As a proponent a leader of the tradeline industry, we, of course, write quite a bit about how adding positive lines of credit to your credit report can increase your credit scores.

We tell you all of the good.

However, in our consultations with clients, we often tell them the bad things they should avoid.

We’ve never really written about it, though.

So, we wanted to write this blog post about the ways in which tradelines may not be able to help and reasons you shouldn’t buy them if you fall into these categories.

Table of Contents

#1) If you are strapped for cash, don’t buy tradelines.

Sometimes we have clients with the best intentions in the world.

They ask if we can do payment programs.

Or, even more extreme, they ask if they can pay us after they get new lines of credit and they will charge our fee to their new lines of credit (i.e., their new credit cards).

We applaud and appreciate this creative thinking. However, our position has always been this:

If you can’t afford the tradelines, you can’t afford the payments on the lines of credit you’d acquire as a result.

It’s not that we are playing hardball negotiations.

On the contrary, it’s that we care about our clients and would never want to put them in a financially unstable situation by getting them into credit lines they can’t afford.

#2) If you have extremely damaged credit, don’t buy tradelines.

We turn down clients and recommend credit repair quite often.

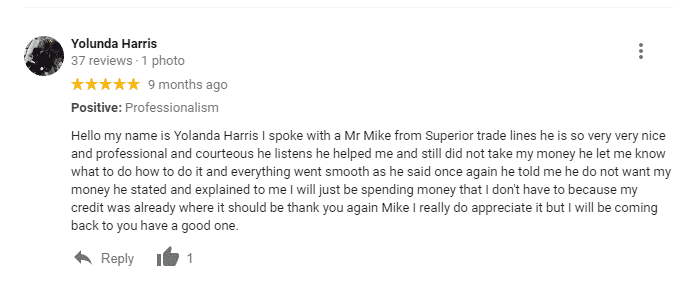

Some clients appreciate our honesty and integrity and thank us for not taking their money.

Other clients, however, get frustrated and say:

If my credit were good, why would I need you?

This position seems to make sense, but it overlooks the distinction that not all credit is the same. There are different degrees of “bad” when it comes to credit.

What if your credit is excessively damaged?

For example, recent collections, recent late payments, recent charge-offs, etc.

Tradelines may have a positive effect. But that impact will be minimal at best.

Let’s say your credit score was 400 and we got you a 150 point boost and your new score is 550. This is a useless score improvement.

Think about it this way:

If you need a 640, it doesn’t matter to a lender if your score was 0, 22, or 639.

Either way, a lender can’t approve you.

This is why we ask for credit reports from our clients and discuss their credit goals with them. We want to make sure they actually benefit from our services. And, if we think they cannot benefit, we recommend other services.

3) If your goals don’t make sense, don’t buy tradelines.

Some people have the misguided notion that tradelines open the door to cash, or will make their business model succeed, etc.

We wrote about buying tradelines for business funding and when it makes sense and when it doesn’t.

We encourage you to read that post because it explains well what we mean here.

If your goals are not well settled, tradelines could act to exacerbate the issues.

Read also the top 5 mistakes to avoid when buying tradelines.

Conclusion:

Tradelines are powerful credit enhancement tools, but they can be misused.

If you are unsure about your credit situation and whether or not tradelines will help or hurt, get in touch and we would be more than happy to discuss your credit situation with you.

I think you’ll discover very quickly that we are here to help.

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

Super cool of you guys to be honest like this. I personally don’t know whether or not I am qualified for tradelines at this point. I wish there were some bright line rules for this stuff, but I guess the credit industry keeps this score stuff secret for a reason 🙁 I will be calling you guys shortly. 🙂

Marsha, you’re spot on. The credit bureaus and credit score modelers keep their math secret. But, we’re referring to reasonable credit situations of the client. While the particular details are unknown, to some degree, we can can make an educated (or “experienced” rather) guess as to whether or not you’re qualified for tradelines. Credit reports and score calculations are not complicated in the sense that people cannot comprehend them, they’re just merely abstract and arbitrary. So, overtime, we see what works and what doesn’t. We look forward to speaking with you.

Thanks,

Matias

I have applied for credit cards and I get turned down. Its not that i have damaged credit, they just tell me that I don’t have any credit. I am 20 years old and have never had anything in my name. I cant figure out how to break out of this cycle. With a score of basically zero, would tradelines be a good idea for me to start with credit or do I need credit to add tradelines?

Your situation describes the perfect candidate for our services. This is one of the main people we help. We could help by adding tradelines to your file. First, I recommend that you call a family member or a friend (you trust and trusts you) and ask them to add you as an authorized user to their credit cards. Make sure the cards are in good standing (never late, low balance, older the better). Once added, your scores will go through the roof. Then, tell them to call us because we can help them monetize the exact process they helped you with. If you don’t have someone in mind, then give us a call at 800-431-4741 or email us at info@superiortradelines.com so we can discuss your goals and help you find the right tradelines. Basically, you can get this done for free if you know someone willing to do it. Or, you can pay us to do it for you. Hope that helps!

What exactly is the fee for your service. Well the range rather, as I’m sure there are different prices for different situations.

