Tradelines lists have an implied expectation of costs, results and a company’s legitimacy. Multiple times, each day, we receive emails stating something to the effect of “please send me a tradeline list” or “provide me a list of tradelines”.

Our opinion on tradeline lists.

One of our sales guys compares this question to medicine. He says, asking for a list of tradelines is like asking for a list of medicine to pick through. Both are horrible ideas. Also, providing a list of tradelines is pure sales. Everyone wants a list, because it makes them feel in control. Therefore, some companies play to consumer’s fantasies of control by offering “lists.” For example:

If you had a list of cars from a car dealer, would that be helpful? No, because you’re looking for a particular vehicle that meets your needs, price range, etc. If they had a complete list of cars you didn’t need, couldn’t afford or wouldn’t meet your transportation goals, what’s the point in the list?

Pro tip:

Don’t ask for a list, make the company provide a specific tradeline package designed for you and your goals!

Put your goals above marketing gimmicks. Make the company tell you what they think you need… don’t do the company’s job for them.

When tradeline lists are useless.

Here are the problems with tradeline lists and some things you should take into consideration before you seek or receive one.

Picking from a tradeline list based on price.

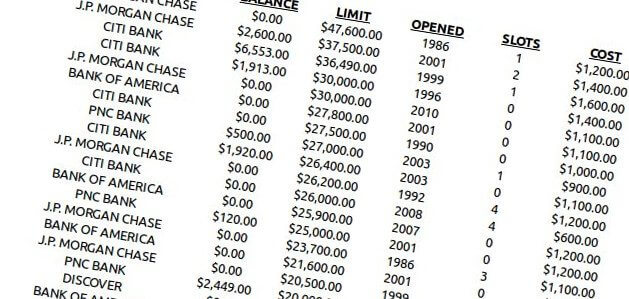

If you pick from a tradeline list based on price alone, you could be setting yourself up for failure. No two tradelines are alike. No two credit reports are alike. You must be appropriately matched in order to receive any useful result from the addition of tradelines. Let’s say you have “enough” money to buy a $4,000.00 limit tradeline with two (2) years of history. Well, what if you needed a $10,000.00 with six (6) years of history. You got a good deal on the 4k, but your scores didn’t go up. It doesn’t matter if you spent $600.00 or $2.00 on the tradeline; you wasted your money. Picking from a list of tradelines can cause you to fall into this trap.

Picking from a list based on age.

The same concept applies to pick from a list of tradelines based on the age of the account. If you can afford only an account with relatively limited seasoning, it doesn’t matter if you got a good deal or not. If the seasoned tradeline is insufficient to achieve your credit goal, it makes no sense to buy it. Again, picking from a list will trick you into believing you are in control over something over which you have no control.

Picking from a list based on the limit.

Similar to picking a tradeline from a list based on age or price, if you pick a line of credit with the incorrect (whether it be too large or too little) limit, you can actually damage your credit score. This is much worse than simply receiving little or no benefit… you can actually make your credit score go down. The basic idea is that if you are bracketed in a certain scorecard, and you bump yourself out of it, your entire credit score will change and refactor your current negative and positive accounts.

When tradeline lists are useful.

There are situations where tradeline lists are useful. Here are a few examples:

You’re a mortgage broker or underwriter.

Mortgage brokers and underwriters look at thousands of credit reports a year. They know them inside and out and have continuing education requirements to keep up-to-date with relevant trends. We provide lists to affiliated mortgage brokers and underwriters as we know they won’t make poor decisions with the information.

You’re a credit repair company.

Similar to mortgage brokers and underwriters, credit repair companies (well, legitimate credit repair companies, I should say) are experienced and are very aware of the beneficial use of authorized user tradelines. They are capable of determining the appropriate line of credit to add to their client’s file. In that regard, we allow affiliate credit repair companies to review our list of tradelines.

Here’s the bottom line.

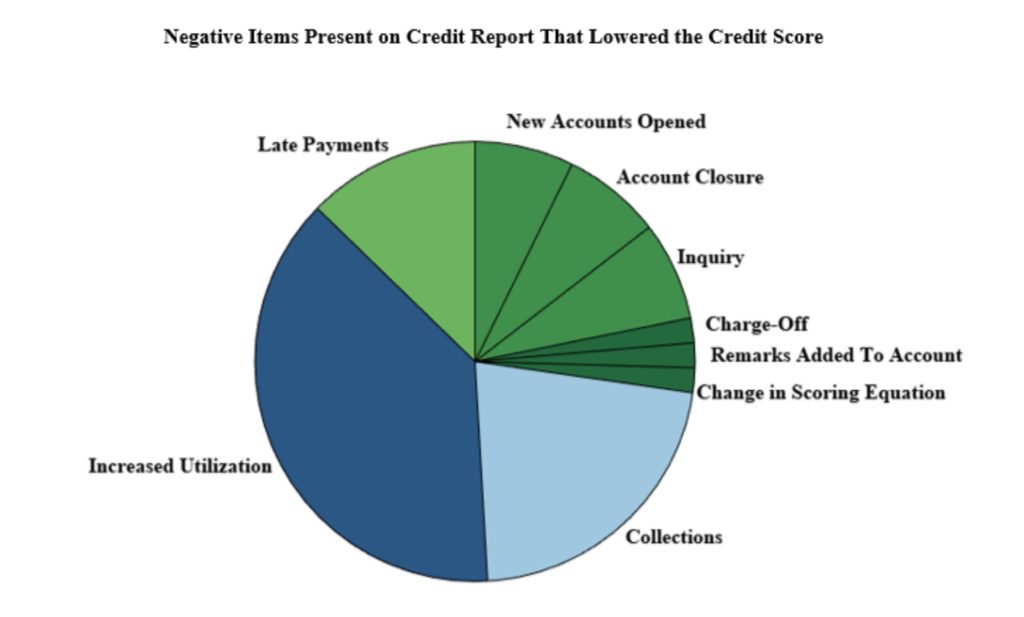

None of this is to suggest the average person is incapable of utilizing a tradeline list appropriately. You have a life, kids, maybe school, a job (or two), yard work, etc. There’s just no chance the average person has the time and energy to figure out this unbelievably complicated system. In that regard, we view it as a disservice to offer them a tradeline list to pick from. Here’s why:

We recommend connecting with a Tradeline expert in our portal. They will be able to answer all of your questions and, trust me, this will be much more beneficial to you than a list of tradelines.