Look, it’s this simple. You don’t know your credit score. In addition, you don’t even know what “credit score” is (that wasn’t a typo).

This is going to be a “did you know” type blog with a touch of “thanks for misleading us, credit score industry” attitude.

Did you know you have multiple different types of credit scores? Here are a few:

- FICO ’04;

- FICO Classic;

- Beacon 1 through 5 (and some new beacons we can’t even verify are released yet);

- FICO Classic II;

- FICO ’08 (which isn’t even used);

- Plus Scores (with a bunch of variations);

- Vantage Scores (even more variations);

- A multitude of online scores which merely mimic these so-called “legitimate” scores (which are pretty much useless).

In fact, we could create a “Superior Tradelines Credit Score”, which would have absolutely no impact on the lending community or consumers and I am sure we would have a lot of consumers buy it simply because it says “credit score” in it. We aren’t going to do this, because we like to tell the truth to our clients and visitors. However, don’t think for a second that hundreds, if not thousands, of companies, are doing exactly this right now as you read this blog… that is, they are selling you fake credit scores.

We tried to reframe the question “what is my real credit score” as well as “where can I get my real credit score” and we encourage you to read those blog posting.

Table of Contents

Credit scores; show me the numbers!

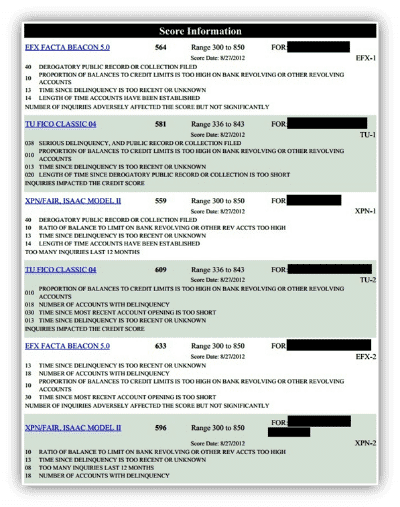

Here’s a score report from a “legitimate” tri-merge (hard pull) credit report for a husband and wife. Note the difference in scores (their names, not the numbers).

Another notable issue is the difference in score ranges. Could you tell me on which range is your credit score? 330 to 830, 350 to 850?

Who knows, right? Scores range anywhere from 330 to 830 and 501 to 990 (and every variation in between).

We pulled out our magnifying glass and found this gem on Vantage Score’s website: “It’s important to note that different models use different ranges.

The VantageScore™ range is 501 to 990.” Doesn’t this disclosure clear everything up for you? FICO, sure; you’d be at the higher end… but Vantage, you’d be smack dab in the middle.

Credit scores; How many scores are out there?

We’ve listed a few of the many different score models at the top of this blog, but according to an expert at Experian, there are more than a thousand. “In fact, there are many different credit scores used by lenders and other businesses, with a wide range of scales, some estimate more than 1,000.”

Credit scores; the many and why this matters.

Why does all this ranting matter? Well, let’s say you rely on these fake score you get online, you prepare for your new mortgage application, already found your house, have a pre-approval and you are getting ready to move forward.

You mortgage broker pulls your report and you are 60 points off from the score you got online. Now you have to figure out why, you lost time and maybe even the house you wanted to purchase, you may need credit repair or tradelines… either way, you were misled by fake scores.

Our advice: Focus on the report, not the score.

Yes, credit scores are a quick and easy tool that lenders can use to view creditworthiness. Did you see what I said – it’s a tool for lenders, not consumers. This score actually has little meaning to you as a consumer. Further, as mentioned above, the credit scores that you get online can be wildly different than what a lender sees.

So what’s our advice? Rather than focusing on the score itself, focus on the content of the report. If you’re trying to get approved for a loan or credit card, make sure that you have no negative items on your report (i.e. late payments, collections, lots of inquiries). Should you have negative items on your report, consider credit repair. If you are looking to increase your scores by adding positive information consider buying tradelines.

If you don’t where to begin, start with a free credit report analysis and recommendation. We can help determine what will most help you achieve your financial goals.

Updated: November 4, 2021

Kate is a managing member of Superior Tradelines, LLC. She manages and coordinates the company’s operations and makes sure clients are assisted with care. You can contact Kate directly by calling: 321-328-0908 or by email: kate@superiortradelines.com