Table of Contents

Yes.*

*Adding someone to your credit card can help their credit score. However, it depends on many factors. In fact, it’s possible to hurt someone’s credit score by adding them to your credit card. Here’s what you need to know.

As an aside… just so we’re all on the same page: when we say “adding someone to your credit card” to “help their credit,” we’re talking about tradelines (or “seasoned” tradelines), a concept sometimes referred to as “piggybacking” credit. I’m not referring to adding someone as a joint account holder.

Things you should know, for your own good, before adding someone as an authorized user.

- Don’t give them the card. If your intention is limited to helping increase their credit scores, there is no reason to give them the actual authorized user credit card (there are many reasons not to). If you want them to have spending ability, that’s fine. Otherwise, you’re risking charges made on your card by someone who does not have any obligation of repayment. That’s right: an authorized user does not have a repayment obligation on your account.

- Don’t add someone if they have a CPN. If you don’t know what a CPN is, please click here to educate yourself, immediately. Bottom line: Never add anyone as an authorized user to your account unless:

- You know for a fact you’re adding the tradeline to their social security number

- You’re certain that you’re not adding the tradeline to a CPN.

- You know for a fact that, even if you’re adding the tradeline to their social security number and not a CPN, they do not possess a CPN.

Things you should probably know, for their benefit, before adding someone as an authorized user.

- Make sure your card is in good standing. This is obvious, but it’s much like a technical glitch with your computer and some IT guy comes in and presses the power button. So, let’s start there first. Make sure the account has never missed a payment, that the balance is below 30% (but 10% is better), and that the account has more than 24 months of history, etc.

- Don’t set them up for failure. If you anticipate ever missing a payment, remove the authorized user first. Missing a payment could hurt their credit… badly. Don’t get added to a person you don’t trust to continue making good payments.

- Don’t just add any card. We’ve discussed this quite a bit. While it is true that any card in good standing will probably positively impact the authorized user’s credit score, there are cases where you could hurt them, too. For example, if the tradeline is too large and does not “represent the authorized user’s creditworthiness,” an underwriter can disregard it, entirely. Or, if the payment history, etc., is good, but the balance is too high, you could hurt their debt to credit ratio.

Can you make money by adding someone to your credit card to help their credit score?

Yes. In fact, if you plan to make money with authorized user tradelines, you’re better off working through a company, like us (Superior Tradelines, LLC), because we have years of experience in doing just that. Short of starting your own business, you would have to work through someone else. We can guide you through the issues outlined above, provide a source of leads and handle payments.

Looking to increase your credit scores with authorized user tradelines? Click here.

If you want to increase your client’s credit scores with authorized user tradelines, click here.

If you’re looking to earn income by adding others as authorized user tradelines to your credit cards, click here.

We hope that was helpful!

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Will adding tradelines help me get approved for credit cards?

Approvals for credit cards require more than just purchasing tradelines for sale. Will tradelines help get you approved for credit cards? Possibly. There’s a really two ways to look at this: 1) Manual underwriting 2) Automatic (or computer/algorithm).

Manual underwriting:

I can’t answer you, because I don’t know what’s in your credit report. As a result, I can’t tell you whether or not your credit score will increase enough from adding tradelines to be approved for credit cards. Also, I don’t know with which banks you’re applying. As a result, I don’t know what their underwriting procedures area. So, what do I know? 🙂

Automatic (or computer/algorithm).

In the case of automatic approvals, such as in the case of online applications, you have a much higher chance of approval, assuming your credit scores increase to a particular level. Also, if you have any significant negative items, like charge-offs, late payments or collections for credit card accounts, don’t even both applying until those are resolved. That aside, how do we know what level of credit score is required? Here’s a really cool trick / resource.

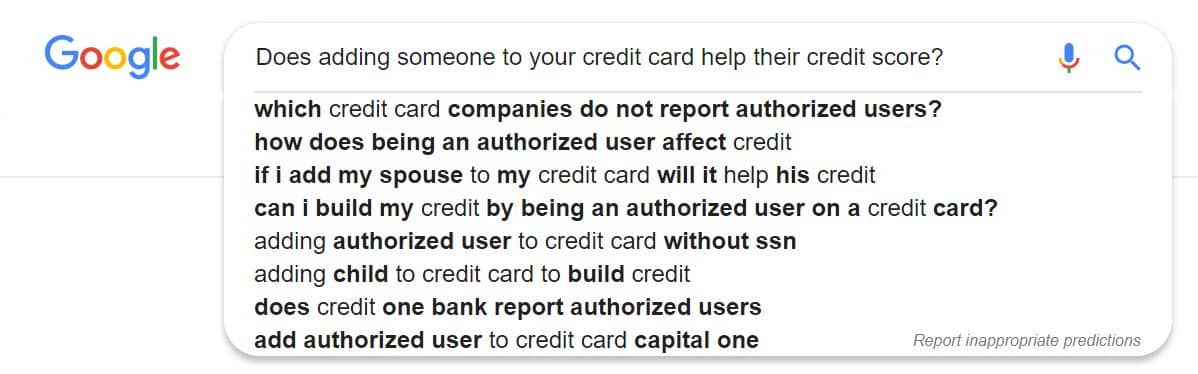

It’s called creditboards. Go to their website, and click on “credit pulls.” Once you’re there, you can search a state, bank, etc., and you will be given results (like the image above) of real people who have recently applied for credit cards. You will see whether they were approved or denied, what credit score they had, the lines of credit their received, etc.

So, once you have this knowledge, you can use our service to add tradelines. From there, you can apply for the lines of credit you’re looking for.