Often, our clients want to know how long do tradelines take to report and post to their credit files. Each tradeline is an account that reports monthly. This means, the bank collects all the information associated with that tradeline (the age, limit, balance, payment history, authorized users, etc.) and sends it to the credit bureaus. This, usually, happens every month. However, some banks report weekly (especially store cards).

So, in order to have the tradeline added to your credit report, you must have been added to the tradeline prior to the bank collecting all of the information they will eventually send to the credit bureaus. The closer to statement date (also the date on which they collect the tradeline’s information) the less likely you are to report on that cycle.

The sooner you are added, the more likely you will be included in that information the bank collects to send to the bureaus. To determine how long do tradelines take to report, you must consider when you apply to be added to the tradeline and when the statement date for the tradeline is.

Table of Contents

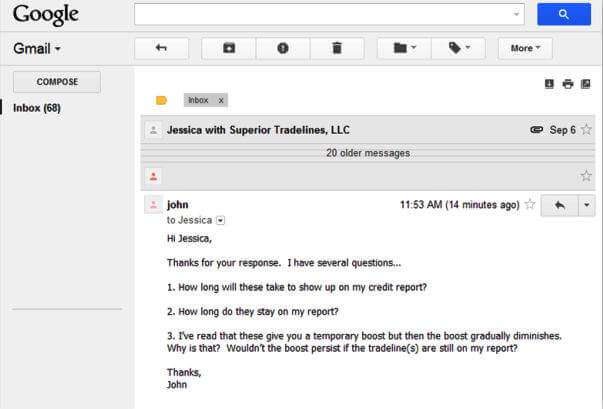

How long do tradelines take to show up on my credit report?

One more relevant piece of information… once the bank sends the information to the bureaus; it usually takes about 3 to 5 days for the credit bureaus to update the information. That brings us to the most common tradeline questions asked by clients, followed by our answers. These questions usually revolve around timing and how long do tradelines take, in general.

Now, let’s put this information in practice to answer the question. Let’s say the statement date of the tradeline is the 1st of the month. Let’s say we add you to the 15th, which is plenty of time for the bank to collect this information.

After the bank sends this information to the credit reporting agencies, they update the reports affected 3 to 5 days later. In this scenario, it took 20 days to have you listed as an authorized user (15 days for the statement date, and 5 days for the credit bureaus to update reports).

A less desirable scenario is that you were late submitting your order to us and you were added to the tradeline too close to the statement date.

This could prevent you from being added to that first cycle. As a result, you’d have to wait for another reporting cycle, which is 30 days. You just went from 20 days to 50 days. In the worst case, there are security freezes, fraud alerts or other issues with your credit file that prevent the tradeline from reporting at all.

How long do Tradelines take or stay on my credit report?

Tradelines can stay on your credit report for years. They can also fall off in as little as 45 days. However, and as explained here, you should concern yourself more with utilizing the benefit of tradelines as soon as possible without regard for how long it stays on your report.

And, as explained in the answer below, the impact of the tradeline does diminish over time, so even if it is on the report years from now, it might have little effect whatsoever.

I’ve read that these give you a temporary boost, but then the boost gradually diminishes. Why is that? Wouldn’t the boost persist if the tradeline(s) are still on my report?

The reason the impact of authorized user tradelines diminishes is a result of the way it reports. Let me explain why the impact of other types of tradelines remains.

Let’s say you have a collection pop up on your report tomorrow. The recent reporting of that negative item is going to severely damage your credit and your credit score. Let’s call it a 150 point decrease from day one. Let’s further assume you just ignore it and do nothing. They’re (the collection agency) going to report again next month, the same information.

Your score decrease remains at 150.

Let’s say a few months go by and they stop “actively” reporting it (reporting every month). So, the collection is now 3 months old.

Your score decreases probably about 120 points.

Let’s say 24 months go by and they haven’t actively reported it.

You’re probably sitting on a 50 to 75 point decrease.

Let’s say it’s 5 years old.

That might represent a 25 point decrease.

**Please note, these are all made up numbers to explain how stuff works conceptually. The exact numbers will be different for each situation.**

Another look at the examples:

Now, let’s take that idea and reverse it. When we add a tradeline, you will see an instant increase in your credit score on day one. Since we are not “actively” reporting it (in other words, we’re not going to report the same data every month), it will be inactive.

