About 40% of all clients with whom we speak about tradelines ask the same question: Do you provide tradeline funding? About 90% of those clients are specifically looking for business funding. The other 10% are looking for business funding as well, but their questions seem to venture into unconventional and perhaps illegal strategies. We wanted to write this post to speak to some of the issues raised by our clients.

What NOT to do with respect to funding.

First, what NOT to do in terms of funding. We’ve all heard about the magical credit sweeps and the infamous credit privacy number (or credit profile number). Neither of these techniques is a good idea, and depending on how they are implemented, they can also be illegal.

Let’s focus instead on things that make sense, rather than those things that merely sound good. While we ruled out mythical creatures of CPNs and credit sweeps, let’s go ahead and rule our conventional funding as well. Why? Because while the small business administration will tell you small business administration loan funds are available, “[t]he negative to a bank is that the loan can often be very hard or next to impossible to obtain,’ says Rick Kahler, a certified financial planner with Kahler Financial Group in Rapid City, S.D. So, the unconventional market has exploded with success.

For unconventional funding, let’s talk requirements.

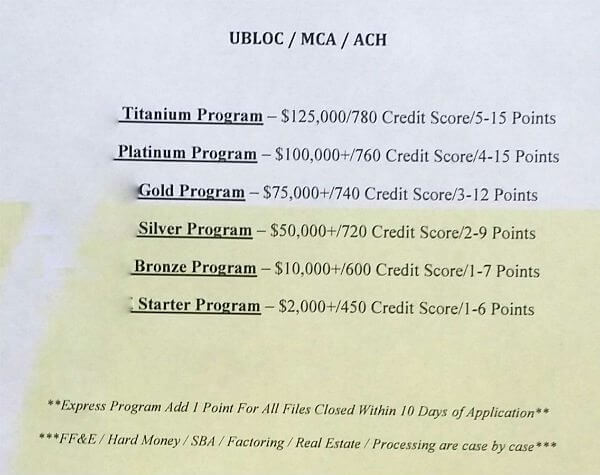

We ruled out certain credit repair and enhancement techniques as well as conventional funding sources. Instead, let’s talk about unconventional funding requirements with respect to your credit standing. According to a third party affiliate in which we place a high degree of trust, here are the requirements for funding:

How do I use tradelines to get funding?

As you can see, lenders are not going to address your funding efforts unless your credit score is sufficient to meet their underwriting guidelines. The first step would be a credit report analysis by a credit expert here at Superior Tradelines. Then, if you need tradelines, we will provide a recommendation for appropriate tradelines. Alternatively, however, tradelines may not achieve your goal and we may recommend credit repair prior to tradelines.

Updated: July 30, 2021

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.

want to increase my score with tradeline

Please give us a call at 800-431-4741, email us at info@superiortradelines.com or complete the registration form here: https://superiortradelines.com/start

This way, we can discuss your situation securely, as apposed to discussing it here on a post comment.

We look forward to speaking with you.

Thanks,

Matias