What are tradelines and how do they impact credit scores?

Tradelines are accounts on your credit report that show the history of your credit usage. They can be positive or negative and are used by lenders to assess your creditworthiness. Tradelines impact scores by influencing factors like payment history, utilization, and length of history.

Are you tired of being denied loans or credit cards? Is a poor credit score getting in the way? There’s good news for you! Tradelines may be able to help boost your credit score. But first, let’s understand what tradelines are.

There’s a lot to know about this process, so we took the time to write the following information for you. In this blog post, we will discuss different types of lines and their importance in boosting your credit score.

So buckle up and get ready to learn about how tradelines can be the key to unlocking better financial opportunities for you!

Quick tradeline fundamentals.

We want to start with a very basic understanding of what trade lines are so that the rest of this page makes sense. You can skip this section if you find it too elementary, but we would suggest taking just a moment to read through the next few paragraphs.

What is credit? It’s literally nothing. It is a made-up system that we use for banking. Lenders use this system to evaluate potential loans. Our system, however imperfect it may be, allows our lenders to be efficient.

Generally speaking, you begin to have credit as a young adult. So let’s start there. Technically, you start with a blank page. Literally, a blank page because your report will have nothing on it and may not exist at all.

Getting started with tradelines.

In order to generate a credit report, you will have to apply for an obtain a line of credit, of some sort. Typically, when you first start to establish your report, you will apply for a small credit card. Capital One hands them out like candy. Otherwise, most people start with a secured card.

- Some banks, like Capital One, will give you a line even if you have a thin file, meaning you have no history with credit. Even though you have no credit, they can approve you because they trust you and the line is purely based on their trust and belief that you will pay them back in you make charged on that card. This is an unsecured line.

- In cases where you are not approved, you can typically get a local bank or credit union to give you a secured card. In this case, you will secure the line by handing them cash rather than them giving you a line based on trust. This is a secured line. The difference between an unsecured and secured line is that the former is based on trust while the latter is based on pre-paying for a card.

What are tradelines in terms of reporting.

When you do this, that account and your payment history and behavior you establish with it gets reported from the creditor (i.e., the bank, etc. that gave you the line) to credit reporting agencies. These are typically referred to as the bureaus. Legally, they’re CRAs, or credit reporting agencies. They are the ones that maintain the database of information referred to as credit reports. You may recognize their names as Experian, Equifax and TransUnion.

Once you establish that account and it gets reported to the reporting agencies, a report is generated. In other words, an account on your report is a tradeline. This includes:

- Credit cards

- Mortgages

- Auto loans

What are tradelines and how do they work?

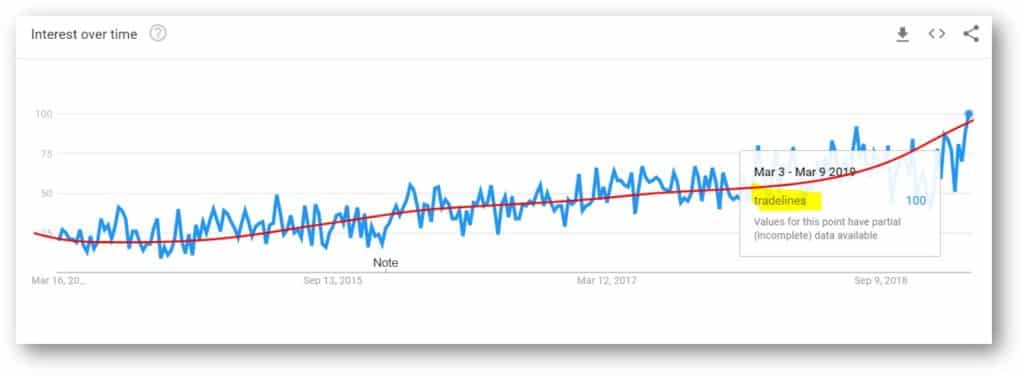

First, we should observe that the term is searched quite often. In fact, searches for the term has increased dramatically over the years. Here’s an example of Google Trends.

We all know that the definition of a tradeline is an account that appears in your report.

But, that’s not why you’re here: You’re here because you want to know what trade lines are in relation to improving your credit and being approved for some other line like a business loan or car or house.

In that regard, we are not talking generally about some previous account already appearing in your report. Instead, we are talking about adding seasoned accounts to your report for the purpose of increasing scores.

Everyone’s heard of “co-signing.” But, did you know you can share scores, too?

Here’s a quick, 60-second video to sum up the page (a longer, more thorough video, later).

Different Types of Tradelines

Those that ask “what are tradelines” might not realize that there are three main types:

- Installment

- Revolving

- Authorized user

Installment

Installment tradelines refer to credit accounts where borrowers make regular payments over a set period. Examples include car loans and mortgages. They typically have fixed loan amounts and regular monthly payments. They play a crucial role in credit history, impacting score and utilization ratios.

Revolving

Revolving tradelines involve lines, such as credit cards. This is where the account holder is given a maximum limit to borrow against. The available credit is the difference between the limit and the current balance. This affects the utilization ratio. Maintaining a low utilization ratio on revolving account is important for a good score.

Authorized User

Authorized user tradelines are revolving accounts that the owner “authorizes” a third party to use. And, the third party (or the “authorized user”) is not responsible for repayment. Being added as an authorized user can positively impact your score.