It will remain on your report, it will just be inactive and time will go by since the last time it was active.

So, let’s say you got a 100 point increase on month 1, well, you might only have a 95 point increase on month 2. Then maybe a 65 point increase on month 3, a 50 point increase on month 4, a 10 point increase on month 12, etc.

So, while the question is important, the time it takes you to utilize the impact from your tradeline is much more important. For example, you wouldn’t want to boost your score 100 points on month 1, wait six months to find a home, another 2 months from offer to closing, etc., and then expect your score to be 100 points higher than it was.

Instead, you’d want to take advantage of the boost as soon as possible. This means, have your house picked out, have your finances in order, all preparations for the mortgage application… then add the tradelines and pull the trigger. This way, you receive maximum benefit from the tradeline.

Interested in tradelines?

Contact us at info@superiortradelines.com

Updated: November 4, 2021

Kate is a managing member of Superior Tradelines, LLC. She manages and coordinates the company’s operations and makes sure clients are assisted with care. You can contact Kate directly by calling: 321-328-0908 or by email: kate@superiortradelines.com

If I paid a guy for 2 tradelines on 8/28/14 how long should the process take. And also can 2 tradelines be added at the same time. He also stated that one tradeline was on already but not to check my credit report yet cause I could mess something up.

Hello Ephraim,

Tradelines post within 15 to 45 days (depending on a few factors). You can read this: https://superiortradelines.com/tradelines-questions/how-long-do-tradelines-take/ and this: https://superiortradelines.com/tradelines-questions/how-soon-do-tradelines-report/ for more specific information.

Yes, you can post more than one tradeline at a time, but it is unlikely that they will have the same exact report date and equally unlikely that the creditors, eoscar, and the credit bureaus will act in sync and post them to your file at the same time. So, that question doesn’t really matter as much, unless the company is using that as an excuse for their failure to deliver.

As for “not checking” your report… there are a few limited circumstances in which this makes sense. For one example, they might have added an address to make the tradelines link to your credit report, and if you go around pulling your report (especially with a legitimate hard pull from a credit application), you could remove that address and prevent the tradeline from reporting.

You said you purchased on 8/28/2014 and you posed this question on 10/15/2014 (47 days later), which is the maximum time frame required to have tradelines report to a file. I would certainly follow up with the company as the tradelines should be on your report.

Thanks,

Matias

Do trade lines post in the morning or at night?

Just out of curiosity, why are you asking? The answer to your question, unfortunately, is that I don’t know. They typically report at random and as far as I can think, it wouldn’t really matter if it’s in the morning afternoon or night. As far as credit and goals are concerned, you should look at this venture in a days and weeks time frame, so that you have reasonable expectations. I don’t know from answering your question about when trade lines report, but I just wanted to give you my two cents.

stupidest question ever

He needs to be put on his hands and knees and spanked against a wire fense so everyone can watch

Sounds a little suspect and fishy. You should be able to check and see for yourself.

I agree.

Interested in personal tradelines.

Looking to build my credit score with trade lines. Overall goal is to secure business credit.

Are you sure? Because it looks like you were just promoting your business with a back link. 🙂 If you want to discuss a potential business relationship, please contact us.

Trying to establish a strong credit history,I currently was approved for a capital one credit card,how and should I purchase tradeslines to increase my credit score.thank you.

Well, if you were already approved, you may not need tradelines, right? It seems to me if you’re in a position to be approved, I’m not sure what tradelines will do for you from here. What credit goals are you trying to obtain, aside from the credit cards?

Sometimes one trade line is not enough especially if you have other all debt in credit card bills it will drastically lower your overall credit card utilization

I HAVE NO CREDIT AT ALL REPORTING ON MY CREDIT PROFILE. MY SCORE IS 0 BECAUSE I HAVEN’T USED MY CREDIT IN OVER 30 YEARS.

WILL ADDING TRADELINES RAISE MY SCORE IN TO THE 800 RANGE? ANY SUGGESTIONS?

