Authorized user tradelines is one of the fastest ways to achieve equal credit opportunity.

Our mission is to assist you in unlocking your credit potential. Through the process known as “piggybacking credit,” we can help you enhance your credit reports by adding positive credit accounts. By becoming an authorized user on established tradelines, you can take advantage of consumer protection and equal opportunity laws. It’s a straightforward and effective method that can make a significant impact on your creditworthiness.

Step 1:

Evaluation and Recommendation.

We listen to you, evaluate your credit goals and review your current credit situation. We do this on a one-on-one basis and we do it for free. This is the most important part of the tradeline process. To get started, you can: Email info@superiortradelines.com or sign up online.

Step 2:

Piggybacking credit.

Once we have a thoughtful plan in place, including a tradeline recommendation, we will get to work for you. We will keep you updated while the services are pending. You will be notified when the tradelines hit your report. You will be able to check your new credit score at that time.

5,036 days in business!

We are the trusted leaders of the tradeline industry, for a reason. We’ve written over 171,813 words on the topic of tradelines. We’re trusted by over 30,000 people, including 1,300 affiliated businesses, since 2010 with 32 years of combined experience on staff. We’ve perfected the process of buying and selling tradelines… for you.

Want your options?

If you are looking for seasoned tradelines, you’ve come to the right place!

Why and how it works:

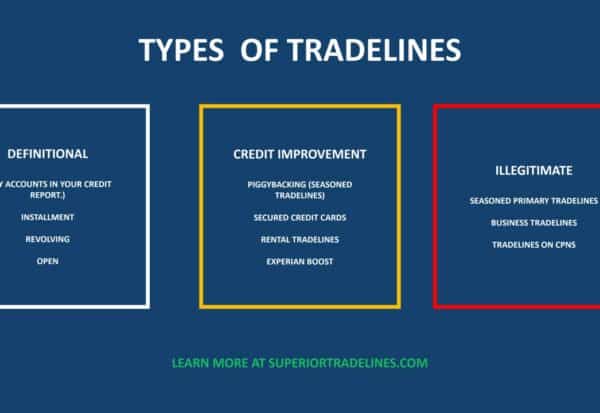

By law, a primary account holder on a credit card can add another person as an “authorized user.” When this happens, the history and details associated with the primary tradeline is reported to the other person’s credit repair as an authorized user. The history of that card (its’ payment history, limit, balance, etc.) shows up on your credit report.

But how is this possible?

Can you legally buy tradelines?

Yes.

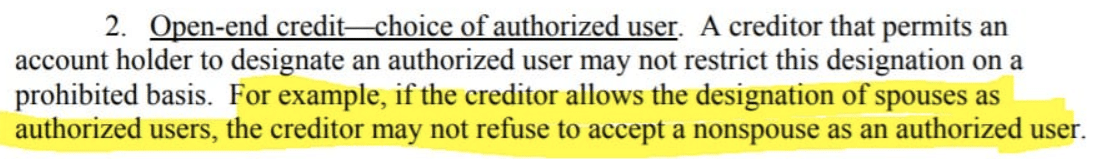

In 1974, Congress passed a law called the Equal Credit Opportunity Act. The Federal Reserve’s updated Regulation B is really what made tradelines possible. That law and regulation work hand-in-hand. Hang in there! I’ll explain. That regulation provides:

Basically, if a bank allows a person to add his or her spouse as an authorized user, the bank must allow (i.e., cannot disallow) a person to add someone other than his or her spouse as an authorized user. This could be a family, friend, or complete stranger. So, you can pay to be added as an authorized user. If the account is in good standing, you will inherit that good payment history. We arrange for you to accomplish this method of credit improvement.

Are tradelines worth it?

In order to determine if its worth it, you have to consider your current credit situation and your goals. Tradelines may or may not work. If you have a thin credit file or a low credit score, adding a tradeline with a positive payment history and low utilization could help improve your credit profile. It’s always recommended to consult with a financial advisor or credit professional before making any decisions regarding tradelines or other credit-building strategies.

How much will a tradeline boost my credit?

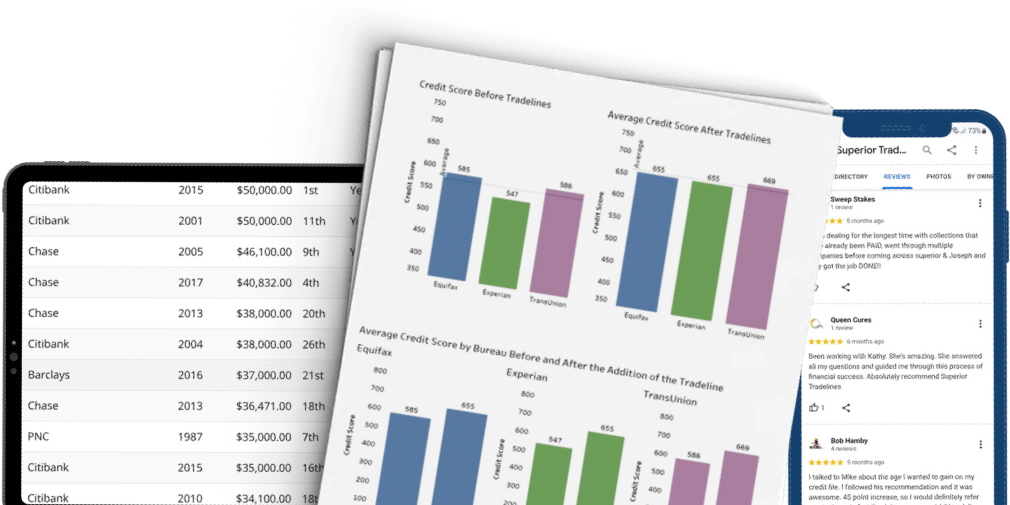

The impact of adding a tradeline to your credit report can vary depending on several factors, including the age and type of the tradeline, your overall credit history, and the scoring model used by lenders. It is important to note that there is no way to guarantee how much it will boost your credit. The study we conducted reported that – on average (over 900 clients) – credit scores increased 88 points. But, you should review the details of that study.

How Long Do Trade Lines Last?

Accounts that appear in your credit reports at the major credit bureaus can remain on your credit report for as long as they are open and, depending on the type of the account, up to 7 to 10 years thereafter. However, in the case of buying authorized user accounts, you will typically be added for two billing cycles. In other words, two months. And, once you’re removed, the account may stay on your report, but it won’t be “actively” reporting each month. This means the positive impact to your credit score you got from the line will go away over time. This usually happens over the course of 6 months.

We’re happy when our clients are happy.

Our trade is tradelines. Our business is people. We believe our transaction is finished when you’re happy. Here’s some of our clients that have experienced our customer service.

Kenneth M.

Tasha B.

Read from our blog articles to learn more.

We are thrilled to have you here, exploring the world of tradelines and credit enhancement. As you browse through our pages, we want you to know that we have been at the forefront of this industry for over a decade. Throughout these years, we have gathered valuable expertise and knowledge in the field, and we believe in sharing this wealth of information with you. In our blog, you will find an extensive collection of articles meticulously crafted by our experts.