You have rights under the law and, unlike other companies, we tell you about them so you can exercise them. By creating an account on our website through any sign-up form or any other method, you expressly consent to Superior Tradelines, LLC, it’s employees, contractors, agents and assigns (hereinafter “our” or “we”) communicating with you, using any phone number, including a mobile or cell phone number, or email address that you have provided us using any current or future means of communication at our full discretion and transmitted by any available means. Technologies we may use to contact you include, but are not limited to, automatic telephone dialing equipment, artificial or pre-recorded voice messages, SMS text messages, or email, all of which may be transmitted by any available technology. YOU ACKNOWLEDGE THAT YOU MAY INCUR COSTS FROM YOUR SERVICE PROVIDER RELATED TO RECEIPT OF OUR COMMUNICATION AND YOU FURTHER CONSENT TO USE OF THESE MEANS OF COMMUNICATION EVEN IF YOU INCUR COSTS. You understand that you may revoke your consent to receive communication from us by visiting:

https://members.superiortradelines.com/opt-out You also understand that it may take up to 48 hours before Superior Tradelines, LLC can acknowledge your revocation of consent.

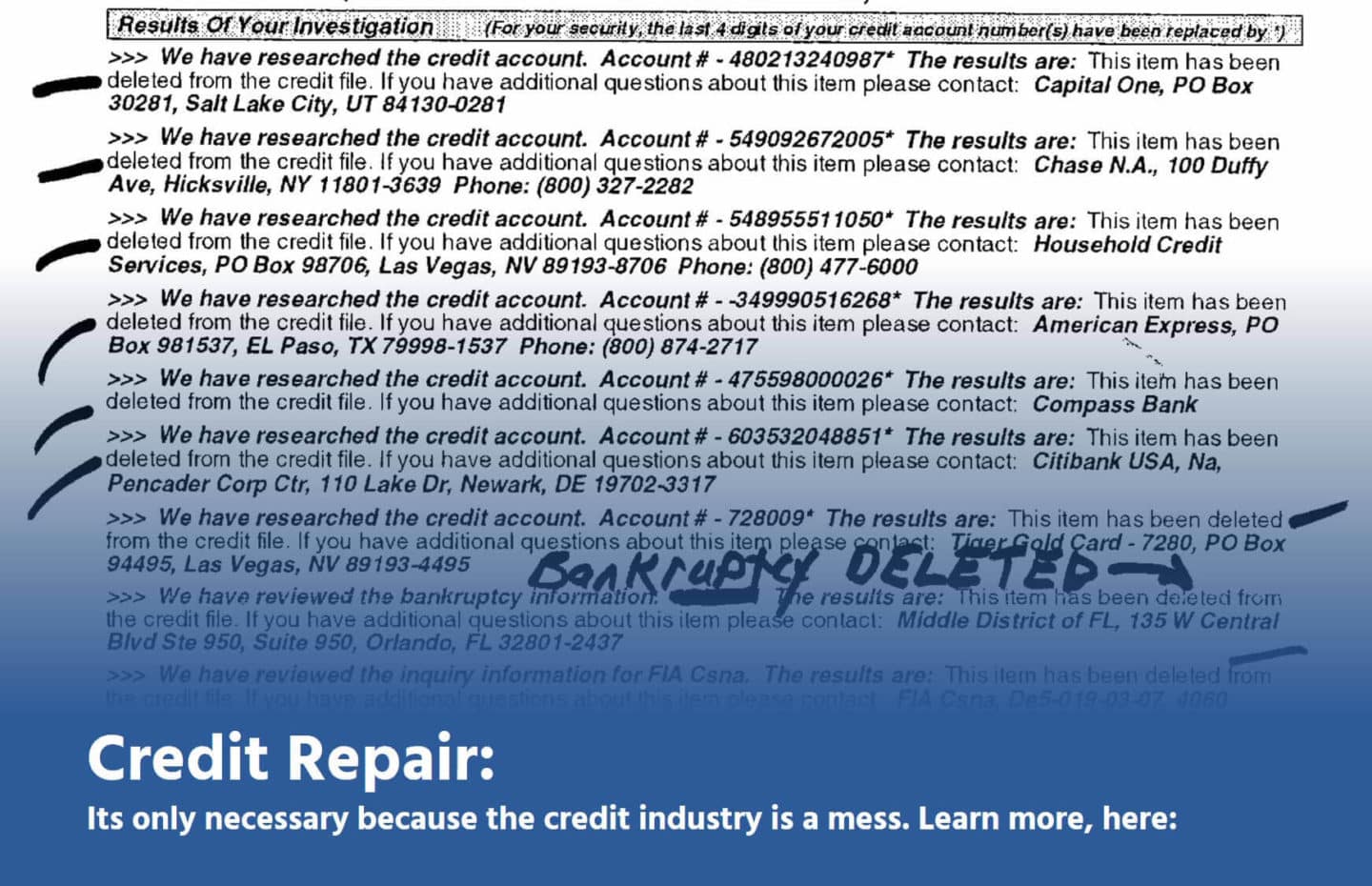

CREDIT REPAIR

Hey Kevin, I assume you hit the send button before you finished your question, so just post whenever you get a chance and we will answer. Thanks!

I have about 8 derogatory credits on my file. Is this guy CORY a repair guy or a middle man.

I have three mortgages that were paid on time with my LLC. I would like them reported to my personal credit since I was the guarantor. Is there a way to do this without a mortgage pull. Please advise.

What a great question. I don’t know the answer. I suppose it’s completely up to the bank on how they report it. I’d suggest you ask them. However, it seems you paid them off, right? It’s nearly impossible to get them to change reporting status after the fact.

You made a good point that for credit repair to work, skilled services are needed. My aunt is planning to look for such a service soon because she’s in the middle of downsizing her lifestyle. Perhaps by getting a credit repair service, she will be able to managed her debts easier.

Hi!

How long do the tradelines stay on your credit report?

Is it just a one-month run for a short term boost to meet a specific goal, or does it help long term? Thanks!

Please call me regarding tradelines.

I want to open a credit repair business and need to add tradelines to my new customers to boost their credit scores up. Can I use the same tradeline i purchase from you more than once ?

Thanks,

Jaime Sanchez