Possibly, actually. But, you don’t need an 800 credit score… for anything. I think the highest threshold, right now, for any loan is 740. Just wanted to point that out. But, to answer your question, we’ve posted some credit reports showing the results of authorized user tradelines under three drastically different credit circumstances. You can see the last one was the situation you described: three tradelines with NOTHING on the credit report (other than the tradelines added). You can see that here: https://superiortradelines.com/add-tradelines/score-increase-adding-tradelines/

Hi..I want trade lines for my business EIN. Is that possible?

Hello Sharon,

No, it is not possible to add tradelines to an EIN. “Piggybacking” credit requires that you are added as an “authorized user” to a pre-existing account. Only personal credit (on your social security number, which reports to the three major credit bureaus, Experian, TransUnion and Equifax) can have authorized user accounts. In other words, there’s no such thing as an authorized user on business credit. Well, more accurately stated (because you can actually be an authorized user on a business line of credit), business bureaus and business credit score modelers do not factor authorized users. Therefore, you will not receive a benefit, even if you were added to a business line of credit as an authorized user.

What people typically do in your situation (assuming you’re trying to obtain business funding or to other keep your funding separate from you person), is to boost their personal credit to qualify to personally guarantee a line of credit for your business.

Give us a call if you have further questions: 800-431-4741 or email us at info@superiortradelines.com

Absolutely… Look into Net 30 Vendors. Those are tradelines that report to the “Business credit bureaus” but still the banks prefer your business’s existence to be at least 2-3 years old. Net 30 vendors may/may not be the solution for that!

I bought a tradeline on April 11 when do u think it should hit my credit because it’s been 36 days now and I still don’t have no score and I purchased the tradeline from [moderated]

Hello. I had 3 tradelines placed and 1 of them fell off. I have multiple inquiries and want to know, if I get the tradeline replaced – will I be able to get approved for credit and such through creditors. I am having a hard time understanding the process with these individuals. Please everyone help

Henrietta, I couldn’t find you in our system. We’d be happy to help. info@superiortradelines.com https://superiortradelines.com/start/ or call 800-431-4741

I want to boost my credit score from 580 to 700 at least. What type of tradeline would you recommend? Also, once the tradeline has dropped from my credit report, will my score decrease because its no longer there?

Kin, it’s – unfortunately – more complicated than that. You could have a 580 credit score for different reasons and one of those reasons may allow you to get to 700 and other reasons may not. It matters why your score is 580 not that it is a 580. So, we’d have to do a credit report analysis, first. You can get started (it’s free), here: https://superiortradelines.com/start/

Also, for your question about scores dropping after tradelines are removed, see: https://superiortradelines.com/videos/ and scroll down to the How Long Do Tradelines Last video. Thanks!

I am looking to raise my credit score with the benefit of tradelines I dont have a long credit history. I have just recieved 2 credit cards and lost 66 points from a previous 673. Could a seosoned tradeline help me get my score back up?

It could. Also, don’t put too much faith in online scores. At least two of the bureaus were sued by the federal government for providing fake scores (one to the tune of a 32 million dollar fine). MyFICO.com is as close are you’re going to get to real scores. Nevertheless, you could be in a good position to benefit from tradelines, so long as you have little to no negative items. https://superiortradelines.com/start/ to get started.

I’m new to tradeline but noticed it was on my credit report. Is tradeine good to have on your credit report and why is it or why not

A trade line is an account that appears in your credit report so whether or not it’s good depends on what the trade line reports. For example, if the trade lines reports bad information, it’s bad. If the trendline reports good information, it’s good. When you buy trade lines from us, you’re buying someone else’s labor effort and time to add you to a good trade line in good standing to make your credit score increase.

Hi I bought a trade line on December 26 and the statement date is December 31 when shall I see on credit report ?

Belle, I looked you up in the system to see if you were a client. If you were a client, you would have received a contract, a notice about reporting sent to your email and phone via SMS as well as a live status in the member’s area. I don’t bring this to say “you should have bought from us” 🙂 I bring it up because you should have received some kind of information about when the tradelines will report from the company from who you did buy tradelines.

