Every year since we started this company, we see search terms in Google for tradelines for sale followed by the current year. “Tradelines for sale 2019” is no different. We assume those searching are wondering whether or not tradelines can still be purchased in that current year or whether not tradelines work.

If you’re reading this, tradelines are still for sale in 2019. The company that’s publishing this blog post literally sells tradelines every day.

In some ways, nothing has changed, but in other ways, many things have changed. Here are some topics we’d like to address for your 2019 search for “tradelines.”

Here’s a “State of the Tradeline Address,” if you will.

Table of Contents

Best tradeline companies in 2019

We’ve written an entire page about which tradeline company is best. You can read that here. In addition, we’ve written a list of ways consumers can identify and avoid illegitimate companies, here. One thing we have noticed is that clients have gotten smarter. They ask better questions and they’re more prepared to discuss their credit goals as it relates to tradelines.

Consumers are getting fatigued by insufficient credit repair.

We’ve noticed that clients are more frustrated with the credit system than ever before. They feel like bad credit is making them miss opportunities and they’re more motivated to get results. This is likely due to a stronger economy where people are trying to enter the buying market.

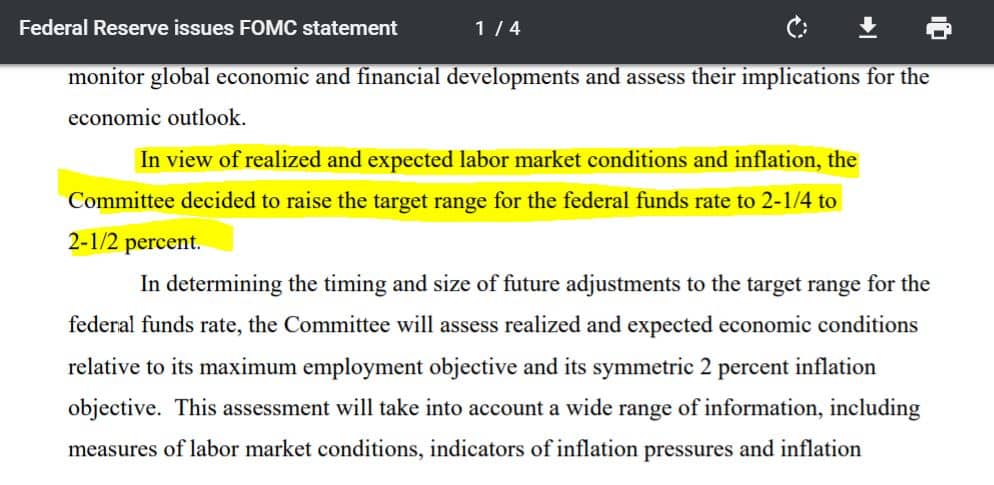

Interest rates are rising.

Part of the frustration of future buyers who face credit issues is fueled by rising interest rates. Every time you turn around, the Federal Reserve has decided to raise rates. Consumers are smart and realize this cuts directly into their purchasing power and want to boost their scores with tradelines as soon as possible.

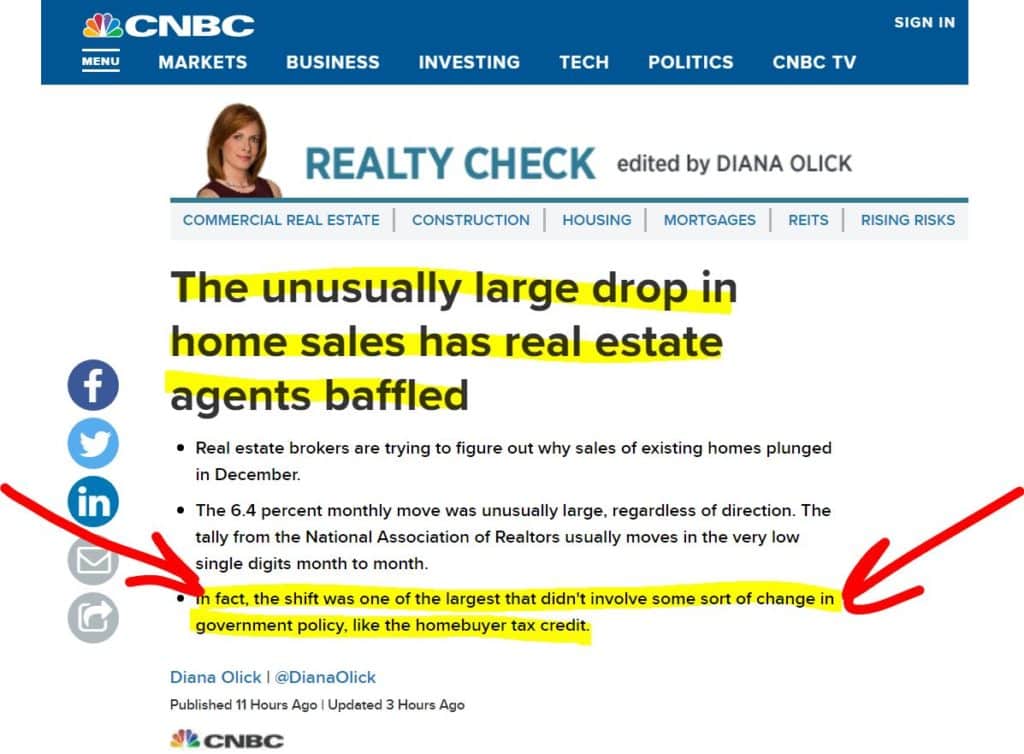

The housing market is shifting.

