The FICO’ 08 fico score. We’ve all heard the propaganda: “authorized user tradelines don’t work anymore”, “I heard that fico 08 isn’t going to score authorized user tradelines”, etc.

Table of Contents

The bottom line

“Every generation of the FICO score formula has included authorized user credit card accounts when calculating a person’s score. FICO 8 score continues that policy. This can help people benefit from their shared management of a credit card account. It also helps lenders by providing scores that are based on a full snapshot of the consumer’s credit history.”

As we’ve said before, if FICO actually removed authorized user consideration from their fico score model, they would have violated the Federal Reserve Reg. B.

Further, they would also violate the Equal Opportunity Credit Act. Bankrate agrees:

“Fair Isaac said lenders complained that using FICO 08 would inhibit compliance with Federal Reserve Regulation B, which requires lenders assessing a married person’s credit risk to consider the credit history of accounts shared by the spouses.”

In fact, we aren’t even going to weigh in on the fico ’08 score issue.

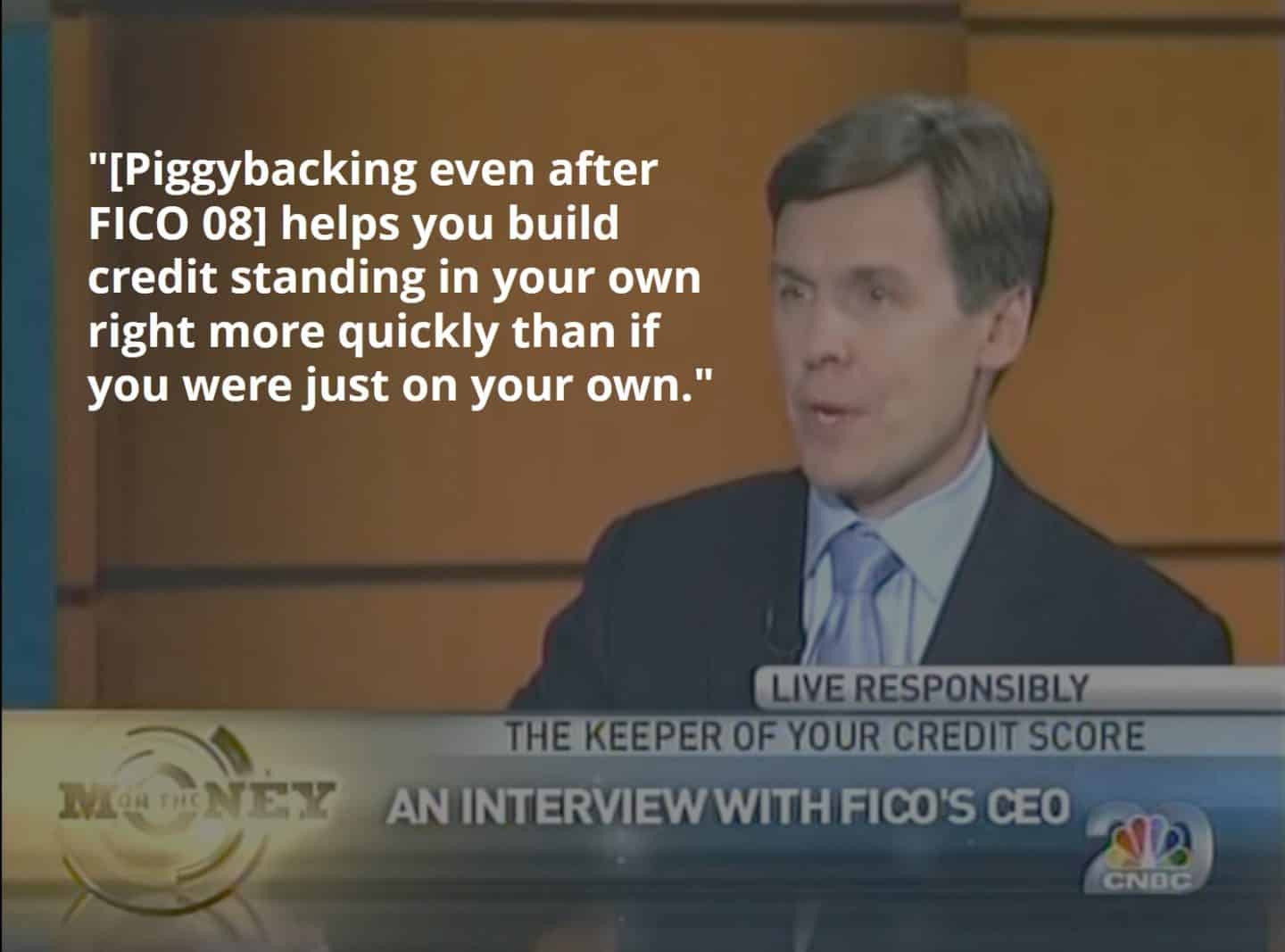

Dismiss opinions and speculation and allow the video above to serve as the authority on the issue.