Since you’re not a client of ours, I can only give you general advice based on a “typical” transaction. First, it actually depends on the card. Some cards report more than once per month. Also, sometimes there’s a gap between the statement date and the date on which the tradeline reports to the credit bureaus. Another issue might be the fact that the statement state by the company might not be correct.

But, since you said the statement date was the 31st, we will go with that. It shouldn’t take longer than 3 to 5 days to report after the statement date. It’s the 10th, today. If it’s not there, it probably won’t be, this cycle. Meaning, you’ll have to wait for another 30 days.

Thre’s a few issues that may have happned. The dreaded one: the company didn’t do what they said. But, that’s pretty issue to address. Let me know if that’s the case and I’ll tell you what to do.

Alternatively, the 26th is pretty close to the 31st. Did you close on the deal early in the day? Was the payment processed? Did the company comply with the 3-day cancellation period required by law? If so, you were probably actually added on the 29th or the 30th. I’d say that’s too close and you probably missed the reporting cycle.

I am not a betting man, but if I were, that’s my guess: they shouldn’t have sold you a tradeline that close to the statement date.

I would be happy to help if you have any other questions.

Trying to raise my score to mid 7s.my fico is 692,my equifax is 711 and my trans is at a low 676,nothing negative on my buerues but also not enough credit so my question is how many trade lines do i need to get to the mid 7s ?my goal is to get approved for the amex platinum and the chase card

Perfect. You sound like you’re in a perfect position to benefit from trade lines. You should get started right now so we can find you a good deal:

https://superiortradelines.com/start/

At your convenience, we can go over the options with you so that we can discuss expectations, Etc.

Hello. I have a pretty complicated mix of debt on most of my credit reports. However, my Transunion – which is my middle score (599) according to myfico.com (which shows you your Equifax 5, your Transunion 4, and your Experian 2 by the way and costs 30 bucks) has only 1 collection left on it. I’m sure more information would be helpful but would a tradeline help to boost my Transunion score significantly? My highest score – Experian – is a 635 but it has more negative debt reporting on it than the Transunion, strangely. Would my Experian experience any improvement at all?

My credit score is 560 and I have 16 open credit cards – all high interest. My oldest credit age is 5 yrs. and lots of new one bringing my average credit age below 3 years. I am 95% maxed out with a total debt of $12,500. The good news, I have 100% payments on time.

I want to take out a debt consolidation loan, would a trade line help raise my score… and what would you suggest? Thank you.

I paid a guy to add a tradeline on my credit report for a boost. It posted a couple days ago but my credit score only went up a few points (literally a few). I mentioned it to him but he says that it hasn’t ‘hit’ yet. Should I be concerned? I screen shot him where it shows on my report but I’m just curious on if my credit score will still clime verses just interesting a few points.

*increasing a few points.

It depends on many things. First, the excuse of it not “hitting yet” doesn’t make any sense. If the tradeline is there, you have a new score and it isn’t going to go up any more than it has already. Few questions: is the before and after source the same? What is the source? Sometimes, online sources do not factor authorized user tradelines correctly. And, by “correctly,” I mean it isn’t using the same score your lender is going to use.

Ultimately, the score will not climb. Once the tradeline is there, you have a new score.

However, you need to check a legitimate source for scores.

Based on the limited information I know about your situation here, and the answer the guy gave, I’d say he is inexperienced (or lying).

But, your real problem is that you don’t have a recourse. Tradeline companies don’t sell score increases, they sell tradelines. So, it’s important from the start to work with a company that cares about your scores/goals and isn’t tricking you into buying with the “best” prices.

You should get a free credit report analysis here.

Out of curiosity:

1) What is the name of the company?

2) What was your before and after score?

3) What tradeline(s) did you buy (age, limit, balance)?

The name of the guys company?

My credit score before was a 566 (Trans) and it went up to 572 with the tradeline added. The tradeline is 2 yrs 7 months $5300 limit and balance is $99.

And it’s a discover card. Actually shows up as discover financial services on my credit

Okay, so prior to adding tradelines, we would do a credit report analysis and inform you whether we believe tradelines will help. In the case of a 566 credit score, I am not sure any tradeline would work (it would really depend on why it’s 566). But, regardless, a $5,300 tradeline with less than 3 years of history isn’t likely to do anything (in fact, it could make things worse if it pushed you into a different score card, which isn’t likely, but just thinking to my self as I type).