I think it is obvious that the housing market is shifting. When you combine this with rising rates, consumers are stepping on the gas peddle of credit improvement. They want to either take advantage of today’s interest rate (rather than a higher one tomorrow) or be prepared to buy by the time prices come down in the shift. Either way, tradelines remain a good option for those clients.

Lending is opening, slightly, but mostly unconventional.

Aside from the recent shutdown, lending seems to be opening up. We see a lot of success with people looking for lines of credit for their business, or auto loans and mortgages.

Consumer confidence is high (we saw the groundswell before it was picked up by statisticians).

Prior to being in business for a decade and seeing, directly, consumer spending habits as they relate to economic factors, things like “consumer confidence” sounded like something an MSNBC contributor would say to sound smart. Now, however, I see consumer confidence with my own eyes. We see consumers’ interest in tradelines in 2019 (and 2018, actually) with much more motivation than ever. Literally, we have not seen consumers like this since we started the company in 2009.

0% down is back, unfortunately.

With slumping house sales and rising rates, banks are starting to get “creative” again. This is good news for the few that are positioned to take advantage of it, but eventually, the consequences of those risky loans will be experienced by someone.

Laws (new CROA type, laws).

We’re actually watching a new law coming down the line. We’ll address it in another post, but it directly affects Credit Repair Organizations, how they operate, how they charge, etc. It should cause some litigation and disagreement between service providers and regulatory agencies like the Federal Trade Commission.

Tradeline companies are flooding and muddying the market.

This is the big one. There are so many tradeline companies, it’s insane. Unfortunately, it’s a bit like the wild west. That’s good in some ways, but there’s a lot of consumers that stand to be harmed by fly-by-night or very new companies who are learning by experimenting with their clients. We all started somewhere, but lucky for you… there’s plenty of companies (like us) that have been around for years. No need to risk it.

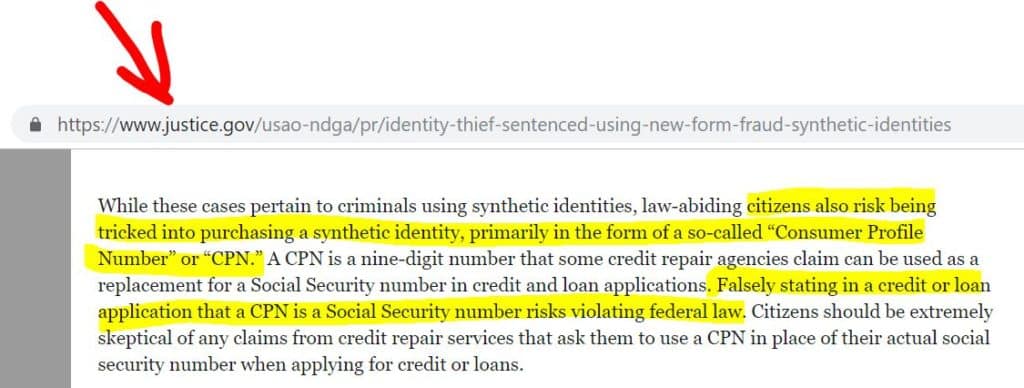

CPNs are still here, but they’re dying.

The Department of Justice and the Federal Bureau of Investigations have clearly targeted CPNs (people have gone to jail for this stuff). Why is this even a topic, still? Despite this fact, people are still, to this day, peddling CPNs. Some of them at least call it something else to pretend the distinction has a difference. It doesn’t. Thankfully, though… clients are getting smarter.

Tradeline prices are staying the same, with a slight uptick.

Despite some companies pretending to offer tradelines in the low 3 figures (which is really just bait and switch once you hop on the phone with them), prices are actually going up. Just slightly. Even with all the companies popping up, prices of tradelines are rising.

Tradeline inventory – and cardholders – are increasing.

Finding cardholders who add consumers as authorized users used to be slightly difficult. We’d have to market for it, tap resources, etc. Now, they flood in like water. We suspect that it is the many companies getting people involved and the cardholders shop around and pick a company they feel comfortable with.

Tradeline demand is through the roof.

If you’re in the market to increase your credit score with seasoned tradelines, you’re not alone. 2018 and 2019 have shown the most tradeline activity ever.

If you’re looking for a solid company to work with, see a list of tradelines with prices in a secure members area, click here (also, you can see our newly designed start page)

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Curious