If you’re looking to purchase a home or make a significant investment, a good credit score is essential. It helps lenders determine your creditworthiness and can impact the interest rates and terms of your loan. In this blog, we will help you understand what tradelines are, how they impact your credit score, and the difference between mortgage and authorized user tradelines. We will also answer some common questions like, “Can you buy mortgage tradelines?” And provide tips on how to prepare for mortgage approval with enhanced credit scores.

Table of Contents

Understanding Tradelines in Credit Reports

Credit reports contain tradelines, which are credit accounts documenting payment history, credit limits, and account status. Lenders use that information from credit bureaus like TransUnion, Equifax, and Experian to assess creditworthiness.

Types of tradelines include student loans, personal loans, lines of credit, and FHA loans.

Importance of Tradelines in Credit Reports

When considering credit reports, tradelines offer vital insights into an individual’s credit history, influencing credit scores and the loan approval process. Mortgage lenders, credit card issuers, and auto loan providers heavily rely on this information to assess creditworthiness and make informed decisions. By documenting credit history and payment patterns, tradelines play a pivotal role in representing an individual’s credit profile.

How Tradelines Impact Your Credit Score

Positive credit tradelines, like maintaining good standing, a solid payment history, and low credit utilization, play a significant role in boosting credit scores. On the other hand, negative tradelines, including late payments and high credit utilization, can have an adverse effect on credit scores. Lenders use this information to evaluate individuals’ credit profiles when considering applications for various types of credit, such as a mortgage.

Differentiating Between Mortgage and Authorized User Tradelines

In order to understand a very interesting point we are going to make below, we’d like to quickly define and explain the difference between mortgage tradelines and authorized user tradelines.

What Are Mortgage Tradelines?

Mortgage tradelines are directly linked to real estate, mortgage loans, and home ownership, providing insights into an individual’s payment history relative to those types of accounts. Mortgage tradelines are a reflection of your mortgage loans, including real estate, payment history, loan amount, and interest rate.

What Are Authorized User Tradelines?

On the other hand, authorized user tradelines involve adding a user to a credit card account, impacting the account history, FICO score, and credit utilization.

Authorized user tradelines involve adding someone as an authorized user to a credit card account. This can positively impact their credit history by reflecting the credit card account’s history, credit limit, payment history, and credit card utilization. They are often used to establish or enhance credit history for individuals with limited credit history.

While mortgage tradelines are associated with property assets, authorized user tradelines are associated with credit cards.

Can you buy mortgage tradelines?

Unfortunately, it is not possible to buy mortgage tradelines directly. However, there is an indirect way to “buy” a mortgage tradeline by assuming responsibility or becoming a joint account holder and then removing the original account holder.

But, there is no commercial practice that offers this service and primary account holders on a pre-existing mortgage are unlikely to hand their mortgage over to you.

More importantly, however, you would would NOT want to buy mortgage tradelines even if you could.

Here’s why:

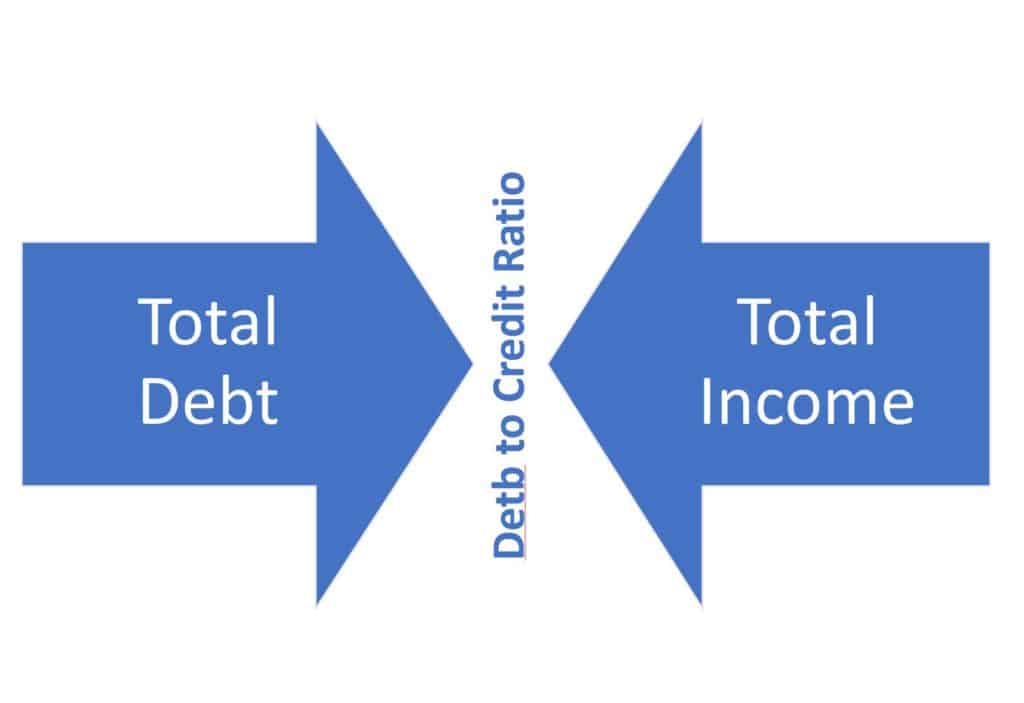

Buying morrtgage tradelines could potentially kill your debt to credit ratio.