What has happened in the tradeline industry, which has a low barrier to entry (anyone can put a website and say “give me money and I’ll add you to a good tradeline”), is that people are putting the cart before the horse. They’re going through the motions: get money, add authorized user. Before that, the only way they can get clients is to undercut (in price) legitimate companies that know what they’re doing. Then, after a few years of upset clients, they start to figure out how things actually work and either go out of business or start doing things correctly.

Sorry, this is more of a stream of consciousness than helpful, but it’s good to know for you and other clients.

With a 566 credit score, I’m willing to bet you have negative items in your credit report that need credit repair and that NO tradeline would help increase your credit score to any meaningful (approve-able) level.

I would recommend filling out a form here: https://superiortradelines.com/start/ or calling us at 800-431-4741 to get the truth about what you need to do in order to achieve your credit goals. As a person who sells tradelines for a living, I am telling you that tradelines are probably inappropriate at this point in time, that you probably need credit repair first. We’d be happy to confirm that with a free credit report analysis.

Thank you so much for your very detailed response! The first thing I did was pay for my credit to be repaired, which he is in fact still working on. Things just got all out of wack and the tradeline was added before the credit repairs were completely handled (I say that because I received mail from Experian wanting me to pretty much state that it’s really me wanting to dispute things off of my credit…. which was a little weird to me but nevertheless I did it so the repair could move forward). So it’s like I’m waiting for that to be taken care of as well. I just hope it all works out. But I will most definitely be checking out that website you gave me to see what you guys think once seeing my credit. I know a lot of the negative impact on my score is college loans which the ‘credit guy’ told me could be consolidated. I just want to try and get things fixed because I have a business I’m wanting to start which was why he suggested to tradelines in the first place.

Very good. It’s a good suggestion (tradelines), generally. But, sometimes they don’t work (like in your case). So, you’re doing the right thing by researching, which we can help you with pretty quickly in one call. Hope to hear from you soon!

Hi, my credit scores average from 620-660. I have 2 auto loans, 3 credit cards, 2 retail cards, and one small limit of $450. The most negative thing on my report is some late student loan payments and one very recent late payment on a retail card. Would a tradeline be beneficial for me? I’d like to get approved for a home loan in 6-9 mos from now. Will this help me ?

Elissa,

Great synopsis. It was helpful. Right off the bat, you should not be buying tradelines… yet. If you’re 6 to 9 months away from the purchase, any score increase from adding tradelines today would be gone by the time you purchased your home. You want to time tradeline purchase with your credit goal.

6 to 9 months is an eternity when it comes to credit. Meaning, you have plenty of time to address those negative items. Make sure you don’t make any more mistakes, though. Once you’re 60 days out, give us a call and we’ll be glad to help. Also, if you need a recommendation for someone to help those negative items, let us know and we will give you a contact.

Hello , I am new to this Tradeline thing . From my understanding, it’s very beneficial and takes patience when it comes to results . It’s a different story when someone tells you it takes “7–10” days and you’re checking your credit score every hour once the 10th day arrives . I guess you can say I worried . I was told that my Tradeline should CLOSE on the 10th and 7-10 days after I should see a score . As for my 2nd Tradeline , it should close on the 16th and take 7-10 days to post.

Well, it’s the 20th . I checked my score at midnight , (I know , impatiently right?) and it still didn’t show up . It’s now 6AM and still no results . Could this mean the bureaus are “slow” , if that even makes sense . Or maybe 7-10 isn’t realistically the timeframe …

If that’s the case , then there’s no telling when I’ll see a score . I guess my main question is , is there a specific TIME when I should see a result . I thought changes would appear at midnight . Not sure . Thanks!

Hey Shan, I looked up your email and you didn’t buy tradelines from us. From who did you buy tradelines. From the information you provided, it sounds like someone was misleading you a bit. First, tradelines do not “close” like loans. There are relevant dates, like reporting date, statement date, etc. But, they don’t “close.” If they’re adding you 10 days from the statement date, that’s pretty close. There’s a chance you could skip the reporting. So, that’s problem number two. Third, the bureaus are not slow or fast. They will do the same thing every, single time. There are other reasons the tradelines might not show up. For example, you may be added to an account that needs an address sync. You might have fraud alerts or security freezes, which will prevent the tradeline from appearing.