The CEO of FICO, Dr. Mark N. Greene, addresses the FICO ’08 model. Specifically, he states that Authorized User accounts remain a mechanism for credit improvement.

The truth is that the law requires that authorized users “shall be considered” by lenders, and everyone knows it.

-

“…any account appearing on your credit report will likely have some impact on your credit scores. Authorized user accounts can help you build credit…” – Experian

-

“…[being added is as an authorized user is a ‘surprising’ way to establish better credit]…” – Transunion

-

“… authorized user tradelines are considered by FICO® Score 9 and all prior versions of the FICO® Score.” – FICO

-

“…Our analysis suggests that piggybacking credit can materially improve credit scores…” – Finance and Economics Discussion Series Federal Reserve Board, Washington, D.C.

What this does not mean for you?

Most importantly, FICO’s inclusion of piggybacking tradelines does not mean you will get approved for a loan. Good credit does not guarantee lending approval. Most lenders have underwriting guidelines and requirements in addition to credit scores.

Furthermore, CPNs and piggybacking with ITINs remain illegal.

What does this mean for you?

In short, Authorized User Tradelines still work. You should not worry about the fico ’08 credit score model and the propaganda surrounding it. If you need to purchase tradelines, please email us at info@superiortradelines.com or get started with us today.

Kate is a managing member of Superior Tradelines, LLC. She manages and coordinates the company’s operations and makes sure clients are assisted with care. You can contact Kate directly by calling: 321-328-0908 or by email: kate@superiortradelines.com

I can tell you right now this is no longer the case. If you have a credit monitoring account on Experian.com go to ‘View Score Details’ then ‘score ingredients’ If you go to “Revolving Credit Utilization’, ‘Total Balances on Revolving Accounts’, ‘Average Age of Accounts’, ‘Age of Oldest Account’, ‘Age of Most Recently Opened Account, etc and hover over the little ‘i’ next to them….it says “Authorized User Accounts not considered in the calculation of this attribute”. I just was added on a tradeline I bought from another site and the utilization is NOT calculated.

Hey Joey,

You’re correct and incorrect. You’re correct as to the fact that your Experian report says what you say it says. However, no lender would use that consumer/educational report. Under the laws that make this possible, lenders “shall” consider authorized user tradelines. In the case you’ve described, this is a not a lender relationship and do not have any obligation to factor authorized users. If you want to confirm what I am saying, do this: When you go to apply for the credit you’re after, ask for the reports and scores your lender obtained from the creditor bureaus and score modelers. I assure you two things: 1) They will have considered the authorized user account you purchased and 2) your scores will be drastically different than the only report you referenced.

I hope that was helpful!

Thank God lol….I was worried. I mean because I saw that my credit score on Experian.com and creditchecktotal were the same….I thought I was screwed. Man, you have NO IDEA how much you helped me by telling me that.

No problem, Joey.

Here’s link to a more thorough blog post on this topic: https://superiortradelines.com/credit-scores/real-credit-score/

Here’s one where we are pretty sarcastic (but entertaining) about misleading scores: https://superiortradelines.com/credit-scores/credit-scores-and-what-you-dont-know-about-them/

Here’s one where we show score changes from AUs with different scenarios: https://superiortradelines.com/add-tradelines/score-increase-adding-tradelines/

Thanks again!

lol I thought I read every article ever posted on here….can’t believe I missed that one. It would have put my mind at ease. Now that I know this though…..I know you guys are extremely busy…but is it possible that I can send you a look at my credit report and give me your quick analysis of what you think the change might be?

And fyi…lol you guys were my first choice when it came to tradelines. I only got this one because it was from a friend of mine who didn’t charge me.

Sure, give us a call tomorrow. Someone on staff will help you.