Thanks in Advacne

Hello, our prices range, depending on a lot of factors, between $600.00 and over $1,000.00 per tradeline. Also, we have discounts for packages and we run specials quite often. Give us a call at 800 431 4741 and we can discuss specifics. Thanks,

do you offer credit repair ive read a few post and dont see a clear answer maybe ive overlooked it thanks for the answer…

Mark,

We do not offer credit repair. However, we have (literally) hundreds of credit repair companies in our network. We often refer clients to these companies if their credit is not yet ready for tradelines. If you have further interest in credit repair, please contact us and we will connect you with a legitimate credit repair company.

Thanks,

Matias

I know that no two credit reports are the same and I admire this companies honesty—much respect…my credit is a 550 and I have 3 paid collections which are like 1-2 years old.. then I have 3 collections that are small medical bills under $200 that are like 2 to 3 year old… and I have an american express card that I have never missed a payment on and it isn’t high in usage in which I had for 7 months.

Is it possible to get a 700 credit score in this situation if I was to purchase the tradelines today in my situation?

Jesse, we would have to see your entire credit report (all of the individual accounts) and not just a score. There are real and fake scores, first of all. But secondly, it depends on which (real) score you’re trying to increase. For example, an auto enhanced score, or a mid score on a mortgage trimerge pulling FICOs. Also, I am sure there is a reason you want a “700 credit score”, but I would encourage you to determine if that really what you need. For example, do you need a mortgage, business, car loan, etc.? And, what did the lender say you need for approval? What did they say you need for the best rate? Give us a call at 800 431 4741 and we can discuss all of these things.

Hi I’m interested in purchasing tradelines but I don’t see any price on your website.I agree that if you can’t afford to buy the tradelines then you shouldn’t but without any prices on your website I have no idea if I can afford them or not. Thank you.

Sher, that’s a fair point. But, the reason we do not post prices is two fold: 1) everyone has pretty similar prices (or at least they should). 2) We don’t want clients picking tradelines based on prices, because this is akin to patients picking medicine from a doctor based on price. Give us a call at 800 431 4741 and you will see what we mean.

Question i had a charge off over 24 months ago paid in full i also had several 30 day payments. Iv been paying all my bills on time for the past 10 months my credit utilization on all 6 credit card are 15% and i have no collections or any negative items reporting unpaid iv been on top of everything. would it be ideal for me to add tradelines to boost up my score so i could get funded for higher limit credit cards? My highest credit score is at a 680 could u please let me know what i could possible do. Thank you for your time

Hey James, if you already have six credit cards, you don’t need more. Six credit cards is a lot to handle for one individual. So, I wouldn’t recommend adding any more trade lines (especially not authorized to trade lines which you have to pay for since you are already on your way to good credit by yourself). If you note, I just denied your business and lost money, so you should probably consider what I’m saying is true 🙂

I would recommend challenging the accuracy of any negative items in your credit report which you feel are not being reported correctly. If you are successful in removing some of those negative items, you will drastically improve your overall credit standing. Rather than buying trade lines from us or any other company, you should ask all of your creditors to increase the limits on your pre-existing credit card accounts. This will also increase your credit score.

Overall, I know you feel like you’re in a bad credit situation, but you’re actually in a pretty good one. The storm is over. You’re now in a building and maintenance stage. So your focus should be forward thinking and make sure you do not mess up anything in the future, such as missing payments on a credit card you do have.

Hello I wonder if your service would help me. I’m looking to buy the house I’m currently renting I have some issues with my credit, mainly student loans which all 27 were defaulted I consolidated them to 1 loan after that my score jumped about 100pts to 587. I have only 2 credit cards which have great payment history no late pmts on 1 and a few late payments on the other roughly 4 years ago. I need a 640 mid score for approval…I have collections which were all paid this year.

I hesitate to answer these questions in a comment section on my blog, but it sounds like you may benefit from trade lines. To find out for sure, create a free account so we can do a credit report analysis for you. https://superiortradelines.com/start/

My wife and I are retired but are planning to buy a home next year with the proceeds of the sale of a home she inherited. My credit score is 662 and hers is 560. We both have collections. Two from credit cards and three medical collections. Can a tradeline get us to 750 for a home loan? We will putting down a large payment for the home

Hi there, I have a Chapter 13 bankruptcy filed in 2017, but it was dismissed and no meeting with creditors happened, etc. So, it really was not a true bankruptcy as nothing happened and no relief was obtained. I also have two collections that need to be paid off and I know that credit repair is my first step in moving my credit from the high 5’s (598/593)..but have no credit cards at all and my car loan has had a perfect payment history for a year now. Would i benefit from tradelines now to get to score closer to 700 or should I work to get the bankruptcy ans collections resolved and removed before coming to you? All the information I am reading seems to say that one of the things hurting my credit is that I have no credit card activity. So, I’m confused. And yes, I can afford tradelines–and i agree, you shouldn’t be buying tradelines unless you can afford them. I’m just thinking that buying tradelines might actually just help me qualify for a credit card or two which I can then use to rebuild my credit. Any thoughts would be greatly appreciated. Thanks!