A legitimate company would give you an expectation and a date when you should see the tradeline on your report and they should e able to handle non reporting, very easily.

As far as scores go, you will have a new score immediately at the moment the tradelines report.

Hope that was helpful. If it doesn’t work out, get a refund and come work with us and we’ll get the job done, correctly. https://superiortradelines.com/start/

Thank you for your quick response. I purchased my Tradelines from a business here in Texas . She/The Company helps add Tradelines to clients accounts depending on the goal they are trying to meet for their credit . I purchased from her on April 7th and she told me the first Tradeline will close on the 10th and it would “post” or appear 7-10 days . It’s 11:33AM , 20th of April , no change . Okay I see . So they don’t necessarily “close” . Thanks for that fact . I also didn’t know the bureaus have a “fast -slow” move . I thought it was all the same as well . Maybe I should wait longer . I’m trying to purchase a car and I’ve already spent my money on Tradelines to help . If nothing happens , will certainly get a refund .

Also, part of being a good tradeline company is customer service. I know nothing about the company form which you purchased, but I would suggest you should contact them/her. The company should absolutely be answering this questions for you. I don’t mind answering, at all, but I feel a little bit helpless, since I don’t know all the details about your order.

There could be a sync issue, which they will have to add the card holder’s address to your credit report. What was the bank associated with the tradelines you purchased?

Also, you said auto loan. Did you have any previous (good or bad) payment history for auto loans? If so, tradelines may or may not help, at all. Auto enhanced credit scores factor authorized user tradelines differently than other types of scores.

Hello,

I have a credit score of 650 to 720 depending on what credit bureau you check. No late payments, or, collections. About 16 accounts, 6 used with a total revolving debt of $29k. About 90k in student loans, no late payments, and are in repayment status with a gov loan forgiveness program. I’m currently at 50% of my available credit. I would like to apply for a home loan. Do you think a tradeline would help? If so, what type of tradelines would be suggested (limit and account age)?

Hello! It’s a great question. I honed in immediately on the fact that your student loans are derogatory. I don’t know all the facts here, and I don’t know which bank you’re going to use, but there’s a very high chance, like 90% or more, that you would not be able to get a loan, no matter what. You would have to bring those student loans into good standing.

As far as your credit scores go, keep in mind that online credit scores aren’t real. So, your scores maybe and likely are much lower.

Keep the first sentence in mind as you read this next sentence. Tradelines do not help you get approved for loans, they help you increase your credit scores which could help you get approved for loans. I say this because we could add tradelines that increase your credit score is but you could ultimately be denied because of the student loans.

With that said, you would want to attack your debt to credit ratio and usage. I do think you could see some benefits from trade lines, but I’m more concerned with those student loans. I saw that you just signed up, which means you’ll be talking to one of my guys shortly. That’s the best way to get the best answers.

By the way, depending on the bank and the deal you find, sometimes you’re able to roll student loans into a mortgage to satisfy them. Clearly, you would have to have the equity in the deal. Which, these days is not that likely. However, it’s something to think about.

I found this useful

I want to piggy back and use an authorized user to boost my credit. I currently have no credit history, so how long will it take for my credit score to boost

I would like to purchase a tradeline to help improve my payment history from 94% to 98-100%. Will obtaining a tradeline help with this?

I bought a trade line to boost my score (not superior tradelines), the representative asked me to check my report about 35-40 days after the initial transaction. 8 days after the monthly cycle date of the line but it had not yet. He then tells me to remove my address from my credit report and put a different one that I’m assuming is the line holders address. Is it wise to change that information on my report??

I am trying to refinance my car for a trade-in for something better. Should I go within that reporting period dates to the dealership so I can get the car with a lesser note?

Will Tradelines help me get a car? looking to finance a hellcat redeye. i want to make sure i have the best credit score to secure a comfortable affordable loan. credit is 600 right now looking to get it to 700-775 range. how many tradelines should i buy? and how long do they take to show on credit report? so i can be able to try to get a good rate on the car