A recent discussion revealed someone’s experience with an unfair and damaging collection account. The story is below, but the alarming facts are these:

- She had an illegitimate collection pop up for a bill insurance should have paid.

- Her credit score dropped over 100 points… from one collection account.

- She had authorized user tradelines.

- The credit score increased 103 points in under 12 days by removing a $195.00 collection.

Table of Contents

Here’s the story.

“I’m a recent college graduate and in my early 20’s. Like most young people, my credit file is rather thin. After graduating, I decided to open an account with Experian to monitor my credit. I knew I didn’t have a great credit score due to this thin file, but I was shocked to find that my score was 659. I had no late payments and was very careful about keeping my utilization low. That’s when I noticed it – I had a collection.

During my senior year of college, I had kidney stones. They’re quite painful – imagine a knife stabbing you in the back for hours on end. I went into the ER for pain management and to verify that it wasn’t anything serious. At the time, I was covered by two separate insurance companies, who fought over who should pay what. In the end about $150 went unpaid, which eventually turned into a collection.

Once I was made aware of the collection, I immediately paid it off. However, a year later, that collection is still on my credit report, dragging it down. I had plans in the near future to buy a house with my husband, and I knew I wouldn’t get great interest rates with a score like that.

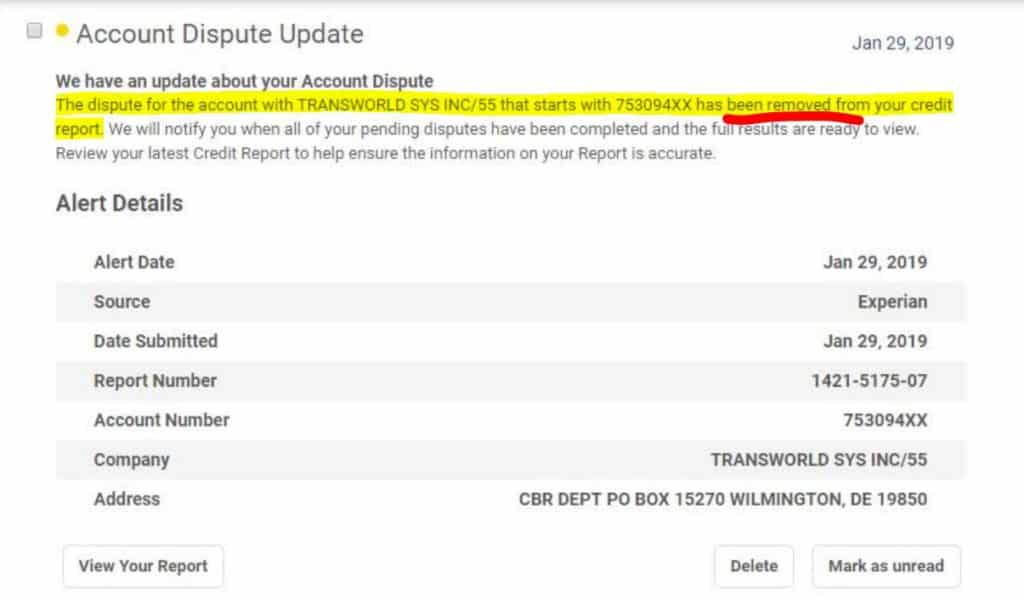

I decided to dispute this claim through Experian. While it can take a month for them to address the dispute, it only took 5 hours in my case! Yes 5 HOURS! I checked my credit report once the Experian removed the collection to find that my score had raised 103 points.

One little dispute, 5 minutes of my time, to raise my score so much. It is so important to know what your credit report actually means, because one little change can save you thousands of dollars in the future.”

Here’s the before credit report with the collection.

Page 9 of 14 is the collection account. Page 12 of 14 is the credit score.

credit report with collectionHere’s the dispute and update:

Experian opened the dispute:

Experian removed the collection:

Here’s the credit report (and score) after the removal of the collection.

credit repair without collectionWhat does this mean for you?

Adding authorized user tradelines are a great way to improve your credit score, but they are not effective in every circumstance. Before considering adding tradelines, it can be very beneficial to address any negative items on your credit and repair your credit.

Want to know if tradelines are right for you? We can help by providing a free credit report analysis and recommendation. Get started today!

Updated November 16, 2021

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Is this a joke? Please tell me that isn’t real! Over 100 points for one tiny collection? No wonder people have problems with credit. What if you had a bs collection like this and they didn’t remove it. Pay it? Add tradelines?

No, but it is alarming. We just wrote an article about whether you should pay balances or not. See if this helps: https://superiortradelines.com/tradelines-questions/should-i-buy-tradelines-or-pay-down-my-balances/

This is soo fake I can’t believe any website would use such a fake but elequent story… like really I know my posit won’t stay up here I’ll bet 50 credit points! Lol

Mo, I don’t understand your point, but I’d love to help. Are you saying that Experian is lying to us? You did see the complete before and after reports, right?

They’re embedded on the post and you can go through them, page by page.

I know the credit bureaus have lied in the past about credit scores, but after paying 20 million dollars in fines, I doubt they’d do it again.

If you’re on this page, it’s likely the case that you need assistance with credit. We’d love for you to post some more, especially if it is helpful for you and others.