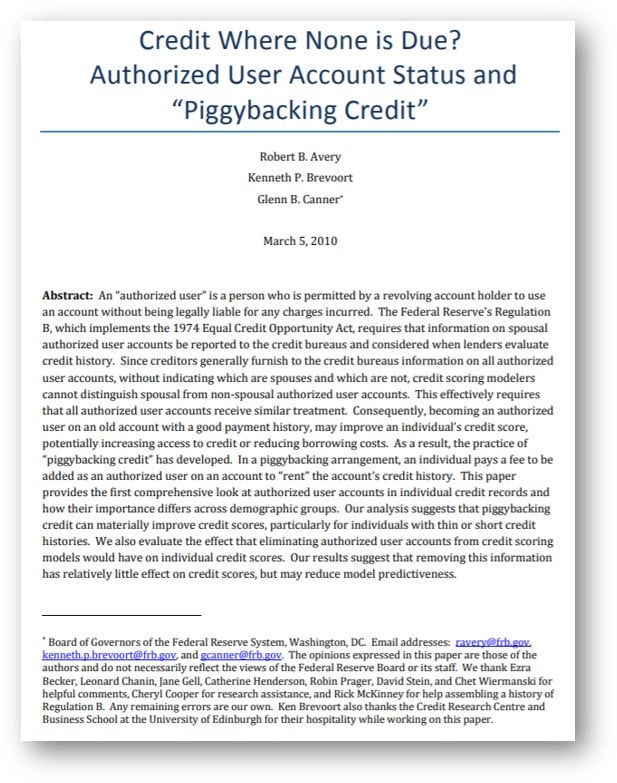

Ahe study, titled “Credit Where None Is Due,” was conducted by the Washington DC. It reviewed the practice of piggybacking. I.e., improving scores through the use of authorized user accounts. I encourage you to read just this first paragraph from the study, below.

Here’s the takeaway(s):

- The law (and regulation) require that information about authorized user accounts be reported to bureaus.

- Becoming an authorized user can increase the authorized user’s score.

- You can buy authorized user accounts from companies and/or individuals willing to add you for a fee.

What tradelines aren’t.

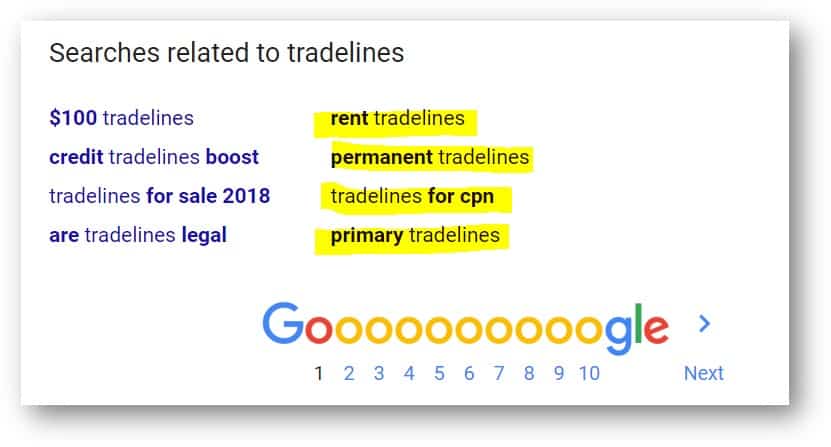

What are tradelines and what they aren’t are both equally important questions. We’ve discussed tradelines, above. You should know what they are, how they help, where to get them, etc. But, what about what tradelines aren’t. That’s a horrible sentence, but an important one. Search engines are really good at showing relevant and linked content based on user searches.

If you start down the rabbit hole searching tradelines, you might end up in some pretty weird places.

In fact, you might end up in some dangerous places. So, here’s a very quick overview of some topics that we’ve discussed in detail elsewhere, but you should know about, here.

Other terms:

- “Renting”

Renting tradelines really means two different things. In the first case, its what we’ve been talking about all along: Boosting scores by being added as an authorized user accounts. In the second case, renting tradelines mean something entirely different. There’s a new wave of companies convert your living residential rent into lines of credit.

- “Permanent”

There’s no such thing as a permanent lines of credit. The only people who discuss permanent lines are those trying to rip you off. They’re just pretending to sell you something different than that which someone else would sell you.

- “CPNs”

We will discuss CPNs in a different article, but suffice it to say you should stay far far away from them. It’s 100% illegal, but that’s not to say you would get prosecuted. There is more than a 0% chance of prosecuted. People are just trying to sell you a “fresh start” that doesn’t exist.

- “Primary”

“Primary” is often confused with authorized user tradelines. Basically, people believe primary accounts are better than authorized users. However, you cannot buy primary line. Anyone that is suggesting they can sell you an aged primary tradeline is likely lying or misrepresenting what they are selling you.

- “Business”

Business tradelines are accounts that appear in a business report. There’s no such thing as authorized user accounts for businesses. There’s no such thing as business accounts which you can purchase the boost your paydex score.

Tradelines are important.

What are tradelines in terms of the importance of credit worthiness?

They play a significant role in scoring and directly influence reported history. These lines provide detailed information about an individual’s account holder, such as the loan amount, current balance, and monthly payments. They contribute to the credit mix, which affects the utilization ratio. The presence of positive lines can boost a score, while lines that represent a negative history can have adverse consequences.

Conclusion

The question “what are tradelines” turns about to be more important and instructive than first thought. They can be a powerful tool to boost your score and improve your financial standing. By adding positive and well-managed accounts to your report, you can demonstrate responsible repayment behavior and increase your creditworthiness in the eyes of lenders. However, it is important to remember that lines are not a quick fix or a guaranteed solution. Building and maintaining good credit requires a holistic approach, including responsible borrowing, timely payments, and regular report monitoring.