Even if you were to successfully add a mortgage tradeline to your file, it could kill your debt to credit ratio and actually bring down your score. When you get a new mortgage, you score actually drops initially because of the debt you just took on. Your credit score slowly starts to come back up after about 6 to 9 months of payment history on the mortgage note. So, it’s not a good idea to add a mortgage tradeline to your credit file.

Buying mortgage tradelines could potentially kill your purchasing power.

Piggybacking off bullet the point above… in addition to killing your debt to credit ratio, you could also kill your purchasing power.

How? Basically, if you took on a mortgage, that would come (at least on paper) with a monthly liability. Let’s say it’s a $150,000.00 mortgage. At today’s rates, for PITI, that’s about $700.00 per month. So, to an underwriter you have now subtracted $700.00 per month from your purchasing power. Again, not a good idea.

It’s not legal (in my opinion).

Most importantly, the reasons “seasoned tradelines” exists is a result of the Federal Reserve Board Reg. B and the Equal Credit Opportunity Act of 1974, which allow the addition of authorized users on revolving accounts. I know of no law that allows for someone to be an authorized user on a mortgage account (tradeline) nor the ability to assume the mortgage.

Revolving tradelines are a better option anyway.

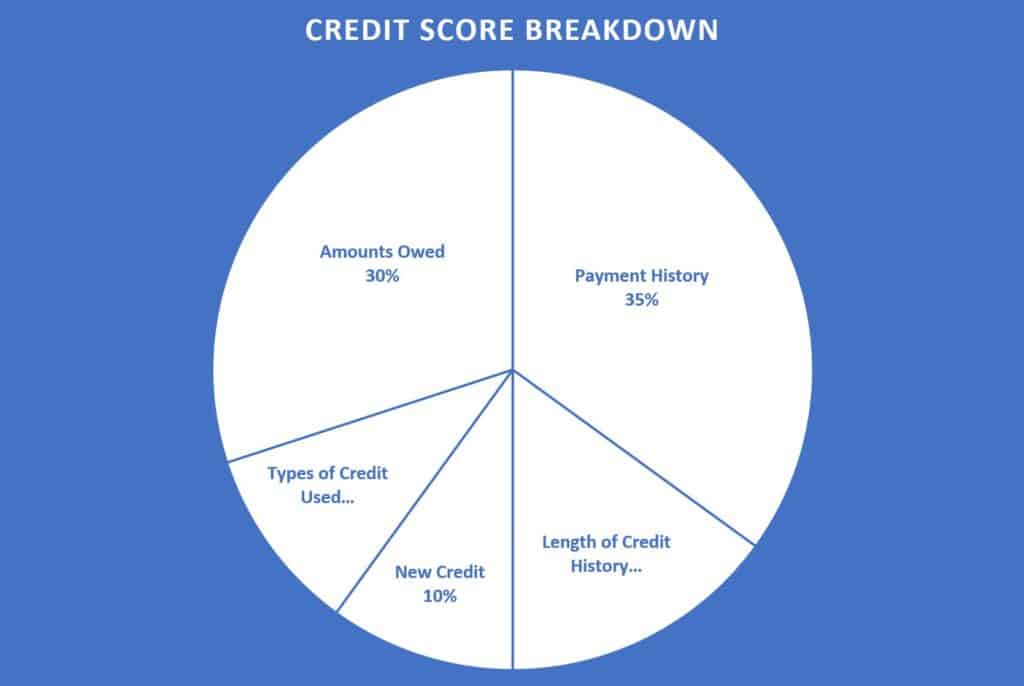

Lastly, mortgage don’t actually help your FICO score as much as you would think. Revolving credit accounts (tradelines) affect your credit score much more than any other account. If you look at this break down of a FICO score, you will note that revolving makes up the largest portion. Mortgages would fall under installment (a much smaller portion):

Buy authorized user tradelines instead of mortgage tradelines in order to get mortgage tradelines.

We know at least three things, now. First, buying mortgage tradelines isn’t possible. Second, even if it were, it’s not a good idea. Three, buying authorized user tradelines can help you improve your credit score in order to get a mortgage.

Purchasing authorized user tradelines from trustworthy sources is necessary. Responsible use of authorized user tradelines can significantly improve your credit profile, opening up doors for various types of tradelines such as mortgages. This can ultimately contribute to preparing for mortgage approval with enhanced credit scores and improving your chances of getting a mortgage.

While purchasing authorized user tradelines is a cost-effective approach, it is crucial to avoid adding too many tradelines at once, as this could have an adverse effect on credit scores.

A higher credit score can significantly improve your chances of securing a mortgage.

Conclusion

Before incorporating tradelines, ensure a thorough comprehension of your credit report and financial position. While utilizing AU tradelines shouldn’t be the sole strategy for enhancing your credit score, it can certainly form an integral part of a comprehensive plan. By considering these aspects, you can make informed decisions about leveraging tradelines for credit improvement.