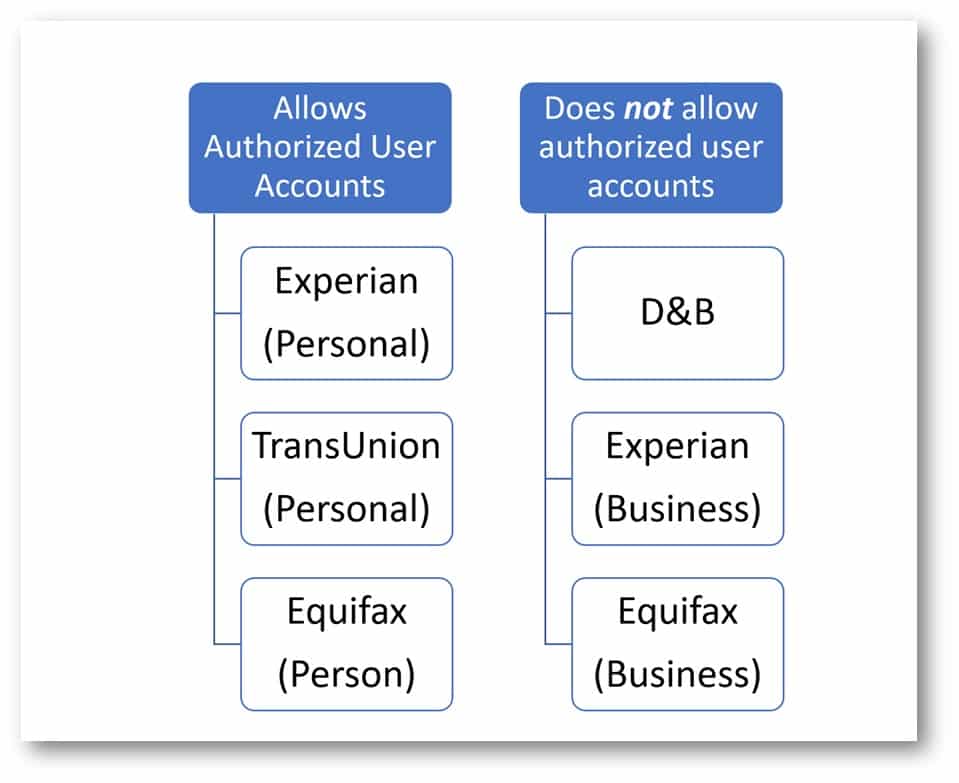

Business tradelines don’t exist in the same way as authorized user trade lines for individual credit files. First, there’s no such thing as an authorized user with respect to business credit reports. Secondly, there’s no such thing as authorized user accounts with respect to business credit scores. I just wanted to get that out right away so as to not mislead or misguide anyone.

With that out of the way, let’s get to it!

As we’ve mentioned in other posts, there’s no such thing as a business loan (unless you have millions of dollars in cash flow). Business loan underwriting is heavily concerned with the operating strength of the entity, not an arbitrary number supposedly representing the entity’s creditworthiness. If you’re looking for funding, stop looking for business tradelines.

Is there any hope?

On the other hand, if you’re looking to borrow money for your business based on your personal credit (usually referred to as a personal guarantee), perhaps tradelines might work for you. Business trade lines might not exist, but there are tradelines for sale that can be added to an individual credit file. These tradelines can increase that person’s ability to secure loans and to do so with more favorable terms and rates. In the case of a business guarantee, this applies.

So what?

Business tradelines exist in an indirect way previously discussed. They do not exist as you might think. Authorized user trade lines do not apply to business credit and funding efforts – don’t be tricked into believing otherwise. But, if you plan to personally guarantee your loan, then authorized user tradelines may be able to help!

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Hello ~ Can your organization add business tradelines to seasoned Nevada Corps? Also how do you set up the business tradelines for free? Please advise. Thank you.

Anthony,

Adding a trade line to a business is discussed thoroughly here:

https://superiortradelines.com/funding/tradelines-business-funding/

In summary, no, you cannot add an authorized user trade line to a business or any tax ID number. Authorized user trade lines can only be added to a Social Security Number.

But for your other question: How do you set up business trade lines for free?

The answer is simple. When you apply for a business loan and you have no prior established credit history under that business, your banker needs to look at something to determine whether you are a good candidate for the loan. In order to do this, they may ask you to personally guarantee the loan. This would mean looking at your personal credit score to ensure you are worthy of taking on the loan and paying it off in a timely manner.

Of course, we can help you with your personal credit score if you decide to personally guarantee the business loan. So let’s talk further about your credit.

You can email your credit report to raj@superiortradelines.com or call my direct number (407-796-1076) to discuss this further.

Regards,

Raj Sahoo

Anthony,

In addition to Raj’s response, I wanted to highlight some text from the link he referenced above. Specifically:

If the business model is good, people will throw money at it. If you actually need an influx of cash, you’ve probably done something wrong in the first place (unless you are expanding, etc). Businessmen often put the cart before the horse and think an influx in funding will solve problems; this is rarely the case and it usually makes things worse. If you’ve got your ducks in a row and the only thing you lack is a sufficient credit score, then in that situation, adding tradelines for business funding makes sense.

I wrote that. And, the intention is to say this: People often think that an influx of cash is going to solve problems or get a company off the ground. Sometimes, that may be true. A majority of the time, it’s not. I started Superior Tradelines, LLC with zero operating capital. I read a lot, figured things out and money rolled in when I got all our ducks in a row. We now have 8 full time staff.

I would encourage you to consider your business goals and target them with laser precision, rather than pouring money on issues you’re trying to resolve. The idea of getting funding for a business in these round about “shortcuts” (that end up being long roads) sounds appealing. My advice: let your competition weed itself out by messing with these funding methods.

Thanks,

Matias