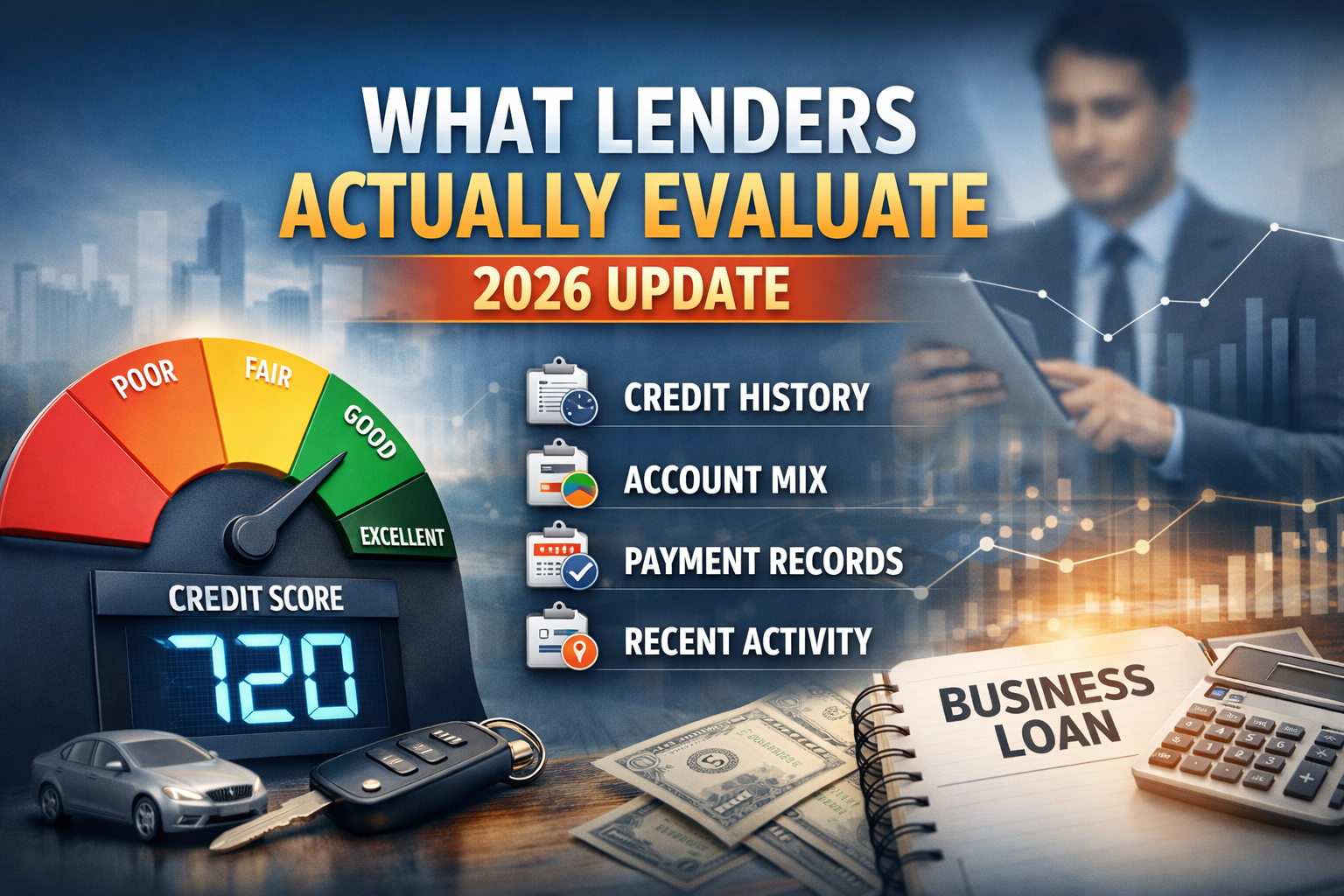

Many consumers are surprised to learn that a decent credit score does not automatically lead to approval for auto loans or business funding. In recent years, lenders have shifted toward a full credit profile evaluation, not just a three-digit number.

A credit score is a summary, not a story. Lenders want to see how the score was built.

Table of Contents

What Lenders Look at Beyond the Score

According to the Consumer Financial Protection Bureau, lenders evaluate several structural factors when assessing risk:

• Length of credit history

• Types of credit accounts (installment vs revolving)

• Payment consistency

• Credit utilization

• Recent activity

A borrower with limited or thin credit history may be declined even with a fair or good score because there is not enough data to predict future repayment behavior.

This is especially common for:

• First-time auto buyers

• Entrepreneurs seeking business funding

• Consumers who have paid mostly in cash or debit

• Individuals rebuilding credit after inactivity

Why Credit History Depth Matters

The Experian explains that lenders rely on depth and diversity of accounts to determine stability. A profile with only one or two accounts does not provide enough behavioral insight for higher-risk lending decisions.

This is why many lenders hesitate to approve:

• High-dollar auto loans

• Business credit lines

• SBA-related funding

• Personal guarantees for business accounts

Where Tradelines Come In

Tradelines are existing credit accounts that appear on a credit report and show payment history, age, and account type. When selected and added strategically, tradelines can help strengthen a credit profile by:

• Increasing average age of accounts

• Improving credit mix

• Demonstrating consistent payment history

It is important to understand that tradelines do not replace responsible borrowing and do not guarantee funding. However, when used correctly, they can help present a more complete and lender-ready credit profile.

Timing and Expectations

For individuals seeking funding within a 30–45 day window, lenders typically want to see a clean, stable report with no recent negative activity. This is why planning, timing, and selecting the correct credit structure matters.

Rushing into applications without addressing credit depth often results in denials that remain on the credit report.

Key Takeaway

Lenders do not fund intentions. They fund profiles that demonstrate reliability over time.

If you are preparing for auto financing or business funding and want to understand which tradeline strategy aligns with your timeline and goals, speak directly with our team.

Call the phone number listed on our website to receive guidance based on your full credit profile and funding objectives

Matias is a serial entrepreneur and CEO of many companies that help people. He owns Superior Tradelines, LLC, which is one of the oldest and most reliable tradeline companies in the country.